Building and construction sector trends biannual snapshot: November 2022

This Snapshot covers key trends from March 2022 to September 2022.

On this page

Download a copy of the Building and Construction sector trends biannual snapshot: November 2022

Building and Construction sector trends biannual snapshot: November 2022 [PDF, 472 KB]

An overview of the building and construction sector

The sector remains strong

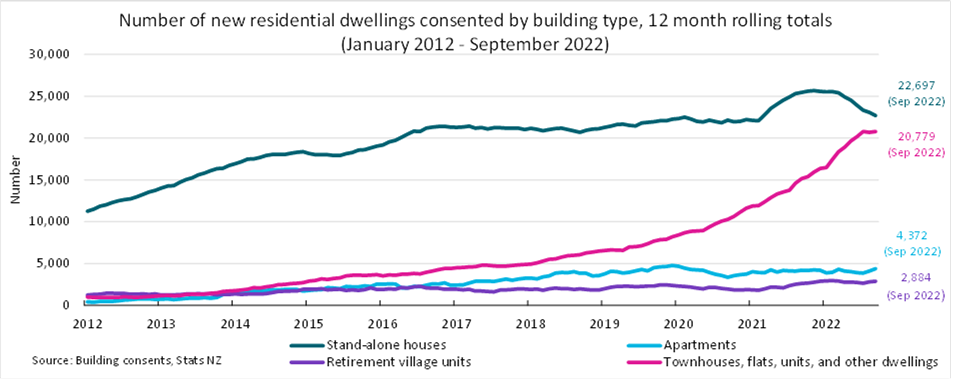

The continued high demand for residential building activity has put the sector in good stead to recover from the impacts of the COVID-19 pandemic. There was a record number of annual new dwelling consents, with 50,732 new dwellings consented for the September 2022 year. This was 7.0% more dwellings consented than in the September 2021 year.

Regionally, Auckland and Canterbury reached new annual records in the number of new homes consented, with 21,985 and 8,718 new dwellings respectively. In Auckland, multi-unit homes accounted for three quarters of homes consented in the September 2022 year.

