Oil

Domestic consumption of oil products remains steady, with declines in commercial sector use counteracting an increase in residential and agricultural use. International transport fuel use continues to increase as travel recovers from the impacts of the coronavirus (COVID-19) pandemic.

On this page I tēnei whārangi

Background

Oil can refer to a wide range of different products, including

- crude oil extracted from oil fields.

- refined fuels like petrol, diesel, and jet fuel, which are produced through refining crude oil.

New Zealand’s crude oil fields are concentrated both within, and just off the shore of, the Taranaki region (Figure 15). Crude oil extracted in New Zealand is bound entirely for the export market.

Even when New Zealand had the capacity to refine crude oil, almost all New Zealand crude was exported as it wasn’t suitable for the capabilities of the refinery. Until 2021, the country’s sole refinery operated at Marsden Point, north of Auckland. This refinery produced several types of refined fuels (mainly petrol, diesel, and jet fuel) from imported crude oil, usually sourced from the Middle East. On 31 March 2022 the refinery shut down for economic reasons and the facility switched to a fuel import terminal only.

Since the closure of the Marsden Point refinery, New Zealand’s imports of crude oil have dropped to zero, with imports of refined products rising to cover the shortfall. Five companies currently import fuel for sale in New Zealand: Z Energy, BP, Mobil, Gull, and Tasman Fuels. These companies sell fuel both directly to consumers and to independent fuel resellers.

