Key points

COVID-19 has created a significant amount of uncertainty for New Zealand’s economy and labour market. The ELMA report and tool provides data that establishes a common framework for assessing how COVID-19 may impact on labour supply and demand.

The report and the tool

- Suggests a range of estimates for employment, unemployment and labour market participation, for 16 Regional Councils and 17 industry sectors

- Sets out an explanation of how different COVID-related scenarios (for example, the impact of community transmission) might impact on the labour market

- Provides scenario-based estimates for how COVID-19 appears to be impacting on different industries and regions

- Are explicit about the assumptions that have been made, and the data that has been used, to come up with these estimates

- Allows users to amend these assumptions and input their own data to customise the estimates for their own planning purposes.

There are a number of caveats that need to be understood by users:

- Assumptions included in the model are based on official statistics and Treasury forecasts. Over time, some of these assumptions have been overtaken by events and new data.

- Currently, we are not able to provide estimates at sub-industry level or for geographical units smaller than Regional Councils.

- Neither is the model currently capable of providing estimates of impacts on population sub-groups, such as youth, Māori, Pacific Peoples or migrant groups

- The report and data files will be updated from time to time, and users should be aware of the version that they are using and the recency of the data that is being used.

Labour market scenarios for 2021

Compared to what was predicted at the beginning of the COVID-19 pandemic, the labour market has performed relatively well. In particular, labour demand has held up in many industries. While the Level 4 lockdown severely restricted economic activity, many firms re-organised their activities to be able to operate at Levels 2 and 3. The biggest impacts have been for firms and industries where this was not possible – for example, as a result of social distancing requirements.

Compared to what was expected to happen had COVID-19 not occurred, employment is lower and unemployment is higher. However, in many areas of the economy, employment remains stable. In particular, growth in some industry sectors (such as construction, and professional business services) has offset reductions in others. Meanwhile, retail spending and domestic tourism have supported employment in sectors that were otherwise vulnerable to border restrictions and a drop in demand.

These patterns are expected to continue through 2021. The longer term outlook will be dependent on both global and domestic conditions – including the containment of pandemic internationally, the impact on global trading patterns and success of the vaccination strategy.

