Monitoring the petrol excise duty reduction

On this page

Fuel excise duty reduction monitoring

On 14 March 2022, the Government cut 25 cents a litre off fuel for 3 months as part of a cost of living package aimed at giving Kiwi families immediate relief through the current global energy crisis triggered by the war in Ukraine.

We are monitoring the performance of the market to determine whether the reduction to petrol excise duty, as well as any consequent GST reduction, is being passed through to consumers in a manner that is expected in a competitive market.

About fuel excise duty monitoring

Cost and revenue information is disclosed by individual fuel companies under the Fuel Industry Act 2020. This allows for monitoring the performance of the market to indicate whether they are passing on the fuel excise reductions. The transparency provided by publication should promote competition in engine fuel markets.

Fuel companies have disclosed cost and revenue information that relates to the period before the excise duty was cut. This provides a baseline to track changes in margins since the excise duty cut.

Fuel importers (Z Energy, BP, Mobil, Gull and Timaru Oil Services) are required to disclose daily cost and revenue information to us every week. Fuel wholesale suppliers and distributors (companies that purchase fuel from importers for resale) are required to disclose weekly cost and revenue information to us every week.

To allow for more accurate reporting, fuel companies may provide updated disclosures each month after transactions have been finalised.

We will publish provisional margin trends each week, that relate to the previous week. This information will be provisional until the end of the month.

We also conduct weekly fuel price monitoring. This information is obtained from a range of sources, including Statistics New Zealand and Hale and Twomey Ltd.

Weekly volume weighted fuel industry margin trends

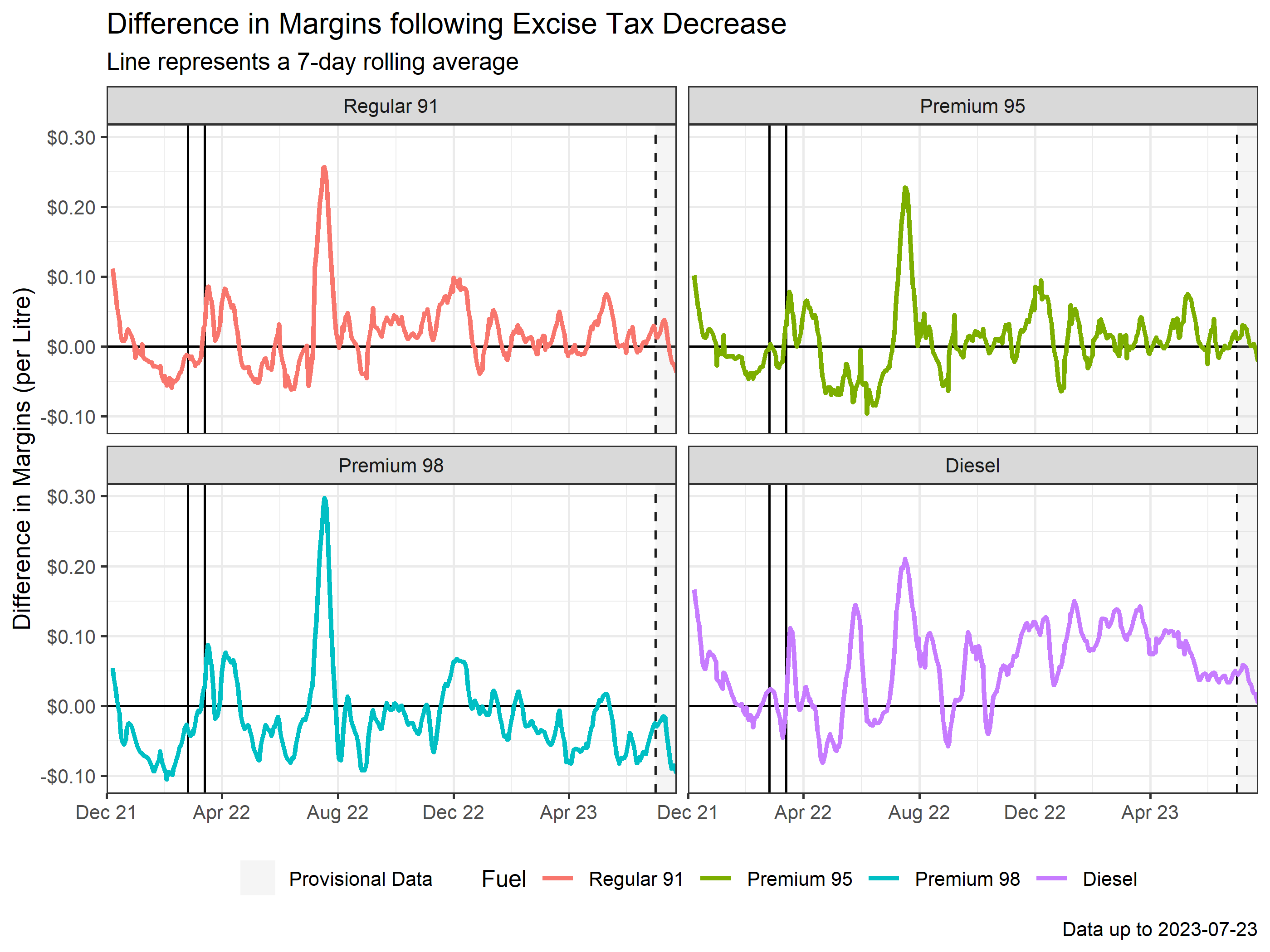

This time series shows how fuel margins have changed by fuel, relative to a baseline period. That period starts with the Russian invasion of Ukraine and ends the day before the excise tax cut.

This is the fuel industry average difference in margins, weighted by fuel sales.

The coloured lines represent 7-day rolling averages.

The first vertical line towards the end of February marks the beginning of the Russian invasion of Ukraine and the second vertical line in mid-March shows when the fuel excise duty was reduced.

Text description of Weekly volume weighted fuel industry margin trends

Weekly fuel industry traffic light

This information compares how the fuel industry’s margins for Regular 91 sold at retail have changed since the baseline period.

Green indicates that margins are 4.50 cents per litre or less above the average during the baseline period.

Orange indicates that margins are between 4.50 and 13.60 cents per litre above the average during the baseline period.

Red indicates that margins are 13.60 cents per litre or more above the average during the baseline period.

A tolerance of 4.50 cents was chosen as it represents the standard deviation of the difference in margins prior to the tax cut.

| Week ending | Fuel | Light | Status |

|---|---|---|---|

| 02/07/2023 | Regular 91 | Green | Provisional |

| 09/07/2023 | Regular 91 | Green | Provisional |

| 16/07/2023 | Regular 91 | Green | Provisional |

| 23/07/2023 | Regular 91 | Green | Provisional |