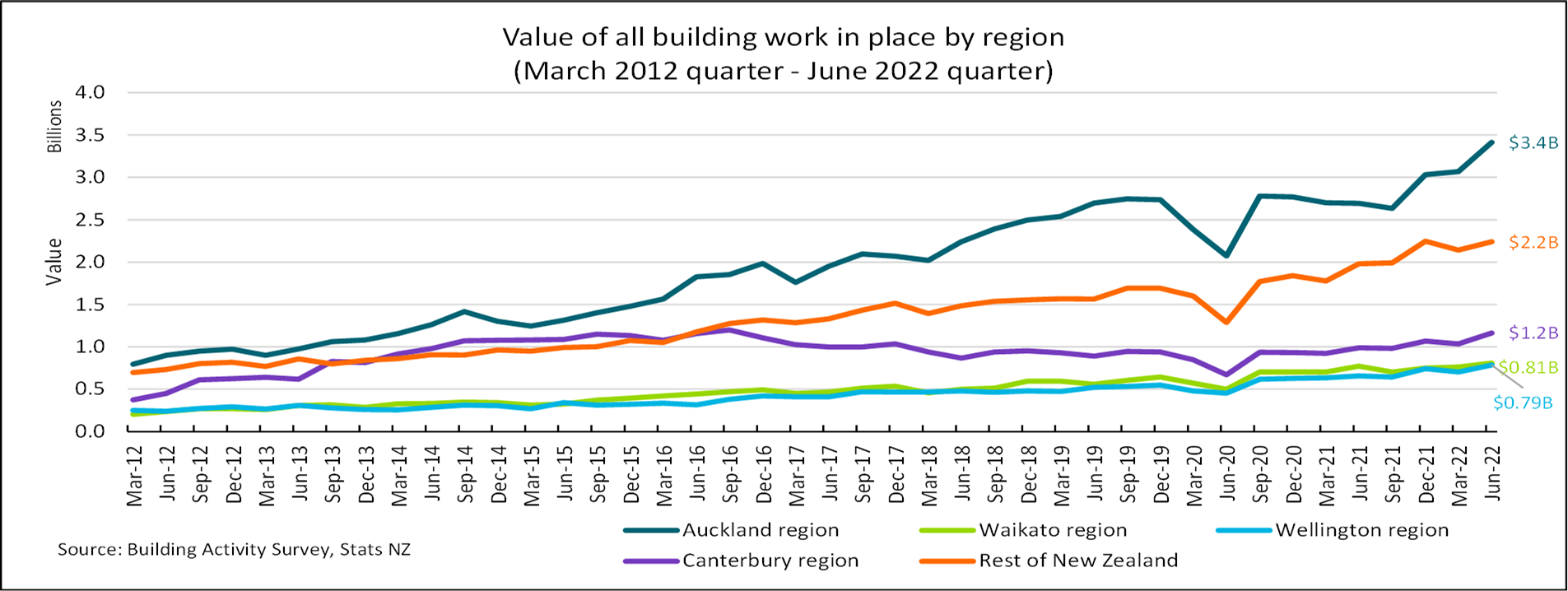

The seasonally adjusted volume of building work put in place for all buildings in the June 2022 quarter grew 2.6%, compared with the March 2022 quarter, with the volume of residential building activity lifting to historically high levels at $2.1 billion.

Economic activity in the construction sector was down 2.4% in the June 2022 quarter, following a 1.3% rise in the March 2022 quarter. This decline was driven by a reduction in activity in the heavy and civil construction sectors.

