Summary of proposed changes: Review of New Zealand Companies Office fees and levies (2025)

On this page I tēnei whārangi

This is the web version of the discussion document 'Summary of proposed changes: Review of New Zealand Companies Office Fees and Levies (2025)'.

Details on how to submit, the full discussion document, and a submission template are available on the following page:

Have your say: Review of New Zealand Companies Office Fees and Levies (2025)

The Ministry of Business, Innovation and Employment (MBIE) has completed an expenditure review and a review of the fees and levies charged for the services provided by the New Zealand Companies Office (the Companies Office), a business unit of MBIE.

The Companies Office performs an important role in building trust and confidence in our economy, helping to make New Zealand a place where doing business is easy, transparent and fair. It administers a portfolio of ‘economy-supporting’ registers, which provide statutory services like registration and annual return filing to entities such as registered companies and incorporated societies.

A detailed discussion document sets out the findings from this review, the funding requirements of the Companies Office, and the basis for setting new fees and levies.

We welcome your feedback on the proposed fees and levies. Written submissions are due by 13 June 2025 and are invited by email or post.

Why are the fees and levies being reviewed?

The Companies Office is required to recover the cost of administering the various registers it operates, and for the services it provides, from the users of those services. It may recover costs from two types of charge:

- Fees: collected to fund specific services; and, in some cases,

- Levies: collected and allocated to broader functions where they benefit a distinct group of users.

The types of fees and levies the Companies Office charges for its various registers and the amounts charged for them are reviewed approximately every five years. Regular reviews ensure that fees and levies are fit for purpose and recover no more than the cost of operating to limit any surpluses or deficits over the long term. Fees were last changed in July 2017.

What is changing?

The discussion document outlines five key changes to how the Companies Office recovers costs, including the introduction of new fees and levies.

