Ngā rāngai mātāmua hou | New priority sectors

On this page

The visitor economy

Nelson Tasman offers visitors diverse and colourful experiences whether they are based in nature or in the culture and the arts of the region. The natural landscape with a unique combination of alpine and coastal environments and three national parks are a major drawcard for visitors. The region also offers cultural, creative experiences and has built a reputation as a centre for the arts. This is supported by markets, a wide calendar of events and opportunities to engage with local artisans at work.

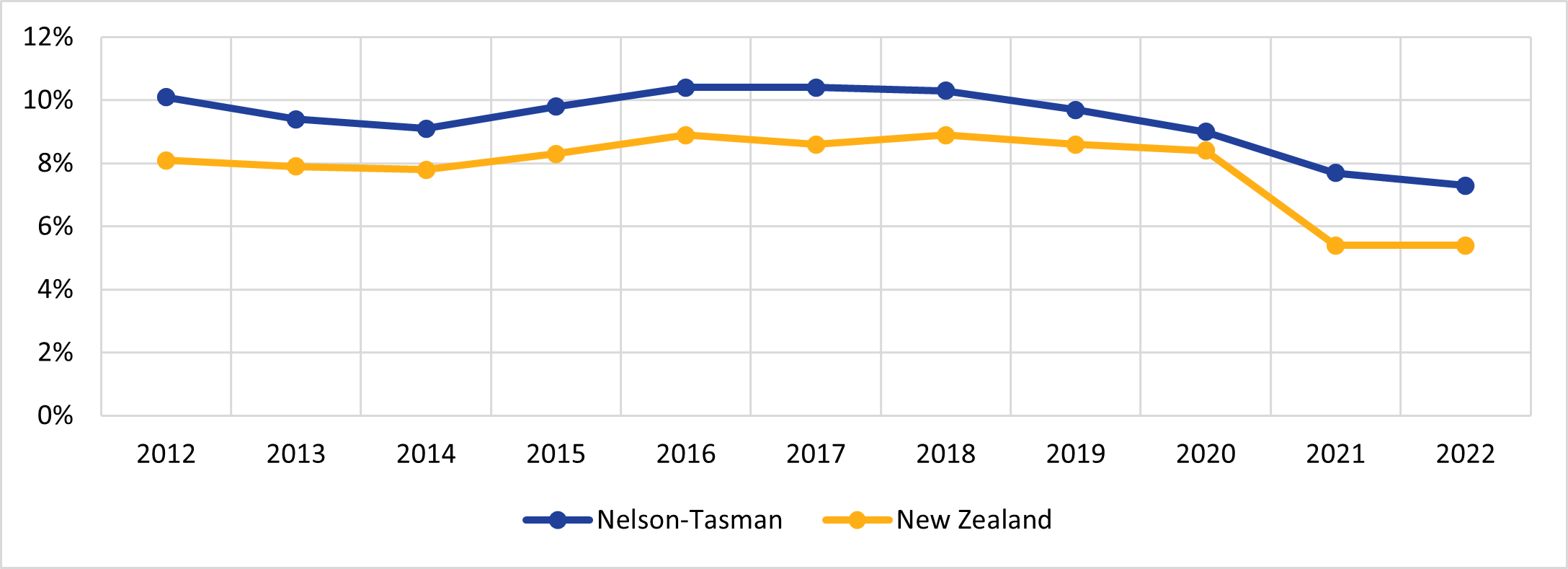

The visitor economy is comprised of both tourism and hospitality businesses contributing $233 million towards GDP in Nelson Tasman in 2022, 3.8% of Nelson Tasman's economic output. Growth in the industry in Nelson Tasman has averaged 3.6% over the last ten years, compared with 2.4% in New Zealand[13]. Overall, tourism employment in the region accounts for 7.3% of total regional employment or 4,295 full time equivalent jobs. This was the seventh largest employment sector in the region in 2022.

Figure 2: Tourism share of total employment, 2012-2022

Data from image

The composition of the workforce changes as people move into, around, and out of the sector, with some more physically demanding jobs less appealing to an aging workforce. Work in the visitor economy has always had seasonal peaks and troughs and many businesses rely on working holiday visa makers to fill workforce gaps. During the COVID-19 pandemic, closed international borders and a downturn in business has resulted in approximately 1,000 less people working in the industry in Nelson Tasman in 2022 as compared with 2019. Changes in immigration settings have compounded the situation by reducing access to temporary migrant workers[14]. Employment forecasts to 2028 show high visitor sector labour demand for the region[15].

Vocational education for tourism and hospitality is largely provided in the region by the national vocational education provider Te Pūkenga | NMIT and Service IQ. NMIT has offered education and training in tourism and hospitality for three decades with a range of programmes in travel and tourism, cookery and food and beverage from Levels 3 to 5. Te Pūkenga | NMIT’s two-year, Level 4 and 5, Adventure Tourism and Guiding programme has shown consistent demand attracting domestic and international students.

