Introduction

Enabling natural and orange hydrogen development offers opportunities for New Zealand.

On this page I tēnei whārangi

Adding low cost, low emission hydrogen to the energy system could support our energy resilience, help us transition to a low-emissions economy and unlock opportunities for economic growth.

The Government has committed to ensure energy settings allow for the exploration of natural geological hydrogen in New Zealand, to maximise future energy resilience. This commitment is reflected in the Government’s Hydrogen Action Plan that was published in December 2024. The Minerals Strategy for New Zealand to 2040 that was published in January 2025 also outlined our commitment to review regulatory settings for new resources such as natural hydrogen.

Hydrogen has the potential to help reduce emissions in hard-to-electrify industries. Hydrogen is the lightest and most abundant element in the universe. When in the molecular form, hydrogen can carry and store energy like a battery. This energy can then be used to produce electricity through a fuel cell to power machines or combusted for heat and energy. It has a wide range of applications in sectors ranging from electricity generation to industrial processes and fuel for heavy transport. Additionally, hydrogen does not produce carbon emissions when it is used in a fuel cell or combusted.[1]

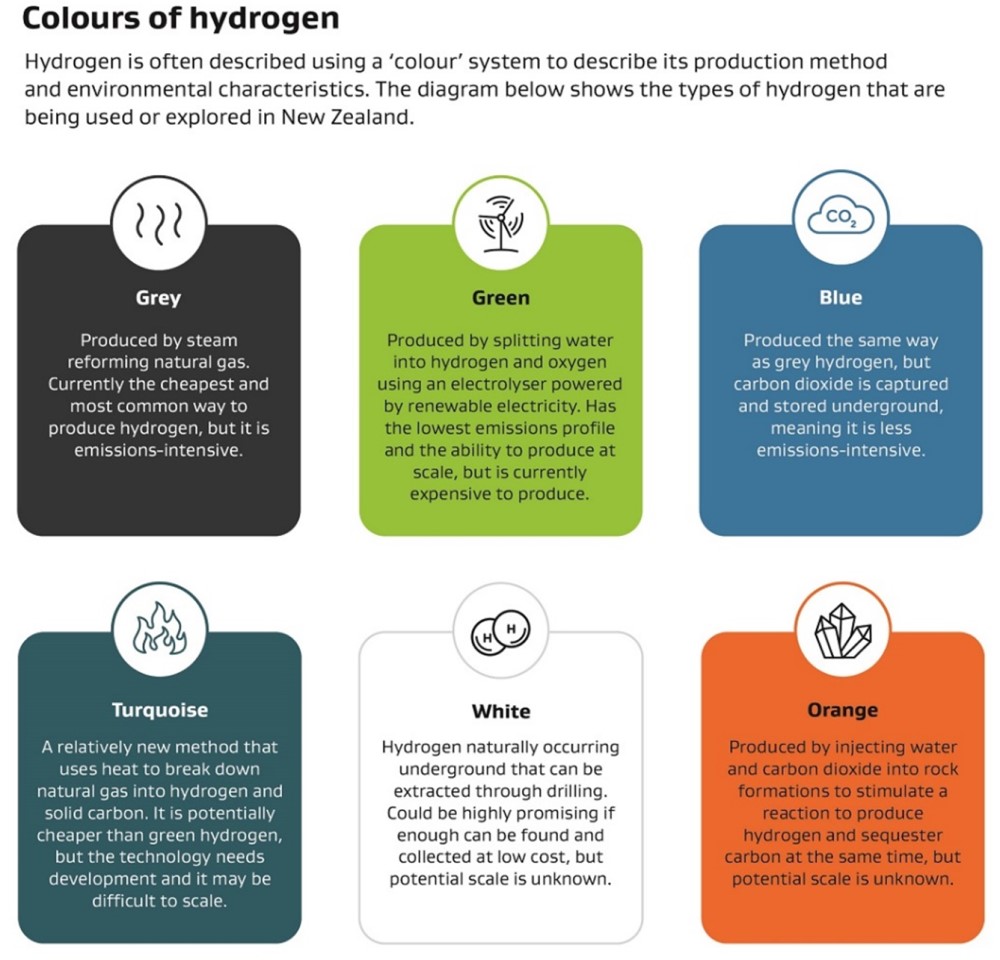

Hydrogen can be produced through a range of methods and is described using colours to distinguish different types of production methods (see figure on the following page). Currently, New Zealand has a hydrogen demand of around 0.25 Mt[2] which is mostly supplied by grey hydrogen that is produced using fossil fuels and used for fertiliser and chemical production. Modelling indicates that demand for low emissions hydrogen in New Zealand could be between 0.64 Mt and 1.2 Mt per annum by 2050,[3] provided low carbon hydrogen can be produced at commercially viable prices. The Government’s Hydrogen Action Plan sets out work underway to enable private investment into green hydrogen as a low-carbon fuel and resource to help reduce carbon emissions.[4] Green hydrogen is produced using renewable energy and is currently being trialled and deployed in New Zealand at a small scale.

