Primary industries

The Waikato is the agricultural heart of Aotearoa New Zealand, with over 20% of the nation’s primary exports generated from the region.

On this page

The industry is growing and adaptive, with significant new technology emerging to change traditional practices. By increasing productivity, we can reduce climate impact – and our future workforce will need to bring new skills and expertise to drive this transition. The growth of Agritech and Aquaculture, alongside emerging fields like alternative dairy and future foods, will create new opportunities across the region that will require a suitably skilled workforce to drive future growth.

Text description

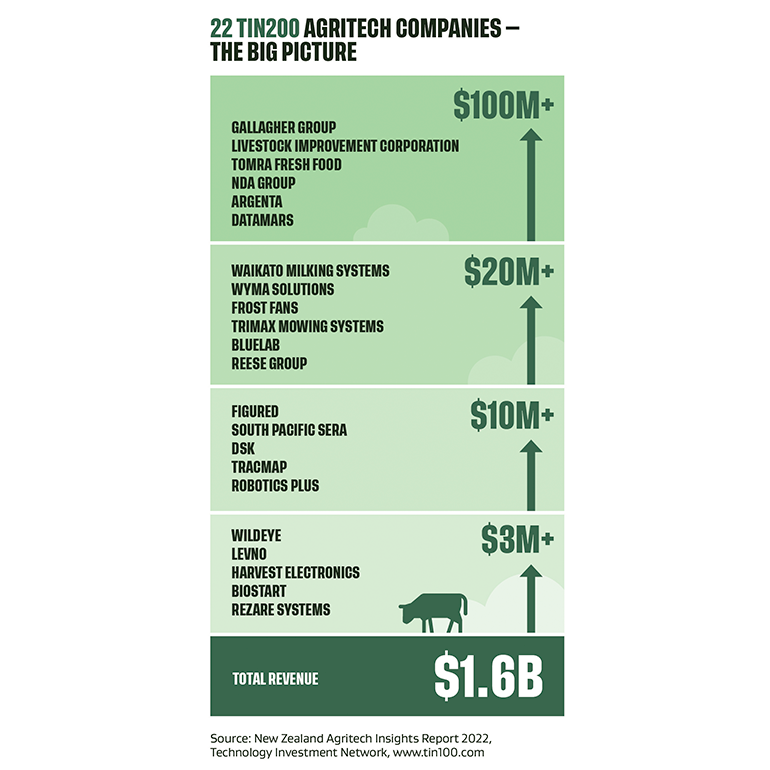

The Waikato continues to be a high-performing region with a strong ecosystem of tech companies that is set to grow the region’s representation further. 10 of the TIN200 companies are based in the Waikato. With a strong agritech presence, 4 of these companies - Gallagher Group, LIC, NDA Group and TOMRA Fresh Food - have maintained strong growth and are ranked within the 10 largest companies in the TIN Agritech Insights Report 2022. There is an exceptional pipeline of technology companies, such as Waikato-based RiverWatch and Synthase Biotech, that span the breadth of agritech categories including Animal and Crop Health, Growing and Harvesting, Post-Harvest, Environment Management, and Data Solutions, building on the international success of established New Zealand agritech companies.

New Zealand Agritech Insights Report (2021)(external link) — Technology Investment Network

Our approach

Agriculture, forestry and fishing are collectively the powerhouse of the Waikato region, contributing $24.8 million to GDP in 2020. The dairy farming sector provides the highest number of filled jobs in primary industries, employing over 9,000 people. The Waikato dairy industry is key to boosting export earnings and constitutes over 60% of the region’s earnings and over 20% of all of NZ’s exports.

Waikato RSLG area - Regional economic profile(external link) — Infometrics Ltd.

Although dairy farming and agricultural biotechnology are the key drivers of the Waikato economy, the region’s success in the primary industries sector is shared amongst several agricultural sub-sectors including agritech and aquaculture.

The burgeoning agritech sector is calling for people with technical knowledge and bio-systems knowledge to meet demand for automation and mechanisation across the sector. It is predicted that the workforce opportunities within agritech, agribusiness and future foods will continue to increase across the Waikato and create a unique opportunity for the region to a be global leader in the ‘Primary Industries Futures’ space.

When developing this plan, the RSLG has considered the workforce modelling studies completed by the dairy sector, research from Ministry of Primary Industries, the New Zealand Government Aquaculture Strategy 2019, and the Agritech Industry Transformation Plan.

