Workforce dynamics and demographics

On this page

Construction is one of the largest employment sectors

The construction industry is the third largest employing industry in New Zealand, accounting for 10.7% of the country’s total workforce for the year ending June 2023.

In that period, there were approximately 308,500 workers employed in construction, an increase of 13,700 workers compared to 2022. Over the last decade, strong growth in building activity has been reflected in employment gains. There was an increase of 140,800 workers from 167,200 in 2013, representing an annualised growth rate of 6.3%. This is more than double the 2.8% annualised growth rate of all industries. These figures demonstrate the steady and sustained growth of the construction sector over the past decade.

Figure 1: Annual employment in construction sector (year ended June 2013-2023)

Text description of Figure 1

Over the year to June 2023, the construction sector played a prominent role in driving the overall increase in filled jobs, according to Stats NZ’s Quarterly Employment Survey (2023a). There were 17,100 more filled jobs in construction in the June 2023 quarter compared to the June 2022 quarter. This growth has been driven by a combination of factors, including ongoing population growth, a strong pipeline of housing and infrastructure projects, and increasing demand for construction services. As a result of these factors, construction has become one of the sectors with the highest percentage growth in filled jobs in recent years.

The number of construction jobs being added (as measured in filled jobs) in New Zealand continues to grow, increasing 9.7% in the year to June 2023, including a 3.1% increase over the June 2023 quarter. This marks the highest annual growth rate since the year ended March 2022, when it reached 10.6%. Within this overall growth, the construction sector ranked sixth among all sectors in terms of filled jobs growth during the June 2023 quarter. It trailed sectors such as transport, accommodation and food services, financial and insurance services, information and telecommunication and arts and recreation.

Construction makes strides in diversity but remains behind other sectors

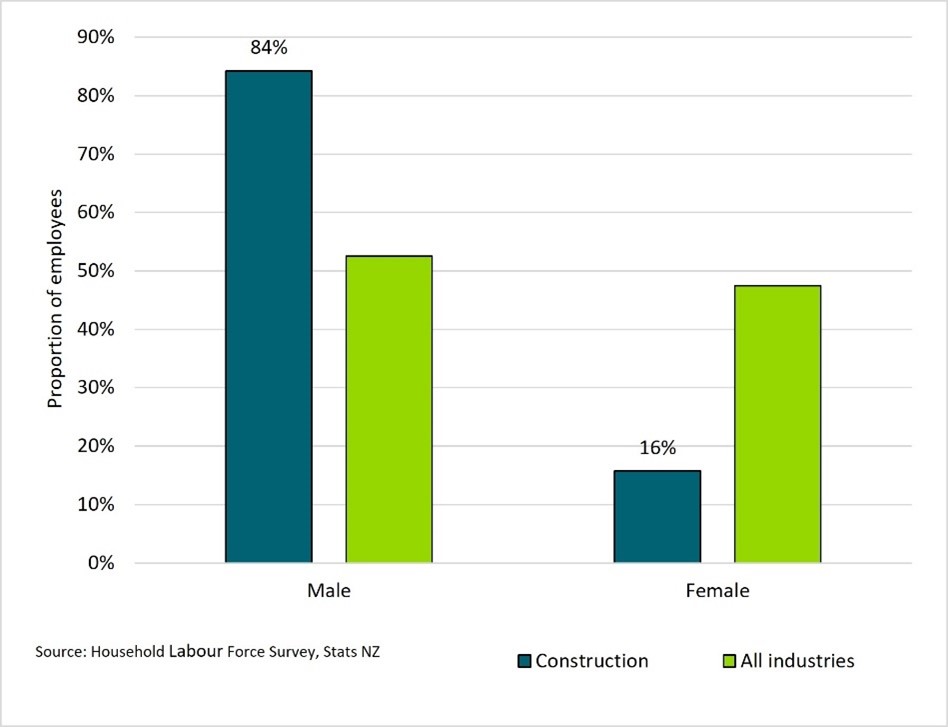

Women are underrepresented in the construction sector.

