Construction sector trends quarterly snapshot: April 2021

A snapshot of the key trends from December 2020 to March 2021.

On this page

Download a copy of the Construction sector trends quarterly snapshot April 2021.

Construction sector trends quarterly snapshot: April 2021 [PDF, 1.1 MB]

Performance

New Zealand economy

The economy continues to recover from the impacts of COVID-19, a year on from the first nationwide lockdown in March 2020.

Gross domestic product (GDP) declined by 1.0% in the December 2020 quarter, following record growth (13.9%) in the September 2020 quarter. GDP declined by 2.9% over the year to December 2020, which is the largest annual decline recorded by Stats NZ’s GDP series.

Economic performance

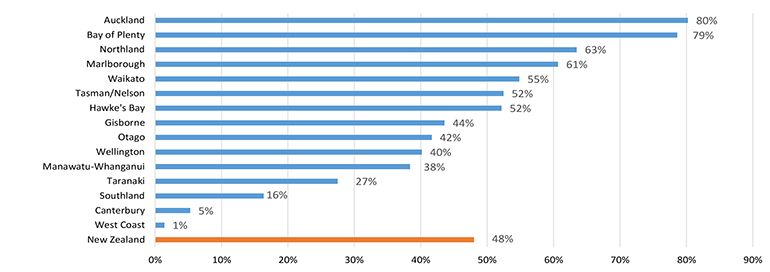

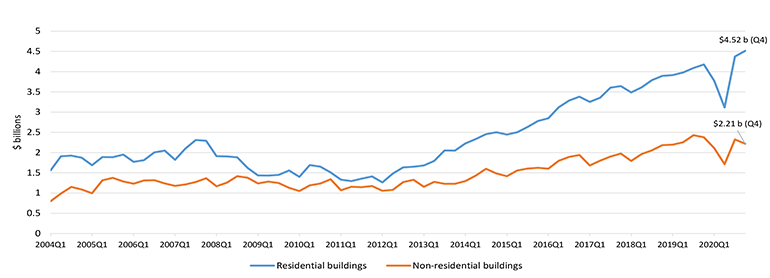

The construction sector’s contribution to GDP declined by 7.3% for the year ending in December 2020. Slowdowns in the non-residential and infrastructure space had driven this decline, such as the decrease in the value of non-residential building work in the Auckland region, as well as the longer term decline in Canterbury (with the region’s earthquake rebuild winding down over the last four years).

Stats NZ noted that construction was an important driver of GDP across most regions in the year to March 2020, and that construction’s share of the national economy had been climbing over recent years. Latest regional statistics showed that the Bay of Plenty and Tasman/Nelson areas had the largest regional GDP increase in the year to March 2020, driven by rising levels of construction work.

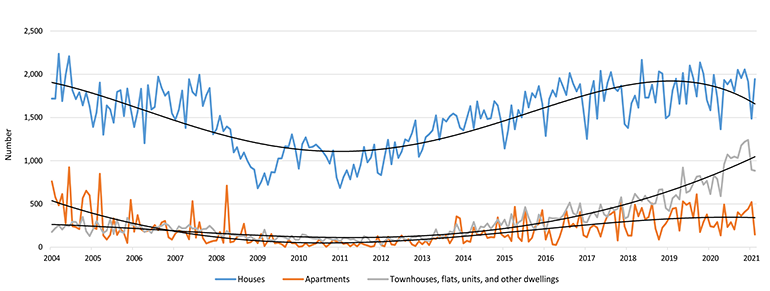

Building consents

The annual number of new homes consented in the year ending in February 2021 was 39,725, up 4.9% from 37,882 in the same period in 2020. The number of new homes consented in February 2021 was slightly lower than in February 2020. Three thousand one hundred and twenty-nine (3,129) new homes were consented in February 2021, compared to 3,285 in February 2020.

Residential consents in the townhouse, flats and units typology continued to rise, up 37.7% on the year ended February 2021, compared to the previous year (i.e. end of February 2020).

Economic outlook

Major banks’ current economic forecasts were reasonably subdued for 2021. ANZ reported a drop in business confidence from February to March 2021, in line with their expectation that lack of tourism and a pending fall in retail spending would impact the economy. A moderation in the construction sector’s level of activity was reported, which was reflected in the slowdown of commercial and infrastructure building work. Westpac similarly anticipated a decline in economic activity, but predicted an overall lift in 2022.

However, both banks, along with the New Zealand Institute of Economic Research (NZIER), foresee residential construction to be a powerful driver for the economy in 2021.