Workforce is stable

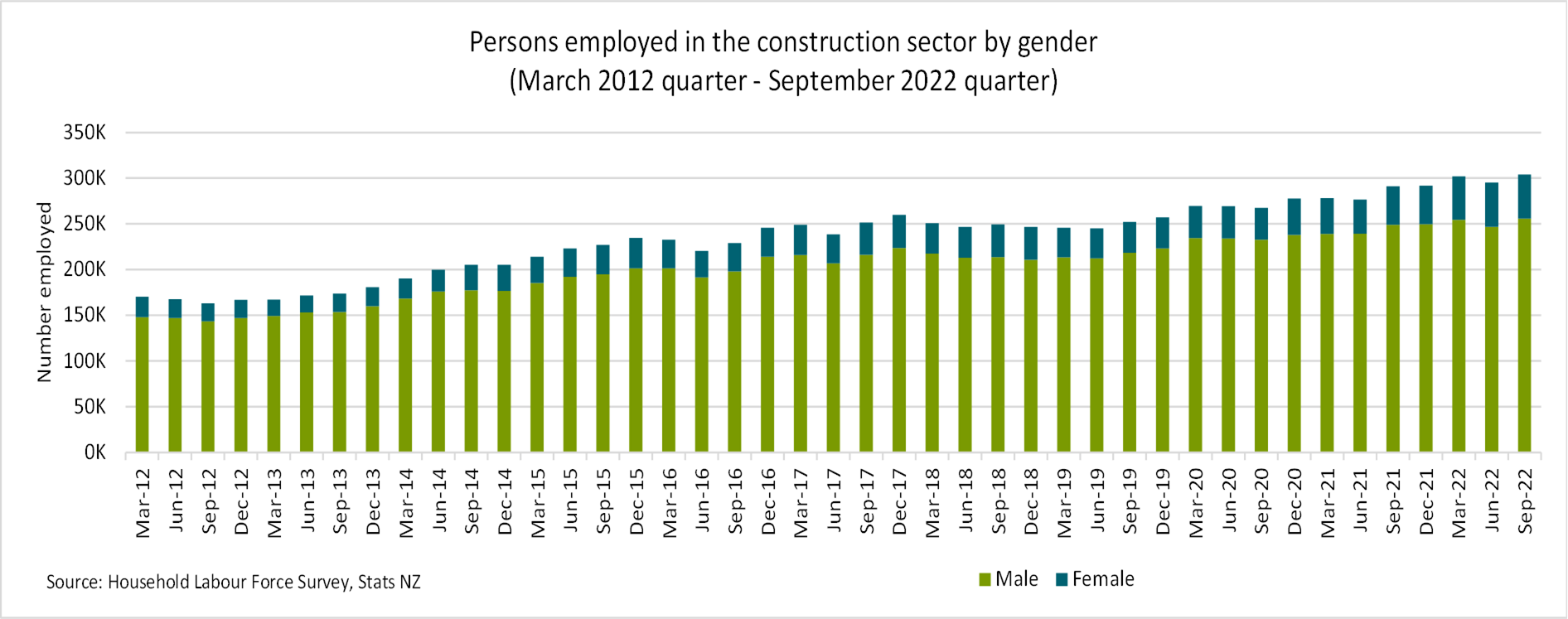

The construction sector was the third largest employer, with 304,100 people employed in the September 2022 quarter — an increase of 2.9% from the June 2022 quarter.

The sector had 7,035 more jobs in September 2022 when compared with September 2021. However, the growth in the number of filled jobs was stable at 0.4% between February and September 2022, and was considerably lower than the 3.9% growth seen in the same time period in 2021.

Teletrac Navman’s annual Construction Industry Survey 2022 reported that the civil construction industry needed to build the capacity and capability of skilled workers. 84% of those surveyed reported that skills shortages were a challenge to industry growth, with 87% indicating that they would hire today if the right skills were available.

Challenges remain but there may be some relief in sight

Despite the solid pipeline of construction work, the building and construction sector may potentially be facing capacity constraints (such as shortage of workers and materials) as well as cost pressures, which could place further constraints on business operating margins.

NZIER’s Quarterly Survey of Business Opinion October 2022 reported that the capacity utilisation for builders and manufacturers eased slightly in the September 2022 quarter, although these were still at historically high levels.

According to Stats NZ’s Consumer Price Index, prices for the construction of new dwellings increased 3.3% in the September 2022 quarter, followed by a 4.5% in the June 2022 quarter. Annually, the average prices for constructing new dwellings in September 2022 was 16.8% higher compared to the same quarter in 2021.

Labour costs remained one of the key constraints for businesses. Wage inflation for the sector rose 0.8% in the September 2022 quarter (compared to the June 2022 quarter). This increase was below the all-industry average of 1.1% for the same time period. Annually, wages in the construction sector rose by 4.1%.

However, the level of domestic demand for building materials may be easing. According to the EBOSS Construction Supply Chain Update, in the last six months to July 2022, 21% reported that domestic demand was impacting their ability to supply building products. This was lower than the 43% reported in July 2021. Additionally, while 64% of suppliers reported that they were having issues supplying to the market in July 2022, which had decreased from 79% in July 2021.

