Outcome 4: Strong and resilient economy delivering energy security and value from resources

A strong and resilient economy is essential to the country’s long-term success and to helping weather global and national changes and natural disasters. Energy security and renewable energy sources provide better economic stability and ensure the nation’s autonomy. The strategic and responsible development of New Zealand’s natural resources enables economic growth and activity. Under this outcome, we also make important contributions to three pillars of Going For Growth (Pillar 2: Competitive business settings, Pillar 3: Promoting global trade and investment and Pillar 5: Infrastructure for growth).

On this page I tēnei whārangi

What we are working towards

Building a strong economy with increased resilience through robust supply chains, energy security, and economic activity from Aotearoa New Zealand’s natural resources.

Expenditure

- Departmental: $47 million

- Non-departmental: $421 million

Ministerial portfolios

- Energy

- Resources

Agencies

- Electricity Authority

- Energy Efficiency and Conservation Authority

Core responsibilities

- Energy and renewable energy infrastructure and market settings

- Management of Crown-owned mineral estates

Key services

- New Zealand Petroleum & Minerals

2024/25 initiatives

- Review of energy markets’ performance

- Supporting small-scale energy initiatives

- Minerals strategy

- Repeal the ban on offshore oil and gas exploration

Outcome measure trends

Key:

+ Positive shift

– Negative shift

‡ Not comparable

- - Greenhouse gas emissions from electricity generation

- + Sustainable national energy system

- + Efficient national energy system

- ‡ Economic productivity

Performance measures

Achieved 18/21

- Milestones 0/0

- Quality 7/7

- Satisfaction 0/2

- Timeliness 8/9

- Volume 3/3

Long-term outlook: New Zealand's Energy system

Energy is fundamental to economic activity and the conduct of much of our daily lives. New Zealanders and businesses depend on affordable and secure energy. Compared with many other countries, New Zealand’s energy supply is reliable, renewable and affordable. We have a highly renewable electricity system, and our abundant resources provide a strong platform to meet increasing electricity demand over the coming decades.

While New Zealand’s energy system has served the country well to date, the gas and electricity sectors currently face significant issues that are driving elevated prices and risks to security of supply. Gas is an important contributor to New Zealand’s economy, and it will continue to be vital to the country’s energy security for the foreseeable future. Gas production is at a 40-year low and continues to be below the sector’s own forecasts. In winter 2024, New Zealand faced historically low inflows into its hydro catchments, a significantly constrained gas supply and a ‘wind drought’. These compounding factors resulted in high wholesale electricity and spot gas prices, affecting the commercial viability of some firms.

MBIE's role in the energy system

The energy system encompasses institutions and markets involved in the production, supply and consumption of energy, including electricity, gas, liquid fuel and new fuels. New Zealand’s energy is delivered by the private sector. MBIE’s role is to help ensure New Zealand has the right regulatory and market environment so that the sector delivers energy that is secure, reliable and affordable. Recent security of supply and affordability concerns have triggered a review of electricity market performance, with a focus on ensuring the market delivers reliable electricity at the lowest possible cost to consumers.

We also monitor and work with agencies with significant roles in the energy system, including:

- the Electricity Authority, which regulates the operation of the electricity market and promotes competition, reliable supply and efficient operation of the electricity industry for the long-term benefit of consumers

- the Energy Efficiency and Conservation Authority (EECA), which regulates for energy efficiency, funds investments (grants and loans) for energy efficiency and decarbonisation projects, and provides information to consumers and businesses.

New Zealand energy performance

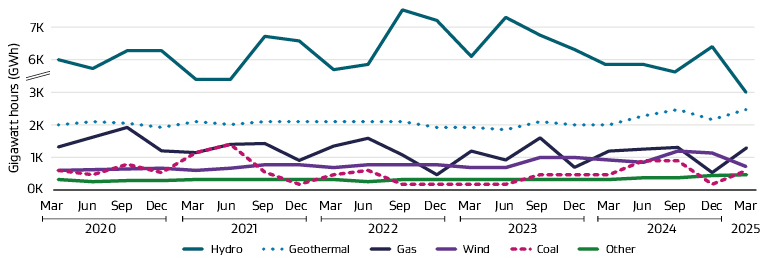

In 2024, 85.5% of New Zealand’s electricity was generated from renewable sources, lower than the previous year and reflecting low hydro inflows.