Based on data from the Household Labour Force Survey (HLFS) for year ended June 2023 (Stats NZ, 2023b), women make up 47.4% of the overall New Zealand workforce. The construction sector ranks second to last (the last being mining industry) in terms of women representation, with only 15.8% of those employed in the industry being women. Figure 1 shows that of the growth in the construction sector workforce in the year to June 2023, 10,100 workers were male and 3,600 were female.

Figure 2: Construction sector workforce by sex (as at December 2022)

Text description of Figure 2

Despite construction remaining a highly male-dominated industry, HLFS data shows that the proportion of women in the construction workforce has been increasing over the past decade. From 11.3% in 2013, the share of women working in the construction sector rose to 15.8% in 2023. This trend translates to an increase in the number of women workers from 18,900 in 2013 to 48,600 in 2023, representing a 157.1% growth or an additional 29,700 women workers in the sector. This growth rate outpaced the 75.3% increase in the number of male workers during the same period.

According to Stats NZ’s quarterly Linked Employer-Employee Dataset (LEED) (Stats NZ, 2023c) for the construction sector, the average worker turnover rate for women was 13.3% between June quarter 2018 and June quarter 2023. This is almost similar to the turnover rate for male workers at 13.0%.

In terms of occupational distribution, almost one-third of women in construction are employed in office and administrative positions, compared to just 1% of male workers. In recent years, industry efforts focused on promoting gender diversity have attracted more women into construction trades and professional services sectors. As of December 2022, there were 1,926 female apprenticeships in the construction sector, a 10% increase compared to the same period in 2021 (Ministry of Education, 2023a). Enhancing gender diversity and developing a pipeline of skilled female construction workers needs a comprehensive approach. This may involve exploring strategies to provide clear pathways into construction careers, such as apprenticeships and traineeships, and examining ways to address barriers that may discourage women from pursuing careers in the construction industry.

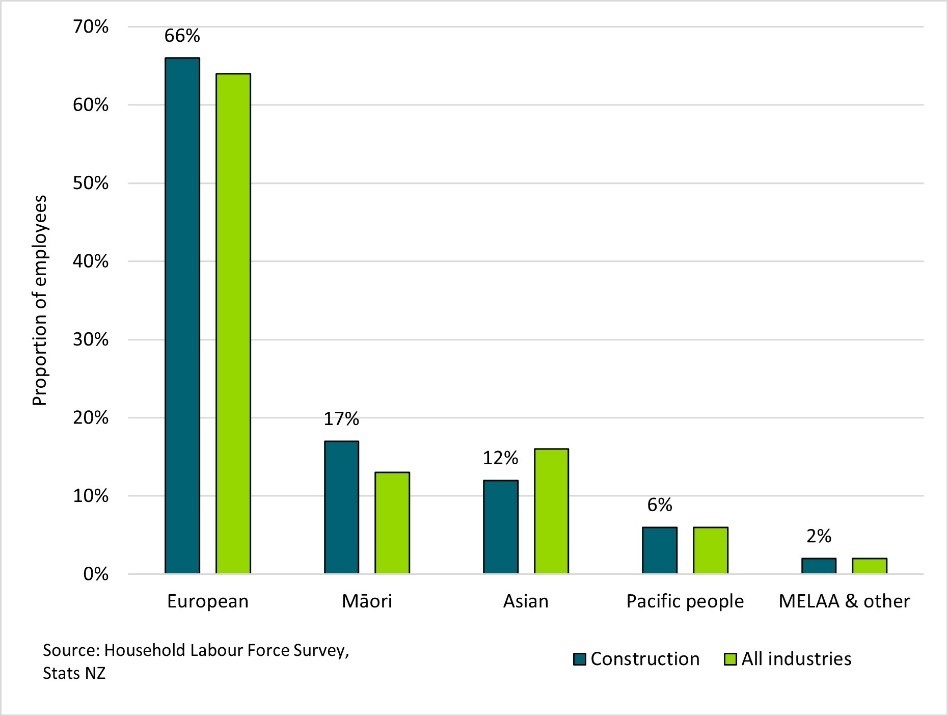

The ethnic makeup of the construction workforce is changing.

