Building and construction sector trends biannual snapshot: May 2022

A snapshot of the key trends from October 2021 to March 2022.

On this page

Download a copy of the Building and Construction sector trends biannual snapshot: May 2022

Building and Construction sector trends biannual snapshot: May 2022 [PDF, 883 KB]

An overview of the building and construction sector

Construction sector continues to recover from the pandemic

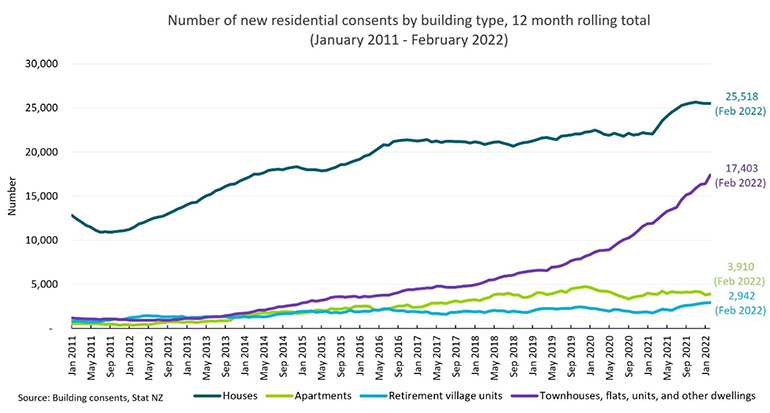

The continued high demand for residential building activity has put the sector in good stead to recover from the impacts of the COVID-19 pandemic. There was a record number of annual new dwelling consents, with 49,773 new dwellings consented for the February 2022 year. This was 25% more dwellings consented than in the February 2021 year.

The volume of building work put in place for all buildings in the December 2021 year grew 10.1%, compared to December 2020 year, with the volume of residential building activity lifting to historically high levels at $8.1 billion.

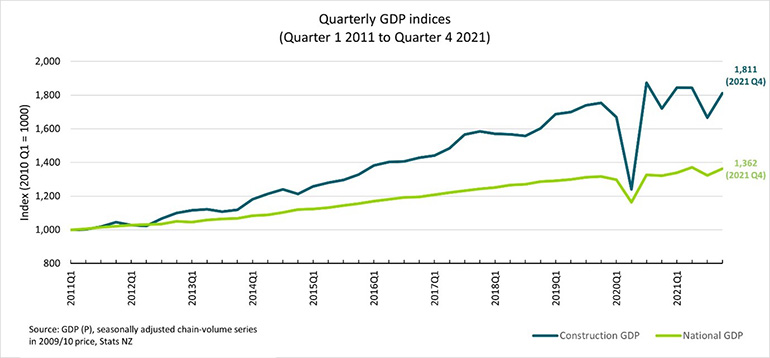

The sector’s contribution to GDP rose 8.7% in the December 2021 quarter, making it the second fastest growing industry. It also contributed 0.6 percentage points to the overall 3.0% national GDP growth.

Forecasts in the National Construction Pipeline Report 2021 estimated an increase in building and construction activity through to the end of the forecast period in 2026.

Strong demand and growth in the construction workforce

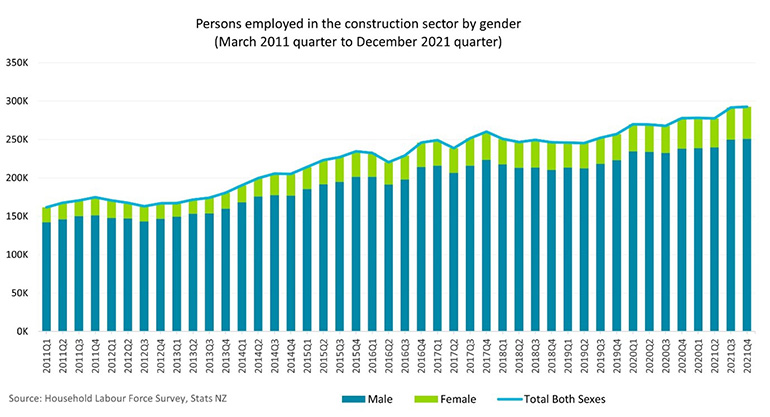

The construction sector is the fourth largest employer, with 292,800 people employed in New Zealand in the December 2021 quarter, an increase of 5.4% from the December 2020 quarter.