New Zealand electricity generation

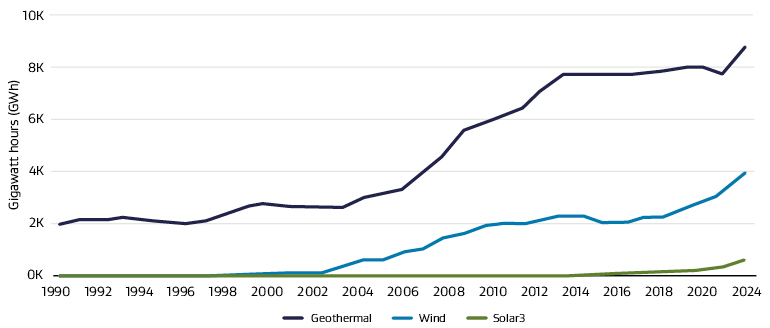

While hydro generation fell, other renewable sources reached new records as newly commissioned wind, solar and geothermal plants led to increased capacity. More generation capacity was added in 2024 than in any year since 2007, and the forward pipeline of renewable developments is strong.

Electricity generation - geothermal, wind and solar

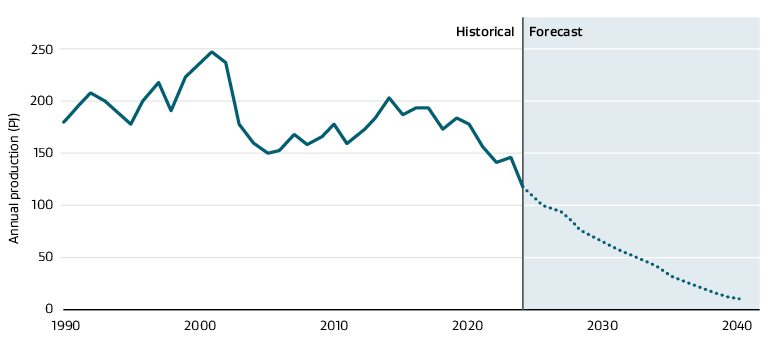

- Gas supply for 2024 was down 19% on 2023 levels, mainly due to natural field decline. Because New Zealand has a ‘closed’ gas system, with limited ability to import gas, total gas use in the economy fell by a similar amount.

- New Zealand’s natural gas reserves (an indication of the amount of gas that can be extracted from existing gas fields) as at 1 January 2025 were estimated to be 948 petajoules, a drop of 27% on 1 January 2024 figures.

Annual gas production

Energy security and fuel resilience

Because New Zealand relies on imported transport fuels, it makes the country vulnerable to disruptions, like supply issues, price volatility and other global risks. Maintaining minimum fuel stockholding and diversifying energy sources helps protect New Zealand against such disruptions and ensures essential services like transport, health care and emergency response can continue operating during crises or shortages.

In 2024, New Zealand experienced an electricity shortage. It was a ‘dry year’, where the lakes were low, the wind wasn’t blowing, and the supply of natural gas was inadequate to meet demand. This pushed up energy prices. To address this, we are supporting the Government to explore an increase in the scale and pace of energy and resource development, to ensure secure, resilient and reliable production and supply.

Strengthening New Zealand’s fuel resilience

Throughout the past year, the Government introduced a range of actions to help support the security of the country’s fuel supply. These included focusing on:

- Fuel security: Developing a fuel security study, released in February 2025, to identify the current state of fuel security and provide recommendations that feed into a fuel security plan.

- Jet fuel reserves: Increasing requirements for fuel companies to hold at least 10 days of jet fuel near Auckland airport, which will come into force in November 2026.

- Diesel reserves: Increasing the minimum stockholding obligation for diesel importers from 21 to 28 days, to bolster New Zealand’s diesel reserves and resilience to supply disruptions.