Construction activity contribution to regional GDP (change between 2015 to 2019)

Source: Regional GDP, Stats NZ

Text version of construction activity contribution to regional GDP

Quarterly value of building work put in place, residential and non-residential (March 2004 quarter to December 2020 quarter)

Source: Building activity survey, Stats NZ

Text version of quarterly value of building work

Monthly new residential dwellings consented (January 2004 to February 2021)

Source: Building consents, Stats NZ

Text version of monthly residential dwelling data

People

Construction workforce

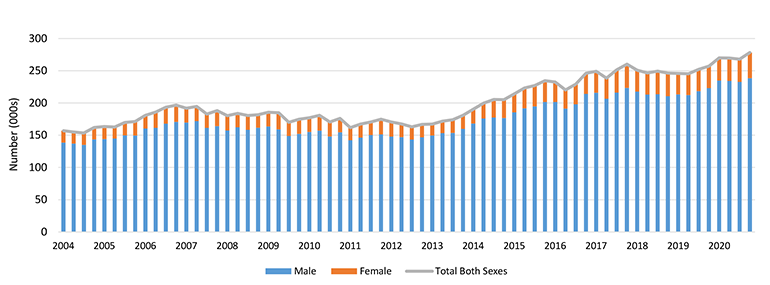

Participation in the construction workforce rose by 21,000 workers in the year to December 2020. Of these, 5,800 were female workers, an increase of 17% (compared with a 7% increase in the number of male workers for the same period).

The number of filled jobs in the construction sector rose 5.4% (9,491 jobs), when comparing February 2021 against February 2020. The construction sector’s job share in total employment is also rising steadily.

The sector is becoming more ethnically diverse. One third (33%) identified as being of Maori, Pacific, or Asian ethnicity (at the fourth quarter of 2020). Maori, Pacific and Asian peoples represented 15, 7, and 11% of the construction workforce, respectively.

The age distribution of the construction workforce showed that the share of younger construction workers (i.e., those aged 24 years or below) was 15% in December 2020 (this was up 2% from December 2019). At the same time, the proportion of workers aged 25 – 54 years declined from 68% (in December 2019) to 66% (in December 2020). The share of older workers (i.e., those aged 55+ years) remained stable at 19%.

In the year ending in December 2020, 30% were employed in residential building construction and 4% in non-residential building construction.

At the end of 2020, the Building & Construction Industry Training Organisation (BCITO) announced they had 16,000 apprentices in training, which was an all-time record.

Government support and initiatives

The Targeted Training and Apprenticeships fund, implemented as part of the Government’s response to COVID-19’s economic impacts, has assisted 106, 600 people since it was first made available in July 2020. Of that total, one third were recognised as construction learners, through apprenticeships and other training methods. The Wage Subsidy was briefly reinstated this year, with applications accepted from 4-21 March 2021.

Health and safety

During 2020, there were a total of 4 construction-related deaths reported by Worksafe. The 2020 total rate is a significant reduction from 2019, when there were 13 total construction-related deaths. The month with the highest death rate in 2020 was November, with two reported construction-related deaths.

In the first half of 2020, there were 2,199 construction-related injuries reported, resulting in more than a week away from work. By comparison, 2,454 injuries resulting in a week or more away from work were reported in the first half of 2019.

Quarterly construction sector employment (March 2004 quarter to December 2020 quarter)

Source: Household labour force survey, Stats NZ

Text version of quarterly construction sector employment

Processes

Legislation

With demand for houses being greater than the supply, and concerns around housing affordability continuing, the Government announced policy to ease house prices, curb demand by investors, while also looking to further New Zealand’s residential development pipeline.

Changes were made to the Reserve Bank’s Monetary Policy Committee’s remit in February, which is now required to take into account Government policy relating to more sustainable house prices, while working towards its objectives.

In addition, the Government released a housing policy package, which included a $3.8 billion Housing Acceleration Fund, which focuses on providing the necessary infrastructure to current and future residential developments. The Apprenticeship Boost initiative was also extended by four months, to further support trades training.

Occupational regulation

For the first quarter of 2021 (January—March) there were a total of 13 complaints received regarding Licensed Building Practitioners (LBPs), while two complaints were received regarding non-LBPs.

Complaints about LBPs spiked in March, with 9 complaints received, while there were 3 in January, with just 1 in February. One complaint was received regarding non-LBPs in both January and February 2021.

Fewer complaints were received in the first quarter of 2021, when compared against the same quarter in 2020. In the first quarter of 2020, 32 complaints were received against LBPs and 9 for non-LBPs.