It provided 13,255 more jobs in March 2022 (compared to March 2021) - this is likely to be driven by the high demand for housing, with more people wanting to build or renovate their homes.

There is a significant pipeline of apprentices currently training in the construction sector. In July 2021, the Building and Construction Industry Training Organisation (BCITO) announced a record level of 20,000 apprentices in training, with more than 6,500 apprentices signed up in 2021 alone.

However, many construction businesses have experienced recruiting difficulty in 2021. According to Stats NZ’s Business Operations Survey 2021, around 90% of construction businesses reported that they experienced moderate to severe difficulty when recruiting tradespersons.

Construction costs continue to rise

Construction businesses have been experiencing higher demand for building activity, continuing supply-chain issues, and higher labour costs which are pushing up the costs of building activity.

Record high new dwelling consents issued and the demand for residential building activity are contributing to the rise in construction costs and may further impact the residential market.

In addition, the EBOSS Quarter 1 2022 Construction Supply Chain Report reported that 78% of suppliers were having issues supplying the market, with 80% of suppliers stating that freight was a key issue impacting business’ ability to supply goods in February 2022.

According to the latest Stats NZ Consumer Price Index, prices for the construction of new dwellings increased 18% in the March 2022 quarter (compared to the March 2021 quarter). It was the largest increase recorded since the series began in 1985.

This was echoed by the NZIER’s Business Opinion Survey in December 2021, in which a net 92% of building sector firms reported an increase in costs, and feelings of pessimism as cost pressures continue to intensify.

Wage inflation for the construction sector rose 0.9% in the December 2021 quarter (compared to the September 2021 quarter). This increase was above the all-industry average of 0.6 percent for the same time period. Annually, wages in the construction sector rose by 3.3%.

The Government has recently asked the Commerce Commission to undertake a study into competition in New Zealand’s residential building supply market. This study will focus on factors that may be affecting competition for the supply or acquisition of key building supplies used to build the major components of residential buildings.

Performance

Economic Performance

There was a 3.0% rise in GDP in the December 2021 quarter. This could be reflective of the gradual loosening of the COVID-19 Alert Level 4 restrictions experienced in the September 2021 quarter, as well as changes in the COVID-19 Protection Framework (traffic lights) during the December 2021 quarter.

Economic activity in the construction sector rose 8.7% in the December 2021 quarter, compared to the September 2021 quarter. Strong growth was observed in construction services and in heavy and civil engineering.

The sector saw the largest sale value percentage increase compared to other industries in the December 2021 quarter. It was up $3.0 billion (16%) from the September 2021 quarter and reached $21 billion. This was the second largest quarterly increase since the September 2020 quarter.

Building Consents and Activity

A record 49,773 new homes were consented in the year ended February 2022, an increase of 25% on the year ended December 2021. The annual number of new homes consents issued were record-high for eleven months between March 2011 and February 2022.

The upward trend for townhouse, flats, units and other dwellings continued in the December 2021 quarter. Townhouses, flats and units now make up approximately 35% of all new homes consented in the December 2021 year.

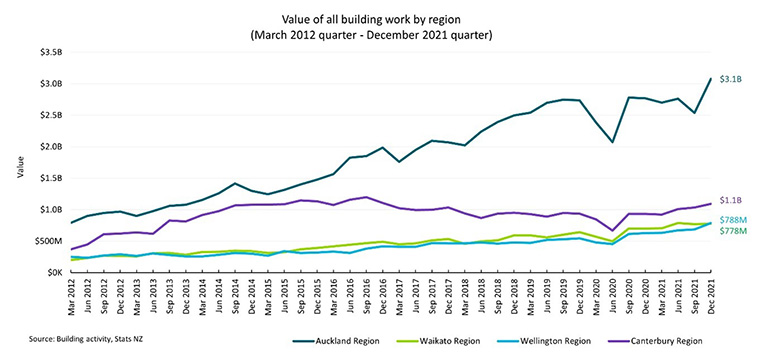

Total building value was $8.1 billion in the December 2021 quarter, an increase of 17% from the September 2021 quarter. Auckland contributed around 38% of the total building value in the December 2021 quarter.