In the current economic situation with low unemployment and high labour demand, there has been a significant reduction in people applying for programmes at Te Pūkenga | NMIT and an increase in the number of learners in the workplace[16]. This situation could change as the economy tightens and there is less demand for labour. Evidence from the industry[17] indicates employers across most sectors want training to be short and sharp, delivered when they need it and created to be the least disruptive to their operations. The increasing demand for and development of micro-credentials and other short courses necessitates the development of these programmes by WDCs with associated government funding.

Visitor economy opportunities and challenges

The development of tourism products and experiences discussed within the Nelson Tasman Destination Management Plan 2021-2026 aligns with the Te Tauihu Intergenerational Strategy 2020 which highlights further development of Māori tourism experiences across the region. The Strategy recommends the initiation of a Māori tourism strategy to facilitate and enable new iwi-based business, partnerships and co-investment opportunities.

In addition, the Destination Management Plan recommends further food and beverage and arts and creative development across the region and to support business cases for new and vibrant visitor experiences. The opportunities for new visitor experiences will have a flow on effect with increased demand for labour. There are also a number of major events forecast over the next five years that will stimulate demand for the region and will require additional labour supply. Events are year-round and are effective in filling the troughs in demand. There are over twenty events scheduled in the 2023/2024 year that require commercial accommodation for more than 100 people. There is also a wide calendar of other business and leisure events focused on the local market[18].

The national Tourism Industry Transformation Plan[19] underpins government action for the visitor sector. The Plan identifies and reinforces the systemic challenges facing the sector workforce. The sector is composed of mostly small and medium sized enterprises. Some businesses lack the scale, systems and capacity to effectively manage human resources and they struggle to attract and retain people with the skills the industry needs, particularly from the domestic workforce[20]. The hospitality sector and some of its subsectors, particularly restaurant, café operations, pubs and bars, are characterised globally by relatively high business and workforce churn and entry-level front-line roles that generally require no prior training. Other parts of hospitality such as hotel operations have clearly defined career progression particularly in the larger hotel brands.

Occupations in the tourism sector such as travel agents; tour, attraction and adventure operators and guides; wellness, cultural and culinary experiences; and event operators have varying requirements for training. Career progression is clearly delineated in some parts of the sector. Travel agents require qualifications to manage compliance and international rules and obligations. Outdoor adventure companies must manage health and safety and pre-employment guide training is the norm.

The first phase of implementing the national Tourism Transformation Plan is a Tourism and Hospitality Accord outlined in ‘The Better Work Action Plan’, which will set voluntary employment standards for businesses and drive transparency and awareness of workplace practices and standards. This will enable both workers and consumers to identify businesses that meet standards relating to decent pay, appropriate training and career progression, and a safe and supportive work environment.

Visitor economy regional actions

Priorities 2023-2024

Action: Create the framework for collaboration that will provide a critical feedback loop to help guide industry progression.

Activities:

Create a working group of regional stakeholders to support national leadership initiatives that focus on increasing the sustainability of the sector: Tourism Industry Transformation Plan; Better Work Action Plan; Tourism and Hospitality Accord.

The working group will facilitate and champion the following activities:

- Coordinate action to positively impact perceptions of a career in tourism where people can develop valuable transferable skills.

- Support the delivery of the new NCEA Tourism Achievement Standards at NCEA Levels 2 and 3 at the region’s secondary schools.

- Stimulate action with employers to implement the Tourism and Hospitality Accord to foster staff retention. Showcase and promote best practice actions in staff management.

- Foster events sector development with the pipeline of events planned for the region to meet the demand for suitably qualified staff for the event sector.

- Target TEC, Ringa Hora and Te Pūkenga to ensure that events training is available for the region and awareness of training options is highlighted and promoted.

Suggested Partners include: NRDA, SPICE, Chamber of Commerce, Industry Associations: Restaurant Association, Hospitality NZ, Te Pūkenga, Tourism and Hospitality Businesses, Secondary Schools Tourism Educators

Priorities 2024-2025

Action: Strengthen the profile of the industry to address visitor economy skills shortages.

Activities

Continue the working group activity to enhance the perceptions of employment in the sector and the effective recruitment and retention of employees (group to include Arts and Creative Lead, and Culinary Leads).

Champion the actions within the Nelson Tasman Destination Management Plan to support new jobs within the region’s visitor economy, reduce the seasonality of the sector and create more meaningful employment: food and beverage and arts and creative initiatives and events.

Action: Advocate for Māori tourism development and support Māori tourism businesses.

Activities:

Foster regional Māori tourism development initiatives. Advocate for funding and support to Māori tourism businesses. Showcase these developments.

