Focus area 1: Resilience against global supply shocks

Our dependence on imported fuels means that if overseas supply is disrupted, we could face fuel shortages and rising costs at home.

On this page I tēnei whārangi

We depend on imported liquid fuels – petrol, diesel and jet fuel – to meet domestic demand. This exposes us to the risk of international supply disruptions and volatile oil markets.

Fuel shortages can have widespread impacts across our economy if we do not have sufficient alternative domestic sources to meet demand.

We are already taking steps to monitor and minimise supply risks. We are a member of the International Energy Agency (IEA), which helps to stabilise supply during global disruptions. During a disruption, the IEA can coordinate the release of strategic oil stocks held by member countries. For instance, in 2022, New Zealand participated in collective action to release oil stocks following the Russian invasion of Ukraine.

International agreements can help ensure ongoing access to fuel if global supplies are disrupted. We will continue to work with key fuel exporting nations to include fuel security in plurilateral and bilateral agreements.

At home, the government requires fuel importers to hold liquid fuel reserves through the minimum stockholding obligation (MSO). The MSO requires 28 days’ cover for petrol, 21 days’ cover for diesel and 24 days’ cover for jet fuel, either stored onshore or on incoming ships within our exclusive economic zone.

Given the importance of diesel for our economy, we are increasing the diesel stockholding obligation to 28 days’ cover for importers with more than a 10% market share from July 2028. In 2026, we will consider expanding this increased obligation to all diesel importers.

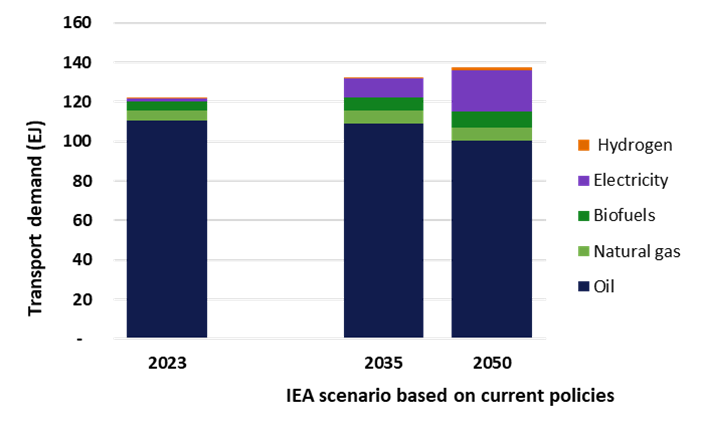

In the longer term, we also need to reduce our reliance on imported liquid fuels and improve our energy independence. We are transitioning towards a more fuel-diverse future with increasing use of alternative fuels including electrification, hydrogen and biofuels (see Figure 3 for the global outlook). By producing these fuels domestically, we can reduce our exposure to global supply shocks. Wider energy security will remain a central consideration throughout this transition.

Figure 3: Liquid fuel demand in transport for International Energy Agency scenarios (source: IEA World Energy Outlook 2024 dataset)

Description of Figure 3: Liquid fuel demand in transport for International Energy Agency scenarios

The Fuel Security Study identified accelerating the energy transition as one of the most cost-effective ways to improve fuel security. Many of the actions across government to reduce emissions and improve energy efficiency will also improve our energy independence by reducing demand for imported liquid fuels.[1] For example, government is promoting fuel efficiency and uptake of electric vehicles.

Further actions on accelerating the transition are covered under Focus Area 3: Supporting domestic alternatives.

Finally, we need good data to make evidence-based decisions. We collect data under various regulatory frameworks, including the MSO and the Fuel Industry Act 2020. As part of the MSO, fuel importers must report detailed information on fuel sources, storage, and distribution. This information will improve transparency across the supply chain and allow government to identify vulnerabilities. We will also regularly update and publish national fuel demand forecasts to support decision making on fuel security.

Our actions

Underway

1.1: Participate in the IEA’s coordinated efforts to ensure stable fuel supply.

1.2: Participate in biennial global emergency exercises coordinated by the IEA and adopt new recommended actions to enhance emergency preparedness.

1.3: Monitor the minimum stockholding obligation, which currently requires fuel importers to hold 28, 21 and 24 days of petrol, diesel and jet fuel cover onshore.

1.4: Make regulations requiring importers (with more than 10% market share) to hold an additional 7 days of diesel.

1.5: Engage with key fuel export nations to secure continued market access to fuel in supply disruptions.

1.6: Improve the government’s visibility of information on fuel sources, storage and distribution through information disclosure regimes.

Planned

1.7: Review minimum stockholding obligation regulations in 2026 to determine whether to require all importers to hold an additional 7 days of diesel.

1.8: Information campaigns on fuel demand management and fuel switching to alternative fuels.

1.9: Regularly review and update fuel demand forecasts.

Questions for consultation

4. Do you believe Focus area 1 addresses the challenges the fuel sector is facing? Why / why not?

5. Do you believe the actions under Focus area 1 will improve New Zealand’s fuel security? Why / why not?

6. Are there any additional actions under Focus area 1 the Government could take to reduce dependence on imported fuels and improve our energy independence?

Footnotes

[1] Emissions Reduction Plan 2026-2030(external link) — Ministry for the Environment

< About our fuel system | Focus area 2: Domestic resilience >