National

The commentary below presents the national context for tourism in the year ending June 2019 (and for the June 2019 quarter where available). Key findings are below:

On this page

Growth in visitor numbers and spend slowing

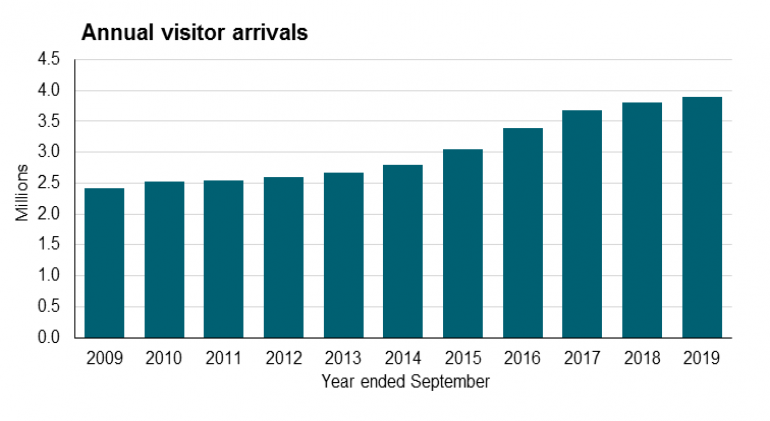

The number of international visitor arrivals to New Zealand increased by 2.7 per cent to 3.89 million, for the year ending June 2019. While this is a softening in growth, the long term trend remains positive, with a 10 year compound annual growth rate of 4.9 per cent.

Source: International Travel, Stats NZ

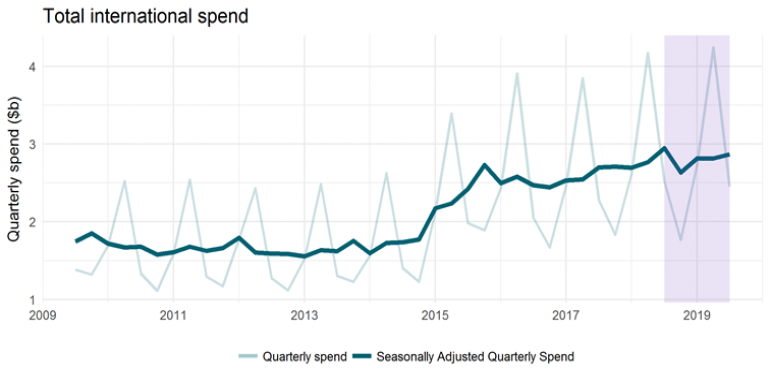

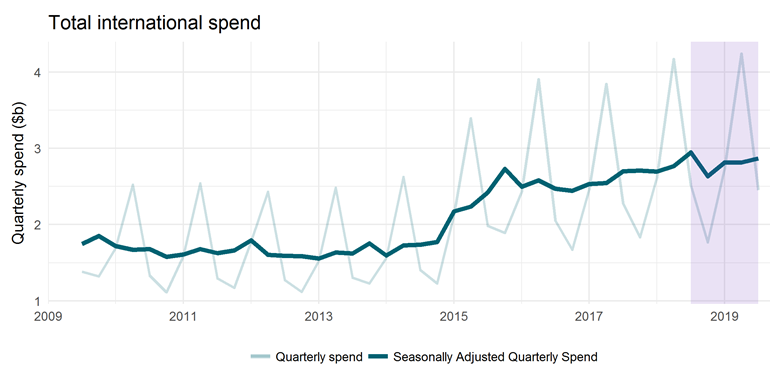

Over the year, spend by international visitors grew one per cent to $11.2 billion, with average spend per visitor up fractionally, to $3,310 (although the growth was not statistically significant).

Source: International Visitor Survey, MBIE

After adjusting for seasonal impacts, international visitor spend in the June 2019 quarter was similar to the previous two quarters, and still well up over the earlier part of the decade.