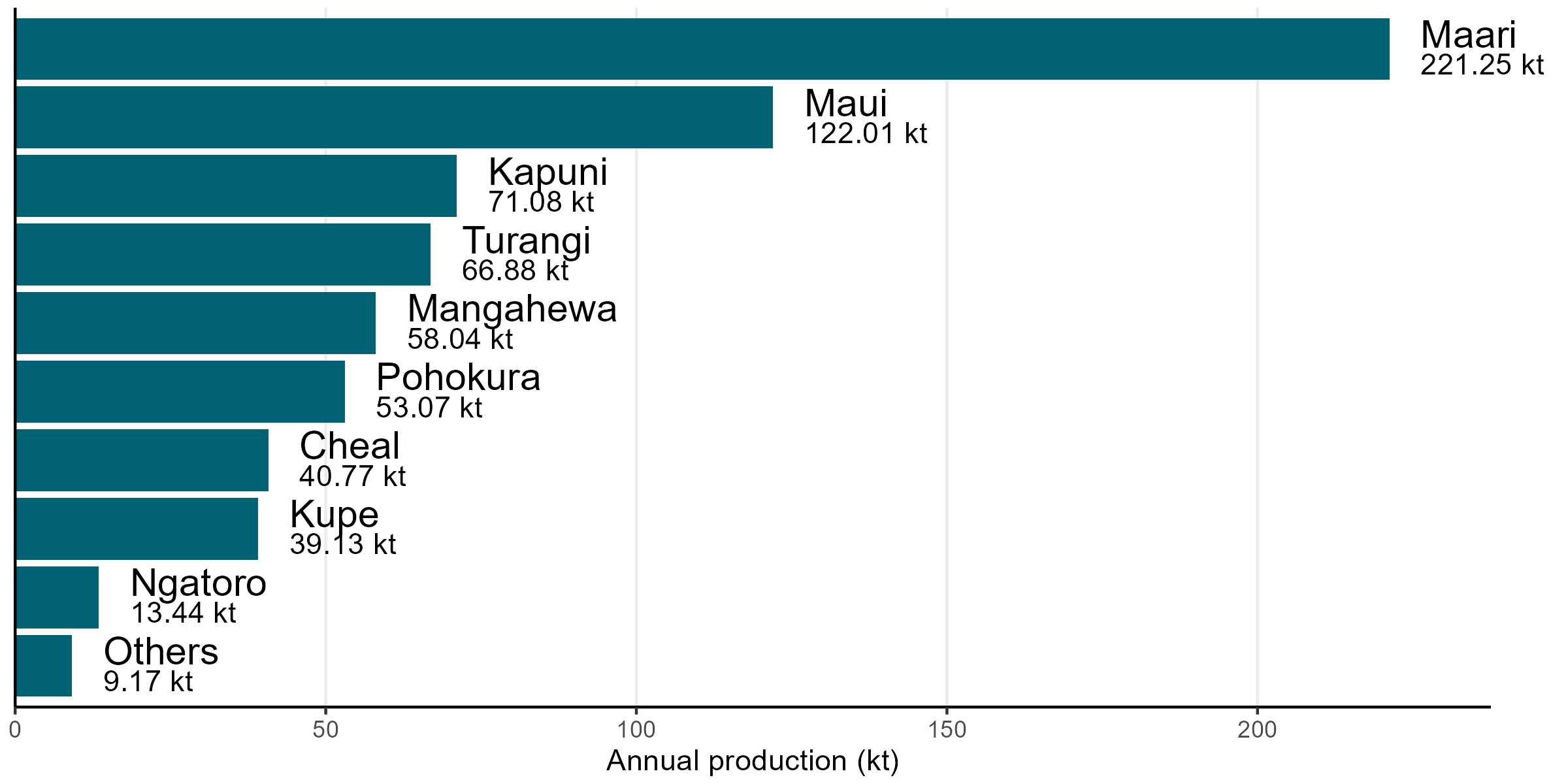

Crude oil production continues to decline

Crude oil production for 2024 totalled 694.83 kt, a decrease of 14% (117 kt) on 2023 figures. Most fields saw decreases in year-on-year production due to ongoing natural decline, with the exceptions (Kapuni and Ngatoro) unable to make up for losses across other fields (Table 2).

Table 2. Crude oil production for all major oil fields in New Zealand. Fields whose annual production in 2024 was less than 10 kt are not shown.

| Field | 2024 production (kt) | 2023 production (kt) | % change |

|---|---|---|---|

| Maari | 221.25 | 221.8 | -<1% |

| Maui | 122.01 | 165.03 | -26% |

| Kapuni | 71.08 | 61.17 | +16% |

| Turangi | 66.88 | 75.74 | -12% |

| Mangahewa | 58.04 | 85.17 | -32% |

| Pohokura | 53.07 | 88.09 | -40% |

| Cheal | 40.77 | 54.13 | -25% |

| Kupe | 39.13 | 40.73 | -4% |

| Ngatoro | 13.44 | 8.19 | +64% |

The Maari field was the largest contributor to New Zealand’s crude oil production in 2024, comprising 32% of all crude oil production (Figure 20). The Maari field started production in 2009, and has been the largest contributor to crude oil production since 2015.

Figure 20. Crude oil production by field for 2024.

