Section 2: Companies Office funding

On this page I tēnei whārangi

The objectives of the Companies Office

The Government has set a priority to grow economic prosperity and foster a dynamic, productive and competitive economy. MBIE promotes this vision through its strategic intention of working towards the outcome of a dynamic business environment that fosters innovation and international connections.[1]

In delivering registry services, the Companies Office has 2 main objectives:

- to facilitate the ease of doing business in New Zealand by providing easy-to-use registers and easily accessible information; and

- to maintain confidence in the registers it administers through a focus on integrity and taking enforcement action where this is necessary.

The Companies Office contributes to protecting New Zealand businesses and consumers by building confidence and helping to keep the market free from entities and individuals who do not comply with the law. Well-functioning and trusted markets are essential to ensure an efficient and transparent New Zealand business environment that in turn helps grow New Zealand for all.[2]

In managing all its registers, the Companies Office aims to provide customer-focused, fair, regulatory-driven registers that are supported by quality management systems and focused on excellence. Its approach to compliance is risk and evidence-based, with a preference to educate first wherever possible.

Current revenue and expenditure

The total current budget of the Companies Office is approximately $37 million per year of which approximately $0.8 million is funded by the Crown. This leaves approximately $36 million per year to be recovered from fees and levies. Table 1 on the next page shows the types of costs incurred and the revenue collected by each register since the last review in 2017.

Table 1: Companies Office actual or forecast expenditure and revenue FY 2018/19 – 2024/25 ($000)

| Actual 2018/19 | Actual 2019/20 | Actual 2020/21 | Actual 2021/22 | Actual 2022/23 | Actual 2023/24 | Forecast 2024/25 | |

|---|---|---|---|---|---|---|---|

| Total revenue by register | 29,470 | 28,746 | 32,627 | 30,706 | 32,227 | 32,641 | 32,521 |

| Companies, limited partnerships, NZBN | 16,839 | 16,405 | 18,740 | 18,067 | 19,133 | 19,264 | 19,371 |

| Incorporated societies | 116 | 101 | 116 | 143 | 175 | 168 | 107 |

| Friendly societies, credit unions, building societies | 6 | 5 | 5 | 4 | 5 | 4 | 4 |

| Retirement villages | 280 | 284 | 347 | 256 | 350 | 398 | 350 |

| Disclose | 989 | 943 | 1,051 | 994 | 910 | 1,056 | 968 |

| Financial service providers | 1,472 | 1,724 | 1,978 | 1,404 | 1,422 | 1,414 | 1,382 |

| PPSR | 9,003 | 8,519 | 9,095 | 8,593 | 8,937 | 8,965 | 8,904 |

| Auditors and insolvency practitioners | 30 | 45 | 571 | 709 | 714 | 724 | 723 |

| Financial reporting filing | 511 | 446 | 543 | 486 | 531 | 514 | 542 |

| Other | 224 | 274 | 181 | 50 | 50 | 134 | 170 |

| Total fees/levies funded expenditure | 30,696 | 35,461 | 34,063 | 33,398 | 38,324 | 35,527 | 35,692 |

| Personnel | 7,246 | 8,691 | 7,830 | 7,289 | 7,442 | 7,785 | 7,617 |

| Other operating | 6,766 | 7,597 | 6,607 | 3,759 | 8,221 | 6,982 | 8,288 |

| Depreciation | 3,753 | 4,772 | 4,848 | 5,312 | 4,592 | 3,046 | 2,450 |

| Capital charge | 678 | 1,165 | 787 | 1,030 | 728 | 681 | 627 |

| MBIE functional support | 12,253 | 13,236 | 13,991 | 16,008 | 17,341 | 17,033 | 16,710 |

| Surplus/(Deficit) | (1,226) | (6,715) | (1,436) | (2,692) | (6,097) | (2,886) | (3,171) |

| Memorandum account balance as of 30 June | 18,017 | 11,302 | 9,866 | 7,174 | 1,077 | (1,809) | (4,980) |

Monitoring revenue and expenditure: tracking the memorandum account

The Companies Office uses the memorandum account to track the annual revenue and expenditure associated with providing services to users of each of its registers that are not funded by the Crown. The memorandum account records the annual surplus or deficit to provide a cumulative balance over time. It is monitored for when changes will be required to the cost recovery settings (the structure and amount of fees and levies) and to ensure that recurring surpluses or deficits are kept to a minimum. This practice is in-line with Treasury and OAG cost recovery guidance. The 3-to-5-year frequency of reviews of cost recovery and resulting adjustments to fees and levies provides entities with a level of certainty that fee and levy amounts will not fluctuate annually and allows them to plan accordingly for any changes.

