Outcome 3: Competitive markets with informed consumers and business

A market with appropriate checks and balances increases the confidence of people and businesses to participate freely in the economy. We achieve this by regulating markets, providing critical information to consumers, providing dispute resolution services, and supporting businesses to grow and evolve.

On this page I tēnei whārangi

What we are working towards

Competitive systems that enable the operations of businesses and the market, while protecting the rights of users and consumers.

Expenditure

- Departmental: $297 million

- Non-departmental: $282 million

Ministerial portfolios

- Small Business and Manufacturing

- Commerce and Consumer Affairs

- Media and Communications

- Building and Construction

- Housing (Tenancy)

Agencies

- Commerce Commission

- Financial Markets Authority

Core responsibilities

- Market and regulatory settings

- Foundational services and support for businesses

- Building and tenancy systems

- Early and alternative means of dispute resolution

- Emergency information services and national disaster response

Key services

- New Zealand Companies Office

- Business.govt.nz

- Consumer Protection

- Tenancy Services

- New Zealand Business Number

- Building Performance

- New Zealand Claims Resolution Service

- Trading Standards

2024/25 initiatives

- Competitive and fair markets

- Better housing, building and infrastructure

- Providing core services to New Zealanders

Outcome measure trends

Key:

+ Positive shift

= Unchanged

‡ Not comparable

- + Consumer awareness of rights

- + Consumer awareness of resolution pathways

- = Tenancy mediation

- + Employment mediation

- ‡ Business experience with government agencies

Performance measures

Achieved 55/65

- Milestones 2/2

- Quality 19/21

- Satisfaction 8/9

- Timeliness 19/22

- Volume 7/11

Competitive and fair markets

Competitive and fair markets boost productivity and competition, create employment opportunities and lift living standards by encouraging innovation, efficiency and better prices for consumers. This year, we focused on a range of areas:

- Banking and energy competition: MBIE supported the passing of the Customer and Product Data Act 2025 to improve competition in banking, energy and other main sectors. The Act establishes a framework for secure data sharing necessary for open banking and open electricity provision, and aims to enable greater choice and lower costs for New Zealanders.

- Grocery competition: In response to ongoing concerns from the Commerce Commission and other stakeholders, we supported the delivery of a work programme to improve grocery competition. This included engaging with industry on what changes are needed to increase competition and drive grocery prices down, addressing these changes and strengthening enforcement settings.

- Financial services reform: MBIE progressed financial services reforms, which aim to rebalance the system to ensure consumer protection without stifling access to credit or innovation. The Credit Contracts and Consumer Finance Amendment Bill, Financial Markets Conduct Amendment Bill, and Financial Service Providers (Registration and Dispute Resolution) Amendment Bill have all been put in front of select committees.

- Monopolies and productivity: MBIE progressed a review of New Zealand’s competition rules, as set out in the Commerce Act 1986, to combat monopolies and improve economic productivity. This aims to strengthen competition across the economy, reduce costs and improve choice for consumers. We consulted on changes and are coordinating a review of New Zealand’s competition regulator, the Commerce Commission.

Better housing, building and infrastructure

Well-functioning housing and construction markets support growth and employment and help ensure people have good, safe buildings and homes. This year, we supported initiatives that aim to create better housing and a more productive building and construction sector, including:

- ‘Granny’ flats: The introduction of the Building and Construction (Small Standalone Dwellings) Amendment Bill will exempt granny flats of up to 70 square metres from requiring a building consent. The change aims to free up consenting resources for higher-risk work and is expected to result in up to 13,000 more granny flats being built over the next decade, improving housing capacity.

- Using overseas building products: The passing of the Building (Overseas Building Products, Standards, and Certification Schemes) Amendment Bill will remove barriers to overseas building products being used in New Zealand to improve competition in the construction sector and lower building costs.

- Accountability when things go wrong: Progressing work to strengthen accountability for poor workmanship by improving the licensed building practitioner complaints and disciplinary processes, updating the public register to show builders who have had their licence suspended, and introducing codes of ethics for licensed electrical workers, plumbers, gasfitters and drainlayers.

- Liability and risk: Early engagement with the building and construction, insurance and legal sectors to explore a more balanced approach to liability and risk allocation alongside a review of the structure of building consent authorities to enhance consistency and efficiency.

- Timeliness of building inspections: Developing a new requirement for building consent authorities to conduct 80% of inspections within three working days to reduce delays.

