September 2025 summary

On this page I tēnei whārangi

This is the web version of the New Zealand Energy Quarterly September 2025 summary.

Download the PDF and word versions:

New Zealand Energy Quarterly September summary [PDF, 618 KB]

New Zealand Energy Quarterly September summary [DOCX, 5.4 MB]

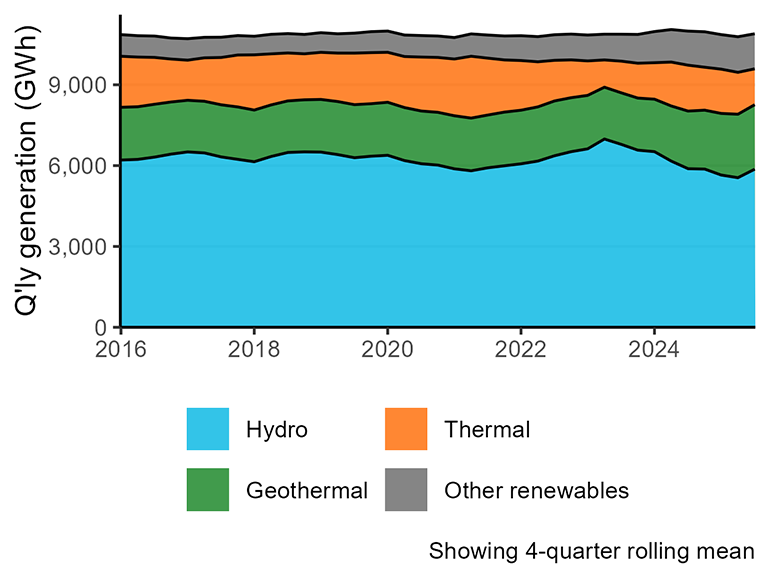

Stronger hydro output drives up renewable electricity generation

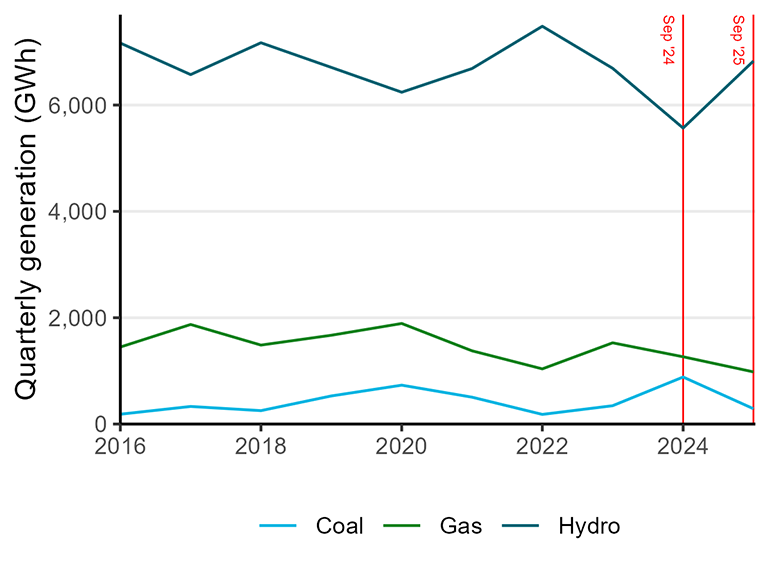

Increased hydro generation, alongside continued increases in solar and geothermal generation, contributed to the share of electricity generation from renewable sources increasing to 89.4 per cent in the September 2025 quarter. This was up 8.2 percentage points from previous September quarter, which had seen a combination of dry conditions and lower gas supply lead to an increase in electricity generation from coal.

Hydro generation was up 1,260 GWh (22.6%) from last September quarter. Geothermal generation was up 156 GWh (6.5%), largely due to the addition of Te Huka Unit 3 which was commissioned in October 2024. Solar generation continued its steady growth, up 83 GWh (64.2%). In contrast, wind generation was down 9.4 per cent mainly due to lower-than-average wind speeds in the lower North Island during July and August.

With an increase in generation from renewable sources, there was a 596 GWh (67.4 per cent) drop in generation from coal and a 284 GWh (22.5%) drop in gas generation.