Key insights

Dairy

Dairy is the major contributing sector to the Waikato economy. A quarter of people employed in the dairy farming sector are on-farm dairy producers and despite employing the highest number of filled jobs, productivity is low. However, the sector is transforming rapidly as it adapts to both swift technological revolution and increasing climate adaptation demands. As such, low skilled on-farm roles are not forecast to rise significantly – the workforce growth in the sector will come from higher skilled roles.

By 2025 the dairy sector is expected to need:

- A net increase of 2,300 workers

- 8,300 more workers with qualifications

- 6,000 fewer workers without post-school qualifications

- An additional 25,700 trained workers to replace natural attrition within the industry

Fit for a Better World – accelerating our economic potential(external link) — Ministry for Primary Industries

The future skills and knowledge required for the dairy sector are:

- More market and product skills in consumer branding, along with cultural knowledge and language skills to address barriers to doing business in emerging markets.

- Business and management skills in the areas of risk management, food safety and quality assurance systems.

- Higher levels of production-oriented skills including whole farm systems, information management, resource use, financial efficiency, soft skills, and managing local and migrant staff and contractors.

- Increased science and technical support skills, particularly researchers on resource use efficiency, reducing environment effects and agriculture resource economics.

- More accredited rural professionals and providers to transfer new techniques and knowledge to farmers.

Between 2014 and 2019, only 4% or 1,200 school leavers from the Waikato studied Agriculture and the majority studied at Level 1 to 3 (low skill)*. This statistic highlights the opportunities for the sector to attract, grow and retain a locally developed workforce for the future.

*Tertiary Education Commission. (2021). Waikato school leavers data.

DairyNZ have recently undertaken comprehensive research to develop a Dairy Workforce Resilience Plan. Early findings from this study have identified 3 key problems that underpin the workforce shortage for the sector:

- The dairy sector is heavily reliant on people to operate

- We are not attracting enough people (and specifically the right people) to on-farm roles to ensure safe and effective operations

- The sector is not keeping enough of the right people with the right skills.

The draft report and supporting action plan highlight a number of activities aligned to mitigating issues identified by the Group, and as such, the RSLG will engage with DairyNZ on the implementation of various actions across the Waikato.

“Although there is no silver bullet, the sector has risen to the occasion in terms of coming up with ideas. As a whole, these ideas continue to value the hard work done by everyone on farm, while looking to technology and productivity innovation as key pillars for workforce resilience. The success of our sector will require the standing together of our sector stakeholders, farm business owners and leaders, to adapt and create the change that will see our sector continue to succeed.” — Chris Lewis, Federated Farmers, April 2022

Agritech

Agricultural technology, or agritech, is an area of significant interest for Aotearoa New Zealand. Historically, agritech has been predominantly valued for its input into New Zealand’s food and fibre sectors and as a key driver for increasing productivity, quality and sustainability across the entire food and fibre production and supply value chain for the country

The Group has met with agritech industry leaders, agritech leads from Callaghan Innovation, and representatives from the MBIE Agritech Industry Transformation Plan, to understand the context of the sector, and to explore opportunities for the future. Members have also spoken with regional leaders who are supporting the establishment of an Agritech Futures Academy in the region.

Agritech is central to driving more efficient land use and management for better environmental outcomes spanning water quality, reduced methane, nitrous oxide, and carbon dioxide emissions, both domestically and across export markets. While the above remains true, it is also clear that our strong food and fibre sector and expertise in this area represents an opportunity to grow the agritech sector as an economic driver, particularly as an export industry. This is the primary reason why the sector has been selected as a priority area under the Government’s refocused industry policy.

The Waikato region has a number of comparative advantages when it comes to Agritech. By effectively exploiting these advantages, the region will be in a good position to increase its share of the global market. Some of these regional advantages include:

- Strong complementary food and fibre industry

- Small market size – ideal for testing technologies

- Ingenuity in developing solutions and world-class research

- Strong pasture-based management systems

- Increased international investment activity.

Digital technology is also a key part of the Agritech sector, allowing for weightless exports to be a feature of the sector and helping overcome some of the challenges of the country’s geographic isolation. Technologies behind our genetic gains, farm modelling and management systems will drive the next levels of productivity and industry transformation.

The sector will need more high-skilled workers with university-level qualifications to:

- Increase enrolment in critical areas of university education for the food and fibre sectors (e.g., Bachelor of Agricultural Science, Horticultural Science and Forestry Science);

- Increase the use of the food and fibre sectors as learning examples across all areas of study at university; and

- Encourage university graduates of specialist and other subjects (such as IT, engineering and robotics) into food and fibre career pathways.