View chart data for figure 20

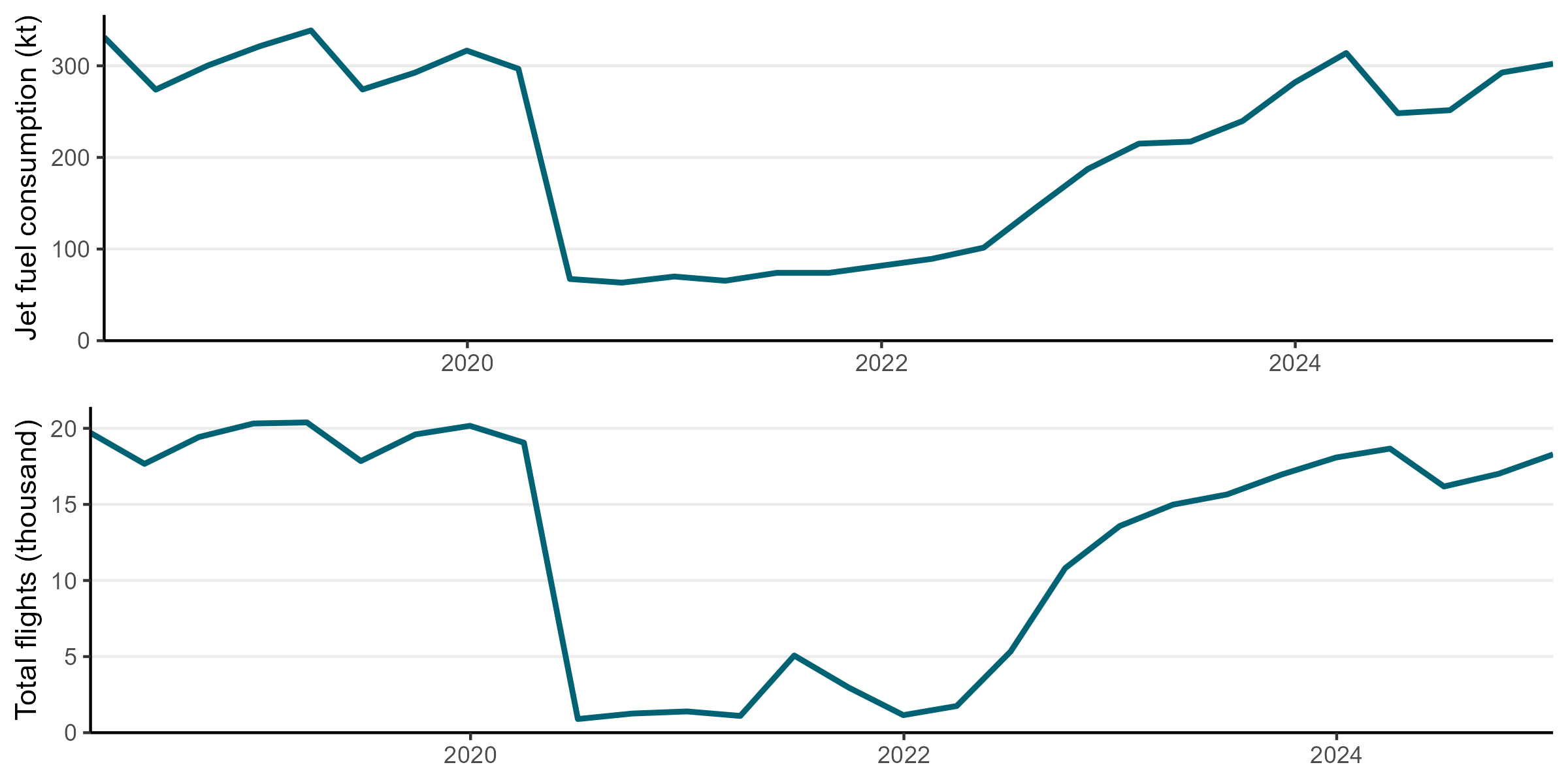

International transport fuel use rises as international travel continues to recover from COVID-19

Fuel use for international transport totalled 1,289 kt in 2024, an increase of 15% (166 kt) on 2023 figures. This includes fuel for international aviation (including jet fuel) and international shipping (including diesel and fuel oil). Jet fuel use increased by 16% (153 kt) on 2023 figures, while fuel oil increased by 9% (10 kt).

International transport was significantly disrupted in 2020 due to border closures implemented in response to the coronavirus (COVID-19) pandemic. Fuel use for both international aviation and international shipping has been recovering in the years since. Jet fuel use for international aviation in 2024 was still only 92% of pre-pandemic levels (based on average use for 2017-2019) while international flight numbers[12] were at 90% of pre-pandemic levels (Figure 21).

Figure 21. Jet fuel use for international transport (top) compared to international flight numbers (bottom). Flight data provided by Cirium.

