Strong foundations to foster economic growth

The Government’s goal is to increase living standards and opportunities for all New Zealanders.

On this page

Lifting New Zealand’s economic and productivity growth is critical to raising incomes and supporting high-quality public services in the short and long term.

The stakes are clear. If New Zealand’s nominal gross domestic product (GDP) was to grow by 1 percentage point more than forecast from 2024/25 onwards, tax revenue would be $7.9 billion higher than forecast by 2028/29.

To put this in context, the Government’s expenditure on primary and secondary schools in 2023/24 was $9.7 billion. An increase in GDP gives the Government more choices about investing in health and education or delivering tax relief.

Economic potential is unleashed by fostering investment, innovation and risk-taking. Removing barriers and creating incentives empowers businesses to drive growth, ensuring market forces fuel prosperity.

Markets for goods and services need to be more competitive to make prices more affordable for New Zealanders and to provide the incentives for businesses to innovate. Reform is also required to address long-standing declines in housing affordability.

New Zealand has many enduring strengths to build on to achieve these outcomes. It is a safe and secure country with a stable democracy, strong institutions and rule of law. It has an abundance of natural resources, fertile land and temperate weather. New Zealand has also created world-leading scientific research and innovative firms.

The New Zealand economy is predominantly a service-based economy (about three-quarters) with goods-producing (21 per cent) and primary industries (6 per cent) accounting for the remainder. About 97% of businesses are small, with fewer than 20 full-time equivalents (FTEs). New Zealand’s main export industries are dairy and meat products, forestry and tourism.

New Zealand has a growing Māori economy, which is a critical driver of national economic growth. In 2023, the Māori asset base was valued at $119 billion (up from $69 billion in 2018) and the contribution of i wi and Māori collectives and businesses to the national economy was $30 billion (up from $17 billion in 2018).

The Māori economy has grown considerably faster than the overall economy over the past decade. To realise further potential, New Zealand needs to support Māori entrepreneurship, land productivity, and investment to unlock further economic potential.

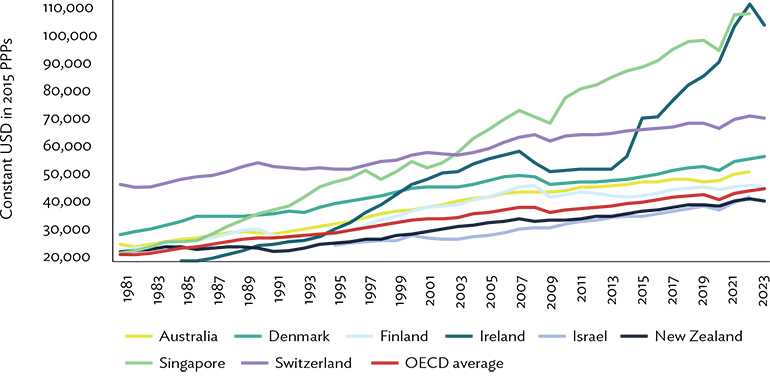

New Zealand’s GDP per capita (output per person) is low compared to other advanced economies and the gap has been widening (see Figure 1).

Figure 1: New Zealand’s GDP per capita compared to other advanced economies

Source: OECD

Text description of graphic

New Zealand has experienced declining annual economic growth since the June 2023 quarter and negative quarterly growth in the last two quarters. This is mostly due to the increase in interest rates needed to bring inflation down. As interest rates ease, economic growth is expected to improve.

New Zealand has also experienced poor labour productivity performance over many decades compared to other advanced economies. There are many likely causes of this poor performance, for example:

- New Zealand’s small population and distance from large economies means businesses face weak domestic competition, struggle to achieve scale and are often poorly connected to international markets

- New Zealand has very low rates of capital investment by business in plant, machinery and technologies

- New Zealand businesses are comparatively slow to adopt productivity-enhancing innovations.

To arrest this slide in growth and productivity, the Government needs to be focused on delivering the policy agenda to enable economic growth. This means low inflation and government spending that is focused on value and removing waste. It means pushing back on regulation that is stifling productivity. And it means unlocking more competitive markets, lower costs for consumers, and driving business innovation. It is only by having stability in these settings that certainty can be provided for businesses and households, supporting their investment and long-term decision-making.

Combined with enabling regulatory and tax settings, stable macroeconomic settings underpin a dynamic and competitive business environment, which ultimately drives increased productivity. Productivity growth comes from the decisions businesses and households make about how to use resources. The decisions they make are driven by the incentives they face and their ability to respond to those incentives. Government policy can help to shape incentives through regulatory settings that make it easier to do business, invest and take risks.

The Government’s focus on sound macroeconomic and fiscal management has contributed to lower inflation and falling interest rates, reinforcing confidence and activity in the economy. The Government will maintain its fiscally prudent approach, and its intention is to put net core Crown debt as a percentage of GDP on a downward trajectory towards 40 per cent of GDP, keeping it within a 20 to 40 per cent range in the longer term.

The Government will keep prioritising spending to areas where it matters most, and will drive change to ensure that regulatory and tax settings do not hinder productivity. Ensuring that Government expenditure represents value for money, and pursuing a credible path to surplus will allow fiscal headroom for the Government to pursue ambitious policies for economic growth.

New Zealand can learn from other small, advanced economies that have improved their economic performance such as Ireland, Singapore and Denmark. While these economies differ from New Zealand’s, there are some common features in the steps they have taken to better deliver on their growth potential. These include reforms to improve education outcomes, fostering a dynamic business environment, deepening international connections through trade and investment, investing in science and new technologies, and building world-class infrastructure.

Going For Growth sets out how the Government will create the environment to lift economic growth now, while also addressing New Zealand’s enduring productivity challenge.

It is organised around five pillars for driving growth, based on the experiences of other small, advanced economies:

- Developing talent

- Competitive business settings

- Promoting global trade and investment

- nnovation, technology and science

- Infrastructure for growth.

Across these themes, the Government is interested in a combination of reforms to support:

- increased capital investment by firms, supported by higher domestic savings and inbound overseas investment

- secure, affordable and abundant energy supply

- tax and regulatory settings that support greater competition in key sectors (including banking, grocery and energy).

Going For Growth will continue to be added to as current Government initiatives are completed and new initiatives are launched. The Government is considering future reforms, particularly in taxation, savings and competition policy. There are opportunities for businesses to shape future developments in Going For Growth. Next steps and how businesses can get involved are provided in the next steps section.

Stratospheric ozone lidar, Lauder, Central Otago. Credit: Dave Allen, NIWA.