Total building volume rose a seasonally adjusted 8.9% in the December 2021 quarter, compared to the September 2021 quarter. Residential building activity rose 5.2%, while non-residential building activity rose 15.8%. Annually, the actual volume of building work put in place for the 2021 year was up 10.1%, when compared against 2020.

Economic Outlook

The Rider Levett Bucknells Forecast Report, released in the fourth quarter of 2021, stated that given the level of increased costs, the difficulty of securing resources, and the “nervousness” of lending institutions, development work was expected to slow. However, with the significant pipeline of public works, capacity issues were expected to continue. An increase of between 5 and 6% of national construction costs was forecasted for the 2022 calendar year.

The EBOSS Quarter 1 2022 Construction Supply Chain Report reported that, on average, there was a 19% increase in the cost of building material to suppliers between August 2021 and January 2022, and that this was forecast to increase a further 11% by July 2022.

Quarterly GDP indices (Quarter 1 2011 to Quarter 4 2021)

Source: GDP (P), seasonally adjusted chain-volume series in 2009/10 price, Stats NZ

Text version of the Quarterly GDP indices graph data

Number of new residential consents by building type, 12 month rolling total (January 2011 to February 2022)

Source: Building consents, Stats NZ

Text version of the Number of new residential consents by building type graph data

Value of all building work by region (March 2012 quarter to December 2021 quarter)

Source: Building activity, Stats NZ

Text version of the Value of all building work by region graph data

People

New Zealand Construction Workforce

There were 292,800 construction workers employed in the December 2021 quarter. The overall construction workforce comprised of 250,900 male workers and 41,900 female workers.

Construction workers occupying filled jobs rose 7.0% in March 2022 (compared to March 2021), providing 13,225 more jobs to the sector. It was the industry with the second largest increase in filled job numbers during that period.

Stats NZ’s Business Operation Survey 2021 reported that around 90% of construction businesses reported experiencing moderate to severe difficulty recruiting tradespersons and related workers (including apprentices). This was an increase from 74% in the 2020 survey.

The strong growth in jobs over the past year is likely to be driven by the high demand for housing, with more people wanting to build or renovate their homes.

Health & Safety

WorkSafe reported 14 fatalities in the construction sector between November 2000 to October 2021.

There were 6,018 total injuries resulting in more than 1 week away from work, between April 2020 to April 2021 (based on the latest data available). Over this period, March 2021 had the highest injury toll at 654 injuries. The number of injuries in April 2021 was higher than in April 2020, which could potentially be attributed to the national COVID-19 Alert Level 4 restrictions between 25 March and 27 April 2020.

Research published by MATES in Construction in August 2021, which looked into the characteristics and rates of suicides in the construction industry, reported that:

- Construction workers had more than twice the risk of dying by suicide compared to the rest of the workforce. The highest number of suicides were in Auckland followed by Christchurch.

- The top 5 occupations with the highest number of suicides were:

- Builders’ labourers (10.9%)

- Technician and trades workers (7.9%)

- Painting trades workers (7.7%)

- Carpenters (7.7%)

- Electricians (6.3%).

Persons employed in the construction sector by gender (March 2011 quarter to December 2021 quarter)

Source: Household labour force survey, Stats NZ

Text version of Persons employed in the construction sector by gender graph data

Processes

Legislation

The Government, with the support of National, introduced a Bill in October 2021 to increase housing supply and enable more medium density housing. It is proposing that the Resource Management Act (RMA) is changed to allow more houses to be built in cities.

The Bill will enable the building of up to 3 homes of up to 3 storeys on most sites without the need for resource consent. Additionally, Tier 1 councils (i.e., Auckland, Hamilton, Tauranga, Wellington and Christchurch) will be able to implement intensification requirements under the National Policy Statement—Urban Development (NPS-UD), at least 1 year earlier than the current requirement.

These proposed changes are intended to result in fewer resource consents being required and a simpler process that avoids notification when a resource consent is needed.

Occupational Regulation

By March 2022, there were 27,148 licensed building practitioners (LBPs), and 32,297 active electrical workers in New Zealand.