Source: International Visitor Survey, MBIE

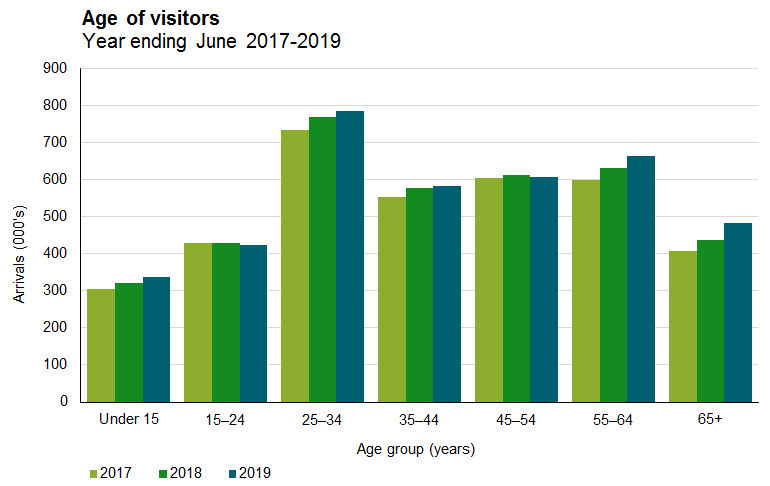

Strong growth in older visitor arrivals

Growth in visitor arrivals was skewed towards older age brackets for the year ending June 2019. The 65+ age bracket had annual growth of 10.3 per cent, while visitors aged 55-64 had annual growth of 4.9 per cent.

According to the UN, by 2050, one in four persons living in Europe and Northern America are projected to be aged 65 or over[1]. Similarly, Australia is projected to have 21 per cent of the population to be aged 65 or over by 2050 (compared to 15 per cent in 2017). As this demographic trend becomes more pronounced over time, it is expected the composition of visitors to New Zealand (across a number of key markets) will follow suit.

[1] Source: https://www.un.org/en/sections/issues-depth/ageing/(external link)

Source: International Travel, Stats NZ

International visitors are staying in New Zealand longer

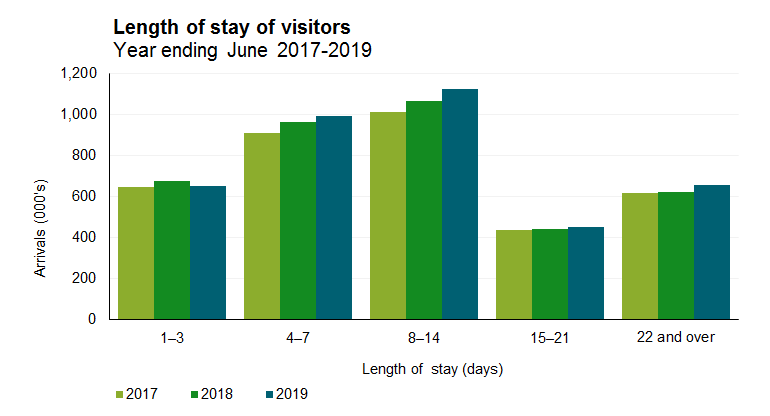

The median length of stay for international visitors increased by 2.7 per cent for the year ending June 2019. The increase reflected a 3.6 percent annual decline in the number of visitors undertaking short trips of 1-3 days, a 2.9 per cent increase in trips of 4-7 days, and a 5.3 per cent increase in trips of 8-14 days.

