Our compliance approach to minimum stock holding obligations

We support and encourage compliance by providing information and guidance, simplifying systems and processes, and using tools and mechanisms that encourage regulated parties to take responsibility for making sure they comply.

On this page I tēnei whārangi

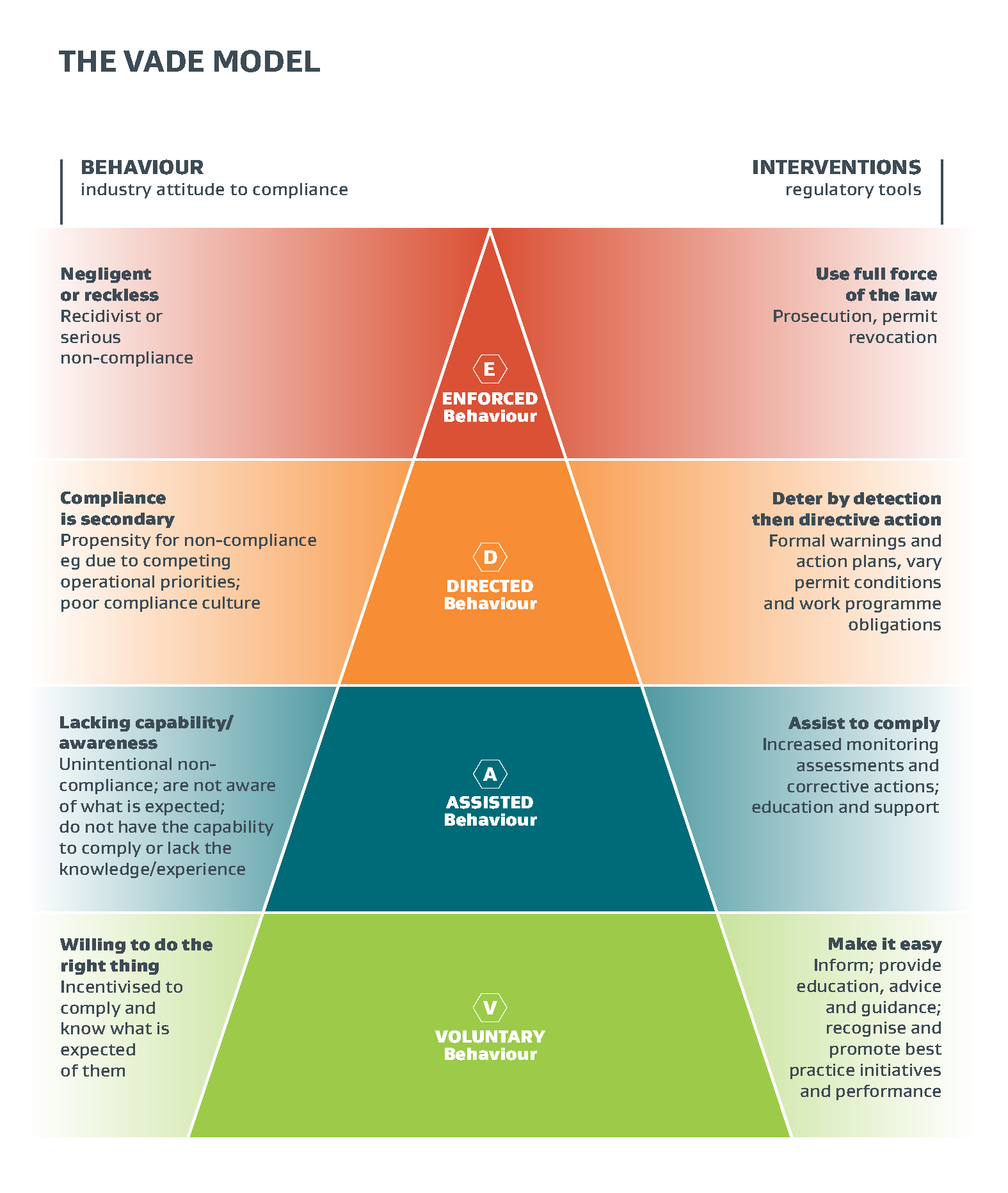

How we decide what compliance tool to use - The VADE Model

We use a range of tools and interventions to encourage compliance and respond when regulated parties don’t meet their obligations.

The tools we use depend on the situation, for example we have:

- proactive tools such as information and education to help regulated parties understand what they need to do to comply with the Act

- reactive tools such as pecuniary penalties and enforceable undertakings for when regulated parties don’t comply with the Act.

We decide on what approach or action to take based on the:

- level of risk

- clarity of guidance available

- willingness of the regulated party to comply with the law.

To help us decide what tools to use in different situations, we operate using the VADE model.

The VADE model (Voluntary, Assisted, Directed, Enforced) is commonly used by regulators to help decide the best tool to influence the regulated party to achieve behaviour change and compliance with the Act.

Image description of the Vade model

Our first step is to make compliance easy. If you are unsure of the requirements or don’t understand your obligations, please reach out for information and support oilsecurity@mbie.govt.nz

Assisted - help and options

If you think you may not be able to comply with the minimum stockholding obligations, contact us for assistance so that we can discuss possible options for a way forward.

Directed - formal agreements

Enforceable undertakings including compliance plans

An enforceable undertaking is a formal agreement between the Chief Executive of MBIE and an obliged person.

A compliance plan related to the agreement may be requested. It could include:

- steps and strategies to meet the stockholding obligation by the end of the agreement period (for example, by building more storage, importing more often, or changing business practices)

- processes for record-keeping, reporting, and quality assurance during the period that the agreement applies.

If the agreement is reached, MBIE’s Chief Executive can apply to the High Court for an order requiring compliance or for a financial penalty to be paid to the Crown.

Audits

We may ask you to have the information you provide us to be checked by an approved auditor and certified as accurate.

Enforced - legal action

Civil pecuniary penalties

The Court can impose a financial penalty for failing to meet stockholding obligations or information requirements.

The maximum penalty for each breach can range from $100,000 to $5,000,000 or higher

For more information see below:

Fuel Industry Act 2020 section 65 Pecuniary penalties under this Part(external link) — New Zealand Legislation