Construction sector trends quarterly snapshot: January 2021

A snapshot of the key trends from September 2020 to December 2020.

On this page

Download a copy of the Construction sector trends quarterly snapshot January 2021.

Construction sector trends quarterly snapshot: January 2021 [PDF, 1.2 MB]

Performance

New Zealand economy

COVID-19’s impact on national economic activity lessened in the September quarter, with Government restrictions easing and business confidence increasing, as a result of New Zealand’s managed response to the pandemic.

Gross domestic product (GDP) rose by 14% in the September 2020 quarter, rebounding from successive falls in the March and June 2020 quarters. However, GDP declined by 2.2% over the year to September 2020, which is the largest annual decline recorded by Stats NZ’s GDP series.

Economic performance

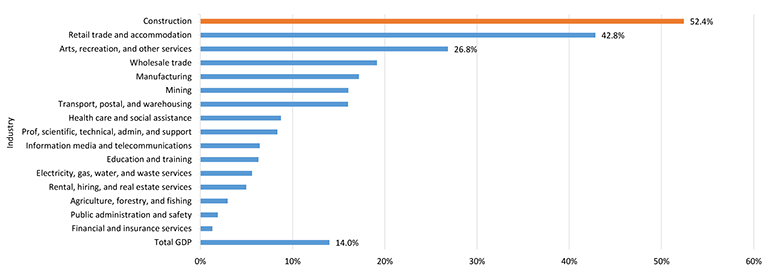

The construction sector’s contribution to GDP rose by 52.4% for the September 2020 quarter, and was the industry with the largest quarterly change.

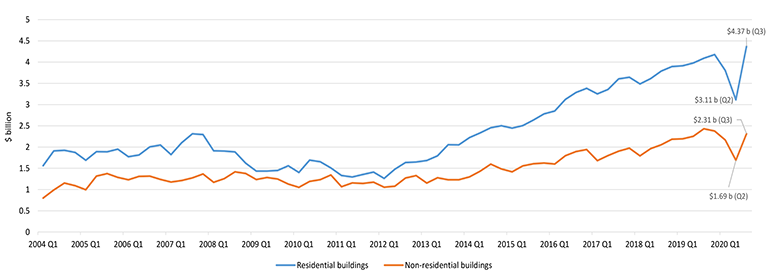

The value of total building work rose by $1.89 billion (in the September 2020 quarter), recovering from a significant drop in the June 2020 quarter.

Changes in the COVID-19 alert levels between the June and September 2020 quarters, and the de-escalation from Alert Level 4 national lockdown, meant that construction work was once again permitted, helping drive the rise in building work value.

Building consents

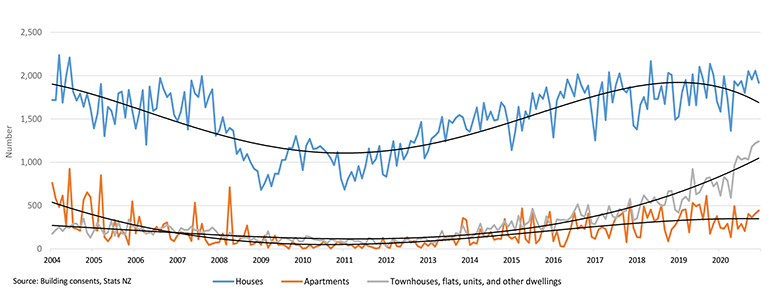

A record 11,291 new homes were consented in the December 2020 quarter, breaking the previous quarterly record of 10,713 new homes consented in December 1973. 39,420 new homes were consented for the year ended December 2020.

The upward trend for townhouse, flats, units and other dwellings continued in the December 2020 quarter. Townhouses, flats and units now made up nearly a third of all new homes consented in the year.

Economic outlook

Various economic outlooks and forecasts point towards a stronger-than expected initial recovery period from the effects of COVID-19. The Treasury, New Zealand banks and NZIER all offer improved outlooks across New Zealand’s economy, with mid-2020 forecasted impacts of COVID being revised to reflect a more positive and resilient economy.

The housing market continues to be a cornerstone of this resilience, with increasing demand from investors.

NZIER’s Quarterly Survey of Business Opinion: December 2020 Quarter showed that the construction sector was the most optimistic in terms of business confidence, reversing the sector’s sentiment in the first half of 2020, which was more pessimistic.

