Section 3: The basis for setting fees and levies

Proposed fees and levies are set to recover approximately $42 million annually, considering the proposed increase in budget and any forecast deficit.

On this page I tēnei whārangi

A cost allocation model identifies the costs to be recovered

The Companies Office uses a cost allocation model, developed in 2017, to identify the type and amount of costs that need to be recovered from users. The model was derived from an analysis of the type of expenditure, the type of services the Companies Office provides, the time spent by staff on specific services within a specific register (like incorporating a company or filing an annual return), and the volumes they deliver.[1]

The cost allocation model assumes that:

- users benefit from the registry services of the Companies Office and should contribute to their funding through fees;

- any forecast deficit or surplus is accounted for in final fees and levies; and

- fees and levies are set to ensure that, overall, the memorandum account balance trends towards a nil balance within the next 5 years.

The cost allocation process has 3 components, outlined in Figure 3 below.

Figure 3: Components of cost allocation

Costs to be allocated

- The current budget and the additional expenditure required for improvements and the registry activities to be recovered.

Cost allocators

- Each cost item (eg salaries, IT support, travel) from the Companies Office financial report is assigned an appropriate cost allocator based on specific assumptions by register.

- Personnel costs are split by team and then allocated across the registries and services those teams are responsible for.

Registry services

- Each cost item is allocated across the registry services based on its assigned cost allocator.

- Direct and indirect costs are allocated across services that are to incur a fee. These costs were divided by volumes to get a unit cost.

- Volumes used in the cost allocation model are based on an analysis of past data and a forecast of future growth based on economic trends.

Cost recovery principles guide the setting of fees and levies

The way costs are allocated has been informed by general cost recovery guidelines. Three principles set by the Treasury and the OAG have been used to develop and analyse the impact of options for setting fees and levies. The principles recommend that fees and levies to be set in a way that is:[2]

- justified: costs recovered through fees and levies should reasonably relate to the services they are charged for, with any indirect costs appropriately included (eg MBIE’s technical support costs);

- efficient: fees and levies should closely reflect the actual costs needed to provide registry services, so that users experience value-for-money; and

- equitable: the Companies Office should ensure that fees and levies are applied and managed so that they are fair for all users of its registry services.

Third-party fees and levies should also be transparent (a 4th principle in the OAG guidelines). Revenue from fees and levies should be correctly accounted for and used appropriately, and the process for developing fees and levies should be clear and easily understood.

Where relevant, these principles have been applied to options for how specific fees and levies could be set to derive the cost recovery impacts (eg which users pay and how often, how much cost is allocated to a fee or a levy, and how it impacts the total amount to be paid to the Companies Office). All proposed fees or levies in this document represent the preferred option, including the proposed additional expenditure of $6.0 million.