Source: International Travel, Stats NZ

Cruise ship numbers and spend increases

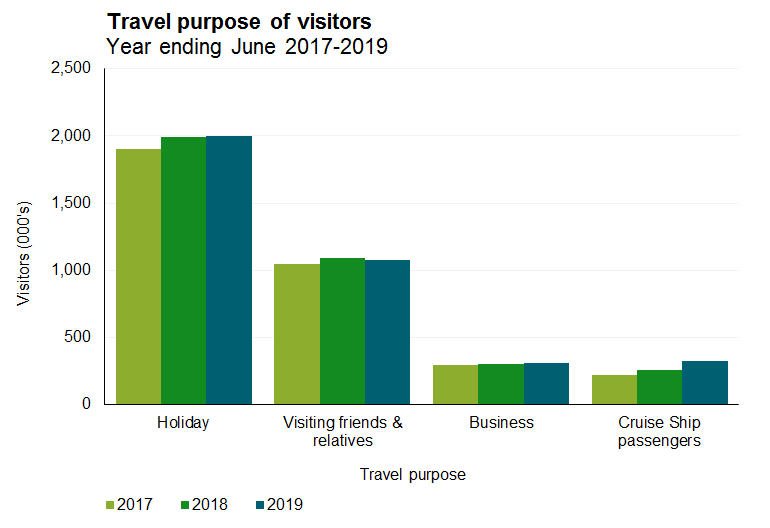

The strongest annual growth in arrivals was from cruise ship passengers. Approximately 320,000 cruise ship passengers visited New Zealand in the year ended June 2019, up 24 percent on last year. Spending by cruise passengers rose to $370 million, up 25 per cent from 2018. Passenger spend comprises of shore excursions (predominantly pre-booked), including overland tours, and spending ashore by passengers and crew.

New Zealand’s cruise industry is playing an increasingly substantial role in driving up visitor arrivals to New Zealand, with both cruise ship arrivals and passenger spend increasing sharply in recent years. Since 2015, spend by cruise visitors has increased 84 per cent (from $201 million to $370 million), while passenger numbers have increased by 65 percent (from 167 thousand to 275 thousand). For the year ending June 2019, this reflected an average expenditure of $1345 per cruise passenger.

Cruise ship passengers do not count towards Stats NZs International Travel statistics; however they are included in the graph below to demonstrate the relative scale of arrivals. For the year ending June 2019, there were more cruise ship passenger arrivals to New Zealand than there were visitors here for business purposes.

Source: International Travel, Cruise Statistics, Stats NZ

The vast majority of passengers were Australian citizens (49%), United States citizens (20%), or New Zealand citizens (11%) and more than three-quarters of all passengers were aged 50+.

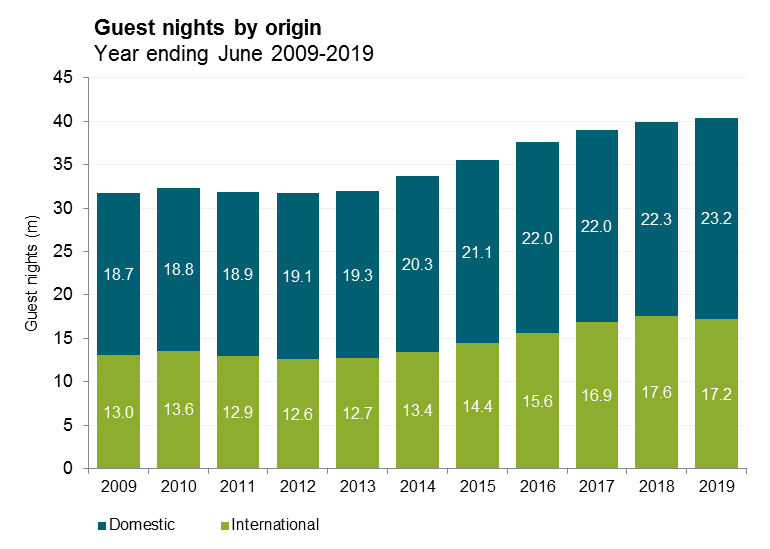

Commercial domestic guest nights to record highs

Commercial guest nights reached a new high in the year ending June 2019, up 1.3 per cent to 40.4 million nights spent in hotels, motels, backpackers, and holiday parks. The long term trend shows strong overall growth in the sector, with a 10 year compound annual growth rate of 2.45 percent.