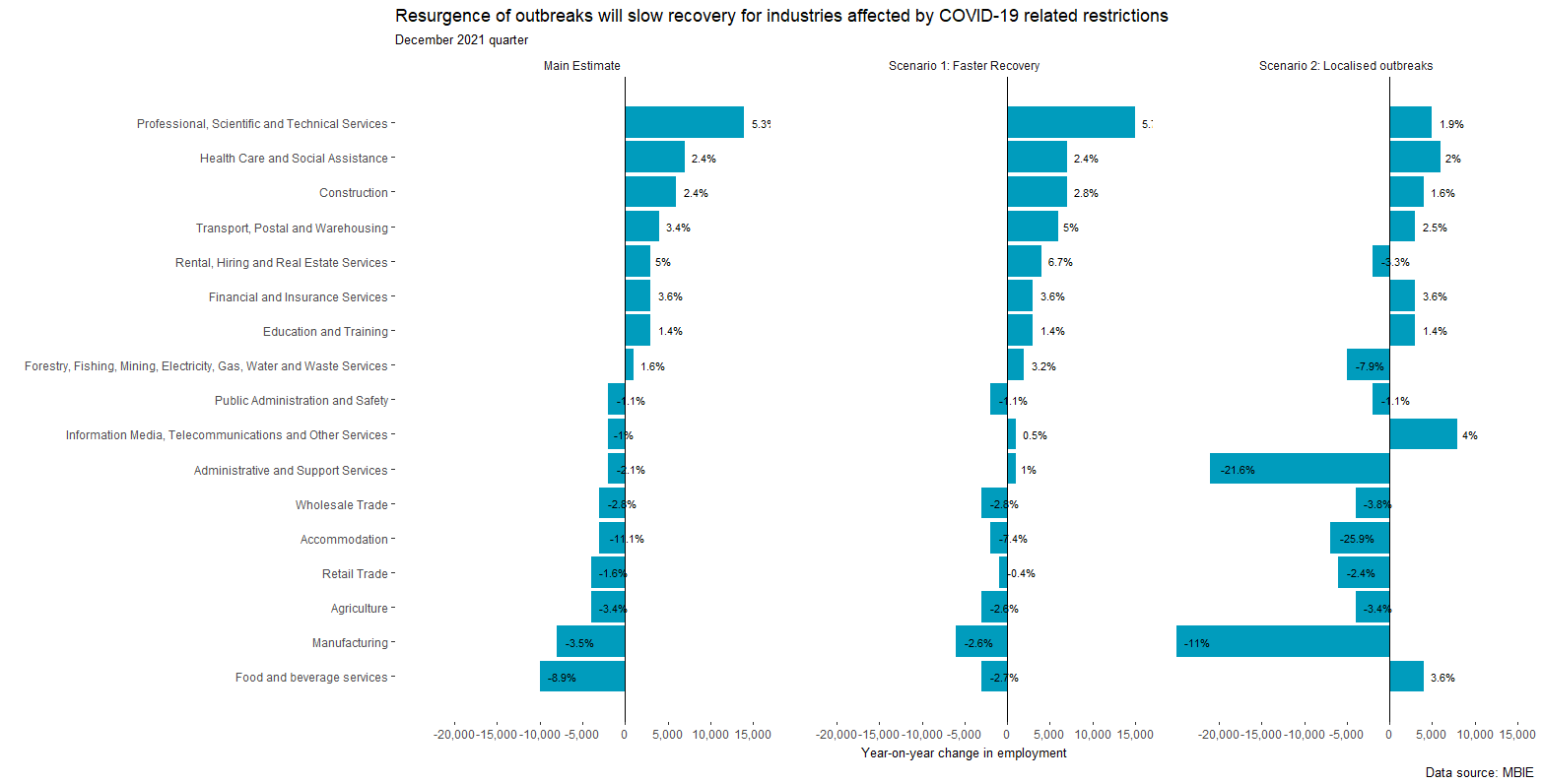

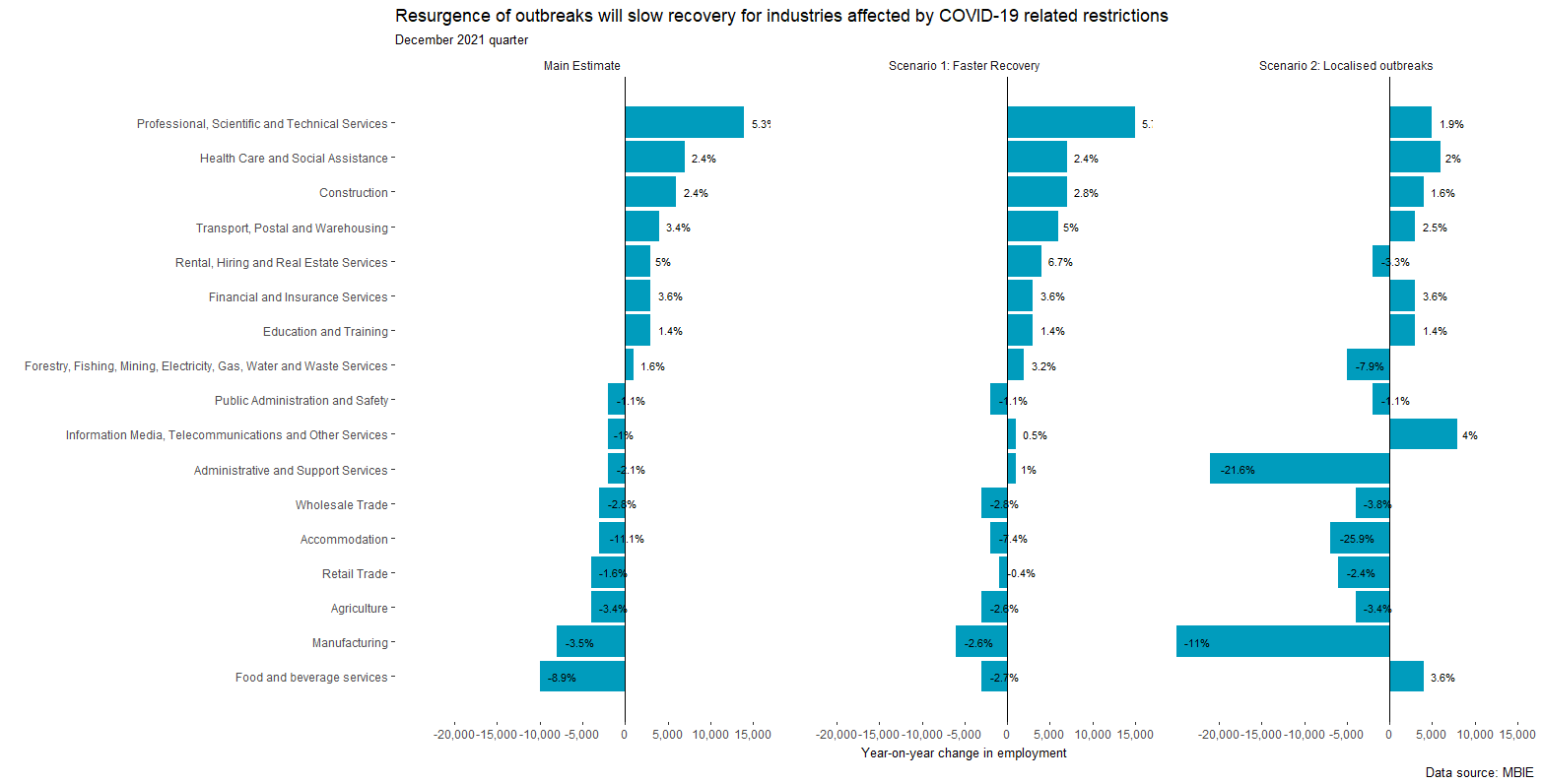

Industry variations

The impact of COVID-19 on labour market activity has so far varied by industry, and this patterns I likely to continue. In particular, business and public services are estimated to offset employment losses in COVID-19 hit industries

A rebound of economic activities to pre-COVID-19 levels and more buoyant household spending will drive labour demand in 2021. Recovery in the labour market will be broad-based, with some industries showing greater resilience and bouncing back faster than others.

Professional, technical and scientific services are expected to make the largest contribution to overall employment growth, followed by Health and social assistance and construction. The growth in these industries will offset employment losses in COVID-19 hit industries.

The business services sector is likely to outpace overall employment growth rate in the short-term. This sector will drive demand for highly skilled workers particularly in urban regions like Auckland and Wellington. Many occupations within the industry can be performed remotely. In contrast, lower-skilled occupations in the Administrative and support services are less able to be performed offsite.

The Construction sector is likely to be one of the biggest employers in 2021, supporting demand for more professionals, technicians and trade workers, and labourers across the country. By the December 2021 quarter, the industry is expected to employ 252,000 workers, boosting employment in the regions such as Auckland, Waikato and Wellington that are experiencing growth in residential investment.

In contrast, in 2021, demand for labour in consumer facing industries like hospitality remain vulnerable to risks of going into higher Alert Levels due to resurgence of outbreaks. Any resurgence of outbreaks is anticipated to slow recovery of these industries, particularly for regions in the South Island.

An understanding of how COVID has a bigger labour market impact on some industries than others as can be seen in the Table below. Those industries that are most affected by changes in Alert Levels (for example, by border restrictions, or physical distancing requirements) will be most affected by continuing volatility in our recovery from recession.

View the full size version of the chart [PNG, 63 KB]