The proportion of workers in the sector who identify as European decreased by 11% between 2018 and 2022. Over the same period, the proportion who identify as Māori increased from 12 to 17%, and Asian workers increased from 9 to 12%. The proportion of Pacific peoples also increased from 4% in 2018 to 6% in 2022.

Figure 3: Construction sector workforce by ethnicity (as at December 2022)

Text description for Figure 3

Workers who identify as Māori are overrepresented as labourers in the construction sector but training data indicates more Māori are also pursuing higher-skilled careers in construction. More than 1 in 5 Māori workers in the sector are labourers, compared to one in ten among non-Māori workers. However, over the past 5 years, the proportion of Māori learners who enrolled in construction-related tertiary programmes has been growing. This growth suggests that more Māori are pursuing qualifications and training that can lead to higher-skilled and more rewarding careers in the construction industry. For example, three quarters of Māori learners studying construction-relevant qualifications are enrolled at Te Pūkenga subsidiaries (Ministry of Education, 2023b).

While the ethnic distribution of learners enrolled in New Zealand Qualifications Authority Level 4 qualifications mirrors the national population percentages, Māori and Pacific learners are overrepresented in qualifications below level 4 and underrepresented in qualifications above level 4 (Ministry of Education, 2023a). This suggests that Māori and Pacific learners are more likely to gain qualifications below level 4, such as certificates and diplomas, than they are to gain qualifications above level 4, such as degrees. This disparity highlights the need for targeted support to Māori and Pacific learners to encourage them to pursue higher levels of education and gain qualifications that lead to more skilled and better paying jobs in the construction industry.

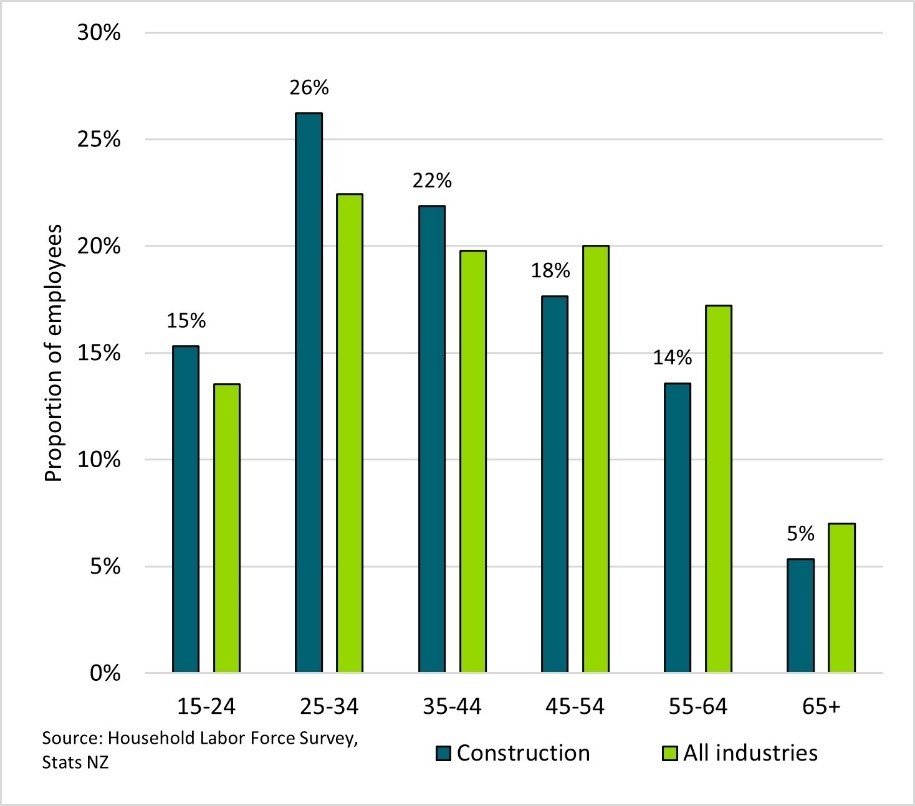

More construction workers are reaching retirement age.