Products

Supply chain

Supply chain concerns continued to be an issue, as focus increased on specific material and product availability. The availability of timber for the New Zealand market became an issue for both small and largescale building projects when supplier, Carter Holt Harvey, announced that they were halting their supply of structural timber to major domestic retailers in March.

With the domestic demand for building products remaining high, and due to elevated levels of building activity, as a result of the post-COVID-19 trend of increased home renovations, the difficulties in sourcing timber products may potentially cause project delays or the cancellation of work.

Stats NZ’s Business Operations Survey, from August to December 2020, found that:

- 38% of businesses experienced delivery disruption from international suppliers,

- 63% experienced delivery disruptions from domestic suppliers,

- 56% experienced production disruption from domestic suppliers.

Construction costs

The cost of construction continued to rise, but at a decreased rate at the end of 2020. Corelogics Cordell Housing Index noted that residential construction costs rose 0.4% in the December quarter of 2020. This is the smallest quarterly rise since the June 2016 quarter (when the rise was 0.3%).

Potential building material and product shortages have raised concerns of extra pressure on construction costs.

Innovation in construction

Initiatives around innovative construction materials and the sustainable disposal of waste products were announced in the March 2021 quarter.

A new Fletcher Building initiative, partially funded by the Ministry for the Environment, will utilize up to three million used tyres in the cement manufacturing process, with the tyres being combusted and the subsequent rubber, metal and ash combined into cement. The process, undertaken at Golden Bay Cement’s plant in Whangarei, will reduce coal use by 15%, and cut carbon emissions by approximately 13,000 tonnes.

SaveBOARD, a new venture in New Zealand, with backing from Freightways and TetraPak, will manufacture construction board out of used everyday packaging waste. It will be used in place of plywood, particle board or plasterboard. The resulting products will have low carbon footprint, while used boards can be reprocessed and recycled for future SaveBOARD products.

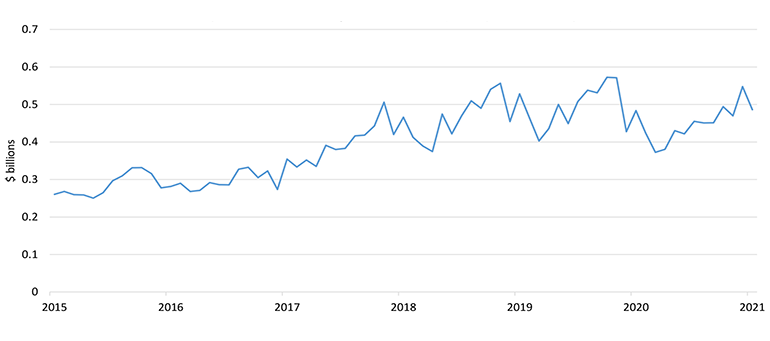

Monthly total value of building product imports (January 2015 to January 2021)

Source: Imports and exports stats, Stats NZ and NZ customs

Text version of building product imports monthly values

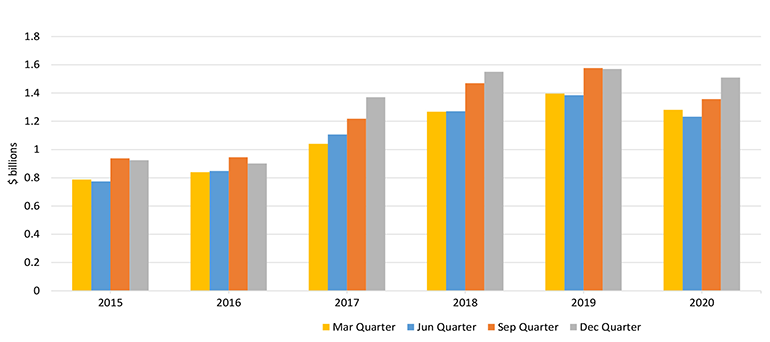

Quarterly building product imports (March 2015 quarter to December 2020 quarter)

Source: Imports and exports stats, Stats NZ and NZ customs

Text version of quarterly building product imports

Construction and the environment

During January to March 2021, the New Zealand Green Building Council reported that: 360 homes were “Homestar” certified (3004 in total), 2 new buildings were “Greenstar” certified (196 in total), while 6 large office buildings received the National Australian Built Environment Rating System New Zealand (NABERSNZ) rating (213 in total).

Sustainable Engineering Ltd reported that two houses were certified as Passive Houses in the March 2021 quarter. As of 31 March 2021, there are a total of 37 certified Passive Houses in New Zealand.