View chart data for figure 21

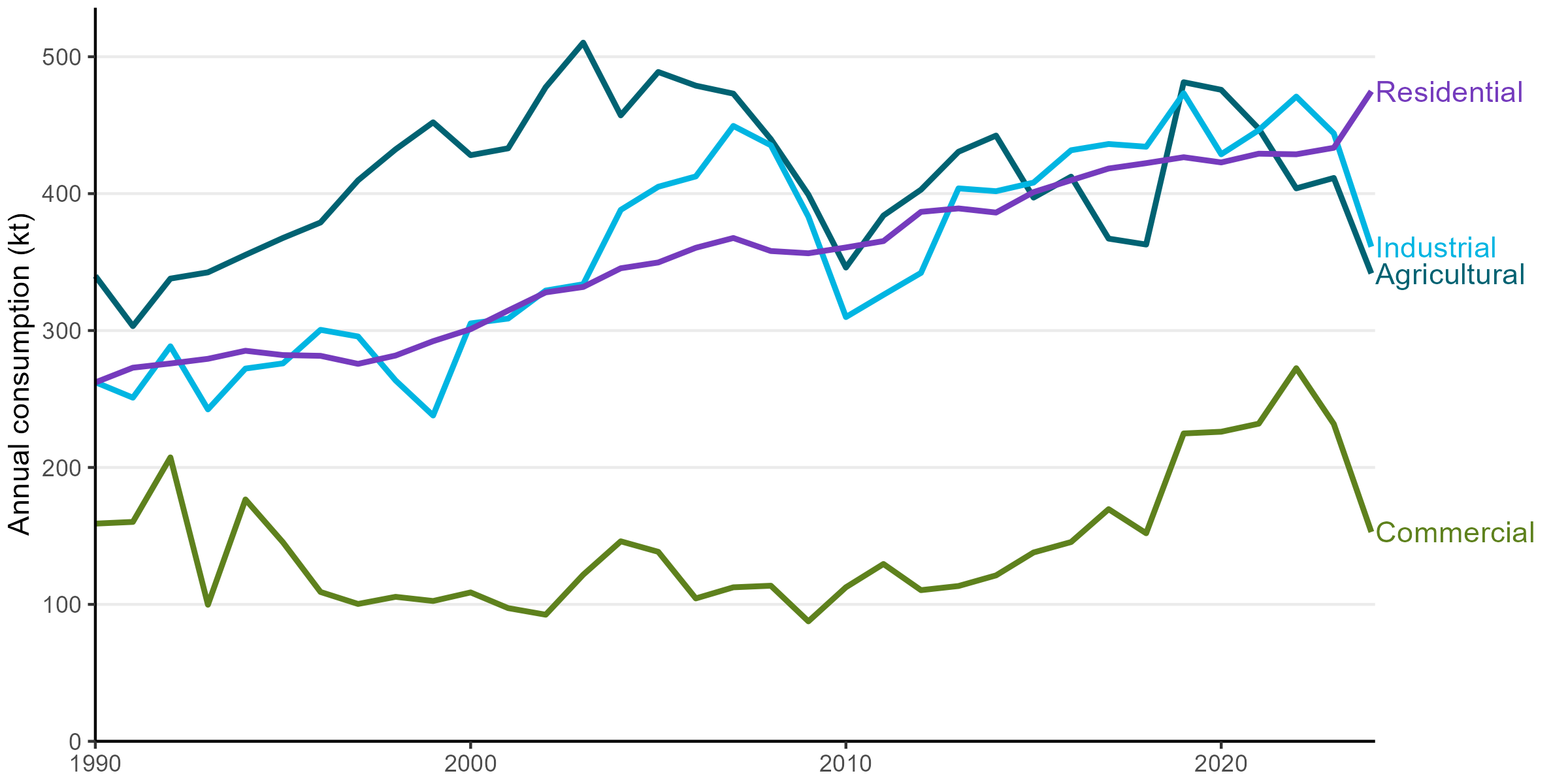

Domestic oil consumption stays steady

Total domestic consumption for petrol, diesel, and jet fuel has stayed relatively level when compared to 2023 usage. Oil use in the agriculture, forestry and fishing sector decreased by 17.0% (69.8 kt) on 2023, driven by a combined drop in petrol and diesel use. Industrial and commercial use of oil also fell, by 18.6% (82.8 kt) and 34% (78.9 kt) respectively (Figure 22). This decrease was counteracted by increased in residential use (up 9.5%, or 41.3 kt) and domestic transport (up 4.0%, or 175.0 kt).

Figure 22. Domestic (non-transport) oil consumption by sector over time.