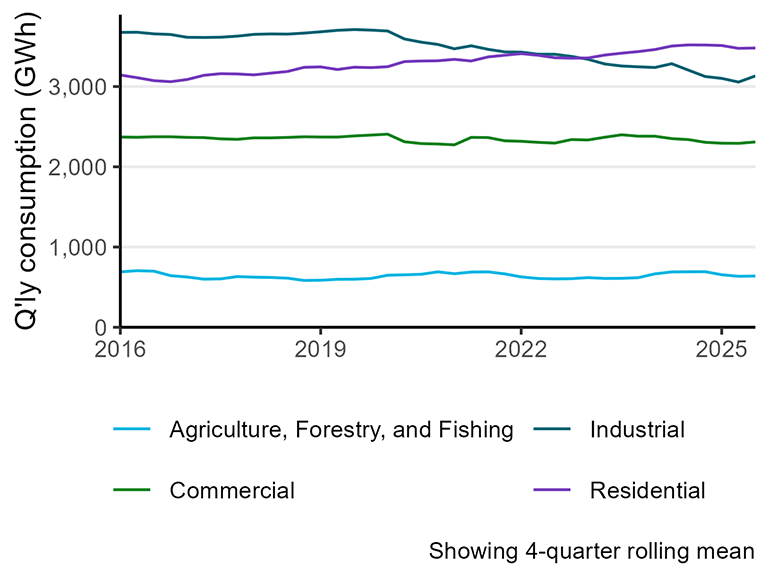

Electricity consumption increased 3.8% on the September 2024 quarter. The commercial and residential sectors both saw higher demand, with residential electricity consumption reaching a new quarterly record at 4,511 GWh.

Industrial consumption increased 10.8% to 3,119 GWh, a similar level to the September 2023 quarter. In August 2024, New Zealand Aluminium Smelters’ (NZAS) demand response agreement was called on, which contributed to a reduction in industrial electricity consumption in the September 2024 quarter. Due to favourable hydro storage levels, the agreed demand-response to be provided over winter 2025 was at a lower level, allowing NZAS to ramp up production.

Gas use in the chemical sector (both for energy purposes and as a feedstock) increased 2.32 PJ on the previous September quarter. In 2024, Methanex idled their production facilities from mid-August to the end of October to free up gas for electricity generation. Methanex paused operations again in 2025 to free up gas for the generation market, although this was from mid-May to early July and had minimal impact on the September 2025 quarter.

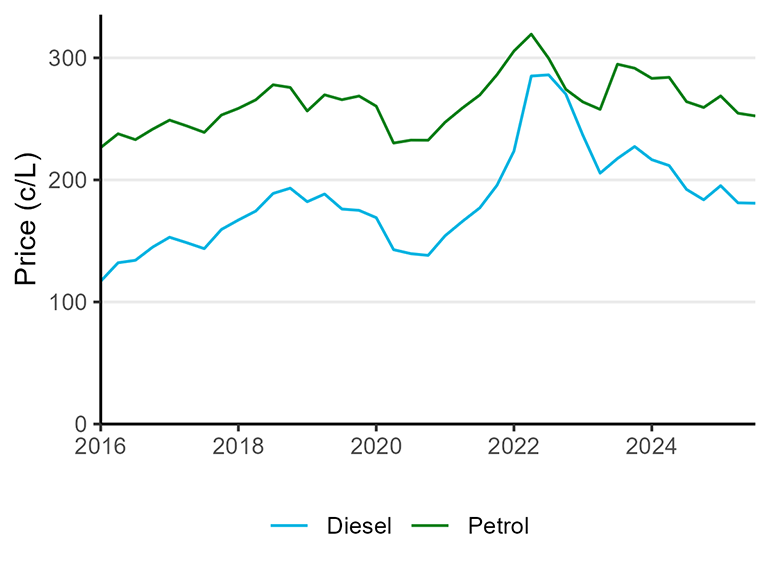

Following a period of voluntary production cuts, eight of the OPEC+ members started gradually increasing their production in April 2025. This steadily lowered the cost of crude oil and importer costs for petrol and diesel over the last two quarters. This has contributed to petrol prices decreasing 4.43% from 264.1 cents per litre to 252.4 cents per litre year-on-year, and diesel prices also dropping 5.90% from 192.3 cents per litre to 180.9 cents per litre.

Summary charts

Electricity generation by source

Text description of chart - Electricity generation by source - September 2025

September quarter generation from hydro, coal, and gas

Text description of chart - September quarter generation from hydro, coal, and gas - September 2025

Electricity consumption by sector

Text description of chart - Electricity consumption by sector - September 2025

Petrol and diesel prices

Text description of chart - Petrol and diesel prices - September 2025