Chapter 5: Options for expanding the scope of assurance

We are considering whether to expand the scope of the assurance requirements from the current obligation to assure GHG emissions disclosures only, to assurance over all disclosures in the climate statement.

On this page

5.1 Status quo

The CRD Act already contains an assurance requirement. From October 2024, the Act requires GHG emissions disclosures in the climate statements to be independently assured in accordance with assurance standards issued by the XRB. No other part of the climate statement is required to be assured.

We expect some climate reporting entities will be ready for, and voluntarily seek assurance over, their full climate statement earlier than others regardless of whether assurance is mandated.

There are currently no legislative requirements for which standards must be used for voluntary assurance. Standards issued by the XRB must be used for the mandated assurance over GHG emissions disclosures only. Therefore, if we continue with the status quo different reporting entities may use different assurance standards to undertake voluntary assurance.

It is likely some reporting entities will not seek assurance beyond what is required by the CRD Act. There is no mechanism to require further assurance without legislative change.

5.2 Problem definition

Investors, regulators, customers, and employees are increasingly making decisions that factor in organisations’ climate-related action or inaction. GHG emissions are an important factor to understand the impact of an organisation on the climate, and any related risks. However, draft Aotearoa New Zealand Climate Standard 1 proposes to require much broader disclosures than GHG emissions only. Disclosures are proposed to cover 4 thematic pillars which represent the core elements of how entities operate – Governance, Strategy, Risk Management, and Metrics and Targets (refer to figure 1 below which sets out the proposed reporting requirements in draft Aotearoa New Zealand Climate Standard 1).

Draft Aotearoa New Zealand Climate Standard 1: Climate-related Disclosures

Governance

- Identity of the governance body

- Governance body oversight of climate-related risks and opportunities

- Management's role in assessing and managing climate-related risks

Strategy

- Identification of climate-related risks and opportunities

- Scenario analysis against a minimum of 3 climate-related scenarios

- Current climate-related impacts, and anticipated impacts of identified climate-related risks and opportunities

- How the entity will position itself in the transition to a low-emissions, climate resilient future

Risk Management

- Processes for identifying, assessing and managing climate-related risks

- How these processes are integrated into overall risk management processes

Metrics and Targets

- Cross-industry metric categories (including scope 1, 2 and 3 greenhouse gas (GHG) emissions)

- Industry-based metrics

- Key performance indicators

- Targets, and performance against targets

Assurance

- GHG emissions disclosures are subject to limited assurance for any accounting period that ends on or after 27 October 2024

Disclosures covering each of these pillars will generate new information about financially material climate change risks and opportunities which can support more informed and accurate decision-making. To promote confident and informed participation in the financial markets, information disclosed must be trusted by primary users. As it stands, a substantial portion of disclosed information is not required to be assured, posing a potential risk to users’ trust and confidence in those parts of climate statements.

Due to the inability to refer to an applicable standard to be used for voluntary reporting, it is unlikely a single high-quality climate assurance standard will be adopted under the status quo. Entities may instead use different standards or obtain assurance in ad hoc ways, undermining investors’ ability to compare and make more informed decisions in the financial markets.

20. Have we described the status quo and problem definition correctly? If not, why not?

5.3 Summary of the options

We have identified the following four options which may address the problem:

- Option 1: Continuing with the status quo

- Option 2: A non-regulatory approach

- Option 3: Extending the assurance requirement to cover the whole climate statement from October 2028.

- Option 4: Extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the XRB to stagger the introduction of assurance requirements prior to this date.

5.3.1 Option 1: Continuing with the status quo

If we continue with the status quo then only GHG emissions disclosures will be required to be assured. Assurance will not be mandated for any other part of the climate statement. The status quo has been described in more detail in section 5.1 above.

5.3.2 Option 2: A non-regulatory approach

The second option is not to regulate, but to focus on awareness raising, education, and supporting the development of assurance standards. This support could seek to encourage the improvement of climate reporting quality and the uptake of voluntary assurance over climate statements. A larger proportion of climate reporting entities may then voluntarily seek further assurance over other parts, or all, of their entire climate statement.

Alternatively, this non-regulatory approach could progress alongside regulatory options to complement legislative changes.

21. Do you have any suggestions for non-regulatory options government should support?

5.3.3 Option 3: Legislation to introduce extended assurance to cover the whole climate statement from October 2028

Option 3 is to widen the scope of mandatory assurance from GHG emissions disclosures only to the whole climate statement. This proposed change would expand assurance requirements to include an entity’s climate-related governance, strategy, risk management, and non-GHG metrics and targets (refer to Figure 1 in the ‘Problem definition’ section above).

If option 3 was adopted, then we propose that full climate assurance engagements should be required to be made in accordance with assurance standards issued by the XRB. We also propose that this requirement would commence for climate reporting entities with accounting periods ending on or after 7 years after Royal Assent of the CRD Act (i.e., 27 October 2028). Under this timeframe, we would expect the first fully assured climate statements to be lodged in 2029. Our reasoning for the October 2028 timeframe is discussed under the “Timing” heading below.

As the independent assurance standard setter, the XRB would be empowered to issue standards to be used for whole of climate statement assurance.

We also consider that this obligation should not be brought into force until the occupational licensing regime, discussed in Chapter 4, has commenced. In line with proposals to establish a regulatory regime for assurance practitioners, as we further extend assurance requirements, there is a need to ensure proficiency of auditors.

Timing

We propose a timeframe of requiring full assurance for financial years ending on or after October 2028 having considered feedback from the FMA, XRB, and assurance practitioners. We consider this timeframe to effectively balance the need for an effective climate-related disclosure regime promoting trust and confidence in the information disclosed, and the need to provide standard setters, climate reporting entities, and assurance practitioners with sufficient time to prepare for the changes. In coming to this conclusion, we also considered the matters set out below.