In addition, to enable accelerated infrastructure growth, MBIE supported the passing of the Fast-track Approvals Bill, which creates a one-stop shop, fast-track consenting regime for regionally and nationally significant projects to help rebuild the New Zealand economy.

Healthier homes for renters

From 1 July 2025, all residential rental properties must comply with the Healthy Homes Standards. The standards became law on 1 July 2019 and introduced minimum standards for heating, insulation, ventilation, moisture ingress and drainage, and draught stopping in rental properties. Landlords are responsible for ensuring their properties meet the standards and continue to do so over time.

MBIE and the Ministry of Housing and Urban Development (HUD) worked together to close the quality gap between rental properties and owner- occupied homes. This allowed the nearly 600,000 households renting in New Zealand to have warmer, drier places to call home. Activities included:

- Information and engagement on new requirements: Supporting the 2025 healthy homes campaign, and communicating the final compliance deadline, including pointing landlords and tenants to information to help them comply and understand their rights, with over 119,000 sessions on our website. Advertisements were shown over 8.9 million times and reached over 1.6 million people. MBIE also responded to over 9,450 queries to the Service Centre on the Healthy Homes Standards from calls taken in 2024/25, with over 4,650 on the topic of how to be compliant.

- Monitoring: Monitoring levels of compliance in rental properties before the 1 July deadline. Over 3,700 healthy homes cases were assessed between July 2021 and June 2025. In the same period, our Tenancy Dispute Resolution service processed over 5,300 Tenancy Tribunal cases that included a healthy home claim.

- Enforcing: Managing enforcement actions related to breaches of the Residential Tenancies Act 1986, which increased by 41% compared with the previous year. This included the issuance of six infringement notices and twice as many improvement notices. Eight landlords were taken to the Tenancy Tribunal for serious breaches, resulting in $192,906.31 being awarded to MBIE on behalf of affected tenants.

Providing core services to New Zealanders

MBIE provides a range of information, support and services to people and businesses. These enable economic participation and activity and provide important checks and balances.

Keeping people and businesses informed and safe

To help keep people and businesses informed and safe, MBIE manages a wide network of communication channels, including: 38 branded websites, 8 social media accounts and over 75 public-facing service channels. These service channels are operated through the Service Centre, comprising 55 voice lines and 23 email channels.

To help keep people and businesses informed and safe, MBIE manages a wide network of communication channels, including: 38 branded websites, 8 social media accounts and over 75 public-facing service channels. These service channels are operated through the Service Centre, comprising 55 voice lines and 23 email channels.

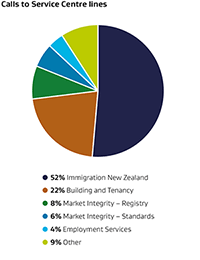

Over the past year, MBIE recorded more than 40 million customer interactions across its websites, phone lines and email channels. The Service Centre handled 1.3 million calls, averaging over 108,000 calls per month. These interactions covered issues relating to immigration, tenancy, employment, company services and workplace safety, amongst many others.

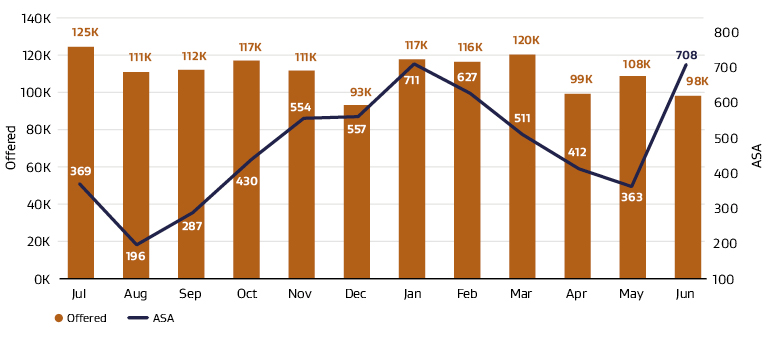

This year, our target was to have an average speed to answer (ASA) of 5 minutes (300 seconds) across all 55 voice lines. We answered 61.4% of calls within 5 minutes, and our ASA across the year was 7 minutes 45 seconds. Call volumes are seasonal and variable, and between January and March, calls exceeded forecasted volumes, which affected the ASA for those months. We continue to use technology to balance efficiency with good customer service.