Between January to March 2022, there were 56 complaints (made against LBPs and non-LBPs), which was more than 3 times the number of complaints received between January and March 2021 (17 complaints).

During the same period, 27 complaints were made against registered electrical workers and non-registered electrical workers (compared with 17 complaints last year).

Products

Construction costs

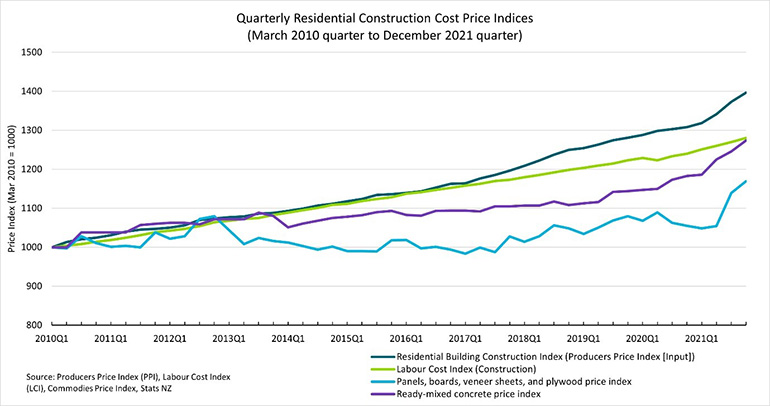

Construction costs continued to rise. These could potentially be attributed to supply chain disruptions (leading to higher inflationary pressures), as well as the continued demand for building work (including record-high building consents being issued).

According to the Master Builders Association, as approximately 70% of all building products are either imported or rely on components of imported products, the ongoing disruptions to global supply chains were likely to increase the cost of building materials and products.

Regarding the continued demand for building work, the seasonally adjusted volume of work put in place for all buildings grew 8.9% in the December 2021 quarter, with the volume for residential buildings increasing by 5.2%.

While most industries observed increases in input and output prices in the December 2021 quarter, the construction sector made one of the largest contributions to increases in overall producer prices. Additionally, the cost of construction-related materials increased for the December 2021 quarter. For example, the cost of panel boards increased by 4.5%.

Wage growth was modest in the sector, with an increase of 0.9% between the September and December 2021 quarter (compared to the average of 0.6% across all industries).

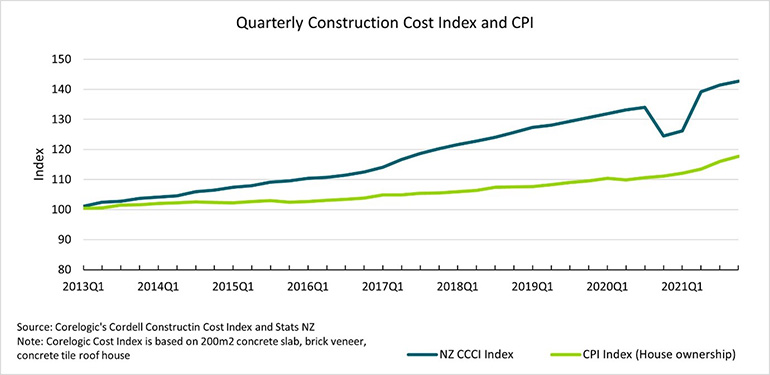

Corelogic’s Cordell Construction Cost Index (CCCI) reported a 0.9% rise in house-building costs for the December 2021 quarter. The annual CCCI increase was 6.1%, the highest yearly growth rate since the March 2018 year. According to the NZIER’s Quarterly Survey of Business Opinion for the December 2021 quarter, a net 92% of building sector firms reported an increase in costs, and feelings of pessimism in the sector as cost pressures continued to intensify.

Construction and the Environment

For the 2020/21 financial year, the New Zealand Green Building Council reported that:

- 4,871 homes were “Homestar” certified

- 31 new buildings were “Greenstar” certified

- 50 large office buildings received the National Australian Built Environment Rating System New Zealand (NABERSNZ) rating.