In order to achieve this, the Group needs to engage with universities to understand what they are offering and how they are encouraging students into food and fibre careers.

Māori are significant players in the agriculture sector, with many entities owning significant land assets. An Agritech and Agribusiness training academy would not only support growth for these entities, it would also give much-needed support for Māori wanting to utilise land that is not currently in productive use. Waikato landowner Aramiro Ahu Whenua Trust has partnered with Te Puni Kōkiri to help develop its land into an agricultural enterprise that moves away from a reliance on simply farming

Despite the Waikato dairy farming and manufacturing sectors being significant contributors to national GDP, there is no dedicated Agritech or Agribusiness training academy within the region. The Group believe there is a strong opportunity to develop such an academy in the Waikato. The academy could be a mix of classroom, field based and digital learning where students will be able to undertake practical and online learning modules. Training could encompass environmental, animal welfare and climate change courses.

Home to over 60 businesses and 800 employees, Waikato Innovation Park continues to be an ideal place for research, collaboration, and commercialisation in the heart of the Waikato and New Zealand. With the recent completion of a 2,900 sqm collaborative space for technology, food and agricultural companies, and growth plans across 15 hectares of master planned land, the Waikato Innovation Park is a synergistic potential home for a new Waikato Futures Academy. Waikato Tainui’s college in Hopuhopu also has the potential to host research and collaborations, as does the University of Waikato.

Aquaculture

More than half of the seafood that the world eats comes from aquaculture and this is expected to rise to 60% by around 2031.

Fisheries and Aquaculture(external link) — Food and Agriculture Organization of the United Nations

In the Waikato, aquaculture activity is largely clustered in the Coromandel Peninsula, with Sanford (New Zealand’s largest seafood company) operating substantial Greenshell Mussel™ farming and post-harvest facilities in the area (Greenshell Mussels™ are a sustainable crop indigenous to Aotearoa New Zealand). The Coromandel aquaculture industry delivers 30% of national Greenshell Mussel™ production and 24% of national Pacific Oyster production by weight. Together, these 2 species bring in over $50 million to the Coromandel economy and create about 400 industry-related jobs.

The burgeoning seaweed industry is a further growth area, with Paeroa seaweed innovation company AgriSea working with University of Waikato on a 2-year sea lettuce (Ulva) growing trial at Kopu marine precinct in the Coromandel. The aquaculture sector is forecast for sustained growth, as outlined in the New Zealand Government Aquaculture Strategy (2019). This strategy has a goal to reach $1 billion in sales by 2035 (from $600 to $650 million in 2019) through maximising the value of existing farms through innovation, extending into high value land-based aquaculture, and extending aquaculture into the open ocean.

The Government's Aquaculture Strategy to 2025 [PDF 2.9MB](external link)

There are no specific requirements to become an aquaculture farmer. However, an aquaculture qualification, such as a New Zealand Certificate in Aquaculture (Level 3 or 4), may be useful.

Explore Careers | Aquaculture Farmer(external link) — Wintech

Primary industries action

-

Fully leverage the Waikato’s position as the agriculture backbone of Aotearoa New Zealand.

Case study: Using cloud technology for an easier weigh of life

Taking on a family farm with over seven decades of success is no walk in the park! So when Kim and Mat Sherriff took over the family farm, Rotomate, in Piopio, New Zealand, 10 years ago, it was imperative to keep that success alive.

The Sherriffs run Romney ewes and breeding cows and started off with a 20-year-old weigh scale with a manual dot matrix print out. This meant manual data input into an excel spreadsheet, which is hugely time-consuming and leaves room for errors.

Keeping a close eye on the weights of their stock is important so the Sherriffs know that animals are being fed correctly, and it makes it easier to pick up if an animal isn’t doing well or is sick. Measuring everything is also vitally important to maximising yield.

The Sherriffs made the move from the old weigh scale to new technology, and now use a Gallagher weigh scale with an integrated EID reader and a compatible cloud-based Animal Performance web and mobile platform. This means that all the team at Rotomate can easily sync data to the account and can check data and graphs from the mobile app whether on or off farm.

Mat says gathering data is so important, and the Gallagher TW unit paired with the Animal Performance web and mobile app is paramount to analysing data to make more informed, data-driven decisions about his animals.