Oil

‘Oil’ is a term that covers a range of different products; from crude oil extracted from oil fields, to refined fuels like petrol and diesel, and non-fuel products like bitumen.

On this page

Up until March 2022, New Zealand’s supply of refined fuels (petrol, diesel and jet fuel) was made up of a mix of imported fuel and fuel produced at the Marsden Point Oil Refinery. Five companies import fuel for sale in New Zealand: Z Energy, BP, Mobil, Gull, and Tasman Fuels.

New Zealand’s crude oil fields are concentrated around Taranaki, either within Taranaki itself, or offshore.

The country’s only oil refinery at Marsden Point stopped refining operations on 31 March 2022, transitioning to operating as a dedicated fuel import terminal. It is important to note that the Marsden Point Oil Refinery was not suited to refining domestically produced crude oil, so both before and after this change nearly all crude oil produced in New Zealand has been exported.

Oil at a glance

Net indigenous production

Imports

Exports

International transport

Consumption

- The Marsden Point Oil Refinery closed on 31 March 2022

- We now import most of our oil products from Singapore

- Crude imports fell 100%, while refined product imports increased 159%

- Under the proposed Fuel Industry Amendment Bill, fuel importers would hold 24 days' use of jet fuel.

Closing the refinery changed has changed the mix of oil imports

On 31 March 2022, Channel Infrastructure (formerly Refining New Zealand) closed the Marsden Point Oil Refinery, New Zealand’s only oil refinery. Since the start of April 2022, New Zealand has relied exclusively on imported oil products to meet its liquid fuel needs, apart from liquefied petroleum gas (LPG) which is condensed from locally produced natural gas.

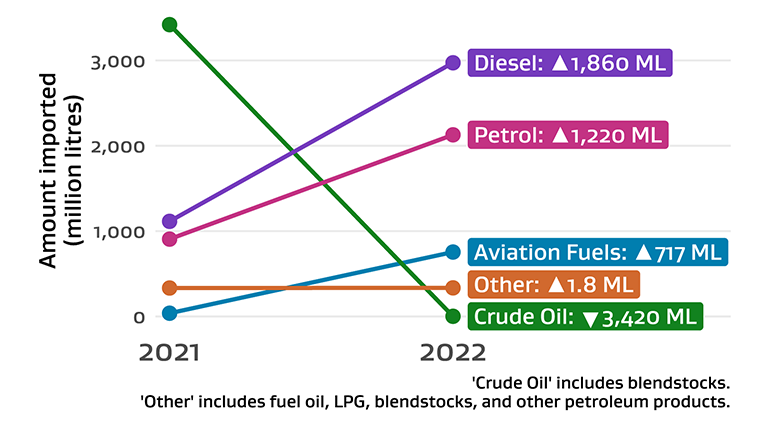

To analyse the effects of closing the refinery on New Zealand’s oil industry, we have compared the amount of oil products that were imported in the last 9 months of 2022 (referred to as “late 2022”) to the amount imported in the last 9 months of 2021 (referred to as “late 2021”) (Figure F.1). We have considered the timeframes between April and December 2022 (the part of 2022 after the refinery was closed), and between April and December 2021 (the same period in the previous year).

Figure F.1 Amount of oil imported during the final three quarters in 2021 versus the final three quarters in 2022, by product

Text description of figure F.1

While the amount of imported refined products increased by 3,798 million litres ML (159%) in late 2022 compared to late 2021, the amount of imported crude oil and refinery blendstocks fell by 3,417 ML (100%). In late 2022, New Zealand’s total imported oil increased by 381 ML (6.6%) and our total usage increased by 295 ML (4.8%) compared to late 2021. This means that our total imported oil largely tracked our total usage, even though the refinery had closed.

