Construction sector trends monthly media and information overview: May 2021

An overview of the key research, data, and media releases in May 2021.

On this page

The key themes were:

- Supply chain concerns, labour shortages and strong building activity are increasing construction costs.

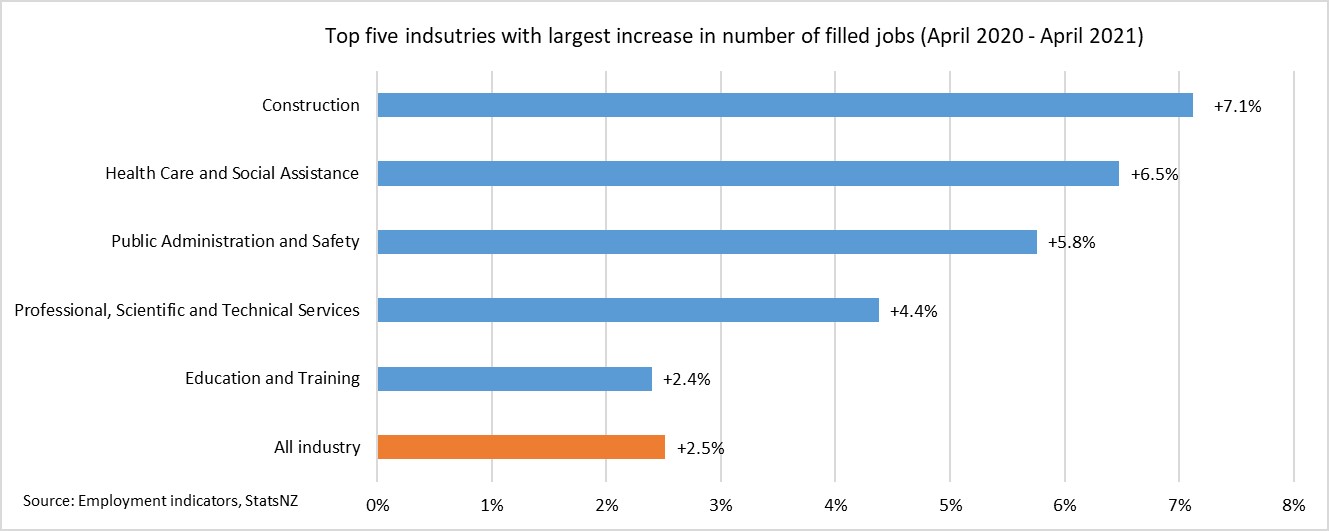

- Data releases show that the construction sector had the largest growth in filled jobs.

- The high level of building activity continues, with multi-unit homes driving the rise.

General summary

Both environmental and economic issues trended across construction-related media items this month.

Supply chain coverage continued to be prominent through May 2021, along with related issues around labour shortages, strong building activity and rising construction costs.

Construction costs were also a focal point for research releases, with CoreLogic noting residential cost rises for both the first quarter of 2021, and on a year-to-year basis.

Data releases showed a level of bounce-back for the construction sector workforce, a continuing high-level of building activity, and an ongoing, upward trend in multi-unit homes (including townhouses, flats and units).

Research releases

BRANZ published three research reports in May 2021, with each focusing on climates and temperatures of buildings. The first report looked at thermal bridging issues with exterior walls, while the second looked at the characteristics of exposed and sheltered areas of residential buildings. The third report investigated indoor climates, and their relationship with the health and wellbeing of children. This study found that indoor temperature was associated with children’s physical and mental well-being.

Positional material deterioration over building envelope (2021)(external link) — BRANZ

Keeping our children warm and dry: Evidence from growing up in New Zealand (May 2021)(external link) — BRANZ

CoreLogic’s Cordell Housing Index Price (CHIP) Q1 2021 reported further rises in residential construction costs during the first quarter of 2021 and for the full year to March, increasing 1.3% for the quarter, with an annual rise of 3.3%.

Housing construction costs on the rise; up 1.3% over March quarter(external link) — CoreLogic

Data releases

Stats NZ reported that there were approximately 2,236,000 jobs across all New Zealand industries in April 2021. This was an increase of over 2.5% (over 54,000 jobs) from April last year, when job numbers fell to 2,181,000 across the COVID-19 Alert Level 4 lockdown period.

The data showed that the construction workforce is maintaining a strong resilience to the economic impacts of COVID-19.

The construction sector had the largest growth in filled jobs, when compared with other industries, for the year to April 2021. The sector grew by 7.1% (12,568 jobs) during this time. Other sectors also maintaining strong rises in their workforce numbers included: health care and social assistance (up 6.5%; 15,474 jobs); public administration and safety (up 5.8%; 8,058 jobs); and professional, scientific, and technical services (up 4.4%; 7,370 jobs).

Filled jobs surpassing pre-COVID-19 levels(external link) — Stats NZ

Building activity continues to operate at elevated levels. Monthly consenting figures for March 2021 were at record levels, with the same upward trend continuing for the April 2021 consenting figures. The monthly number of new homes consented in April 2021 was 3,994, up nearly 84% from April 2020. This increasing number of new homes consented in recent years has mostly been due to the rising number of townhouses, flats, and units, which increased nearly 45% compared to the same period in 2020.

New home consents remain high in April(external link) — Stats NZ

Media

There were over 900 building and construction-related media articles generated in May, a sizable increase from the over 730 articles produced throughout April 2021. Trending media content included key themes of: “green building”; the Budget 2021 announcement and implications for housing; continuing coverage of supply chain concerns and labour shortages (both of which were linked to rising construction costs); and the civil case against James Hardie and the company’s ‘Harditex’ product.

The New Zealand Herald ran a series of special feature articles in May, dedicated to various stories and perspectives around “green building”. A key point highlighted in one article (which was also a prevailing theme across the remaining feature articles), was the need to rethink the way that we typically design, build and use homes and workplaces, for a positive impact on our climate and natural environment. Along with the environmental benefits of green building, some articles also highlighted the economic benefits, such as increasing economic growth and job creation.

Green building 'We need to rethink how we build'(external link) — NZ Herald

Green Building: Greenprint for Covid recovery(external link) — NZ Herald

Media reaction to the announcement of Budget 2021, with respect to the building and construction components in the Budget, focused on the $380 million which would be invested into housing for Maori, including papakainga housing and repairs to existing housing. Outside of this, coverage and commentary alluded to the policy changes announced before the Budget, which focused on the Government’s effort to relieve pressure on New Zealand’s housing market.

Coverage of CoreLogics’ finding that construction costs had risen 3.3% over the past year honed in on the potential drivers for the rise.

In a Radio New Zealand article, CoreLogic’s Chief Property Economist, Kelvin Davidson, was quoted as saying that a perfect storm had come together to drive costs higher. These included: unprecedented demand, labour shortages and supply chain issues.

Construction costs surge to annual 3.3% growth rate(external link) — RNZ

Throughout the month, the civil case against James Hardies continued, where the accountability for the alleged failures of the Harditex cladding product was debated. While the prosecution focused on the alleged failures of the company, the defence maintained that issues with poor workmanship on NZ houses was to blame.

Top 5 industries with the largest increases in the number of filled jobs (April 2020 to April 2021)

Source: Employment indicators, Stats NZ

Image description