Reflecting the global trend of a softening in the international travel market, domestic guest nights have grown strongly, while international guest nights in commercial accommodation have dropped slightly over the year. Compared with the June 2018 year, domestic guest nights rose 3.9 per cent, while international guest nights fell 2.1 per cent.

Source: Accommodation Survey, Stats NZ

Please note that this measure is partial, and does not include guest nights in hosted accommodation, such as homes rented through a peer-to-peer network such as Airbnb. It also does not include guest nights of people staying with friends and family, or responsible campers (who own or hire mobile accommodation).

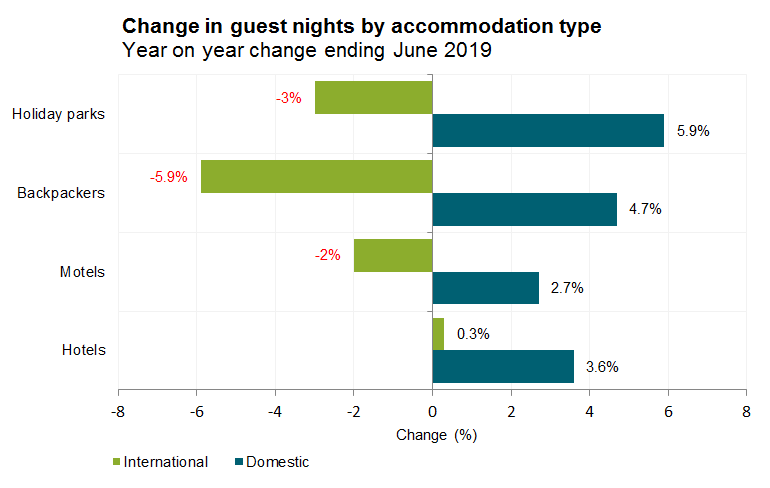

International backpacker guest nights have fallen

Growth in domestic guest nights was distributed across the range of commercial accommodation types. Holiday park guest nights were up 5.9 per cent, backpackers were up 4.7 per cent, hotels were up 3.6 per cent, and motels were up 2.7 per cent.

International guest nights displayed the opposite trend, with backpackers contributing the most to the fall in visitor nights, down 5.9 per cent on last year. Holiday park guest nights were down 3 per cent, and motels down 2 per cent.

Source: Accommodation Survey, Stats NZ

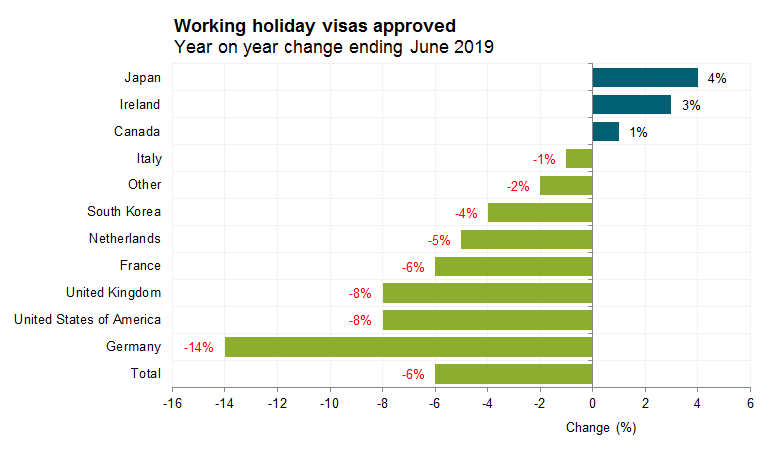

The number of working holiday visas approved for 18 to 30 year olds declined significantly on last year, down 6 per cent (down 3790) for the year ending June 2019. This is likely contributing to the slowdown in international guest nights (especially in backpackers and holiday parks) as they generally have a high length of stay. A one per cent decline in the number of visitors aged 15-24 also indicates a softening in the young traveller market.

Source: Migration statistics, MBIE

Please note that working holiday visitor arrivals are generally classed as visitors as most stay for less than 365 days.