Fluctuations between surplus and deficit are expected over time (shown year-to-year in Table 1). Many of the Companies Office services are demand driven, and economic shocks such as the recent COVID-19 pandemic, can impact the demand for service across the Companies Office registers. In 2017, the memorandum account showed an accumulated surplus of $19.243 million. Therefore, the 2017 fees and levy review resulted in some fees being set below cost recovery to reduce this surplus over time. As at 30 June 2024, the memorandum account balance reached a deficit of $1.809 million and forecast to continue to decline by approximately $3.0 million per year unless charges are updated.

Why the current level of fees cannot be maintained

Without any change to fees, MBIE would need to either seek a capital injection or fund the deficit from its cash reserves. Funding from cash reserves is not sustainable overtime, as it would compromise MBIE’s capital investment plan. A capital injection would need to be considered by Cabinet in the wider context of investment across New Zealand.

Proposed additional expenditure

The review of the cost model has identified a level of savings to cover increased costs in other areas (eg savings in personnel reprioritised to offset other types of expenditure). The proposed fees and levies in this document incorporate a proposed increase of $6.0 million to the Companies Office budget above this reprioritisation exercise. This increase would meet new cost pressures, improve the types of operational services provided and maintain the integrity of the Companies Office registry regime within the next 3-to-5 years.

The increased budget would be applied to the 4 categories of cost pressures below.

IT Infrastructure upgrades to ensure continued functionality and security ($3.0 million)

$3.0 million will be applied to required IT spending to cover the cost of essential security and maintenance upgrades to the existing IT systems (primarily supporting the Disclose register). Costs include appropriate resourcing to meet current IT standards, improving the efficiency of registration and renewal processes for customers and enhancing cyber security measures to minimise the risk of cyber-attacks. Improvements to IT systems will simplify registration and payment, as well as the statutory declaration and disclosure processes, which will improve the overall processing of online applications and renewals.

MBIE IT functional support ($0.250 million)

$0.250 million will be applied to additional MBIE IT functional support costs for IT platforms shared across MBIE. MBIE has recently integrated several IT platforms shared by the Companies Office registry systems to the cloud (including migration of register websites). The integrations and migrations aim to eliminate security and continuity risks and improve technical resilience but have resulted in an additional operating expenditure to the registers managed by the Companies Office.

Expanding education and awareness activities ($0.750 million)

$0.750 million will be applied to working with existing incorporated societies to help them understand their new obligations under the Incorporated Societies Act 2022 (which came into effect on 5 October 2023) over the next 3 years. Work will also focus on improving how incorporated societies interact with the registry system.

Improving enforcement programme ($2.0 million)

$2.0 million will be applied to enforcement activities and programmes across the suite of registers that help to encourage market compliance and combat harmful phoenixing and other poor business practices:

- Further funding will allow an increase in enforcement against companies and directors who are not complying with the law, which will have a positive impact on the marketplace.

- New and amended legislation will result in a widening of enforcement activities that will need to be undertaken by the Companies Office Integrity and Enforcement Team. For example, the new Incorporated Societies Act 2022 includes an expanded suite of enforcement tools which will require additional full-time positions to be effectively administered. New provisions within this Act are more aligned with those set out in the Companies Act 1993 (the Companies Act), spanning infringement notices and prohibition of office holders through to prosecution.

- There has been an increase in the complexity of matters referred to the Registrar of Companies relating to director prohibitions, which provide protection for the public from company directors who have been dishonest, incompetent or irresponsible. More high-profile directors of multiple companies are being prohibited where mismanagement has resulted in company failures. There has also been a significant increase in the number of prohibited directors seeking to overturn decisions via appeal proceedings in the civil registry of the High Court. This has led to increased legal expenditure as Crown Law must be engaged to act on behalf of the Registrar of Companies.

- Criminal prosecutions carried out for the Registrar of Companies have also increased in complexity, impacting legal expenditure. More time is spent on preparing matters for Court, as well as extended hearing and trial durations.