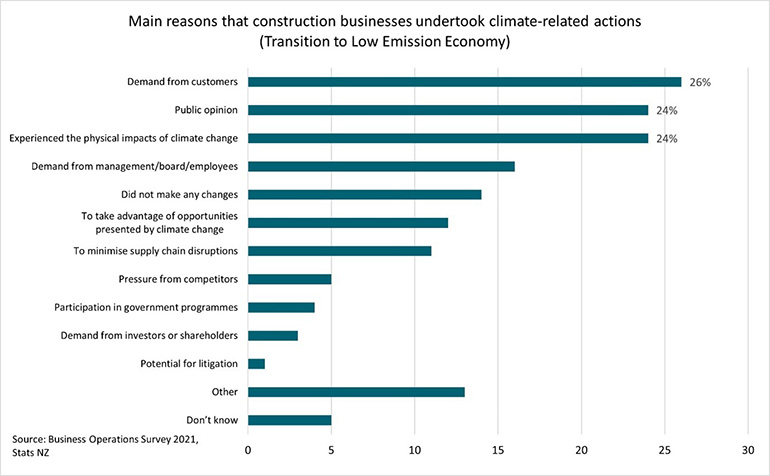

Stats NZ’s Business Operation Survey 2021 reported that the 3 most common reasons construction businesses took climate change-related actions were due to: customer demand (26%); public opinion (24%); and experience of the physical impacts of climate change (24%). The cost (21%) and lack of viable technology (14%) were the top 2 reasons which prevented construction businesses from making changes to adapt to climate change in the past 2 years.

Quarterly residential construction cost price indices (March 2010 quarter to December 2021 quarter)

Source: Producers Price Index (PPI), Labour Cost Index (LCI), Commodities Price Index, Stats NZ

Text version of the Quarterly residential construction cost price indices graph data

Quarterly Construction Cost Index and CPI

Source: Corelogic's Cordell Construction Cost Index and Stats NZ

Text version of the Quarterly Construction Cost Index and CPI graph data

Text version of the Quarterly Construction Cost Index and CPI graph data

Main reasons that construction businesses undertook climate-related actions (Transition to Low Emission Economy)

Source: Business operations survey 2021, Stats NZ

Text version of the Main reasons that construction businesses undertook climate-related actions graph data

Text version of the Main reasons that construction businesses undertook climate-related actions graph data

Feature article: Unpacking the rising costs of construction

Introduction

In response to the COVID-19 pandemic, New Zealand’s borders closed to international travellers and businesses experienced periods of full or partial closure in 2020 [1]. Similar decisions were made by governments all around the world [2]. In anticipation of a global economic crisis at the beginning of the pandemic, many international companies decided to reduce their production levels [3]. However, when they faced the increased demand for products, due to people spending more time at home, most of them could not produce their products at full capacity. At later stages, vast closures created further disruptions. This backlog of orders combined with disruptions in international freight, created an international level supply chain issue in all products, including construction materials [3]. It affected countries differently, and almost all industries were impacted, with the construction industry being no exception.

Construction costs in New Zealand

The increasing costs of construction in New Zealand is a known issue. An analysis of Stats NZ’s consent data by the New Zealand Building Economist (NZBE) showed that the average cost per square metre of consented residential units had increased from $1,394 in 2010 to $2,360 in 2020, which is a 69.2% increase in ten years [4]. A recent report by the New Zealand Infrastructure Commission, Te Waihanga, confirmed this trend. According to Te Waihanga, “high construction price inflation isn’t just a COVID-era phenomenon. Over the last 5 years, New Zealand had the seventh-highest construction price inflation in the OECD. Our residential construction price inflation averaged 5.2% per annum from 2016 to 2021” [5].

However, the COVID-19 pandemic and its associated restrictions may have further exacerbated this. According to Stats NZ, the Consumer Goods Price Index (CGPI) for residential construction was 2,338 in December 2019. However, it increased to 2,415 (an increase of 3.3%) in December 2020 and then 2,789 (an increase of 15.5%) in December 2021 [6]. The average quarterly increase in the CGPI of residential construction was 0.6% in 2019, 0.7% in 2020, and 4.5% in 2021 [6]. This clearly shows that the sharpest increases in construction cost occurred during 2021, which was 1 year after the first national lockdown.