Infographic: Colours of hydrogen

Text in infographic

What is the potential for natural and orange hydrogen in New Zealand?

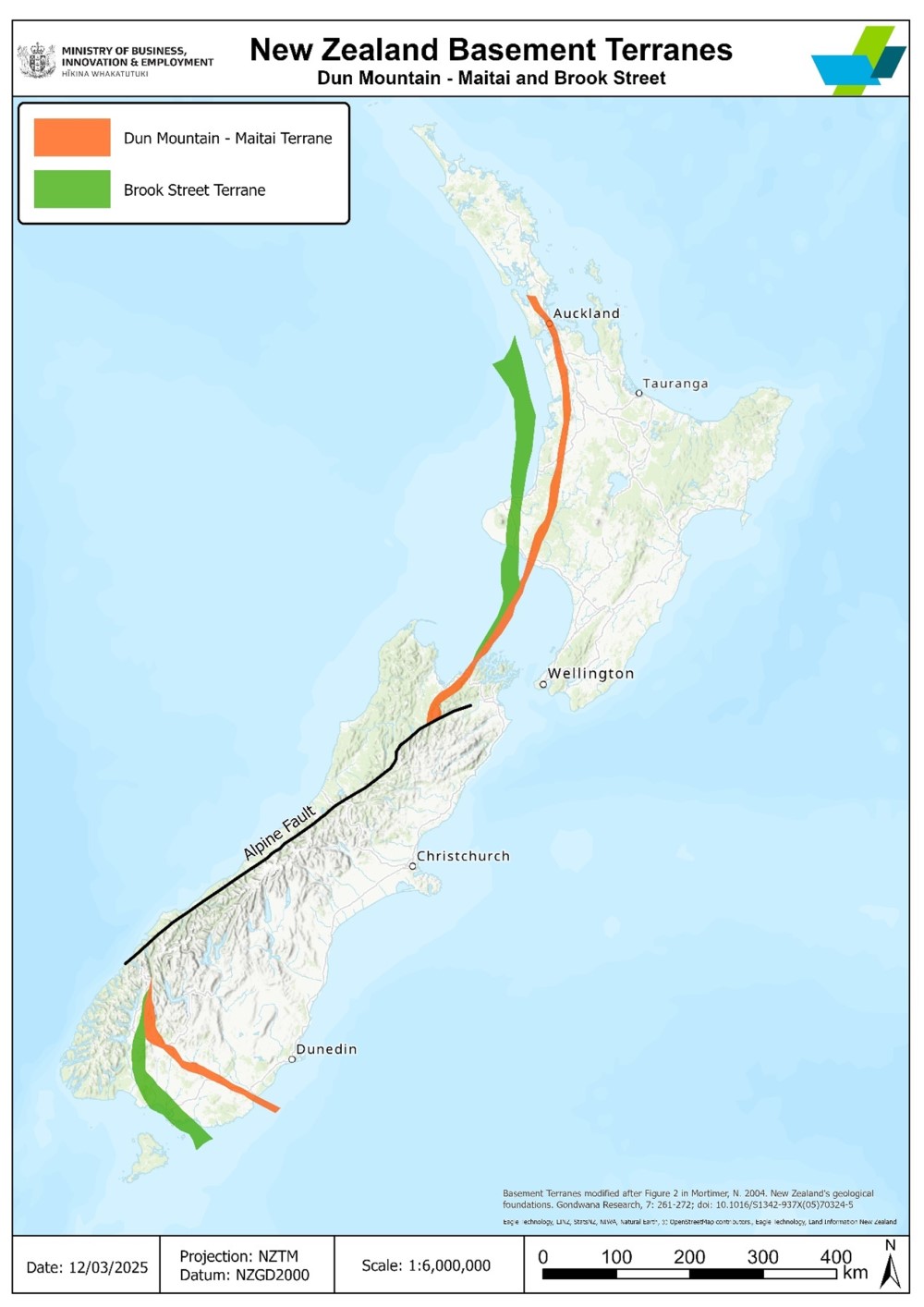

In New Zealand, natural hydrogen is believed to be generated primarily through a process known as serpentinisation - a chemical reaction between water and certain minerals rich in magnesium and iron. These minerals are found along much of the length of New Zealand (see map below). The minerals that are likely to produce natural hydrogen are the same ones that are likely to produce orange hydrogen. The serpentinisation process that generates natural and orange hydrogen can also generate other gases like methane.

Due to limited global and national research on the topic, we have a limited understanding of natural hydrogen systems in New Zealand and the conditions under which an economic natural hydrogen resource may exist. For example, we do not know yet whether natural hydrogen is likely to be considered a renewable or finite resource.