In the year ended December 2022, construction workers aged 55 and above make up 18.8% of the construction workforce. Over the last decade, the number of construction workers from this age group increased from 6,000 in 2013 to 15,500 (an increase of 158.3%), while the number of workers aged 15 to 24 years increased from 24,500 to 44,500 (an increase of 81.6%). This means that within 10 years, nearly 20% of construction workers will be reaching retirement age, while fewer young people are entering the construction sector.

To address the ageing profile of the construction workforce, the industry has taken steps to attract younger workers. Apprenticeships are helping attract and train younger workers to meet the future demand for skilled tradespeople. Initiatives such as the government’s Apprenticeship Boost Programme (Te Pūkenga – New Zealand Institute of Skills and Technology, 2023) supports businesses to keep existing apprentices and hire new ones as part of New Zealand’s recovery from the economic impacts of COVID-19. As of June 2023, 26,855 architecture and building-related apprentices have been supported through the programme. The 3 most common occupational training areas for these apprentices were carpentry and joinery (59.1%); plumbing, gas fitting and drain laying (14%); and painting, decoration, sign writing and other finishes (6%).

Figure 4: Construction sector workforce by age band (as at December 2022)

Text description for Figure 4

Labour constraints and skills shortages persist in the construction sector

The New Zealand construction sector has struggled to attract skilled labour for the past decade.

Research from the Infrastructure Commission estimated that the infrastructure workforce would need to grow from around 40,000 to 97,000 over the next 30 years to fully address New Zealand’s infrastructure needs (Infrastructure Commission, 2021). A construction workforce model from Waihanga Ara Rau forecasts that on average, about 600 full-time equivalent (FTE) employees are required each quarter for the residential recovery work damaged by Cyclone Gabrielle over the next 2 years (New Zealand Infrastructure Commision, 2022; Waihanga Ara Rau, n.d.).

BDO New Zealand’s 2021 Construction Sector Report also found that the current labour shortages are due to the cyclical nature of construction activity and the high levels of building activity. It found that around 53% of respondents were actively looking for on-site staff, up from around 45% in 2020. (BDO New Zealand, 2021).