Secure and affordable energy

This year, we worked on improving energy security and ensuring New Zealand’s energy system is stable, reliable and affordable. This included focusing on:

- Offshore oil and gas: Supporting the passage of the Crown Minerals Amendment Bill, to reverse the ban on offshore oil and gas exploration.

- New gas development: Supporting the Government in its co-investment (with up to $200 million of tagged contingent funding) into new gas development over the next four years to secure New Zealand’s energy supply.

- Review of the electricity market: Supporting an independent review of the electricity market, to ensure it supports economic growth and access to reliable and affordable electricity.

- Consenting process: Working with the Ministry for the Environment to develop reforms to streamline consenting processes for renewable electricity generation and electricity networks and developing proposals to enable carbon capture and storage.

- Solar: Enabling greater solar uptake in New Zealand by expanding the permitted voltage range for electricity networks that power households and businesses, enabling people with rooftop solar panels to send more electricity back to the grid and reduce electricity bills.

- Offshore renewables: Developing a regulatory regime for offshore renewable energy, to give greater certainty for developers to invest in offshore renewable energy developments.

- Hydrogen: Releasing a hydrogen action plan that outlines the Government’s commitment to boosting the hydrogen sector through removing regulatory barriers and supporting international trade and investment.

- Consumer data right for electricity: Securing the data sharing necessary for open electricity.

Deriving value from resources

The Government released the report A Minerals Strategy for New Zealand to 2040 in January. This sets a long-term vision to responsibly grow the minerals sector while supporting economic resilience. The strategy is built on three pillars: enhancing prosperity for New Zealanders, demonstrating the sector’s value, and delivering minerals for a clean energy transition. It emphasises responsible development aligned with the Treaty of Waitangi/Te Tiriti o Waitangi, environmental stewardship, and improved regulatory settings to attract investment and innovation in the sector.

In alignment with the strategy, the Government also published New Zealand’s first Critical Minerals List. This identifies 37 minerals essential to the country’s economy, national security and clean technology ambitions.

By increasing efficiency in MBIE’s permitting processes, New Zealand Petroleum and Minerals successfully resolved more than 80 per cent of its historical minerals permit application backlog through a focused five-month ‘permitting sprint’, addressing long- standing processing delays. This initiative cleared more than 130 applications by improving operational efficiency and laid the groundwork for enhanced transparency ahead, with the introduction of quarterly processing timeframes being published from July 2024.

The Government published a discussion document proposing new regulatory approaches to support the development of naturally occurring and orange hydrogen, an overlooked resource that could drive economic growth, energy resilience and innovation. Natural and orange hydrogen could be game-changers for New Zealand’s energy sector, particularly for the hard-to-electrify industries and in reducing the country’s reliance on imported fossil fuels.

MBIE developed a draft geothermal strategy to unlock the potential of New Zealand’s geothermal resources. In addition to energy outcomes, the draft strategy aims to extend New Zealand’s position as a world leader in geothermal innovation and strengthen regional economies and the Māori economy. It will advance geothermal development and help unlock industrial growth, tourism and trade to support the country’s goal of doubling exports.

Tui oil field decommissioning

In 2025, Tui was the first offshore oil and gas field to be decommissioned in New Zealand, both on time and below budget.

MBIE has been engaged in the decommissioning of the Tui oil field in the offshore Taranaki Basin since early 2020. This project came about after the permit operator was placed into receivership and liquidation in 2019, which meant the obligation for decommissioning fell to the Crown. This left a significant reputational and financial risk in the hands of the New Zealand taxpayer.

MBIE acted urgently to manage the decommissioning, and due to strong and proactive management, the project was completed well within budget and will return $150 million. Successful completion represented a significant milestone for the energy sector and MBIE, with all important technical, environmental and regulatory objectives achieved without any significant health and safety or environmental incidents. Post- decommissioning monitoring has confirmed any adverse effects of decommissioning were minor, highly localised and largely temporary. A second and final round of environmental monitoring of the decommissioned wells is planned for 2027.