Tō mātou horopaki ā-rohe | Our regional context

On this page

Welcome to the Nelson Tasman Regional Workforce Plan (RWP) 2023. This document reviews and builds on our 2022 RWP, as part of a yearly review process. A full review is planned in 2025.

In this RWP you will find last year’s highlights showcasing some of our region’s achievements, the lessons we have learnt as we progress our actions, the actions we will focus on this year, the advice we provided to the Tertiary Education Commission (TEC) to help focus their funding decisions for 2024, and our progress against the year one priority actions. In addition, we are reporting on the regional workforce challenges and opportunities of two new sectors important to our region’s growth – the visitor economy, and forestry and wood processing.

The lack of regionally specific data continues to limit our ability to identify gaps and plan solutions to workforce and skills challenges. Generally, the quantitative evidence base for the Nelson Tasman labour market is poor, mostly attributable to our small population base and margins of error. We continue to highlight the need for better regional data. To supplement and add depth to the available data, we remain focused on gathering qualitative regional evidence.

Key labour market indicators

The Nelson Tasman economy performed well in the year to March 2022, with both GDP and the number of filled jobs increasing to pre-COVID-19 levels, after decreasing in 2021. GDP was up 5.6% and the number of filled jobs increased 2.3% from a year earlier.[1]

Productivity increased by 3.2% from the year earlier compared with a national increase of 2.3%. Despite this growth, our region’s productivity remains the second lowest in New Zealand and our wages are the lowest in New Zealand.[2]

The key main urban areas of Nelson, Richmond, and Motueka had 79% of the region’s employment in 2022. While job growth over the past decade has been slower in Nelson City (0.5%pa), it has been particularly rapid in Richmond (4.5%pa) and Motueka (3.1%pa), and other (mainly rural) areas (2.8%pa)[3].

For the March 2023 quarter, our regional employment rate was 68%, unemployment was 3% and the labour force participation rate was 70%. The proportion of people who indicated they would like to do more paid work (underutilisation rate) was 10%. The working age population grew 7%, increasing to 92,900. The number of people employed grew 6%, increasing to 62,900[4]. Filled jobs grew by over 1,700 between April 2022 (46,290) and April 2023 (48,000)[5]. During 2022, the number of Māori in employment grew by 5.5%.

Nelson Tasman has a higher level of self-employment at 18% compared to the national rate of 16%. In addition, 96% of our businesses employ less than 20 people. These two facts highlight the need for a collective regional approach to workforce planning and development.

In 2021, Nelson Tasman had 1,500 school leavers of which just over a quarter (27%) had their first enrolment in further study in the Nelson Tasman region[6]. For the March 2023 quarter, Nelson Tasman youth (15–24-year-olds) not in education employment or training (NEET) continued to be relatively high at an estimated 15%, (noting the data combines Marlborough, Nelson Tasman, and West Coast regions). The NEET rate was 18% for 20–24-year-olds but only 5% for 15–19-year-olds[7].

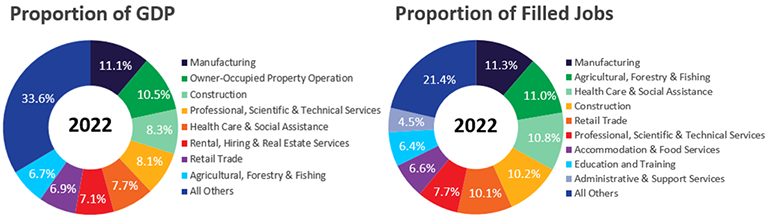

Our region’s key production, processing and manufacturing focuses of forestry, horticulture, and the ocean economy have all expanded strongly over the past decade. Among broad industry groups, manufacturing was the largest contributor to regional GDP in 2022. Other key employing industries include health care and social assistance, construction, retail, professional services, accommodation and food services, and education.[8]

Figure 1: Contributors (industries) to economic and job growth in Nelson Tasman over the last 10 years

Data from image

Regional workforce outlook for our priority sectors

Construction[9]

Construction is a significant employer in and contributor to the Nelson Tasman economy and has been so for the last 10 years.

In 2022 it was the third largest contributor to the region’s GDP at $5.07m (8.2% of the region’s total GDP). Construction made up 10.2% of filled jobs and construction was the fourth largest sector for self-employment at 31%.[10]

In the year to March 2022, its contribution to the region’s employment grew by 6.8%, making it the sector that created the most jobs in the region.