Average speed to answer across all calls offered to Service Centre voice lines in 2024/25

MBIE’s efforts to make sure New Zealanders are informed and protected span many areas and services, including:

- Product recalls: Published 497 voluntary consumer product recalls and have 160 high-risk consumer products on our watchlist. For example, a joint product safety campaign with Maritime New Zealand to recall Hutchwilco Lifejackets with faulty inflatable mechanisms, and a nationwide compulsory recall on all Serene S2068 bathroom heaters, following several fires related to this product. Of around 44,000 Serene S2068 heaters sold in New Zealand, 21,900 units have been returned or replaced as part of a compulsory nationwide recall campaign.

- Awareness campaigns: Delivered multiple consumer awareness activities providing consumers with information on consumer laws, scams and fraud, and protecting children from unsafe products. The Consumer Protection website had over 746,000 visits during the year. We ran a campaign with Safekids Aotearoa to increase awareness of serious safety risks of children under 5 years around button batteries and high-powered magnets, which generated 1.2 million views and over 900,000 engagements.

- Insurance reform: Supported significant policy and legislative reform, including the passing of the Contracts of Insurance Bill, which provides consumers with significant new safeguards, including changes that ensure fairness and clarity for New Zealanders when they take up an insurance policy.

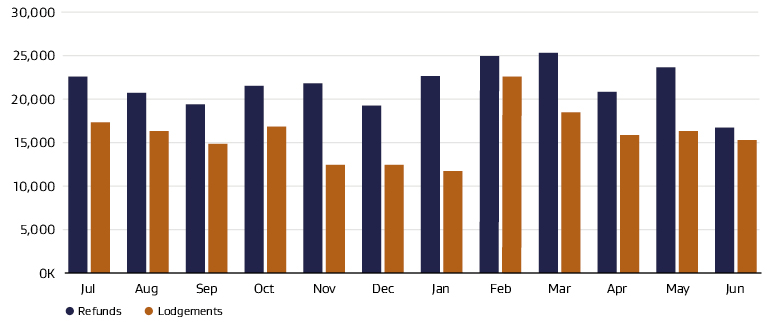

- Rental bonds: Lodged over 191,000 bonds and refunded over 160,000 bonds.

Bond refunds and lodgements 2024/25

Foundational economic services

MBIE also provides foundational services that underpin commercial operations, such as:

- Business tools: The business.govt.nz website, which offers 10 interactive tools to support businesses at every stage, 138 downloadable resources, and over 780 online learning videos to help businesses grow and succeed.

- Digital interaction: Business Connect, which is a digital platform that enables businesses to interact with government agencies online, in one place.

Over 113,000 businesses are registered and over 60 services are available.

- Intellectual property: The Intellectual Property Office of New Zealand (IPONZ), whose register contains over 13,300 registered designs, 24,000 granted patents, 1,280 granted plant variety rights, 347,000 registered trademarks and over 2,000 registered geographical indications.

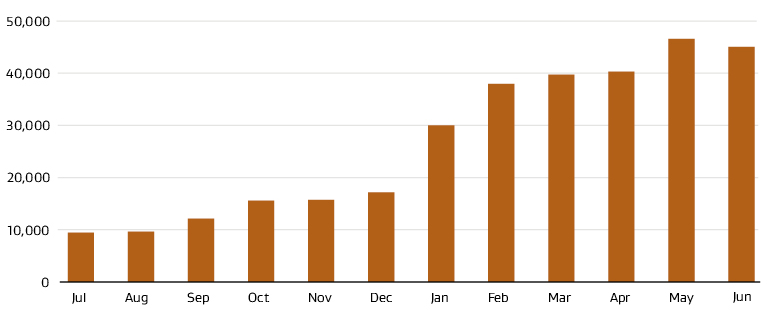

- eInvoicing: MBIE is responsible for increasing the use of eInvoicing, the direct exchange of invoice data between any two accounting systems, which makes doing business smoother, faster and safer. This has productivity benefits and helps speed up processing and payment to improve business cash flow. To increase uptake, MBIE has been engaging with government agencies, large businesses, relevant software providers and relevant industry leaders. It also held the first-ever government eInvoicing day in March 2025, with 140 attendees, including 80 government agencies. As at 30 June, more than 51,000 businesses, including government agencies and large businesses like Datacom, Bunnings, Countdown, One NZ, Westpac and Office Max, have chosen eInvoicing. This result is thanks to the drive to increase eInvoicing’s adoption and use, with the number of eInvoices being exchanged growing 479 per cent in the past year. The economic benefits of New Zealand moving to eInvoicing are estimated at $4 billion over 10 years.

eInvoices received 2024/25

- Digital details: The New Zealand Business Number (NZBN), which is a globally unique identifier that allows parties to quickly and digitally access all the basic details of a business and confirm whether it is real. Over 1 million businesses are now registered with an NZBN, with over 4,660 identifying as Māori businesses and 200,000 unincorporated entities (sole traders, trusts and partnerships) who voluntarily register. Full adoption of NZBN will return over $500 million per year. In 2024, the New Zealand Institute of Economic Research (NZIER) estimated around $170 million of this value was being realised.