We are cautious of introducing further assurance engagement requirements too early. Entities may restrict information disclosed or become overly cautious with forward looking statements if assurance engagements are required too early, thereby restricting innovation. Because of this, it may be unhelpful to require further assurance in the initial years where climate reporting entities focus needs to be on improving the quality of reporting.

In the early years of the climate-related disclosure regime, assurance practitioners may not have the necessary tools and expertise to assure all information contained in a climate statement, particularly information that is qualitative and/or forward-looking. It is also important to enable time for multiple iterations of reporting to be undertaken so that areas requiring early attention from assurance standards setters and practitioners can be identified and prioritised. For these reasons, climate reporting entities may not be ready for full assurance prior to 2028.

The October 2028 date would enable the XRB to have undertaken a post-implementation review of NZ Climate Standards 1 – 3, which is anticipated to begin by December 2025. The XRB could make well informed decisions on assurance application based on learnings from this review process. In response to this review, there is also potential for climate standards themselves to change, making it challenging to assure against any new standards in the initial years.

The FMA will need time to issue findings and recommendations to climate reporting entities in response to their first years of climate reporting. These findings and recommendations will enable entities to make the necessary improvements before assurance requirements come into force. If broader assurance were introduced from October 2028, most climate reporting entities will have released 5 climate statements by this time.

Introducing a requirement for assurance of the whole climate statement from October 2028 should enable time for the issuance of bespoke assurance standards by the XRB and allow for the market to develop. The non-financial assurance market is expected to evolve considerably both domestically and globally by the end of 2028.

Alternatively, this timeframe may be overly cautious. The development of a licensing regime for assurance practitioners, international assurance standard developments, quality of climate reporting, capability of assurance practitioners, and expectations of primary users may rapidly evolve over the next few years. Under these circumstances, it may therefore be appropriate to introduce requirements for assurance over the whole climate statement at an earlier date.

22. What comments do you have on the proposal to require full assurance of the climate statement for accounting periods ending on or after October 2028?

5.3.4 Option 4: Extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the XRB to stagger the introduction of assurance requirements

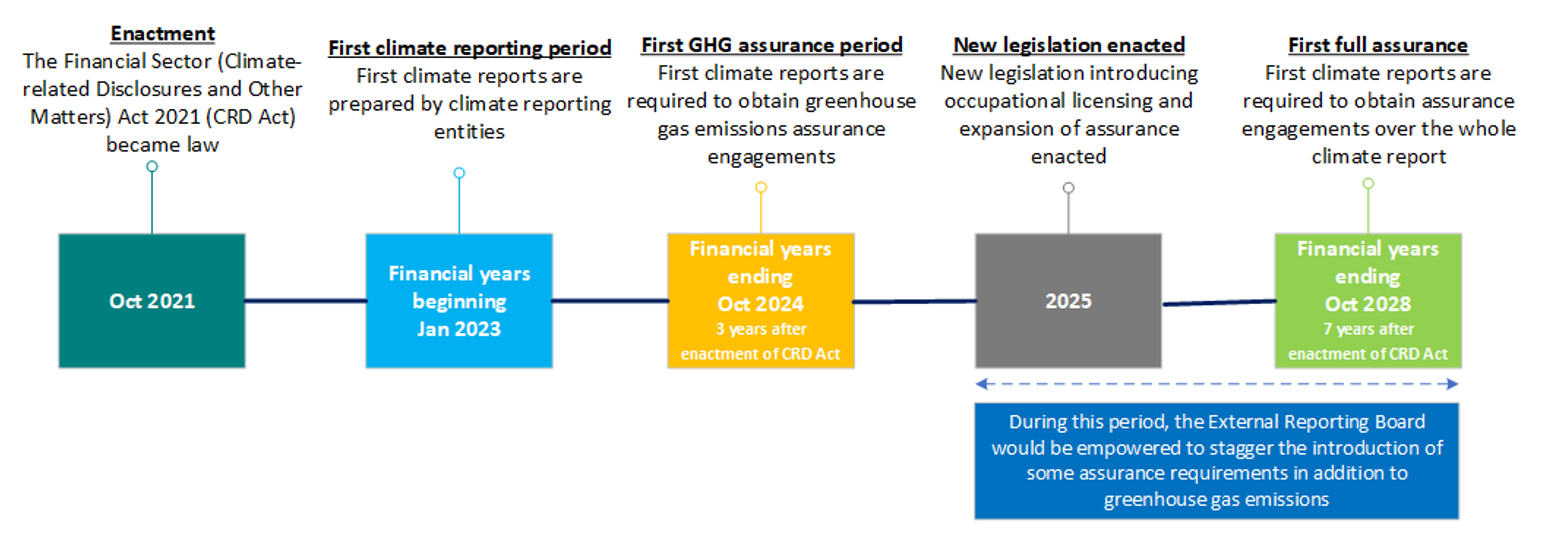

In addition to introducing a requirement for whole of climate statement assurance from October 2028, the XRB could be empowered to stagger the introduction of non-GHG emission assurance requirements prior to that date (see below for the proposed timeline for Option 4).

Figure 2. Potential timeline towards whole of climate report assurance

Image transcription

For instance, the XRB could be empowered to require some aspects of climate assurance to come into effect earlier than others e.g., assurance over an entity’s climate-related governance and risk management may be required in an earlier accounting period than strategy. While some areas of governance and risk management assurance are already well established, other areas will be more difficult to obtain assurance over.

Enabling a staggered introduction of climate assurance requirements would be consistent with the existing approach to how the XRB is empowered to set standards. