Focus area: Growing export success

On this page

Context

Much of the activity in the digital technologies sector is export-oriented, generating new revenue and helping to diversify New Zealand’s exporting base. The breadth of markets buying our digital technology products and services is contributing to both our economic growth and resilience.[1] As our globally oriented digital technologies sector grows, we are not reliant on just one sector or market, rather we earn export dollars via a range of SaaS and game development sectors that sell into a wide range of international markets.

Creating more and stronger businesses in the digital technologies sector means new intellectual property is created and retained in New Zealand, along with growth in the number of higher-paying jobs for New Zealanders.

MBIE has been working with industry to explore the growth potential of two sub-sectors with high export growth and potential: SaaS and game development. This ITP outlines activity to support the SaaS Ecosystem, funded in Budget 2022, and evolving work on the game development sector.

What is Software-as-a-Service?

SaaS is the combination of a technology, software delivered via the internet (most commonly via the browser), and a business model (software paid for as subscription). SaaS businesses create and sell software services that can be accessed anywhere and anytime over the internet. The software is hosted in the cloud. As SaaS products are predominantly productivity tools, the technology is creating both an industry and lifting the productivity of New Zealand businesses.

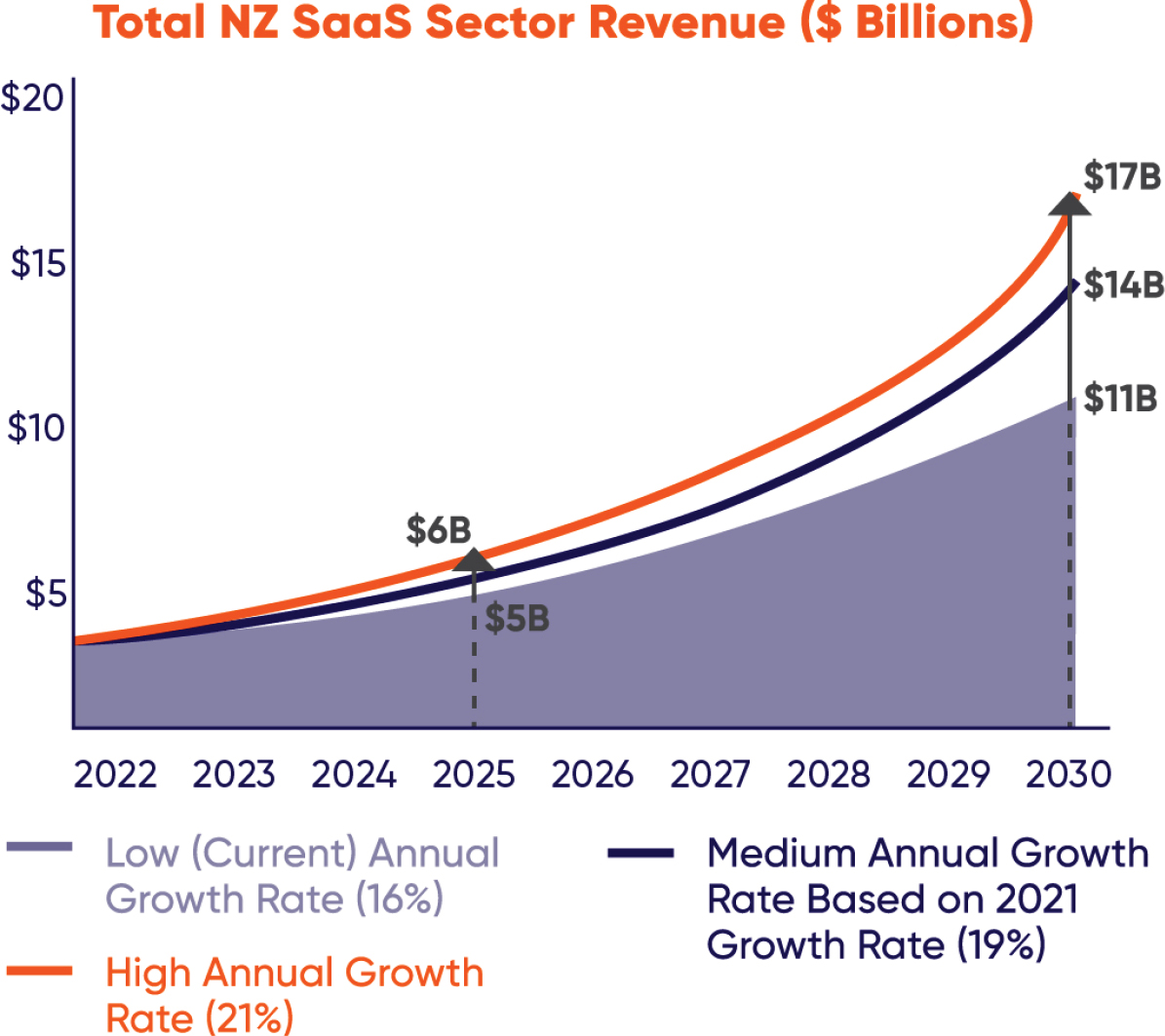

New Zealand’s SaaS sector generated $2.2 billion in revenue in 2021[2] and is currently growing by 16% annually.[3] The sustained growth by the SaaS sector over this period indicates that the sector could become a major industry for New Zealand. If this growth can be accelerated to 19% per year, by 2030, it is estimated that the sector could be worth nearly $14 billion and generate as many as 58,000 new jobs (provided the talent could be found).[4]

SaaS companies typically disrupt traditional industries and processes, providing more scalable and efficient ways of operating. The SaaS business model has the advantage that it creates resaleable intellectual property through research and development or creative design, making it hard to replicate and inherently high value. Additionally, it allows for weightless exports that have the potential for significant scale with limited impact on inputs. Unlike many other industries, the sector is not constrained by land, the natural environment, location or the need for significant new infrastructure. Its core ingredients for success are people and a high-quality telecommunications network providing good internet connectivity.

What is game development?

Interactive media describes products or services where a user’s experience is shaped by their input. Interactive media is sometimes used interchangeably with game development, but interactive media also includes virtual and augmented reality, e-sports, apps, and social media.

The game development industry depends on two core operating models:

- Games-as-a-Product – Users buy a license to a physical or digital copy of a game that they can fully experience. Users pay an initial price for a complete game product; and