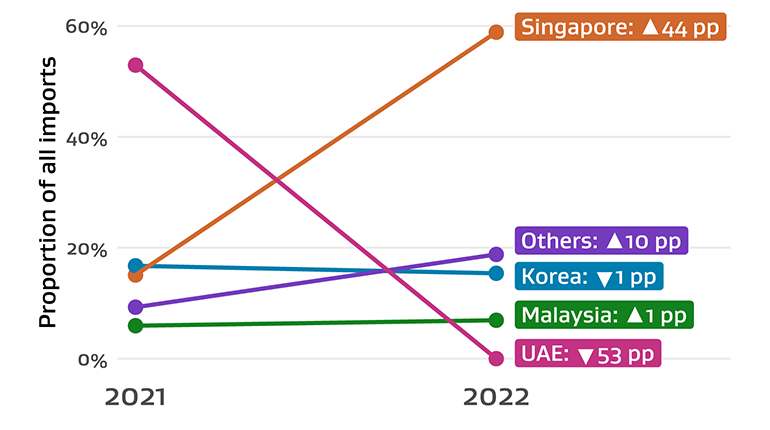

Singapore is now our main source of oil products

The change in the type of oil products we need means that we have changed where we import them from. In late 2022, we imported most of our oil products from:

- Singapore (59%)

- South Korea (15%)

- Malaysia (7%).

This is in comparison to late 2021 where the main sources were the United Arab Emirates (53%), South Korea (17%), and Singapore (15%) (Figure F.2). Driving this change has been the stoppage of crude oil imports, of which the United Arab Emirates was a major source.

Figure F.2 New Zealand’s imported oil during the final three quarters in 2021 versus the final three quarters in 2022, by country of origin

Text description of figure F.2

One difficulty with importing more refined products is that it is less clear where our oil originates. We can only see which country the product was imported from, not which countries they originally received the crude oil from.

Stockholding is more important than ever

Just as closing the refinery changed how we import oil products, it also has implications for how we hold oil stocks. In late 2021 we held 25% of our in-country stock of oil as crude oil. By late 2022 that had fallen to 12%, and it will likely fall further in future as we decommission the former refinery and remove any of the remaining crude oil.

As a member country of the International Energy Agency, New Zealand maintains oil stocks that are equivalent to at least 90 days of net imported oil. This stockholding enables New Zealand to play its part in collective oil security through the release of reserve oil stocks to moderate the impact of a global oil supply disruption. The formula to determine the days of net imported oil counts all oil and stocks of refined oil products, and includes stock held overseas under reserve stock contracts known as ‘stock tickets’. The formula measures those stocks in terms of New Zealand’s oil imports minus oil exports (from domestic crude production).

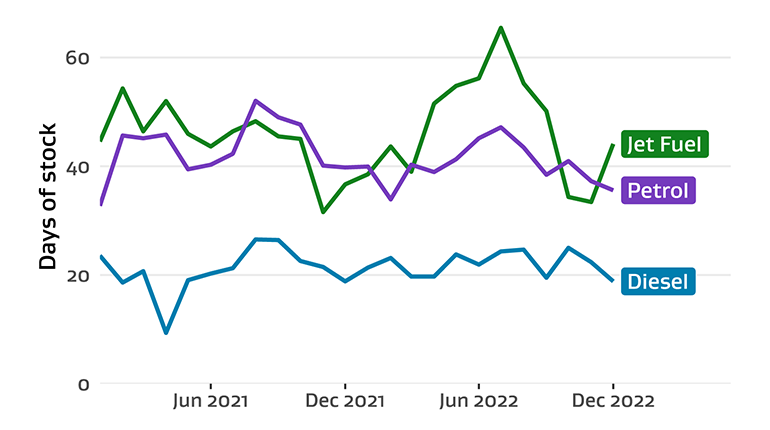

Figure F.3 Petrol, diesel and jet fuel stock levels by month and fuel, from 2021 to 2022

Text description of figure F.3

Comparing domestic stocks with the average daily consumption provides an alternative stockholding indicator that is more reflective of domestic fuel supply security. Stocks of jet fuel and petrol rose after the refinery closed at the end of March 2022 (Figure F.3). Stocks of jet fuel peaked at 65 days, and diesel stocks peaked at the end of 25 days in July 2022. Stocks of both fuels declined over 2022 to levels similar to the start of 2022.