CoreLogic’s Cordell Construction Index (CCCI) showed that construction costs rose by 6.1% over 2021 [7]. The latest CCCI data (Quarter 1 2022) reported an annual growth of 7.3% and a quarterly growth of 2.4% [8]. The average quarterly CGPI for non-residential buildings had also increased for factories (2.6%), shops/offices (2.3%), and civil construction (2.0%) in 2021 [9]. The construction costs for residential buildings in 2021 (4.5%) was steeper than non-residential buildings.

In addition to the cost of labour and construction materials (contributing to the rising costs of construction), it is worth considering the impact of other parameters that are also likely to be having an impact on construction costs.

Additional factors influencing construction costs

a) Impact of the COVID-19 pandemic

Construction materials experienced various levels of price increase in recent years. The NZBE publishes updated regional construction costs on a quarterly basis. The table below provides a comparison of the cost of selected building elements between February 2020 [10] and February 2022 [11] in Auckland (i.e., before the first national lockdown and the current situation). According to Table 1, while the rate of the price increase varied from item to item, it was more than 10% for most building elements.

Table 1. A comparison of the cost of selected building elements between Feb 2020 and Feb 2022 in Auckland [10, 11].

| Building element | Cost in Feb 2020 | Cost in Feb 2022 | Change in percentage |

|---|---|---|---|

| Concrete 20 MPa in reinforced ground floor slabs | $374/m3 | $424/m3 | +13.4% |

| D32mm dia. (deformed) rods (158 meters per 1000 kg) | $3.70/Kg | $4.21/Kg | +13.8% |

| Timber decking (Ex 100 x 25mm hardwood) | $10.5/m | $12.2/m | +16.2% |

| Insulation (Ceiling batts R 3.2) | $28.90/m2 | $30.90/m2 | +6.9% |

| Weatherboards, Tan Rad P pre-primed profiled, finger-jointed (Ex 150mm) | $215/m2 | $243/m2 | +13.0% |

| James Hardie fibre cement sheets (Hardies Monotek 7.5 mm sheet) | $103.60/m2 | $114.00/m2 | +10.0% |

| Profiled steel cladding (0.4mm Colorsteel) | $62.1/m2 | $68.0/m2 | +9.5% |

| 10mm Gib. Board to walls | $45/m2 | $48/m2 | +6.7% |

| Timber Doors – Internal (1980 x 760 x 38mm hollow core flush door faced both sides with paint quality hardboard including grooved frame, and a 3 coat enamelised paint system, excluding furniture) | $572/ea | $672/ea | +17.5% |

| Powder Coated Aluminium Sliding Windows (Includes double glazing with clear glass) – 1200 x 1000mm | $793/ea | $932/ea | +17.5% |

| Roofing tiles (Colortile metal tiles including supply and fixing battens and roofing underlay – gable roof) | $56.2/m2 | $63/m2 | +12.1% |

| Shower Units: (Includes mixer, rose and waste) – Stainless steel 925 x 925 x 100mm | $1300/ea | $1450/ea | +11.5% |

b) New Zealand-specific factors

While New Zealand construction costs have been affected by global supply chain issues, other domestic factors may have also contributed to the rising costs of construction:

- There was unprecedented demand for new builds during 2020-2022, whereby New Zealand observed historically high numbers of building consents issued during 2021. According to Stats NZ [12], a record 48,522 new homes were consented in the year ended November 2021. Additionally, record low home loan interest rates during 2020 and 2021 [13], and the Government’s tax incentives for investment in new builds [14], were 2 likely reasons for the increased demand for new builds during 2020 and 2021.

- New Zealand also had one of the longest and most restricted border closures in the world [15]. Despite some exceptions for construction workers during 2021 [16], international students and work visa holders were generally unable to enter the country between March 2020 [17] and April 2022. This potentially could have had an impact on the capacity and capability of the sector’s workforce [18].

- Results of a survey published in July 2021 (by the Association of Consulting and Engineering New Zealand, Civil Contractors New Zealand, New Zealand Institute of Architects, and Registered Master Builders Association) reported that there were 3,229 vacancies across 135 firms. It also reported that 90% of firms were having difficulty recruiting in New Zealand, with 66% getting no domestic applicants [19].