Quarterly percentage change in GDP by industry, September 2020 quarter

Source: Seasonally adjusted chain-volume GDP series in 2009/10 prices, Stats NZ

Image description

Quarterly value of building work put in place, residential and non-residential (2004 Q1 to 2020 Q3)

Source: Building Activity Survey, Stats NZ

Image description

Monthly new residential dwellings consented, January 2004 to December 2020

Source: Building consents, Stats NZ

Text version of monthly new residential dwellings consented, January 2004 to December 2020

People

New Zealand workforce

The labour market began to feel the impact of COVID-19 in the September quarter of 2020, before rebounding in the December quarter. The unemployment rate dropped to 4.9% in the December 2020 quarter, after reaching 5.3% in the September 2020 quarter. The increase from the June to the September quarter was the largest observed increase in a single quarter since the series began.

The employment rate was 66.8%(in the December 2020 quarter), up from 66.4% in the September 2020 quarter. Employment remains at relatively high levels when compared against the post- Global Financial Crisis period.

Construction workforce

There were 278,300 construction workers at the end of the December 2020 quarter. The overall construction workforce comprised of 238,400 male workers and 39,800 female workers.

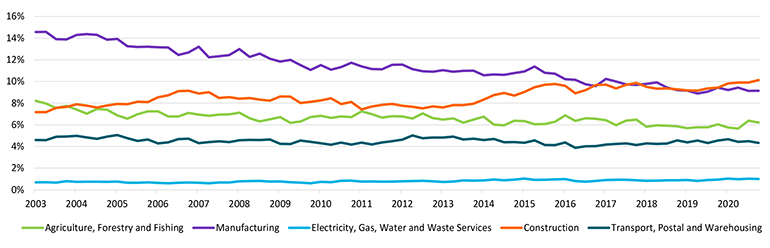

Construction workers occupying filled jobs rose 4.9% from December 2019 to December 2020. Construction was the second-fastest growing industry, behind public administration and safety. The construction industry’s job share within the primary and manufacturing industries is also steadily increasing.

With increased business confidence and a high-volume of building work underway across the country, construction firms are reportedly looking to recruit. NZIER’s Quarterly Survey of Business Opinion: December 2020 Quarter, reported that 15% of firms were planning to increase their headcount.

Government support and initiatives

All new applications for COVID-19-related wage subsidies closed off on 11 September 2020. MSD figures reported in December 2020 that the construction industry had the highest proportion of jobs supported by at least one wage subsidy—with 106% uptake.

The largest volume of wage subsidy uptake was by small firms of 1-19 employees (representing 59% of construction industry uptake), while larger firms (100-plus employees) had the smallest uptake with 19% of the construction industry.

Health and safety

WorkSafe reported 3 fatalities in the construction sector from November 2019 to October 2020.

There were 4,929 total injuries resulting in more than a week away from work, from May 2019 to April 2020 (based on the latest data available). August 2019 had the highest injury toll, while April 2020 had the lowest during the year to April 2020. April 2020’s low injury toll could be attributed to the national Alert Level 4 lockdown from 25 March to 27 April 2020.

Job shares in total employment for primary and manufacturing industries

Source: Household Labour Force Survey:December2020 quarter, Stats NZ

Text version of job shares in total employment for primary and manufacturing industries

Processes

Legislation

New Zealand held its national election in November 2020, with the Labour party elected for another term in Government. Post election, Government initiatives and legislative setting changes have focused on addressing issues such as: COVID-19 response measures, labour shortages, housing shortages and environmental concerns.

A proportion of migrant workers currently in New Zealand will be able to stay and work in the country for longer, following adjustments to visa settings through mechanisms such as visa extensions. These adjustments aim to mitigate labour shortages across a number of sectors, including construction, and to ease the impact of border restrictions (which limit the number of incoming workers).

The Government’s Public Housing Plan 2021-2024 was released in January 2021, which outlines the location intentions of 8,000 additional public and transitional housing places announced in Budget 2020.

The Government also announced its Carbon Neutral Government Programme, which will require public sector agencies to measure and publicly report on their emissions and to offset any they are unable to reduce by 2025.

Occupational regulation

Complaints against licensed building practitioners (LBPs) reduced through the second half of 2020, after peaking in June, when 28 complaints were received for the month (including complaints made against LBPs and non-LBPs). March, April and May 2020 recorded the lowest monthly totals of the year. This is potentially due to building work being restricted during this time, in accordance with COVID-19 response measures.

Compared to 2019, the second half of 2020 also trended lower. The monthly complaint volumes notably decreased from March to December 2020, compared to the same period in 2019.