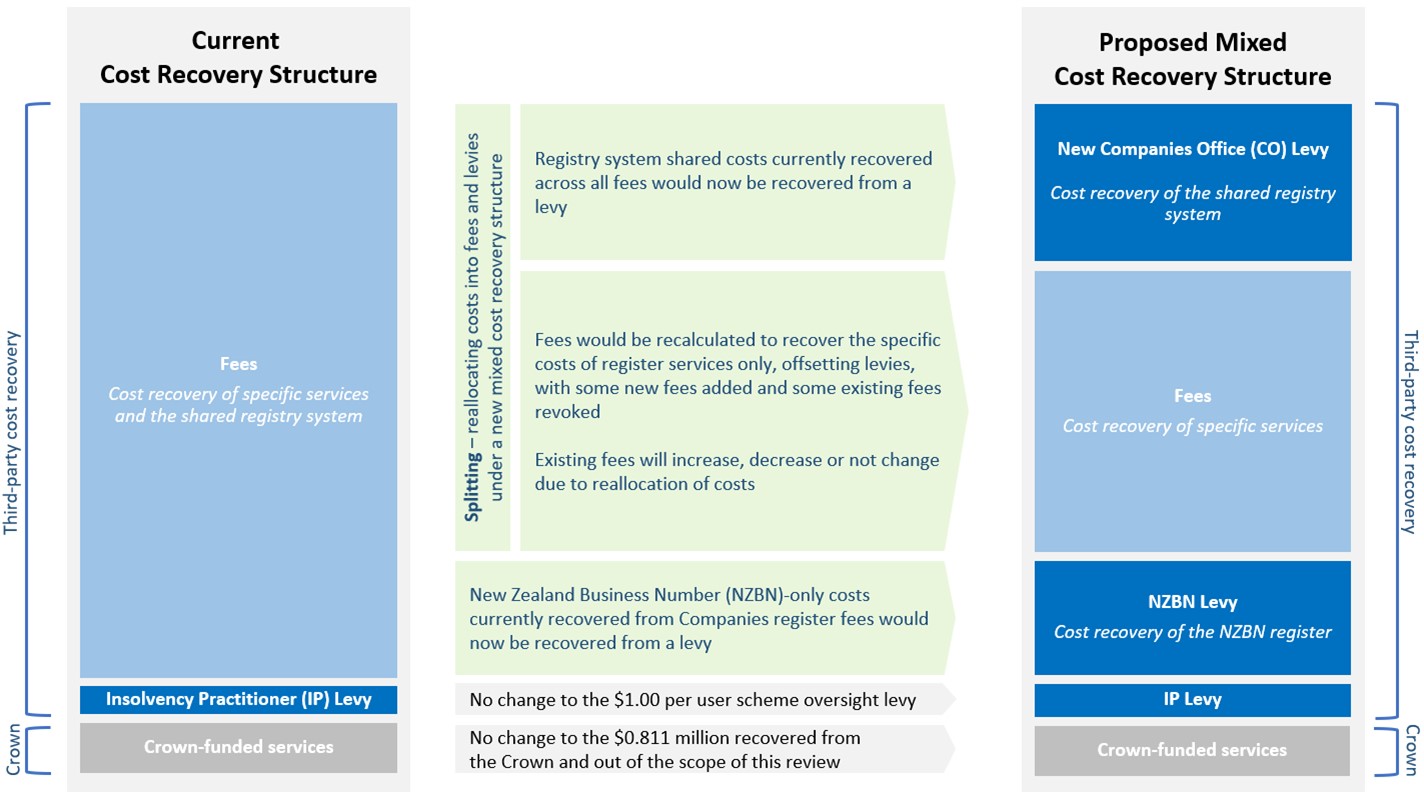

- Forming a clearer and fairer cost recovery structure to enable full cost recovery which utilises:

- levies (to recover the shared costs of the system)

- fees (to recover the remaining costs of specific registry services).

- Seeking an increase of $6 million to the Companies Office annual expenditure budget, from approximately $36 million to $42 million to meet forecast cost pressures. This includes the need to make incremental upgrades to aging registry systems and undertake enforcement and education activities related to recent legislative changes, for example the introduction of the Incorporated Societies Act 2022. The proposed fees and levies incorporate this increase.

- Setting 2 new levies to meet some costs that were previously included as part of various Companies Office fees:

- a $15 (plus GST) Companies Office levy (CO levy) to recover approximately $11 million of the annual expenditure budget that would be allocated to existing shared system costs

- a $12 (plus GST) New Zealand Business Number levy (NZBN levy) to recover approximately $9 million of the annual expenditure budget that would be allocated to operating the existing NZBN register.

- Setting new fees for incorporated societies to incorporate new functions set out under the Incorporated Societies Act 2022:

- an annual return fee

- an amalgamation fee (for two or more societies to amalgamate as one society)

- a conversion fee (for conversion of a body corporate or other association that is formed or incorporated by specific legislation into an incorporated society).

- Adjustments to fees, where required, across all registers and revoking some fees for services that are no longer provided for some registers.

Infographic: Companies Office current and proposed cost recovery structure

Description of infographic

Why are the changes needed?

In the last review in 2017, some fees were set to recover less than the cost required to operate in order to account for a level of over-recovery from previous years. The reduced fees, in effect, returned that prior over-recovery to the users. As of 30 June 2024, the Companies Office is now in deficit, and this is forecast to increase. Fees and levies need to be adjusted as soon as possible to correct this deficit.

The proposed fees and levies include a $6 million increase in the Companies Office budget to meet new cost pressures and maintain the integrity of the Companies Office regime in the short-to-medium term. The increase includes:

- increased compliance and enforcement activity in response to the growing complexity of non-compliance and to combat harmful phoenixing

- a programme of engagement to support new legislative requirements introduced in the last few years

- a planned information technology (IT) upgrade to aging systems to meet security requirements and attain IT efficiencies.

This budget increase will ensure that there is no reduction in services the Companies Office delivers.

The Companies Office recognises that any increase in costs, especially in the current economic environment, may cause concern. All proposed charges have been developed to make the best use of the money collected from users and provide a clearer understanding of what users are paying for. For some entities this means that the total amount they pay annually will stay largely the same. Others may need to pay for services that they have not been charged for in the past, which may mean a slight increase in existing fees, or new fees. Most entities will be required to pay a levy for the first time.

When would the changes take effect?

MBIE will publish a summary of the submissions it receives and will report on the impact of the proposals to the Government. Once the Government decides on final fees and levies, regulations will be drafted to set these fees and levies and their amounts.

Subject to these decisions, new fees and levies will take effect from 1 December 2025.

How do I have my say on the changes?

Details on how to submit including a submission template are available on the following page:

Have your say: Review of New Zealand Companies Office Fees and Levies (2025)