View chart data for figure 22

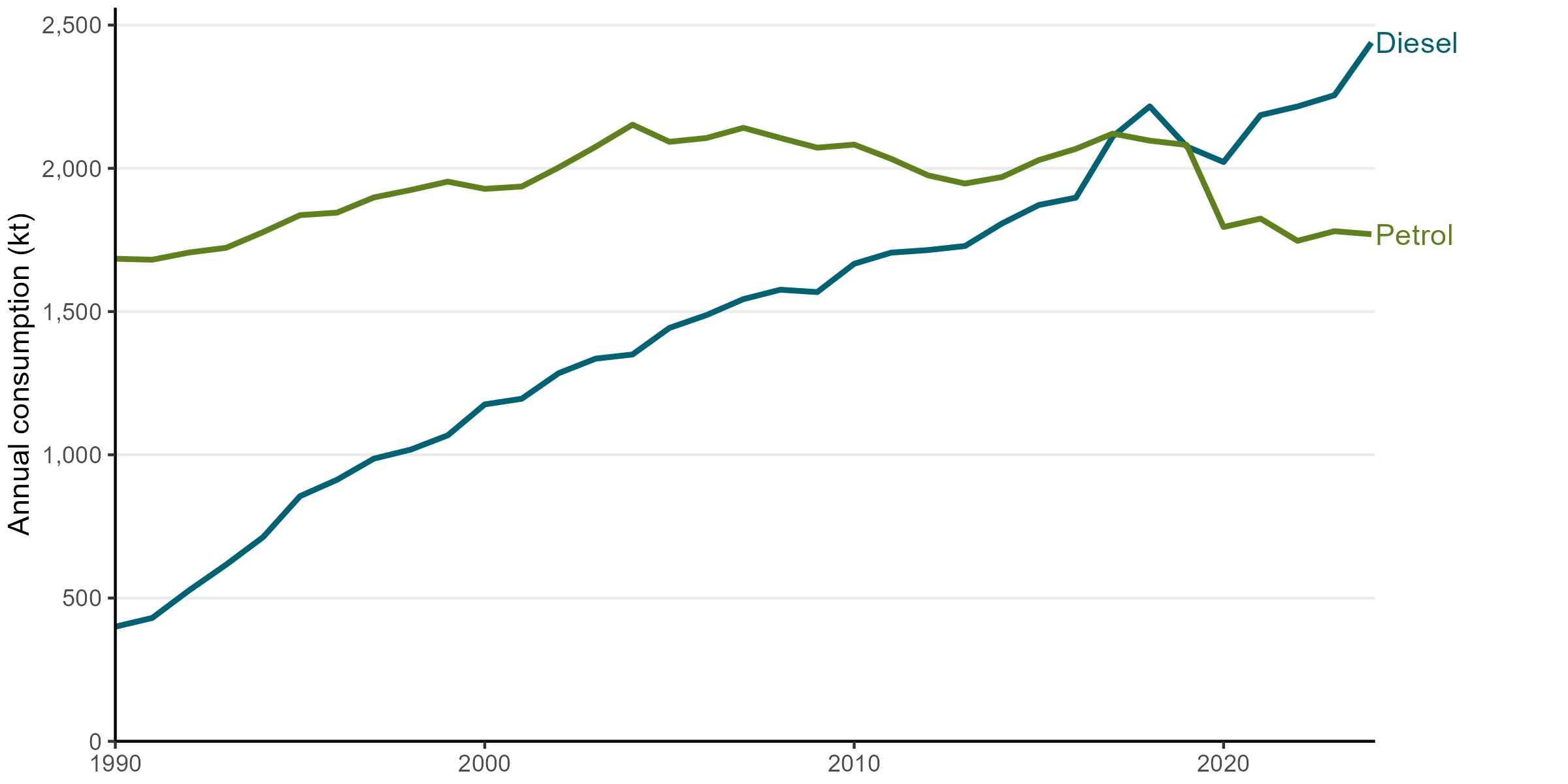

Domestic transport accounts for almost three quarters of all domestic consumption of oil products in New Zealand. As a result, small changes in domestic transport fuel use can have marked effects on overall oil product consumption. Petrol use for domestic transport is usually linked to private vehicle use (for example, commuting and private transport), while diesel use is driven by commercial activity (such as freight transport by trucks and vans).

In 2024, petrol use for transport decreased by 0.6% (10.6 kt) on 2023 levels, while diesel increased by 8.1% (183.5 kt) (Figure 23). Petrol use remains below pre-pandemic levels, which may indicate behaviour changes resulting from the pandemic such as working from home. In contrast, diesel use for domestic transport is now 17.5% higher than it was in 2019 levels, reflecting the continuing economic recovery from the pandemic.

Figure 23. Petrol and diesel use for domestic transport over time.

View chart data for figure 23

Fuel prices drop, driven by international factors and removal of regional fuel tax

Petrol prices for the final quarter of 2024 were 274.00 cents per litre (c/L) for premium petrol and 254.70 c/L for regular petrol, a decrease of 11% (when adjusted for inflation) on the same quarter of the previous year. Diesel prices also dropped, with retail diesel dropping 19% to 183.70 c/L and commercial diesel dropping 15% to 146.09 c/L[13] (Figure 24).

Fuel prices experienced significant spikes in 2022 and 2023 due to the Russian invasion of Ukraine and the Israel-Hamas conflict respectively. These conflicts drove up international oil prices as they threatened international supply of crude oil, resulting in higher domestic fuel prices. In contrast, slowing global oil demand growth, coupled with increasing global oil supply, led to lower prices during 2024[14].

Figure 24. Petrol and diesel prices over time, adjusted for inflation. All values are in December 2024 prices.

View chart data for figure 24

In July 2024, the Government removed the legislative framework for regional fuel taxes, which in turn led to the repeal of Auckland’s regional fuel tax. The Auckland scheme started operation on 1 July 2018 and imposed a tax of 10 c/L (11.5 c/L including GST) on all petrol and diesel distributed in the Auckland region. With the removal of the Auckland Regional Fuel Tax, fuel prices in the Auckland region dropped by between 8 and 11 c/L, indicating that the removal of the tax was carried through to consumers[15].

Footnotes

[12] Based on flight data provided by Cirium.

[13] Commercial diesel prices are exclusive of the goods and services tax (GST).

[14] Oil Market Report - December 2024(external link) — IEA

[15] Focus Report: Removal of Auckland Regional Fuel Tax (August 2024)

Monitoring and focus reports(external link) — Commerce Commission New Zealand