- Creating common standards: Standards New Zealand, which is New Zealand’s leading developer of standards. New Zealand and Australia have been working together on shared standards for over 40 years, making it easier to operate and trade across the Tasman. These joint standards are important for protecting consumers and supporting trade and market access. This year, to ensure consistent standards across New Zealand and Australia, dedicated funding has supported over 20 joint projects, helping small businesses and significant sectors stay aligned.

- When things go wrong: The New Zealand Insolvency and Trustee Service, which supports administers liquidations, bankruptcies and insolvencies. This year, personal insolvency increased slightly to just over 1,200, and company liquidation allocated to the Official Assignee increased 53 per cent from 381 to 586 on the previous year. Total liquidations were just over 2,600, a 23 per cent increase on the previous year.

- Establishing a company: the New Zealand Companies Office, with 745,000 total companies registered at the end of June 2025, and 57,000 new company registrations and over 44,000 removals across the year.

Building resilience after severe weather events

Due to its geography and location, New Zealand is prone to natural hazards. As the climate changes, an increase in the frequency and severity of damaging environmental events can be expected. In recent years, New Zealand has experienced a series of severe weather events, including flooding, cyclones and landslides. These place significant pressure on communities, infrastructure and housing, and show the importance of robust building emergency management, accessible temporary accommodation, effective claims resolution, and a coordinated and resilient response system.

Temporary Accommodation Service

The Temporary Accommodation Service (TAS) activates in response to significant civil defence emergencies. It provides temporary support for those who have been displaced from their damaged homes for longer than two weeks. TAS helps identify temporary accommodation options and provides guidance on how to access support services, such as insurance advice and financial assistance. TAS was activated twice in 2024/25:

- on 9 July 2024 for the 25–26 June Wairoa flooding event, following a period of heavy rain

- on 17 October 2024 in Otago, following heavy rainfall that resulted in significant flooding and landslides.

In October 2024, TAS divested five houses in Westport, built to support the West Coast Flooding Event in 2021, to the Buller District Council. The accessibility and proximity of these houses to central Westport allowed for their easy conversion to housing for the aged community.

In November 2024, TAS collaborated with mana whenua at Ōmāhu Marae to create a temporary housing village, named Ūtainia Ōmāhu. Ōmāhu Marae was one of the seven marae devastated by Cyclone Gabrielle in February 2023 in Heretaunga, Hastings. The temporary accommodation village is made up of 11 relocatable homes constructed by businesses that are 100 per cent Māori owned. The houses are for eligible whānau who need accommodation while their homes are being repaired or rebuilt following the cyclone.

The delivery of these homes was a collaborative effort between MBIE, the people of Te Piringa Hapū, Ōmāhu Marae and Ngāti Kahungunu Iwi Incorporated.

New Zealand Claims Resolution Service

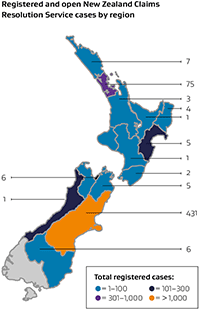

MBIE continues to support households to resolve residential insurance issues resulting from disasters and extreme weather events. This year, just over 600 cases were registered through the New Zealand Claims Resolution Service (NZCRS) and over 960 cases were closed.

MBIE continues to support households to resolve residential insurance issues resulting from disasters and extreme weather events. This year, just over 600 cases were registered through the New Zealand Claims Resolution Service (NZCRS) and over 960 cases were closed.

As at 30 June 2025, NZCRS (and its predecessor, the Greater Christchurch Claims Resolution Service) had resolved over 6,400 cases across 15 regions, with over 540 still open across 13 regions.

NZCRS works collaboratively with insurance industry stakeholders to educate customers about the limitations of the Natural Hazards Commission Land Cover because it will often not be enough to fully reinstate the damaged land, and should be treated as a contribution only. In addition, NZCRS continues to raise issues with the industry on the amount of temporary accommodation cover available and limits on retaining wall cover.