Box F.1 Fuel prices have been driven up by Russian invasion of Ukraine

On 28 February 2022, Russia invaded Ukraine. To exert pressure on Russia to change its course of action, many countries around the world placed sanctions on major Russian exports, such as oil and diesel. Countries that previously relied on Russian oil products began looking for new sources, putting pressure on global supply.

At the same time, global refining capacity was under pressure. The years of slow economic growth and uncertainty caused by the coronavirus (COVID-19) pandemic meant that countries had reduced their investment in and maintenance of oil refining. The ‘refining margin’ — the difference in cost between crude oil and finished products, like diesel or petrol — was also increasing.

This was especially true for diesel. Russia once exported significant quantities of diesel to the European Union (EU). In 2022, the EU was looking for other sources, including products from as far east as Singapore or South Korea, directly competing with New Zealand importers.

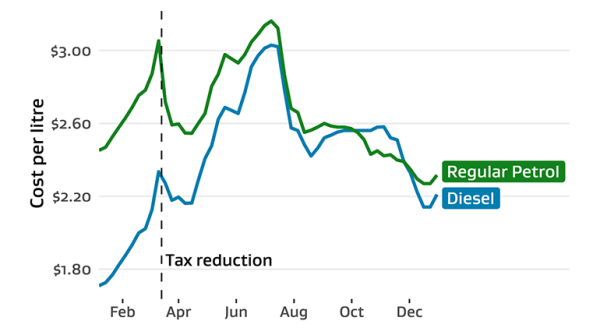

While supply was tightening, there was also uncertainty in demand, as global economies started recovering from the impacts of COVID-19. This all contributed to driving up prices — average prices for Regular 91 leapt above $3 a litre. In response, the Government temporarily cut excise taxes on petrol by 25 cents a litre (plus GST) on 14 March, and temporarily reduced Road User Charges for diesel users. This had an immediate effect, but the impacts of the invasion and supply uncertainty lasted for most of the year. This was such an unusual year for the global market that diesel prices even overtook petrol in New Zealand.

Figure F.4 Fuel prices in 2022

Text description of figure F.4

Line chart showing weekly petrol and diesel prices over 2022. Prices for both fuels rose quickly in late February and early March, but dropped quickly following the reduction in taxes. Price then rose again, peaking in mid-July, and then gradually fell during the course of the year. Diesel prices briefly overtook petrol prices during October and November.

Towards the end of 2022, demand for oil was falling due to slowing economic growth and COVID-19 lockdowns in China. At the same time, global supply chains were adjusting. Russian oil and oil products found new export countries, such as Brazil, Turkey, India, or China — albeit often at heavily discounted prices, under heavy sanctions and price caps. Prices began to fall towards levels last seen before the invasion. In New Zealand, the temporary tax reduction was reversed on 1 July 2023.

Box F.2 New Zealand’s fuel supply resilience is being improved

In November 2022, the Government announced a fuel resilience policy package after considering the implications of the refinery’s closure, the changing geopolitical environment, and the role of the energy sector in the transition to a low carbon economy.

The main components of the policy package include:

- introducing a minimum fuel stockholding obligation on fuel importers that have the right to draw fuel from bulk storage facilities

- investigating financial and contractual options for government procurement of services for holding at least 70 million litres of reserve diesel stock in New Zealand (roughly equivalent to seven days of New Zealand’s diesel consumption).

The Fuel Industry (Improving Fuel Resilience) Amendment Bill, which will provide the statutory framework for the minimum fuel stockholding obligation, was introduced in June 2023.

Information about the minimum stockholding obligation

The proposed minimum stockholding level that fuel importers will have to meet will be an average of:

- 28 days’ use of petrol

- 24 days’ use of jet fuel

- 21 days’ use of diesel.