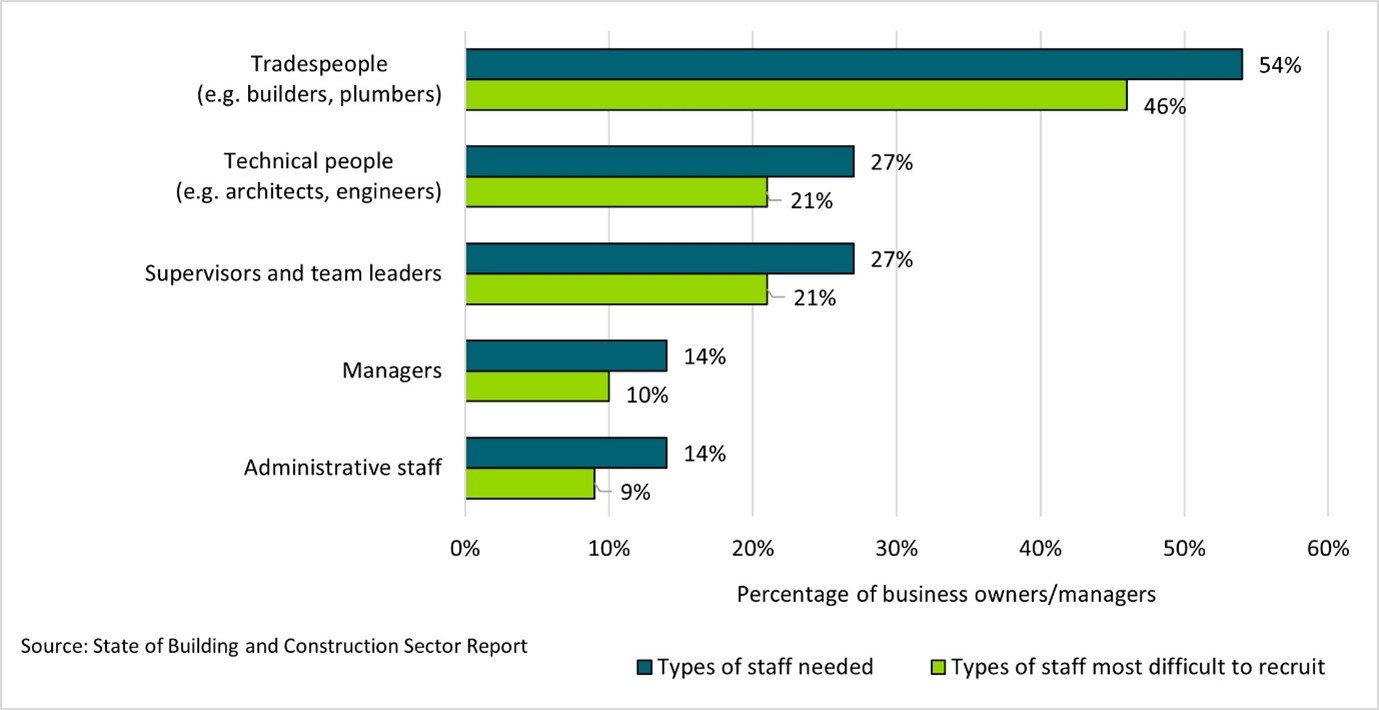

Skilled construction workers were not only in high demand but also posed significant recruitment challenges. Findings from MBIE’s State of the Building and Construction Sector Report 2022 (Figure 2) found that 46% of business owners or managers surveyed were having difficulty recruiting tradespeople. This was also the case for supervisors and team leaders (21% reported difficulty) and technicians (22% reported difficulty) (Research New Zealand, 2022).

Figure 5: Construction sector roles in high demand and/or difficult to fill

Text description for Figure 5

There is a strong pipeline of new entrants to the industry, but skilled and experienced staff continue to be most highly sought.