Exploration of natural hydrogen is likely to employ similar techniques and technologies to those currently used in petroleum exploration (e.g. drilling wells), with some elements taken from mineral and geothermal resource exploration. Globally, hydrogen exploration and commercialisation techniques and methods are still evolving.

Orange hydrogen is expected to be generated by pumping water and carbon dioxide into reactive minerals to stimulate hydrogen production by causing a chemical reaction in a similar way to how natural hydrogen is expected to form. The reaction can sequester carbon dioxide at the same time. The reaction to generate hydrogen can occur underground or in a production facility.

In this document, we refer to and are only considering orange hydrogen as hydrogen being stimulated below ground with human intervention, with or without carbon sequestration. This is because there is already a clear regulatory pathway to mine magnesium and iron-rich minerals if an above ground orange hydrogen production facility is planned.

What are the likely impacts on water use and the environment?

Compared to other types of hydrogen, production of natural and orange hydrogen is expected to have low direct water consumption in the production process. Seawater or even wastewater may work well with orange hydrogen production.[5]

Natural and orange hydrogen have the potential for a significantly lower environmental impact compared to traditional hydrogen production methods using fossil fuels, but their full environmental impact is still being researched and depends heavily on extraction and processing techniques, including potential hydrogen leakage challenges during extraction and transportation.

Early engagement

In line with Treaty settlement commitments, MBIE undertook early iwi engagement from March to April 2025 on the regulatory approach for hydrogen with interested iwi. Common themes from the engagement included the need to understand the impact of hydrogen development on water use and the environment and ensuring impacts can be appropriately managed. Iwi were also interested in potential economic development opportunities from hydrogen but outlined that the Treaty, customary rights and interests, and Treaty settlement commitments need to be upheld in the design of a regulatory approach. Iwi were interested in ensuring policy settings are fit for purpose for New Zealand’s unique context, particularly as the science of natural and orange hydrogen is still emerging.

MBIE also undertook early engagement with some groups to better understand the science of natural and orange hydrogen in New Zealand and the challenges for development. MBIE intends to engage further with interested iwi and groups during this public consultation phase.

Map of natural and orange hydrogen potential in New Zealand

The areas highlighted in orange and green (Dun Mountain - Maitai Terrane and Brook Street Terrane) on the map indicate the known location of minerals with potential to generate natural or orange hydrogen.

GNS Science 2012, adapted from Mortimer (2006). More information:

Terranes and batholiths of Aotearoa New Zealand — GNS Science Dataset Catalogue

Enabling natural and orange hydrogen development could unlock opportunities for economic growth and energy security and resilience

Why is natural and orange hydrogen gaining interest?

Hydrogen produced using low-emission methods presents a potential clean energy opportunity which has been gaining increasing global interest over the last decade. Natural and orange hydrogen specifically is gaining interest due to its low-carbon nature and potential for diverse applications – particularly in hard-to-electrify industries. Natural and orange hydrogen also has potentially lower production costs[6] and carbon emissions to produce than other types of hydrogen (including green hydrogen). Exploration is active and growing in international regions such as Africa, United States, Brazil, Colombia, Australia, France, Spain and Oman.

Opportunities for New Zealand

A secure and affordable supply of energy is critical for our economy, our regions and our people. It is important that the Government continues to add to the energy mix to maximise future energy resilience. As a potential new resource and energy source, natural and orange hydrogen could unlock opportunities across New Zealand. Specifically, it could:

- reduce emissions in hard-to-electrify industries (e.g. steel, cement, chemical production and heavy air, sea and some land transport activities)

- maintain and build high-value economic activity and employment by creating a new industry with export potential

- support energy security and reliability by reducing the demand for imported fossil fuels, help to smooth energy demand and supply mismatches across time, and improve resilience to energy supply interruptions.

Footnotes

[1] Like any combustion process, hydrogen combustion can lead to nitrogen oxide emissions, but technologies and methods exist to help mitigate this.

[2] How much hydrogen could we need in New Zealand? Understanding the diverse hydrogen applications and their regional mapping. Journal of the Royal Society of New Zealand(external link) — Taylor & Francis Online

[3] Ernst and Young. (2023). Hydrogen Economic Modelling Results: Final Report. [PDF, 2.2 MB]

[4] Low-emission hydrogen plan released(external link) — Beehive.govt.nz

[5] Orange hydrogen is the new green(external link) — Hal open science

[6] The production costs have been estimated at USD 0.5-1/kg for natural hydrogen, versus USD 0.9-3.2/kg for grey hydrogen, and USD 3-7.5 /kg for green hydrogen.

Natural hydrogen: the new frontier(external link) — GEOSCIENTIST

The production cost of orange hydrogen is also likely to be less than green hydrogen.