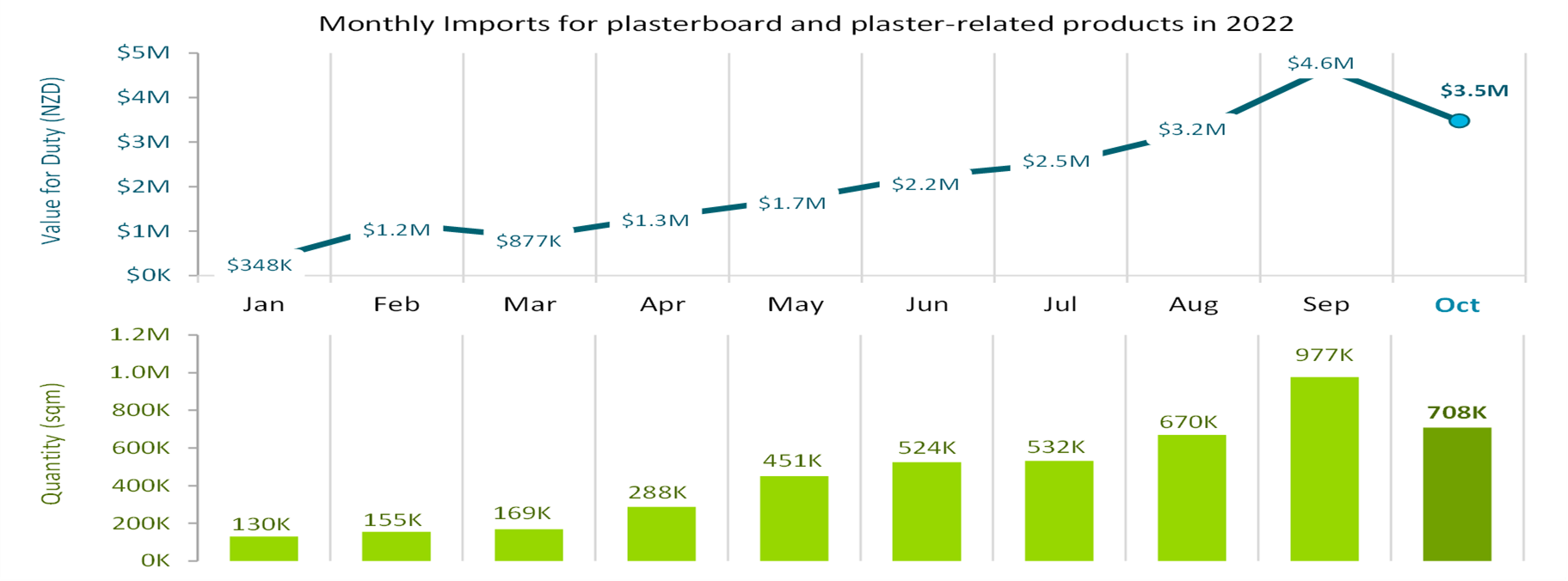

Regarding the importation of plasterboard and plaster-related products into New Zealand, a total of 4.6 million square metres was imported between January and October 2022. This was an increase of 444% between this time period.

Performance

Economic performance

Nationally, there was a 1.7% rise in GDP in the June 2022 quarter. This reflects the reopening of borders, easing of both domestic and international travel restrictions and fewer domestic restrictions.

However, economic activity in the construction sector was down 2.4% in the June 2022 quarter, following a 1.3% rise in the March 2022 quarter. This decline was driven by a reduction in activity in the heavy and civil construction sectors.

The strong demand in building construction led to continued growth in investment in the residential building and non-residential sectors, which rose by 1.0% and 0.6% respectively in the June 2022 quarter.

Building consents and activity

A record 50,732 new homes were consented in the year ended September 2022, an increase of 7.0% on the year ended September 2021. The annual issuance of new dwelling consents remained above the 50,000 homes consented since the March 2022 year.

The upward trend for townhouses, flats, units and other dwellings continued in the September 2022 quarter. This category made up approximately 41% of all new homes consented in the September 2022 year.

The total value of building work put in place was $8.4 billion in the June 2022 quarter, an increase of 19% from the June 2021 quarter. Auckland contributed $3.4 billion of the total building activity, up 27% compared to the previous year.

The total building volume rose a seasonally adjusted 2.6% in the June 2022 quarter, compared to the March 2022 quarter. Residential building activity rose 3.2%, while non-residential building activity rose 1.6%.

Economic outlook

The NZIER’s Quarterly Survey of Business Opinion July 2022 reported that the building sector was facing acute capacity constraints, such as shortages of workers and materials as well as strong cost pressures, and that this was putting further constraints on operating margins. However, while these were at historically high levels, the capacity utilisation for builders and manufacturers eased slightly in the September quarter.

The EBOSS Construction Industry Confidence Report August 2022 reported that 46% of specifiers (architects and designers) and 59% of builders believed that the situation will deteriorate — this was almost double the percentage from 2020.

Source: GDP (P), chain volume series in 2009/2010 prices, Stats NZ

Real GDP growth of the construction sector (June 2012 quarter - June 2022 quarter)

Source: Building consents, Stats NZ

Number of new residential dwellings consented by building type, 12 month rolling totals (January 2012 – September 2022)

Source: Building activity survey, Stats NZ

Value of all building work put in place by region (March 2012 quarter - June 2022 quarter)

People

New Zealand construction workforce

There were 304,100 construction workers employed in the September 2022 quarter. The overall construction workforce comprised of 255,800 male workers and 48,300 female workers.

Construction workers occupying filled jobs rose 3.6% in September 2022 (compared to September 2021), providing 7,035 more jobs to the sector. It was the industry with the second largest increase in filled job numbers during that period.

However, due to the tight labour market, the monthly employment indicators showed just an 0.4% increase in the number of filled jobs between February and September 2022. This growth was considerably slower than the 3.9% growth seen in the same time period in 2021.