- Games-as-a-Service – The initial commercial release of the game is just a milestone of the production process. There is continued development, and projects can be updated and monetised indefinitely.

In 2021, the video games market generated USD180 billion in global revenue and is forecast to reach USD219 billion by 2024.[5] New Zealand’s game development studios earned $407 million in the 2022 financial year, up from $276 million the previous year.[6] Their games are sold around the world, with 97% of the sector’s revenue coming from exports of weightless digital products or services in the 2021 financial year.[7]

New Zealand is home to over 70 studios ranging from large game studios with over 100 employees to smaller indie studios with one to three people. While relatively small, with 1070 full time employees as of March 2022, New Zealand’s game development sector has demonstrated high growth rates over recent years and its latest survey results suggest a high level of revenue per employee (of around $380,000).[8]

Saas ecosystem – (funded)

kiwiSaas – a community for SaaS company employees, founders and leaders

kiwiSaaS was established in late 2021, as a community-building initiative to connect the businesses working in New Zealand’s SaaS sector. Its first year was funded by MBIE, and continued funding of $11.2 million for the next 3 years has been provided through Budget 2022.

The key purpose of kiwiSaaS is to improve the learning environment for business leaders, founders, and employees, by providing them with easy access to relevant networks and information. kiwiSaaS runs events, shares community insights, provides access to a virtual orbit networking platform and in person regional networks. It is a place of learning and an environment to foster connections for the people working in SaaS businesses. A central online community platform will be launched in 2022/23, which will enable the community to have maximum reach across New Zealand. Future work may include extending the platform through options such as a mobile app.

The design of the community draws from feedback obtained from a series of interviews conducted with SaaS company leaders and founders at the start of the ITP process, as well as research into the needs of software entrepreneurs. The findings from the interviews informed the need for a Community for SaaS company founders to have a forum where they can learn from others who have travelled the same path. It confirmed that the process of developing a business venture into a successful venture with employees in secure jobs can be a lonely one.

SaaS focused short courses

In order to realise the growth potential that is available from an increasing global demand for SaaS services, New Zealand’s SaaS businesses will need to continually increase their focus on skills.

Interviews with SaaS companies and research completed by Sense Partners (commissioned by MBIE), highlighted how the shortage of people with specialised business and soft skills in SaaS is contributing to challenges in hiring skilled workers and boosting sector capacity. The development of short courses is an opportunity to support the upskilling of the talent pool and equip more SaaS firms with the skills needed to scale up a business/product and enter the global market to achieve accelerated export growth.

