Buy-Now, Pay-Later

closed

Submissions closed:

16 December 2021, 5pm

In November 2021, the Government sought feedback on the relative benefits and costs (including financial hardship) of Buy-Now, Pay-Later.

About the consultation

The Minster of Commerce and Consumer Affairs released the discussion document Buy-Now, Pay Later - Understanding the triggers of financial hardship and possible options to address them on 4 November 2021.

The discussion document aimed to get input and feedback on:

- the benefits of BNPL to consumers and to the wider economy

- how the use of BNPL could trigger financial hardship for consumers – under what circumstances and at which points in the consumer journey financial hardship could occur

- how risks of financial hardship could be addressed if BNPL exhibited certain desirable features

- what is an effective BNPL sector?

- the options available to achieve an effective BNPL sector, the costs and benefits of these options and how their effectiveness could be monitored and evaluated.

Published: 4 Nov 2021

A detailed paper outlining the relative benefits and costs (including financial hardship) from BNPL and how these could be addressed.

File

PDF, 599KB, 38 pages

Published: 4 Nov 2021

A short document summarising the key issues from: Buy-Now, Pay-Later – Understanding the triggers of financial hardship and possible options to address them.

Published: 4 Nov 2021

A template to fill out if you would like to make a submission on the Buy-Now, Pay-Later consultation.

Published: 10 Nov 2021

Cabinet paper seeking approval to release the discussion document.

File

PDF, 190KB, 13 pages

Published: 10 Nov 2021

Cabinet agreed to release the discussion document.

Published: 10 Nov 2022

2022 analysis of options for bringing Buy Now Pay Later loans within this legislation.

File

PDF, 917KB, 24 pages

Submissions

Submissions closed on 17 December 2021 and a total of 63 submissions were received. They represent the views of a range of users of BNPL, providers of BNPL, financial mentors, community organisations, businesses, industry bodies, banks, and other financial institutions.

Personal contact details have been redacted from the submissions.

Some submissions have not been published at the request of submitters.

View the submissions on the BNPL consultation(external link)