In terms of the migrant workforce, 7,392 visas were approved for the year ended September 2022. The most common occupations were: carpenters (37.8%), builders’ labours (7.7%), scaffolders (6.1%) and painting trade workers (4.9%).

Teletrac Navman’s annual Construction Industry Survey 2022 reported that the civil construction industry needed to build capacity and capability of skilled workers. For example, 84% of those surveyed reported that the skills shortage was a challenge for industry growth. 87% indicated they would hire today if the right skills were available.

Health and safety

WorkSafe reported 7 fatalities in the construction sector between March 2022 to August 2022, which was similar to the figures from the same period last year.

There were 5,589 total injuries resulting in more than one week away from work, between June 2021 to May 2022 (based on the latest data available). Over this period, the average injury per month was 466 cases, and the highest injury toll at 582 injuries in July 2021.

The result from MATES in Construction NZ’s Industry Wellbeing Survey 2022 reported that despite the end of lockdowns and the easing of COVID-19 restrictions, respondents had similar or higher levels of anxiety and suicidal ideation compared to the previous year, and had lower levels of resilience for managing stress. In 2022, 47% reported that their mental health had been worse than usual. This was slightly higher than the 43% in 2021.

Source: Household Labour Force Survey, Stats NZ

Persons employed in the construction sector by gender (March 2012 quarter - September 2022 quarter)

Processes

Government initiatives

In May 2022, the Government released its first Emissions Reduction Plan, which sets the direction for meeting New Zealand’s carbon emission reduction targets. MBIE’s Building for Climate Change programme is leading the building and construction sector’s approach to emissions reduction and will be introducing measures to limit emissions due to the construction and operation of buildings.

The law change for the BuildReady scheme and revised CodeMark scheme took effect in September 2022. This allows offsite building manufacturers to become certified, and will enable faster consenting of quality assured homes/buildings.

The Government set up a Ministerial taskforce in June 2022 with key construction, building consent, and supply chain experts to look at what more can be done to ease and resolve plasterboard shortages. This Plasterboard Taskforce was then reshaped to form the Critical Materials Taskforce in November 2022. The intent of the Critical Materials Taskforce is to include broader sector knowledge and expertise; and will watch for emerging supply chain risks and troubleshoot building materials shortages.

Occupational regulation

There were 27,106 licensed building practitioners (LBPs), and 33,189 active electrical workers in August 2022.

For the year ended August 2022, there were 207 complaints made against LBPs and non-LBPs. This was 33% more than the number of complaints received for the August 2021 year, in which 156 complaints were made.

During the same time period, 111 complaints were made against registered electrical workers and non-registered electrical workers (compared with 70 complaints in 2021).

Products

Construction costs

Construction costs continued to rise. This could potentially be attributed to: supply chain disruptions, rising labour costs, and the continued demand for building work (including record-high building consents being issued).

Regarding the continued demand for building work, the seasonally adjusted volume of work put in place for all buildings grew 2.6% in the September 2022 quarter, with the volume for residential buildings increasing by 3.2%.

With regards to rising labour costs, the Labour Cost Index (LCI) rose by 0.8% in the September quarter, lifting the annual rate to 4.1%. Wage growth was modest in the sector, with an increase of 0.8% between the June and September 2022 quarter (compared to the average of 1.1% across all industries).

Domestic demand for building materials appeared to show signs of easing. According to the EBOSS Construction Supply Chain Update, in the last six months to July 2022, 21% reported that domestic demand was impacting their ability to supply building products. This was lower than the 43% reported in July 2021.

Construction and the environment

The New Zealand Green Building Council reported that in the six months to June 2022:

- 4,190 homes were “Homestar” registered (up 67%, compared with the same 6 months in 2021)

- 1,385 homes with “Homestar Built Ratings” (up 113%)

- 26 new building were “Greenstar” registered (up 44%)

- 62 large office buildings received a National Australian Built Environment Rating System New Zealand (NABERSNZ) rating (up 36% from 2020)

Based on the latest data releases from Stats NZ, the seasonally adjusted quarterly greenhouse gas emissions in construction decreased 3.2% in March 2022 quarter, while the national greenhouse gas emissions rose by 1.7%. Annually, construction emissions were up 75kt (5.0%) for the year ended March 2022.