Suggested Lead and Partners: Iwi, Wakatu Inc, Toiere Māori Business Network, Chamber of Commerce, Māori Tourism operators, Te Puni Kōkiri, NZ Māori Tourism

Forestry and Wood Processing

Our region has a competitive advantage in forestry and logging, sawmilling, and forestry support services, making us a potential leader in our ability to add value in forestry and wood processing. Nelson Tasman is home to one of the largest MDF plants in the world and New Zealand’s highest concentration of specialist wood processing, particularly in laminated and structural wood products and glues used in these production processes.

The national Forestry and Wood Processing Industry Transformation Plan released in November 2022 and quoted below, highlights the importance of the sector workforce in achieving the proposed actions. These actions aim to increase New Zealand’s onshore wood processing capacity and capability, maximise the value of our wood, and drive innovation through developing new industries, products, technologies, and markets.

Forestry and Wood Processing Industry Transformation Plan(external link) — Ministry for Primary Industries

“Transformation (of the Forestry and Wood Processing sector) will require a greater level of collaboration across the sector, the right skills, the right regulatory settings and the science system all working in concert, to create more higher-paid jobs, build resilience in the sector and support our climate change goals. As the benefits of transformation are fully realised, our regional communities will have access to high wage jobs, a more diverse range of work through training opportunities … moving from volume to value, and developing a high wage, low emissions economy.”

Forestry and Wood Processing opportunities and challenges

The Forestry and Wood Processing sector accounts for more than 2,000 jobs in Nelson Tasman, or 3.6% of employment, compared to a 1.3% share nationally. Around 5% of the nation’s standing volume of plantation forests is in our region. The Nelson Tasman Regeneration Plan names forestry and wood processing as a key economic driver. NRDA also notes the potential of the sector to lift productivity, and therefore regional outcomes and wages[21].

Nationally, the forestry and wood processing sector is experiencing a range of long-term strategic challenges and opportunities[22]. The volume of logs harvested has roughly doubled since the year 2000, although the overall harvest volume is expected to decline due to a reduction in planting since the boom of the 1990s. Over the same timeframe, wood processing capacity has not grown. There are missed opportunities to maximise the value of creating finished wood products in New Zealand, with most logs being exported offshore. Global demand for wood is expected to quadruple by 2050.

Table 2: Components of the Forestry and Wood Processing Sector

| Nelson Tasman | New Zealand | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| GDP | Employment | Businesses | GDP | Employment | Businesses | ||||

| Sub-Industry | Level | % of total | Level | % of total | Level | % of total | % of total | % of total | % of total |

| Logging | $43.9m | 25.1% | 411 | 20.0% | 30 | 7.9% | 32.9% | 14.9% | 10.0% |

| Log Sawmilling | $36.9m | 21.1% | 469 | 22.9% | 18 | 4.8% | 11.6% | 17.4% | 3.9% |

| Reconstituted Wood Product Manufacturing | $26.2m | 15.0% | 318 | 15.5% | 6 | 1.6% | 2.1% | 3.2% | 0.3% |

| Wooden Structural Fittings & Components Manufacturing | $17.3m | 9.9% | 245 | 12.0% | 27 | 7.1% | 15.7% | 23.4% | 12.6% |

| Forestry | $14.1m | 8.1% | 130 | 6.3% | 228 | 60.3% | 14.6% | 6.6% | 53.2% |

| Timber Wholesaling | $12.9m | 7.4% | 119 | 5.8% | 9 | 2.4% | 4.7% | 5.1% | 3.4% |

| Forestry Support Services | $11.2m | 6.4% | 193 | 9.4% | 33 | 8.7% | 6.6% | 12.0% | 8.2% |

| Timber Resawing & Dressing | $8.60m | 4.9% | 110 | 5.4% | 9 | 2.4% | 3.7% | 5.5% | 1.5% |

| Other Wood Product Manufacturing n.e.c. | $1.92m | 1.1% | 26 | 1.3% | 9 | 2.4% | 4.5% | 6.7% | 5.1% |

| Prefabricated Wooden Building Manufacturing | $1.65m | 0.9% | 22 | 1.1% | 9 | 2.4% | 1.1% | 1.6% | 1.5% |

| Veneer & Plywood Manufacturing | $0.40m | 0.2% | 6 | 0.3% | 0 | 0.0% | 2.3% | 3.5% | 0.3% |

| Wood Chipping | $0.00m | 0.0% | 0 | 0.0% | 0 | 0.0% | 0.1% | 0.1% | 0.2% |

| Total | $175m | 2,049 | 378 | ||||||

Source: Draft NRDA Forestry and Wood Processing Sector Profile, January 2023 (unpublished)

The forestry workforce is experiencing significant changes in the type and nature of the work, with an accompanying shift in the type of skills and knowledge required to do the job. Entry into forestry management generally requires a degree-level qualification, while mechanisation of harvesting practices has seen workforce changes from physically wielding chainsaws to sitting in a cab operating million-dollar machines. Corresponding changes in business models include a division between land ownership and forestry ownership; sub-contracting; part ownership of logging crews; and machine sharing[23].