Survey summary

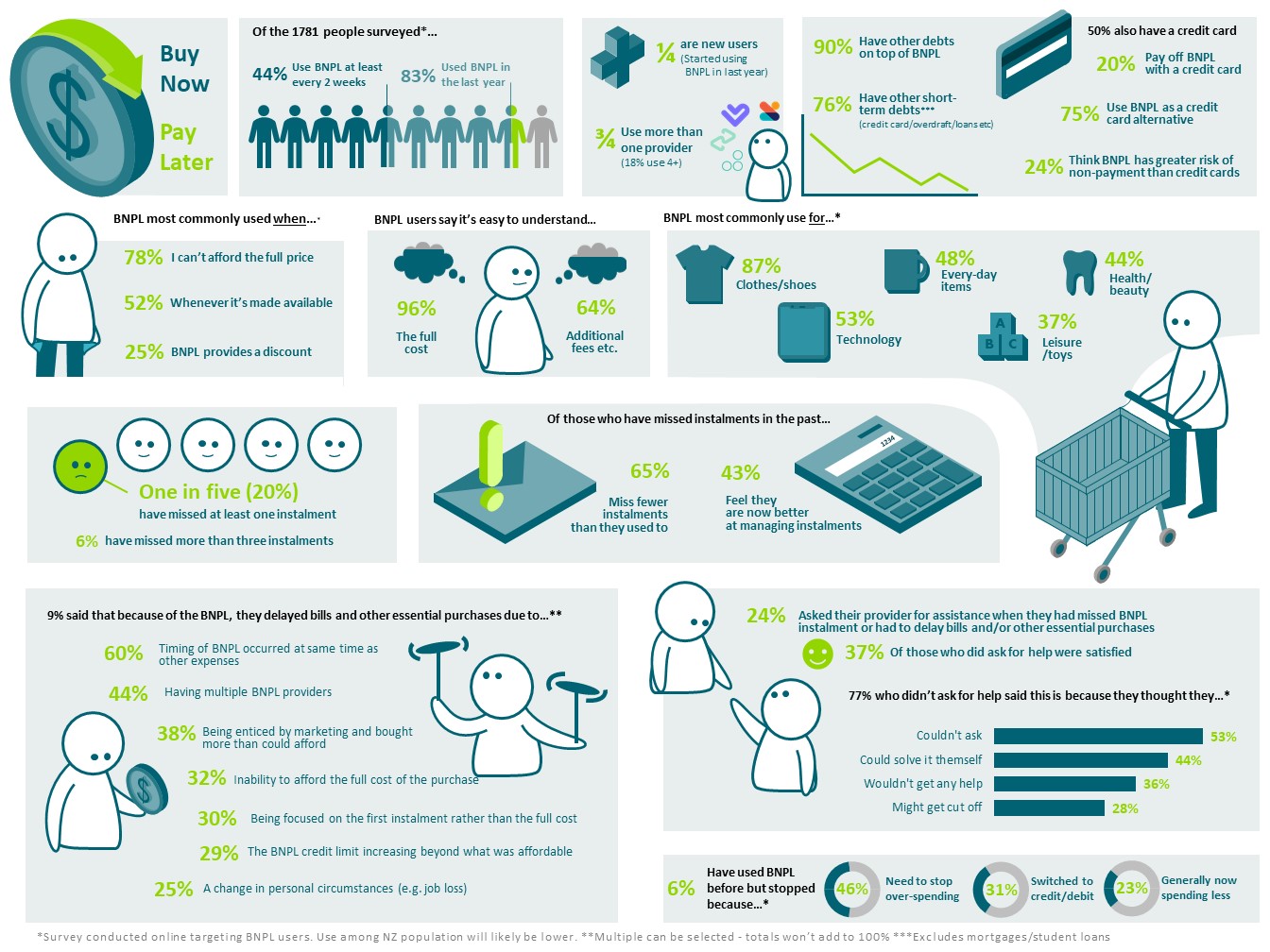

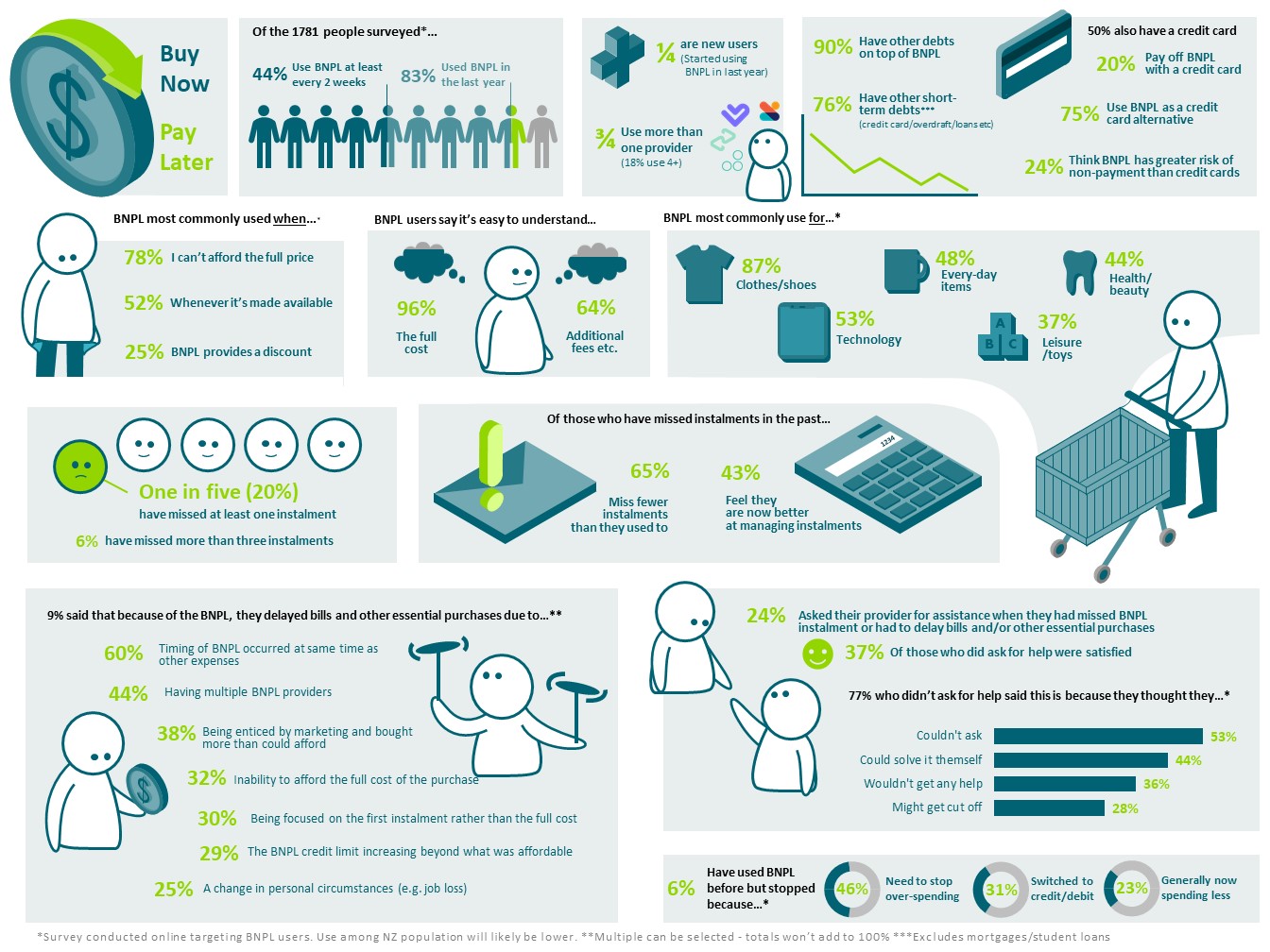

In addition to the submissions, we also provided an online survey to consumers of BNPL seeking both their positive and negative experiences with BNPL. The survey was publicised through social media and through MBIE’s digital channels. In total 1,781 responses were received. Respondents self-selected into the survey and so the results are not representative of the whole population. With some of the questions, multiple answers could be selected and so totals will not add up to 100%.