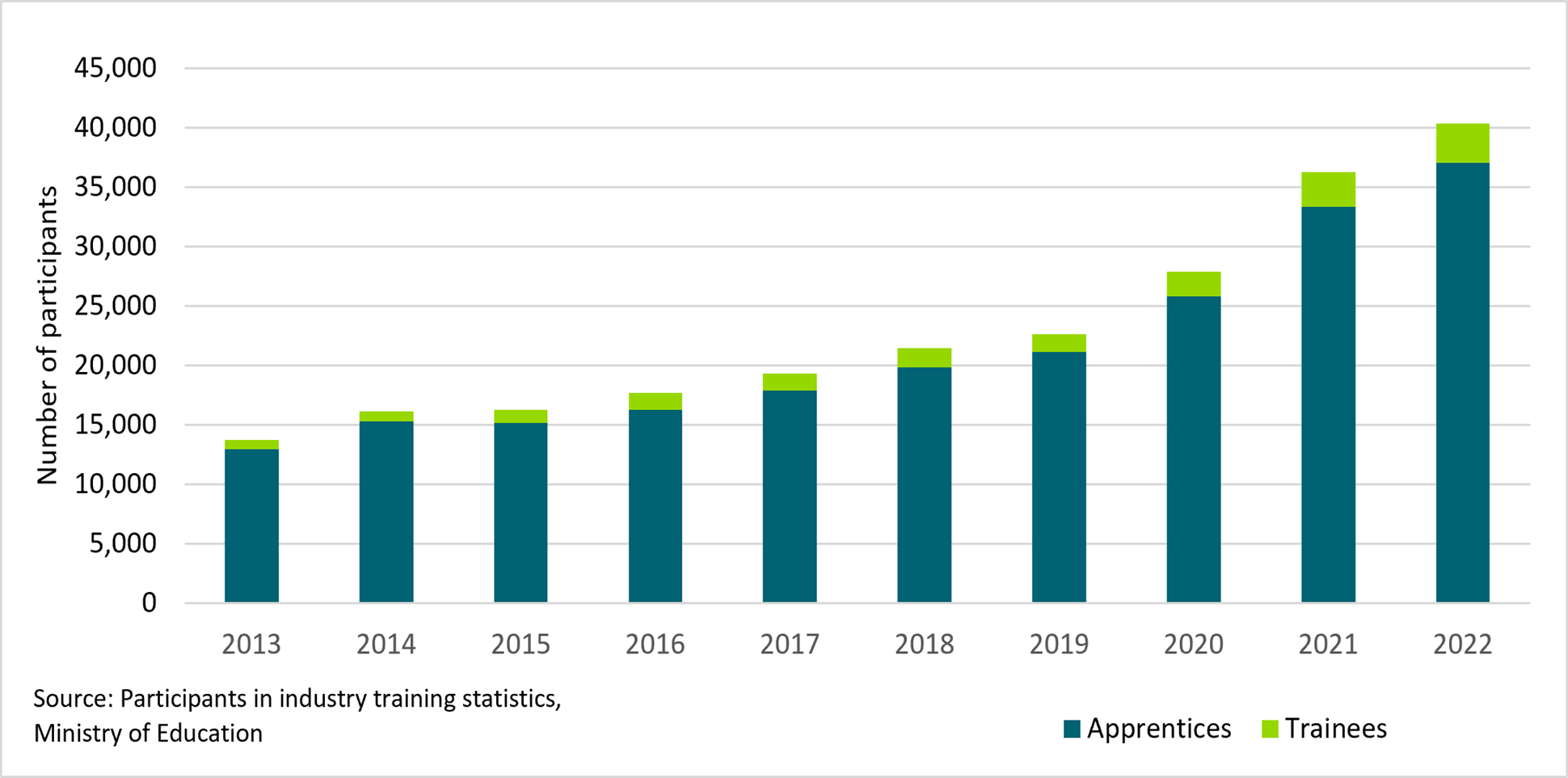

Apprenticeships in architecture and building are currently at a record high with 37,015 apprentices in the year ended December 2022 (Figure 6). Including trainees, there were a total of 40,320 new entrants in architecture and building in 2022, an increase of 26,630 people since 2013.

Figure 6: Participants in architecture and building-related training (year ended December 2013-2022)