The wood processing sector has also seen changes in workforce skills and experience, including increasing requirements for digital skills and the operation and maintenance of what are often bespoke pieces of machinery developed by individual processing businesses. Additional challenges include an ageing workforce with 41.6% aged 45-64 years, higher than all other industry workforces in New Zealand. One in five workers in this sector have no formal qualifications and 28% of employees are labourers compared to 10.7% for all industries.

Logging, sawmilling and wood product manufacturing are all forecast to have critical workforce shortages by the year 2028. Attraction challenges include rural depopulation and perceptions of the work being unsafe and physically demanding.

The forestry industry has some well-developed career pathway information, but there is a lack of education around the opportunities and types of jobs in the wood processing sector. This makes it harder to attract younger workers and retain older workers. Employers require support and education about how to actively retain their older workers, including upskilling opportunities and reshaping of roles. Diversity is a challenge for the sector - it is dominated by male workers (82%) compared to the national male labour force (52%). Māori workers are overrepresented in lower wage roles. Leadership positions tend to be occupied by Pākehā men, with women, Māori and other ethnicities underrepresented.

Despite the challenges the industry faces nationally, Nelson Tasman has the highest employment by region in the specialist manufacturing sector. There is significant potential for commercial uses of engineered wood products in the construction sector - Nelson’s airport terminal showcases this use. There are further opportunities for wood product manufacturing to capitalise on demand for housing and sustainable building practices. Nelson Tasman also has the highest number of scientists per capita in New Zealand, providing significant sector opportunities to add value to our logs[24].

Forestry and Wood Processing regional actions

Priorities 2023-2024

Action: Establish a framework for collaboration across the Nelson Tasman forestry and wood processing sector, to enable a collective response to the economic development opportunities and workforce planning requirements.

Activities:

- Acknowledge the partnership between NRDA and RSLG in working together to advance our respective objectives - economic development and workforce planning and development - for the forestry and wood processing sector.

- With NRDA, explore establishing a potential collaboration with two groups of key regional businesses:

- Forestry (including forestry management, silviculture and harvesting)

- Wood Processing (including solid wood manufacturing, and wood panel and plywood).

- Inform both sector groups’ understanding of the workforce planning necessary to achieve their economic development objectives.

- Provide support for regional applications for the government’s Wood Processing Growth Fund aiming to increase productivity and volume of domestic processing of wood, and boosting high value, high wage jobs.

Wood Processing Growth Fund(external link) — Ministry for Primary Industries

Priorities 2024-2025

Action: In partnership with NRDA build on the framework for collaboration that has been established.

Activities:

- Expand the concept of collective action to guide and coordinate development of a shared workforce planning capability across the forestry and wood processing sectors in Nelson Tasman.

- Share examples of good practice and knowledge regarding workforce planning and development approaches (noting this includes actions to increase regional awareness of career pathways, opportunities and employment in the forestry and wood processing sector).

- Encourage collaboration between these regional groups and the relevant WDCs to make sure the regional voice of industry is heard and WDCs engage in supporting the workforce planning and development.

Nelson Airport photo by Luke Marshall, sourced from www.nelsontasman.nz

Footnotes

[13] Infometrics (2023) Regional Economic Profile; Regional Skills Outlook

[14] Ringa Hora (2022) What makes the Service sector resilient?(external link)

[15] Infometrics (2023) Industry Employment Projections for 2028

[16] TEC (2022) Ngā Kete(external link)

[17] Service IQ (2021) Accommodation Sector Skills Summary(external link)

[18] NRDA (2023) Sport, Professional, Incentive, Conferences and Events Steering Group

[19] Ministry of Business Innovation and Employment (2021) Tourism Industry Transformation Plan(external link) MBIE LINK

[20] Ministry of Business Innovation and Employment (2023) He Mahare Tiaki Kaimahi Better Work Action Plan, page 13

[21] Nelson Tasman generated $105,070 of GDP per filled job in 2022, less than the New Zealand average of $132,815. Source: Nelson Tasman Productivity Gap - 2022 supplementary update [PDF, 346KB](external link), Benje Patterson, People and Places, February 2023

[22] Cabinet paper released under the OIA ‘Releasing the final Forestry and Wood Processing Industry Transformation Plan’(external link)

[23] Mike Fraser Logging YouTube video(external link) history of company, changes over time particularly in the last 30 years.

[24] NRDA submission to MPI responding to consultation on the Draft Forestry Industry Transformation Plan 6 October 2022