Covid-19 recovery packages across international jurisdictions

United States

A more than $2 trillion infrastructure and economic recovery package was unveiled at the end of March 2021 to bolster post-pandemic recovery. The plan includes putting: $621 billion into transportation infrastructure (such as bridges, roads, ports, airports); more than $300 billion into building and retrofitting affordable housing, along with constructing and upgrading schools; more than $300 billion into improving drinking water infrastructure, expanding broadband access and upgrading electric grids; and investing $580 billion into American manufacturing, research and development and job-training efforts.

Canada

The Government of Canada is adapting the Investing in Canada Infrastructure Program to respond to the impacts of COVID-19. A temporary COVID-19 Resilience stream, with over $3 billion in existing funding, has been created to provide provinces and territories with added flexibility to fund quick-start, short-term projects. It comes with an accelerated approvals process which will enable multiple projects at a time, and a single simplified application. Eligible infrastructure projects include: all retrofits; repairs and upgrades for municipal/territorial/ provincial/indigenous buildings, health infrastructure and schools; COVID-19 response infrastructure; and active transportation infrastructure. Projects must start no later than September 2021 and must be under $10M in total eligible costs.

United Kingdom

The UK Construction Leadership Council (CLC) prepared a post-COVID-19 roadmap Industry Recovery Plan (IRP) in June 2020. This plan is being implemented in three phases: restart (1-3 months), reset (3-12 months), and reinvent (12+ months). The “reset” phase is currently in progress and a pipeline of work across the whole construction ecosystem is being developed. For example, new approaches will be used to improve productivity, there will be investment in training and the adoption of collaborative business models, and fairer contracts and payments.

Australia

The Australian Government has established a $1 billion COVID-19 Relief and Recovery Fund to support regions, communities and industry sectors that have been disproportionately affected by the COVID-19 pandemic. The initiatives announced under the Fund will be supporting industries including aviation, argriculture, fisheries, tourism and the arts.

Global trends on the impact of Covid-19 on architectural design

The architectural design of buildings typically follows the way people use those buildings and their personal requirements. The COVID-19 pandemic has caused people to rethink what their building design needs are. With an increase in the number of employers and employees working from home (WFH), this has started to shape peoples’ housing preferences and design requirements. Below is an overview of some key changes reported to date.

Home size:

Home builders and designers are seeing a greater demand for bigger houses. For a number of years, there has been criticism about the inefficiency of larger homes and homeowners were being encouraged to downsize. However, COVID-19 has caused people to reconsider this. With people having to spend more time at home, larger homes are more desirable again.

Home layout:

Until recently, cellular plan houses were considered old fashioned. However, with more people staying at home during the day and engaging in several parallel activities, people may demand more flexible house layout options. This might include, for example, having moveable screens and walls in apartments to reflect the different uses throughout the day e.g., “day mode”, “play mode”, and “night mode”.

Home office:

In the pre-COVID-19 world, the home office was a casual space, however, post-COVID-19, it has become an essential space. For some, the home office is now being used 8 hours a day, five days a week. These heavy-duty spaces are also needing to accommodate larger desks, chairs, and more storage space. The size, number, and the quality of home office spaces are now important considerations for designers.

Kitchen:

Pre-COVID-19, the kitchen was considered a less-used space because people tended to buy their meals. This trend has led to shrinking kitchens in apartments and houses. However, as a result of COVID-19 restrictions, peoples’ behaviours shifted to spending more time in the kitchen and eating homemade meals, and also reduced visits for their groceries. If this trend continues, larger kitchens with bigger pantries and storage space may be what is sought after.

Interior design:

While the focus of interior design has historically been on aesthetics, this has now shifted to function and flexibility in the post-COVID-19 world. With people spending more time in their homes, the quality of all interior features may matter more now than before. It also highlighted the importance for all spaces to be functional. To improve peoples’ wellbeing, interior designers are now considering design ideas such as: better indoor/outdoor connections; the inclusion of green spaces inside the house; the use of sound proofing material in interior walls; and the use of wallpaper patterns to create a feeling of being connected to nature.

Heating/cooling:

The household energy use in China and Australia showed significant increases in energy consumption during their lockdowns. If people continue to want to spend more time at home post COVID-19, then they may want to be in homes that are well-insulated and have reliable and energy efficient heating systems.

Open spaces:

It has been reported that those living in apartments had one of the worst lockdown experiences. It also highlighted that having open spaces was an essential need rather than an amenity. Connections between indoor and outdoor spaces were also seen to help with peoples’ mental wellbeing. Related to this, balconies are now being regarded by some as a right and not a privilege.

References