Table 2 on the next page details how the additional expenditure would be allocated across the registers as well as how much of it would be recovered through fees and levies. It compares this to the current budget and the scenario where the current budget would be split across the proposed new levies and existing fees with no increase.

Table 2: Impact of new levies and additional $6 million budget on registers ($000)

| Current budget | Current budget with proposed levies | Proposed additional budget | Proposed total budget | |

|---|---|---|---|---|

| Expenditure by register | ||||

| Companies | 12,053 | 12,053 | 3,449 | 15,502 |

| PPSR | 6,842 | 6,842 | 151 | 6,993 |

| NZBN | 8,008 | 8,008 | 700 | 8,708 |

| Disclose - managed funds | 1,286 | 1,286 | 525 | 1,811 |

| Disclose - financial statement filing | 809 | 809 | 275 | 1,084 |

| Financial service provider register | 2,920 | 2,920 | 300 | 3,220 |

| Limited partnerships | 497 | 497 | 38 | 535 |

| Retirement villages | 533 | 533 | 49 | 582 |

| Incorporated societies | 2,102 | 2,102 | 500 | 2,602 |

| Friendly societies, building societies, and credit unions | 134 | 134 | - | 134 |

| Insolvency practitioners (IP) | 13 | 13 | - | 13 |

| IP oversight scheme | 663 | 663 | 6 | 669 |

| Auditors | 183 | 183 | 7 | 190 |

| Total expenditure budget | 36,043 | 36,043 | 6,000 | 42,043 |

| Recovered through | ||||

| CO levy | - | 9,417 | 1,449 | 10,866 |

| NZBN levy | - | 8,008 | 700 | 8,708 |

| IP levy | 663 | 663 | 6 | 669 |

| Fees | 35,380 | 17,955 | 3,845 | 21,800 |

| Total revenue | 36,043 | 36,043 | 6,000 | 42,043 |

Forecast position of the memorandum account

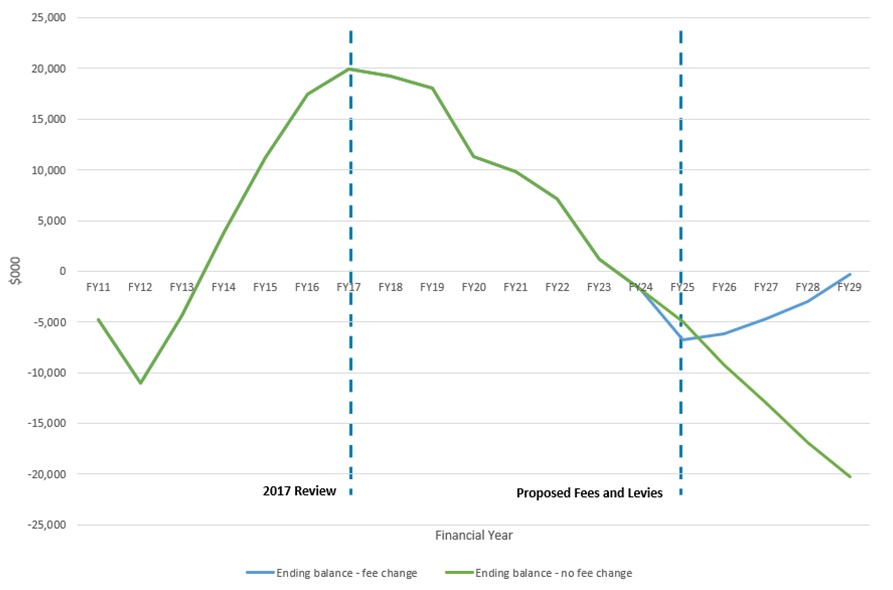

Figure 2 shows the trend of the annual surpluses or deficits resulting from forecasts of existing and proposed fees and levies over financial years. Surpluses and deficits should trend towards zero overtime. There are 2 trends:

- if there is no change in fees, the deficit is forecast to continue (downward trend); and

- if fees and levies are changed as proposed in this document, the memorandum account is forecast to return to a zero balance within 5 years (upward trend).

Figure 2: Memorandum account balance FY 2011 – 2029

Footnotes

[1] MBIE Strategic Intentions 2021-2025 [PDF, 3.4 MB]

[2] MBIE's purpose is to ‘grow New Zealand for all’. Who we are

< Section 1: Summary of the review and proposals | Section 3: The basis for setting fees and levies >