Plasterboard imports

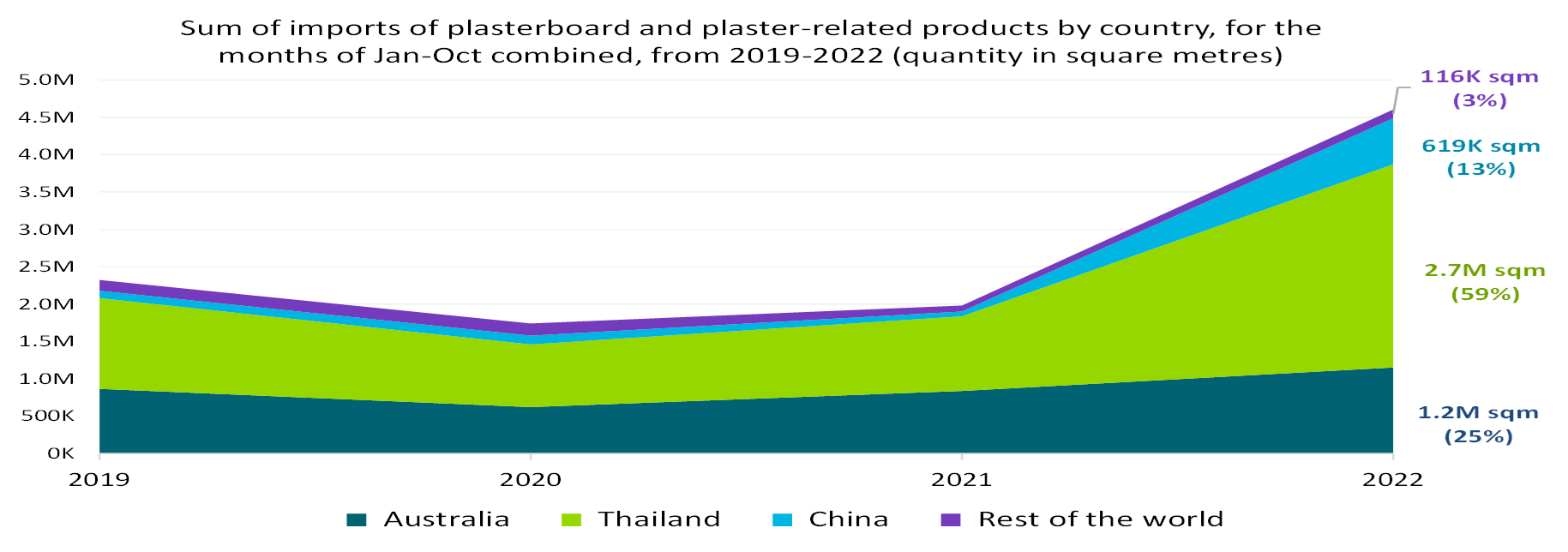

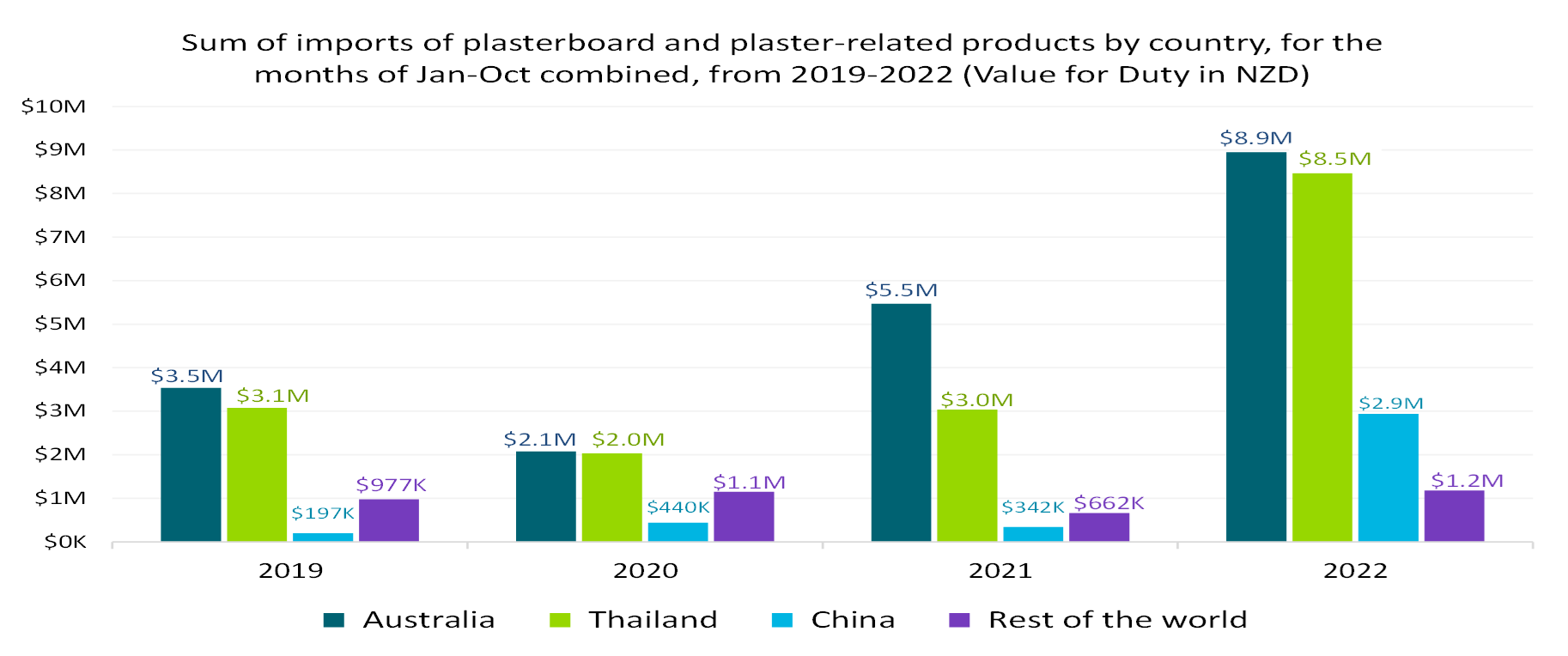

Between January and October 2022, 4.6 million square metres of plasterboard and plaster-related products were imported into New Zealand (an increase of 444% within this time period). In the month ended October 2022, 708,000 square metres of plasterboard and plaster-related products were imported.

Thailand and Australia were the top two countries from which plasterboard and plaster-related products were imported from, and accounted for 3.9 million (84%) out of the total of 4.6 million square metres

Monthly imports of plasterboard and plaster-related products (from January 2022 to October 2022)

Sum of imports of plasterboard and plaster-related products by country, for the months of January-October combined, from 2019 to 2022 (quantity in square metres)

Sum of imports of plasterboard and plaster-related products by country, for the months of January-October combined, from 2019 to 2022 (Value for Duty in NZD)

Feature article — Retrofitting and the role it can play to help reach climate change targets

Background

As a signatory to the Paris Agreement in 2015, New Zealand is committed to becoming carbon neutral by 2050. To reach net zero carbon in the building and construction sector by 2050 [1], one available lever is to reduce building related emissions in new builds or existing buildings. The former American Institute of Architects president Carl Elefant once said that “The greenest building is... one that is already built” [2]. This represents the belief that refurbishing existing buildings rather than demolishing and building new buildings was a more efficient way of lowering the carbon emissions in buildings.

The International Energy Agency (IEA) estimated that around two-thirds of the global building area that exists today would still exist in 2040 [3]; and that approximately 20% of the existing global building stock will need to be zero carbon ready by 2030, to meet the 2050 carbon neutrality target [4].

Additionally, the need for retrofitting is not confined to old buildings but also applies to new builds. For example, new buildings may still create greenhouse gas (GHG) emissions through the energy they use to operate (such as through heating, lighting etc.) and due to the lack of energy efficiency in building envelopes.

What are deep retrofits?