Products

Supply chain

Supply chains continue to be a concern across multiple sectors. Statistics NZ reported a fall of $1.1 billion in the total value of monthly goods imports across all sectors in November 2020, when compared against November 2019. According to Stats NZ, the fall in imports coincided with disruptions to global supply chains and delays at New Zealand ports (particularly Auckland).

The Ministry of Foreign Affairs and Trade reported global maritime supply chains becoming congested, due to increased global freight demand stemming from economic activity recovery from COVID-19 restrictions, air freight capacity constraints, price increases, and strike action at overseas ports in Australia and the United States.

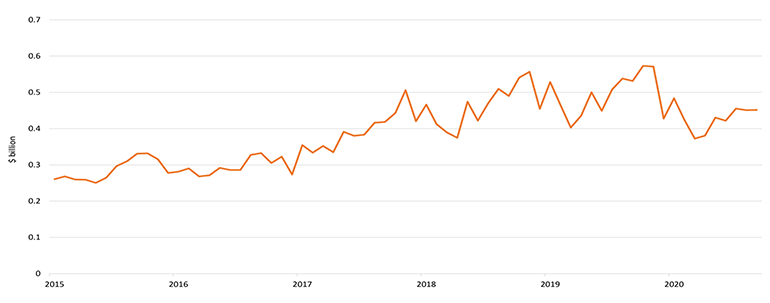

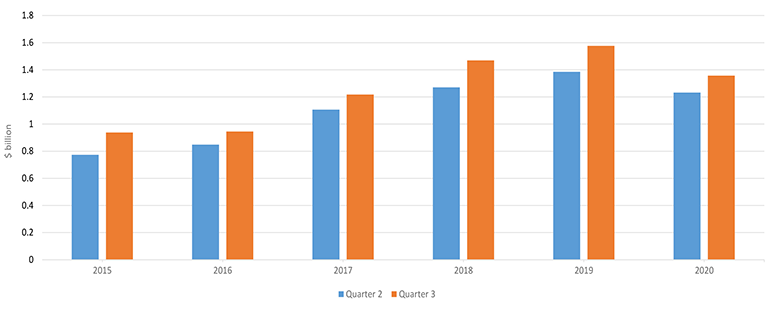

Building product imports (by value) dropped from the December quarter 2019 to the January 2020 quarter, with the fall continuing through the March 2020 quarter. Building product imports rebounded in the September quarter, potentially enabled by the end of national Alert Level 4 lockdown and cessation of working restrictions.

At the distribution level, outlets such as Bunnings, Placemakers and Mitre 10 are reporting limited availability of some building product stock due to supply chain issues.

Construction costs

Construction cost rises across the residential sector. Corelogic’s Cordell Housing Index Price (CHIP) reported a 0.6% rise in house-building costs for the September 2020 quarter. Corelogic reported annual growth rate of construction costs at 3.6%, compared to 2.5% through 2013-2016.

The latest QV costbuilder reported a similar finding. According to QV’s methodology, the average cost of building a new home in six of New Zealand’s main centres rose on average by 2% in the year to October 2020, and has risen 15% since October 2015.

Modern methods of construction (MMC)

Panasonic Homes, part of the multinational Panasonic Corporation, has expanded outside of Asia for the first time to enter the New Zealand house-building market. They will partner with residential building company, Mike Greer Commercial, to produce prefabricated component-comprised stand-alone houses and rental apartments for the New Zealand market. Specifically, they will provide the prefabricated panels, such as external walls and flooring, while Mike Greer Commercial will own the land and oversee construction.

Panasonic Homes completed a prototype 3 bedroom house in the Waikato region within a 3-month period, taking approximately half the time of a traditionally constructed 3-bedroom home.

Construction and the environment

During September to December 2020, the New Zealand Green Building Council reported that:

- 389 homes were “Homestar” certified (2645 in total);

- 6 new buildings were “Greenstar” certified (194 in total);

- 16 large office buildings received the National Australian Built Environment Rating System New Zealand (NABERSNZ) rating (206 in total).

Sustainable Engineering Ltd reported that 2 houses were certified as Passive Houses in the December 2020 quarter. As of 31 December 2020, there are a total of 35 certified Passive Houses in New Zealand.