- Workforce capacity and capability constraints created an environment whereby construction workers were being poached and offered higher salaries/wages by competing businesses [20]. The implications of this are increased labour cost and delays (and associated costs) for construction projects.

c) Demand for renovations

Described as the “biggest renovation boom in decades” [21], New Zealand, like other countries, experienced an unprecedented increase in DIY projects since the outbreak of the pandemic in 2020. Deferred maintenance projects, such as Healthy Homes standards upgrades [22, 23] may have also contributed to this increase. The implication of this was an increased demand for construction materials and products.

According to Stats NZ’s Household Living Costs Price Index (HLPIs), while “property maintenance” had, on average, increased by 3.3% per year between December 2012 and December 2021. The increase between Quarter 4 2020 and Quarter 4 2021 was 6.1% [24].

A similar pattern was also observed in other developed countries. For example, a survey by the Farnsworth Group in the United Stated (US) found that:

- Between 2020 and 2021, 60 to 74% of households had started DIY projects in their home [25].

- 90% reported that the COVID-19 pandemic had caused them to start their DIY projects; and that “being at home more often” and “having more spare time” were the main reasons for starting their DIY projects [25].

Being able to spend more time at home caused people to reconsider the space requirements of their homes [26] and the need to renovate to meet those new requirements [27].

What is the current situation?

There are differing views regarding the “true extent” of the increases in construction costs. For example, according to CoreLogic this was 6.1% , while the Registered Master Builders Association thought this was closer to 10% [28]. During an interview with Newshub [29], the director of a building company stated that timber prices had increased by 20% , and that steel by 30% in September 2021.

The EBOSS Quarter 1 2022 Construction Supply Chain Report reported that the average price increases to customers (between August 2021 to January 2022) had been: 20% on structure, 16% on enclosure, 19% on interior, 15% on finish, and 15% on other construction material categories [30]. Research conducted by MBIE in 2021 found that timber products had the highest price increases in comparison to the pre-COVID-19 era [31]. Additionally, uncertainty about the availability of construction materials had also led to, and an increase in, stockpiling activities which had put “larger businesses with deeper reserves” to better stockpile products and in a better position to survive [31].

How does NZ compare with other countries?

New Zealand is not alone when it comes to rises in construction costs. According to data released by the US Census Bureau [32], construction costs in the US increased by 17.5% between 2020 and 2021— this was the highest increase seen in 50 years [33]. A similar pattern was also observed in other countries including Canada [34] and Australia [35]. A recent report by the New Zealand Infrastructure Commission, Te Waihanga, found that New Zealand had the 10th highest construction price inflation in the OECD during 2021 [5]. Among those countries, Canada had the highest (20.3%) and Switzerland had the lowest (1.3%) inflation rates in 2021 [5].

What does the future hold?

In these unprecedented times, and in a rapidly changing environment, it is difficult to predict the future of construction costs in New Zealand. It is plausible that some of the pandemic-related impacts, such as supply chain issues, will remain in the long term [3, 30, 36]. The EBOSS Quarter 1 2022 Report predicted that the price of construction materials will continue to increase for at least the next 6 months with an average of 11% in all categories [30]. The results of MBIE’s research also found that 39% of construction businesses believed that the overall cost of products will get significantly worse in the next 12 months [31].

While international travel restrictions to New Zealand are now easing, the COVID-19 pandemic is on-going. With self-isolation requirements for COVID-19 positive cases and their households, a significant number of New Zealanders (including construction-related and freight workers) may not be able to work at full capacity, which could have an impact on workforce availability. Although the re-opening of New Zealand’s borders could help alleviate some of these workforce issues, it is noted that the sector’s workforce issues have been ongoing [37], and are likely to continue post the COVID-19 pandemic.

Internationally, the war between Russia and Ukraine increased the price of oil to US$139 a barrel at one stage, which was the highest it had been in 14 years [38]. An increase in crude oil price creates inflation in the price of goods either directly (e.g., through the production of construction materials) or indirectly (e.g. through increased freight costs).

In conclusion, in the short and medium-term, the costs of construction are likely to continue to be impacted by the longer-term impacts of the COVID-19 pandemic and the geopolitical climate.

Bibliography

Feature article references