Text description for Figure 6

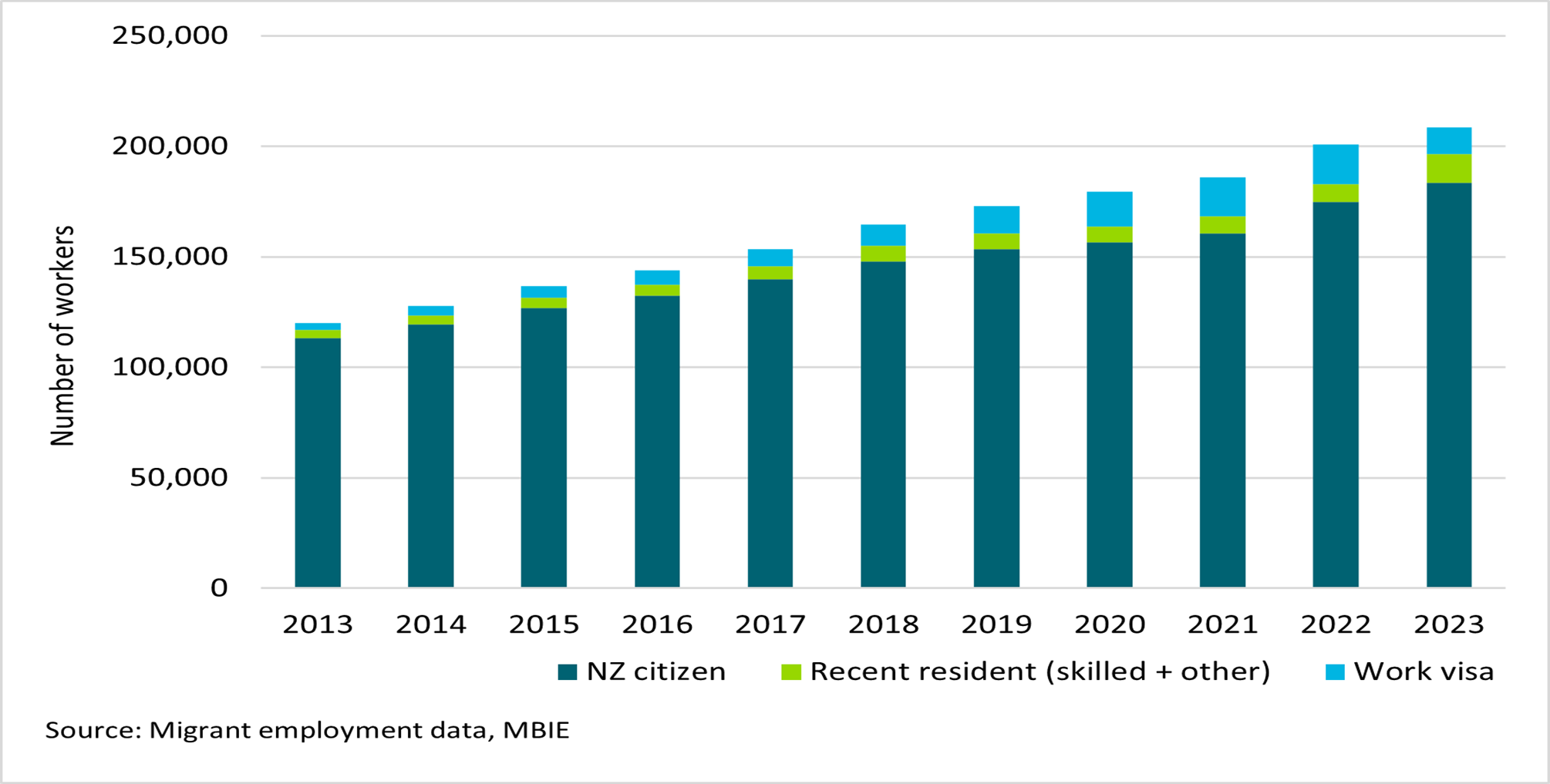

Immigration also plays a role in the construction workforce.

Analysis of the size of construction workforce by their entitlement to work in New Zealand suggests that the proportion of construction workers with work visas grew from 2.5% in the year ended March 2013 to 10% in the year ended March 2023. Moreover, the number of construction workers who have migrated to New Zealand has also risen to 10.8% in 2023 (Figure 7).