Monthly total value of building product imports (January 2015 to September 2020)

Source: Imports & Exports Stats, Stats NZ and NZ Customs

Text version of monthly total value of building product imports (January 2015 to September 2020)

Quarterly building products imports

Source: Imports & Exports Stats, Stats NZ

Text version of quarterly value of building products imports

International jurisdictions - impacts of Covid-19 on the sector

Global Summary

COVID-19 continues to have a strong impact across international jurisdictions. Johns Hopkins University reported over 102,871,000 COVID-19 cases worldwide and 2,225,700 COVID-19 related deaths as at 01 January 2021. Subsequent waves have hit many areas, such as the United Kingdom and Europe, while the first wave is still unabated in other countries. Economic impacts vary depending on individual jurisdictions and COVID-19 response measures.

The OECD projected global GDP to decline by 4.2% in 2020, before rising 4.2% in 2021 and a further 3.7% in 2022; while the IMF projected the global economy to grow 5.5%in 2021 and 4.2 in 2022. These projections assume that vaccination deployment, joint health policies and government financial support will help buffer the impact of COVID-19. Recovery is

expected to be stronger where there is a faster roll-out of vaccines as this could lift market confidence and reduce uncertainty.

There is marked interest in infrastructure investment and adoption of new technologies around the world, as a way of revitalising economies, strengthening capability in the supply chain, driving demand, increasing productivity and creating jobs for those who have had their employment affected by COVID-19.

Building activity has decreased across many jurisdictions, despite financial support to businesses and individuals to offset the economic impacts of COVID-19. The construction sector has sizable uptake of these support schemes in countries such as New Zealand, Australia, and the United Kingdom which have a large segment of their overall workforce in the construction sector.

Canada

GDP rose by 8.9% in the September 2020 quarter, which reflected the reopening of the economy, but was down 5.3% compared with the December 2019 quarter.

Investment in building construction bounced back from a record low level in April 2020 (at $7 billion), to over $17 billion from June to September 2020. This recovery reflects the easing of COVID-19 related restrictions. Investment declined for the third consecutive month to $15.3 billion in November 2020.

The seasonally adjusted value of non-residential building permits is down 10.8% in December 2020, while the non-residential building permits were down 28.1% year-on-year in December 2020.

On 27 November 2020, the Canadian Government announced an investment of more than $15.5 million for 218 projects under the Enabling Accessibility Fund (EAF). The EAF provides funding for projects that will make communities and workplaces more accessible for persons with disabilities.

United Kingdom

GDP for the United Kingdom increased by a record 16% in the September 2020 quarter. While this reflects some recovery after the 19.8% contraction in the June 2020 quarter, it was still 8.6% below what it was in the same period in 2019.

Construction output increased by 41.7% in the September quarter 2020, compared with the June 2020 quarter. Most of this increase was driven by growth in new building work (40.8%) as well as repair and maintenance (43.4%) following the reopening of construction sites after the easing of lockdown restrictions. Private new housing

experienced a record 84.4% growth in the third quarter compared with the June 2020 quarter.

Construction output in November 2020 was 0.6% above that of February 2020, with repair and maintenance work 7.4% above and new work 3.1% below its pre-pandemic level.

With COVID-19 still a major concern in the UK, construction site restrictions, including maintaining social distancing and the re-arrangement of work tasks, continue to have impacts on work scheduling. Year-on-year employment level for the September 2020 quarter fell by 7.4% and is now at 2.17 million, which is at the lowest level since the June 2013 quarter.

Australia

GDP rose by 3.3% in the September 2020 quarter but fell by 3.8% year-on-year. Seasonally-adjusted filled jobs increased by 1.7% for the September quarter and fell 4.0% through the year.

The seasonally adjusted number of total dwelling approvals rose by 2.6% in November 2020, when compared with the previous month, and is up 15.0% over the year. This upward trend is mainly driven by the increase in approval for new homes (6.1% since October 2020, and 33.6% over the year), and has been facilitated by the HomeBuilder scheme. The HomeBuilder scheme provides eligible owner-occupiers with a grant to build a new home or substantially renovate an existing home.

Construction sector filled jobs decreased by 1.9% in the September 2020 quarter, compared to the same period in 2019. According to the Workplace Gender Equality Agency (WEGA), the construction industry has the second highest gender pay gap (at 26.1%).

Similar to New Zealand’s Wage Subsidy scheme, the Australian Federal government introduced the JobKeeper Payment scheme in March 2020, to support the Australian workforce in the face of COVID-19. The scheme was first extended in July 2020, and will now end on 28 March 2021. As in New Zealand, the construction sector had the largest uptake of JobKeeper Payments.

In the 2020-21 Federal Budget, the Australian Government announced an additional 10,000 First Home Loan Deposit Scheme (FHLDS) to support first home buyers to build or purchase new homes sooner.

References