The proposed courses will bring together selected educational trainers and practitioners into a new programme that is scalable in a one-to-many format. Particular areas include:

- Advanced non-technical SaaS specific skills and experience, including knowledge of how to build an international SaaS business at scale, product sales and development.

- Soft skills in the SaaS context, including managerial skills to recruit or develop the right talent or their own businesses.

- SaaS/Cloud-specific technical skillsets, which due to the nature of the industry, evolve faster than academia’s ability to deliver training needs. This will include courses focused on ensuring diversity needs are met within product development (e.g. inclusive thinking about disability when developing a product).

The SaaS short courses will provide reskilling opportunities to a wide range of New Zealanders who are new to the sector. The courses will also enable learners from other sectors with transferable skills to develop SaaS focused skills that will offer higher value employment opportunities. For example, someone who currently works in sales can learn about SaaS sales, and then shift into the digital technologies workforce.

The next step in this initiative will be a Request for Proposal process to select a suitable provider. MBIE will also ensure this is linked to the wider work programme on developing digital skills.

SaaS database

This work will include the development of a dataset for the SaaS sector and an interactive dashboard.

This initiative responds to the limited data available about the sector, which makes it difficult to secure an accurate quantitative representation of the sector including its value, growth, and employment situation.

The SaaS Database will collect the necessary data to overcome this shortfall and create opportunities for benchmarking so that SaaS firms can measure and monitor growth against that of peers. It will collect employment data which can be re-used for skills mapping and advising on immigration settings.

Over time, the database will become a source of reliable and up-to-date data on the sub-sector and look to contribute and inform national statistics efforts.

Success factor for this focus area

Lift the SaaS sector Compound Annual Growth Rate from the current trend of 16% to 19% in 2025.

Text description of graph

Future support for the game development sector (in progress)

Given the size of the global market, and the increasing applications of digital game design and functions in different domains (e.g. health, education, workplace health and safety), businesses developing interactive media will play an increasingly important role in our economy and society. Game development businesses are often creating their own intellectual property assets that are retained in New Zealand, and are supporting creative and software development roles. With examples such as games that increase children’s nutrition knowledge, or that feature te reo Māori or utilise te ao Māori for storytelling, it is clear that the sector also holds potential for tackling social issues and opportunities in new innovative ways.

MBIE commissioned a report on the gaps and opportunities in the existing investment ecosystem within New Zealand for small and medium-sized interactive game development studios. The work:

- identified where in the business (studio) and project (game) development cycle, investment gaps and opportunities exist and their approximate size (e.g. number of studios and dollar value);

- identified barriers for both New Zealand and international investors to invest in New Zealand’s game development sector; and

- described options, including the potential costs and benefits and any scope to scale or pilot opportunities.

MBIE is assessing the recommendations from this report and is working with Ministers on options to support the growth of the game development sector, noting the suite of incentives available in Australia (including the introduction of a federal tax offset) and other jurisdictions. The industry is particularly concerned about the possible impact of the Australian regime on New Zealand’s talent pool and studio expansion plans.

In November 2022, the Government announced new and stable funding for the Dunedin-based Centre of Digital Excellence (CODE) to establish new regional hubs in the upper and lower North Island and expand its contestable grants and skill development programme to game development studios nationwide. MBIE will continue to work with the game development sector to consider the role that government can play to support its future growth.

Funding boost to support NZ’s game development industry(external link) — Beehive.govt.nz

Footnotes

[1] The US is New Zealand’s third largest trading partner overall and it is now our largest destination for services – receiving over 22% of our total service exports. Digital services are a major contributor to that figure, with $682 million worth of exports to the US spread across computer services and software license exports. Source: The NZ-US trade relationship: stability and diversity in a time of change(external link) — Beehive.govt.nz [Back to text]

[2] Source: kiwiSaaS [Back to text]

[3] Source: kiwiSaaS – this number is based on revenue per head with the baseline year of 2020. [Back to text]

[4] These numbers result from a collaboration between kiwiSaaS and Stats NZ and emphasise the value of a domestic and international marketing campaign to raise awareness and interest in working in New Zealand tech (see sections on Telling Our Tech Story). [Back to text]

[5] Source: 'NewZoo, Global Games Report (2021)'. [Back to text]

[6] Industry survey results in the NZ Interactive Media Industry Survey 2022(external link) — NZGDA [Back to text]

[7] NZ Interactive Games 2021 Survey Results(external link) — NZGDA [Back to text]

[8] NZ Interactive Media Industry Survey 2022(external link) — NZGDA [Back to text]