Figure 7: Construction workers by residency status (year ended March 2013-2023)

Text description for Figure 7

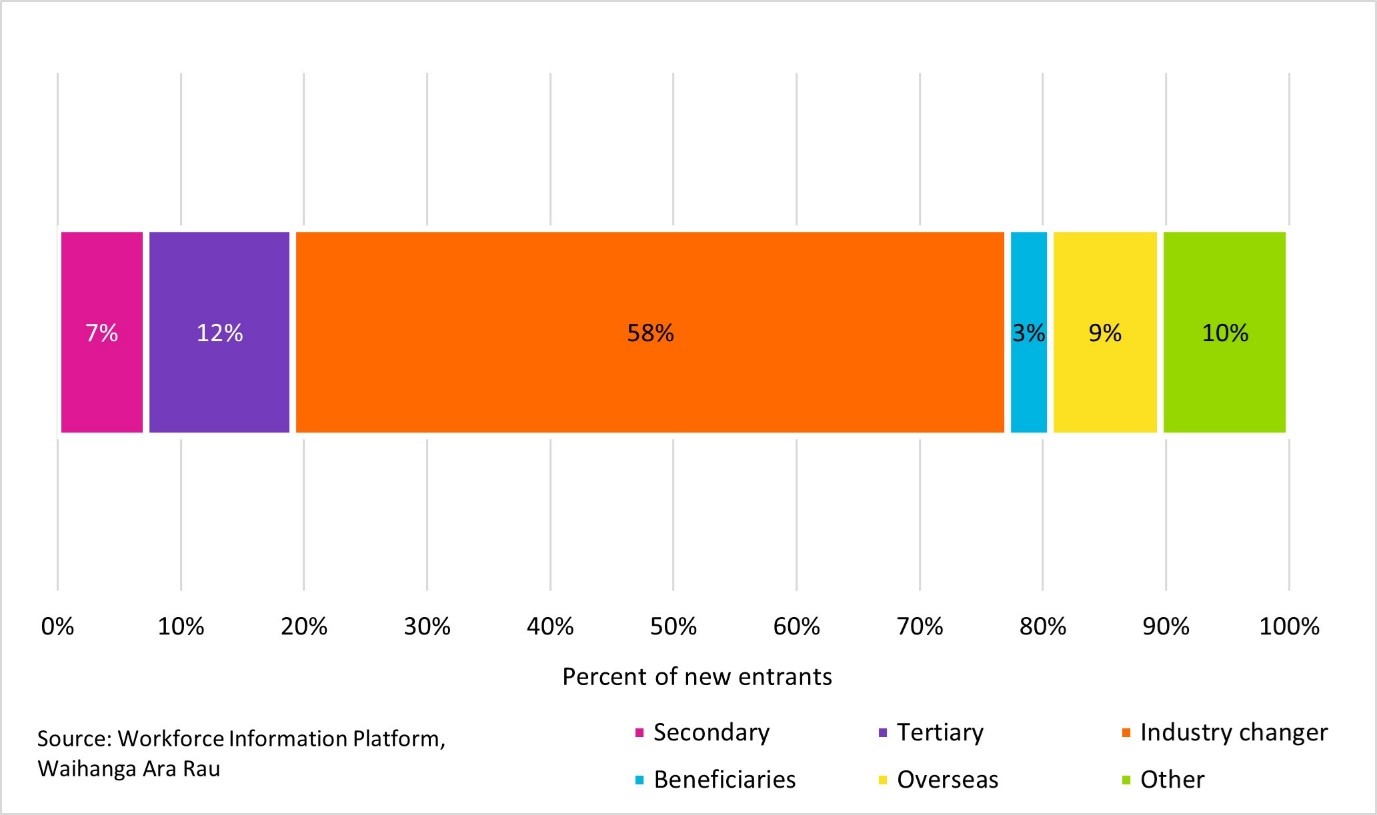

Analysis from Waihanga Ara Rau Workforce Development Council showed that in 2021, approximately 58% of people who entered the construction sector were new entrants, while secondary and tertiary graduates accounted for 19%, and 9% came from overseas (Waihanga Ara Rau, 2023). Furthermore, people who are industry changers (transitioned into the construction and infrastructure workforce) were previously employed in the administrative and support services, manufacturing, and retail trade sectors.

Figure 8: Sources of construction new entrants (2021)

Text description for Figure 8