Infographic of survey results

Text description of survey results infographic

Summary of infographic

Of the 1,781 people surveyed:

- 44% use BNPL at least every 2 weeks

- 83% used BNPL in the last year

- ¼ are new users (started using in last year)

- ¾ use more than one provider (18% use more than four providers)

- 90% have other debts as well as BNPL

- 76% have other short-term debts (credit card/overdraft/loans etc. but excluding mortgages and student loans)

- 50% also have a credit card

- 20% pay of BNPL with a credit card

- 75% use BNPL as credit card alternative

- 24% think BNPL has greater risk of non-payment than credit cards

BNPL was stated as commonly used when:

- Can’t afford the full price (78%)

- Whenever it’s made available (52%)

- BNPL provides a discount (25%)

BNPL user say it’s easy to understand….

- The full cost (96%)

- Additional fees etc. (64%)

BNPL most commonly used for:

- Clothes/shoes (87%)

- Technology (53%)

- Every-day items (48%)

- Health/Beauty (44%)

- Leisure/Toys (37%)

20% have missed at least one BNPL instalment

6% have missed more than three BNPL instalments

Of those who have missed instalments in the past:

- 65% miss fewer instalments than they used to

- 43% feel they are now better at managing instalments

9% of those surveyed, said that because of BNPL they delayed bills and other essential purchases due to:

- Timing of BNPL occurred at the same time as other expenses (60%)

- Having multiple BNPL providers (44%)

- Being enticed by BNPL marketing and bought more than could afford (38%)

- Inability to afford the full cost of the purchase (32%)

- Being focused on the first instalment rather than the full cost (30%)

- The BNPL credit limit increasing beyond what was affordable (29%)

- A change in personal circumstances e.g. job loss (25%)

24% asked their BNPL provider for assistance when they had missed BNPL instalments or had to delay bills and other essential purchases. Of these, 37% were satisfied.

77% who didn’t ask for help said this is because they thought they:

- Couldn’t ask (53%)

- Could solve it themselves (44%)

- Wouldn’t get any help (36%)

- Might get cut off (28%)

6% have used BNPL before but stopped because:

- Needed to stop over-spending (46%)

- Switched to credit/debit (31%)

- Generally now spending less (23%)

What is Buy-Now, Pay-Later

BNPL is a relatively new, innovative and fast growing credit alternative in New Zealand, and is particularly popular for online purchases. Afterpay, Humm, Zip, Laybuy, Genoapay (Latitude), Openpay and, Klarna are examples of BNPL in New Zealand. By using BNPL, people can get access to goods or services now but pay for them later in a series of instalments.

Concerns of financial hardship

Financial mentoring organisations who work to help New Zealanders in financial difficulty have made MBIE aware that BNPL could be creating financial hardship for some consumers.

While BNPL products have features of consumer credit contracts, they fall outside the strict definition in the CCCFA (section 11) because they do not charge interest, fees or take a security interest over goods. They are subject to the Fair Trading Act 1986, and some BNPL providers offer other products which are CCCFA regulated.

CCCFA (section 11)(external link) — New Zealand Legislation website

During the MBIE 2018 Review of Consumer Credit, there was found to be little evidence of harm caused by BNPL products at that time and therefore they were not brought within the scope of the CCCFA. Through that review the Government created a new power under the CCCFA to extend legal requirements to BNPL and other non-regulated credit products if warranted.

Review of consumer credit law

New power to extend legal requirements to BNPL and other non-regulated credit products(external link) — New Zealand Legislation website

How can the risks of financial hardship be balanced against the benefits of BNPL

The Government’s overall objective is that the BNPL sector delivers long-term benefits to consumers through an effective BNPL sector - one where addressing the risks of financial hardship is balanced against the benefits of BNPL.

The interests of BNPL consumers should be protected, so that they are confident and informed participants in a transparent, competitive and innovative BNPL sector.

BNPL should be affordable and suitable to the needs of the consumer. A number of features that could help address the risk of financial hardship to consumers are outlined in the discussion paper.

Risks of financial hardship

- Financial hardship can take a range of forms. This could include consumers missing or being late with payments, which adds to the debt they already face. This could also include consumers meeting their BNPL instalment/payment but not being able to afford other expenses (such as a power bill or groceries) because instalments/payments are collected automatically via debit card or credit card.

- The risk of financial hardship is increased if the consumer uses more than 1 BNPL provider.

Benefits of BNPL

- There are also benefits to using BNPL. BNPL can be an effective and low-cost way to spread the costs of purchases without paying interest.

- BNPL can also be useful for businesses as it may generate additional sales.

- In terms of economy-wide benefits, BNPL disrupts the credit market by providing consumers with a low-cost alternative to existing credit products, resulting in greater innovation and competition, and therefore better outcomes and options for consumers.

Last updated: 09 March 2022