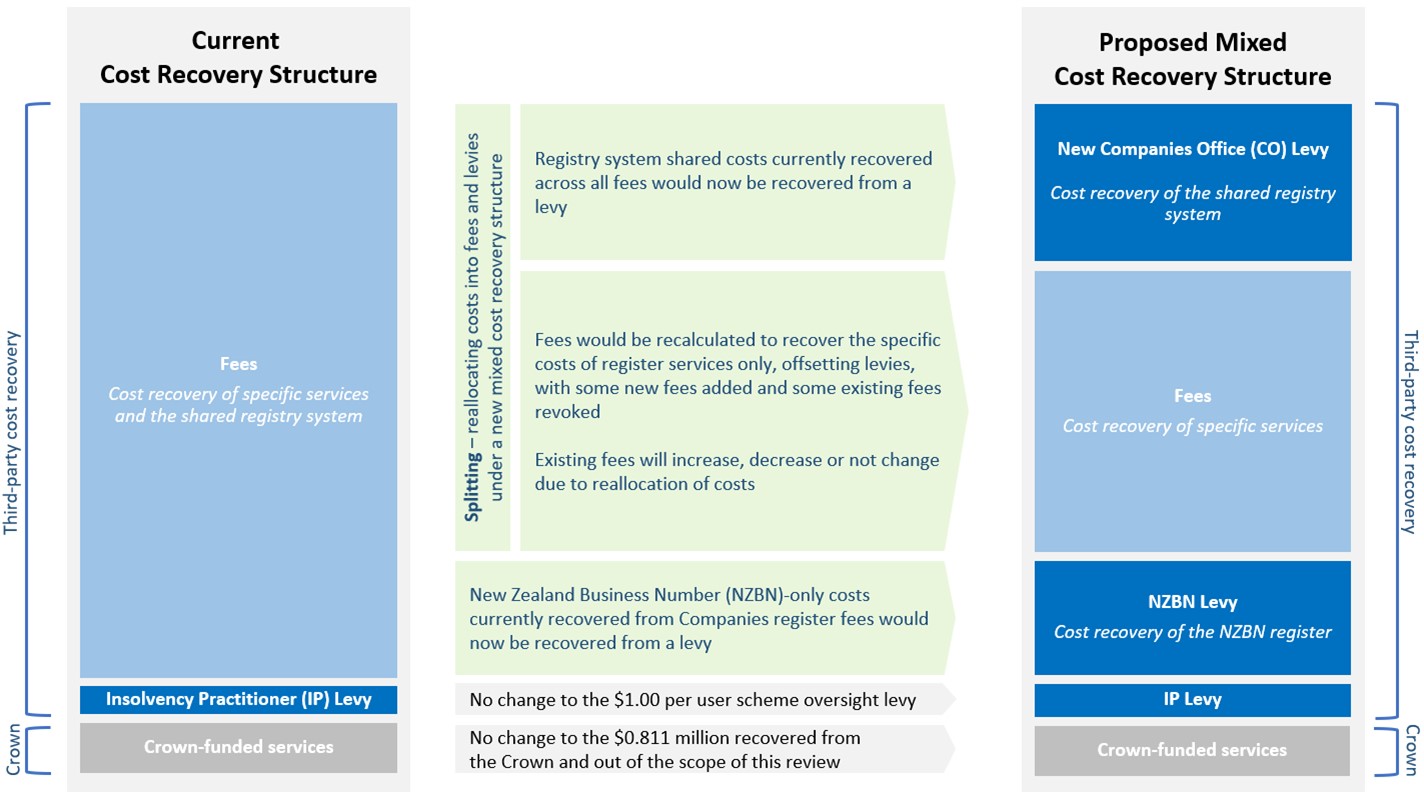

Proposed cost recovery structure: splitting existing costs between fees and levies

A revised cost recovery structure for all registers is proposed, splitting existing and new charges into fees and levies, to better reflect that the Companies Office operates its registers as a system with shared services.

Historically, the Companies Office has recovered the costs of operating all its registers from users through fees. Over time it has introduced shared services (eg personnel and systems that work across registers) to better manage increasing operating costs without significant fee increases. It achieves this by ensuring smaller registers with low volumes of users (eg the Friendly Societies register) do not pay a disproportionate amount to recover the costs of similar services, such as filing an annual return, than larger registers with higher volumes (eg the Companies register). This ensures that users experience the same level of service at a fair and reasonable cost.

Figure 4 shows how shared services benefit all users of the Companies Office according to cost recovery principles.

Figure 4: Principles and benefits of shared services

A shared approach enables:

Justified

An organisational structure and operating model, supported by legislative changes to introduce new levies, that produce economies of scale (meaning it is more cost-effective to operate a group of registers as 1 office rather than individually) in the delivery of registry services.

Efficient

Any registers and functions to leverage off the existing business processes, technology, and infrastructure, minimising the overall cost.

Equitable

Users of smaller registers (registers with a comparatively low number of users) to benefit from a registry system that includes larger registers, so that fixed costs of providing registers are spread across more users.

The Companies (Levies) Amendment Act 2022 amended the Companies Act to enable the Companies Office to collect levies from its users to recover shared services costs. A levy under the Companies Act allows for money to be collected from specified users of 1 register and be legitimately used to meet the costs of operating any or all registers under 1 Companies Office registry system.[3] Without introducing a specific levy to recover the costs of providing shared services, smaller registers would experience a significant, exponential increase in their fees.

MBIE proposes that cost recovery is split between fees and levies under a mixed structure to give effect to these legislative changes, where:

- a new levy would recover the shared costs of the registry system to more clearly identify the existing costs of providing shared services, charging them to the appropriate group of users at a fair amount; and

- fees would offset the remaining direct costs of providing specific registry services, offsetting the shared costs recovered through levies paid by specific users.

This mixed cost recovery structure would sit alongside other levies that recover the cost of specific club goods, such as the existing Insolvency Practitioner levy and a proposed NZBN levy. Section 4 sets out the proposals for applying and setting the amount of each of the 3 levies.

Figure 5 shows how the current fee-based cost recovery structure will be split across new and existing fees and levies. The overall type of costs, the type of charges that will recover those costs, and the approximate portion of revenue and expenditure for each type of charge are easily identified.

Questions for submitters on proposals for a mixed cost recovery structure:

1) What is your view on a mixed cost recovery structure of fees (for specific services) and levies (for fixed shared costs), and the types of costs allocated to fees and levies?

2) Are there any other options you would like to see considered to recover shared costs from users?

Figure 5: Current and proposed mixed cost recovery structure

Description of infographic

Footnotes

[1] Volumes are the total instances of a specific activity in a year – eg the total number of annual returns filed each year with the Companies Office on the Companies register. Volumes are included in this document where relevant and summarised in Appendix 3: Forecast annual volumes by register to determine unit costs.

[2] Section 404 of the Companies Act specifically requires any levies that are recovering costs across the Companies Office registry system to be set in regulations according to these 3 principles. It requires that they must be applied “having regard to the cost of administering the whole system of registers, not on the basis of the costs of administering individual registers.”

[3] Section 404 of the Companies Act, as amended by the Companies (Levies) Amendment Act 2022.

< Section 2: Companies Office funding | Section 4: Current and proposed levies >