Between 2012 and 2022, construction was the single biggest contributor to economic growth in Nelson Tasman - $222m out of a total increase in GDP of $1,524m. It was also the industry which created the most jobs - 2,000 out of 9,500.

Workforce demand profiling indicates an ongoing demand for construction workers with relevant qualifications. Critical workforce shortages are expected in residential and non-residential building construction, road and bridge construction, electrical services, and painting and decorating services.[11]

Aquaculture[12]

Nelson Tasman has more than 2,700 jobs in fishing, aquaculture, and seafood processing, representing 4.7% of employment, compared to 0.4% nationally. The region, together with Marlborough, has the highest share of employment in New Zealand dedicated to ocean food production.

Nelson Tasman is also a leading region in industries that support the ocean economy, including boat building and repairs, textiles (ropes), scientific research, and specialisations in high-value products such as nutraceuticals and fish oils.

This clustering of activity, coupled with the supporting infrastructure, builds the region’s competitive advantage in the ocean economy. The New Zealand Government’s Aquaculture Strategy outlines opportunities to grow the aquaculture industry to $3 billion in annual sales by 2035, up on $600+ million in annual sales when the strategy was released in 2019.

New Zealand Government’s Aquaculture Strategy [PDF, 2.0MB](external link) — Ministry for Primary Industries

Forecast job openings for Nelson Tasman show gaps in key sectors, including construction. Table 1 below shows industries where demand is expected to be high in the region in 2028.

Table 1: Forecast skill shortages for Nelson Tasman in 2028

In 2028, jobs in these industries are expected to make up a considerable number of all job openings in the region and demand is expected to be higher than the national average

Retail Trade

- Supermarket & Grocery Stores

- Hardware & Building Supplies Retailing

- Car Retailing

- Department Stores

- Other Store-Based Retailing

Manufacturing

- Seafood Processing

- Log Sawmilling

- Reconstituted Wood Product Manufacturing

- Wine & Other Alcoholic Beverage Manufacturing

- Other Machinery & Equipment Manufacturing

Health Care & Social Assistance

- Hospitals

- Aged Care Residential Services

- Other Allied Health Services

- Other Health Care Services

Construction

- House Construction

- Electrical Services

- Non-Residential Building Construction

- Road & Bridge Construction

- Painting & Decorating Services

Agriculture, Forestry & Fishing

- Apple & Pear Growing

- Logging

- Vegetable Growing (outdoors)

- Dairy Cattle Farming

- Other Agriculture & Fishing Support Services

In 2028, jobs in these industries are expected to make up a considerable number of all job openings in the region

Accommodation & Food Services

- Cafes & Restaurants

- Accommodation

- Takeaway Food Services

- Pubs, Taverns & Bars

Professional, Scientific & Technical Services

- Management Advice & Other Consulting Services

- Scientific Research Services

- Legal Services

- Engineering Design & Consulting Services

Education & Training

- Secondary Education

- Primary Education

- Higher Education

- Preschool Education

Source: 2028 Infometrics forecasts for the Nelson Tasman Region, ANZSIC Level 1 and Level 4

Photo taken by Oliver Weber, sourced from www.nelsontasman.nz

Footnotes

[1] Nelson Tasman Annual Economic Profile 2022, Infometrics, accessed 9 May 2023

[2] Nelson Tasman Regional Economic Profile, Infometrics, accessed January 2023 and Nelson Tasman Productivity Gap 2022 Supplementary Update, People and Places [PDF, 346KB](external link), February 2023.

[3] Nelson-Tasman Regional Economic Briefing – 2022 data update, Benje Patterson, March 2023 (unpublished)

[4] Household Labour Force Survey, Stats NZ, published May 2023

[5] Region by Variable (Monthly) Table, Employment Indicators (MEI), Stats NZ, accessed 7 June 2023

[6] Ngā Kete, accessed 20 April 2023

[7] Household Labour Force Survey, Stats NZ, published May 2023

[8] Annual Economic Profile, Infometrics, accessed 7 June 2023

[9] Infometrics Regional Economic Profile, accessed 19 May 2023

[10] Annual Economic Profile, Infometrics, accessed 7 June 2023

[11] Infometrics Industry Employment Projections for 2028

[12] Nelson-Tasman Regional Economic Briefing – 2022 data update, Benje Patterson, March 2023 (unpublished)