To convert existing buildings to carbon neutral buildings, deep retrofits are required. Deep retrofits:

- Minimise the use of high emission and non-recyclable construction materials in the retrofit process

- Replace the reliance on fossil fuels with green energy sources

- Enable the building envelope to be more energy efficient

To get an idea of the volume of the work that is required for deep retrofits in New Zealand, below are some statistics on the portion of New Zealand houses with double-glazed windows, insulation, and the types of heating used:

- Double-glazed windows: According to the BRANZ (2015) House Condition Survey, 10% of dwellings had double-glazing for all windows, while 8% had a mix of single and double-glazed windows[5]. These rates increased to 16 and 9% in 2018 [6].

- Insulation:

- Roof: According to the BRANZ 2018 Pilot Housing Survey, 49% of surveyed houses had less than 120 mm roof cavity insulation [6].

- Underfloor: 23% of the surveyed houses that could have subfloor insulation had less than 80% insulation coverage in 2018 [6].

- Wall: BRANZ estimated that 53% of New Zealand houses had no wall insulation in 2015 [5].

- Heating: According to the 2018 Census, 52.5% of New Zealand houses still used natural gas, wood, pallet, or coal (in combination or without other heating systems) for heating purposes [7].

How many buildings need to be retrofitted?

According to experts, the life span of residential buildings can range from 70 to 100 years [8]. Many parameters could impact the life span of buildings, such as geographic location and building maintenance.

In New Zealand, residential buildings from the 1920s are still in use. This shows that the life span of 100 years is realistic for some buildings. Based on this assumption, it is plausible that by 2050, the existing New Zealand building stock could comprise of buildings that are built from 1950 and onwards.

Table 1 below shows the volume of the New Zealand building stock that was consented between 1950 to 2021. The numbers in the last column provide a lower-bound estimate of the volume of the building stock that might need a deep retrofit so that all buildings are carbon neutral before 2050.

Table 1. The total floor area (in million M2) of consented building stock in New Zealand from 1950 to 2021

| Type of building | 1950s | 1960s | 1970s | 1980s | 1990s | 2000s | 2010s | 2020s | Total |

|---|---|---|---|---|---|---|---|---|---|

| Residential | NA¹ | NA | 17.4² | 24.7 | 34.0 | 44.6 | 45.1 | 13.7* | 179.5 (1974-2021) |

| Non-residential | NA | NA | NA | NA | 19.3³ | 31.7 | 28.6 | 5.8* | 85.5 (1992-2021) |

| All buildings | NA | NA | NA | NA | 50.4³ | 76.2 | 73.8 | 19.5* | 219.9 (1992 -2021) |

¹ Data not available; ² Data available from 1974; ³ Data available from 1991; * Data available up to 2021

Additionally, this volume is still increasing through new builds — an average of 5.3 million m2 residential and 3.0 million m2 non-residential buildings per year were consented in New Zealand in the past decade (2012-2021) [9]. Based on these figures, it could be estimated that approximately 8.3 million m2 additional volume could be added to the building stock every year up to 2050 [9]. What this highlights is the potential volume of the existing building stock which may require a deep retrofit by 2050.

International examples

Countries across the globe including China [10], Germany [11], Canada [12, 13], and the European Commission [14], are employing incentives for retrofitting existing buildings. For example, as an action plan of the European Green Deal by the European Commission, Renovation Wave was introduced in October 2020 [14, 15]. This aims to at least double renovation rates in the next ten years and to ensure renovations lead to higher energy and resource efficiency [16]. The European Commission estimated that 35 million buildings will be renovated and up to 160,000 additional green jobs will be created in the construction sector by 2030 [16]. Additionally, along with voluntary schemes and incentives, some countries such as England, Wales, Italy, Portugal, USA, Brazil, and Canada also have mandatory policies for retrofitting existing buildings [17]. For example, in Italy, existing buildings that undergo a major renovation must comply with Near Zero Energy Building requirements like new buildings [17].

Conclusion

Around the world, and in New Zealand, the volume of the existing building stock that would need deep retrofitting, to achieve carbon neutrality, is potentially large and increasing. In this era of climate change, retrofitting existing buildings is an important lever that could be used to help New Zealand reach net zero carbon by 2050.

Bibliography

Feature article references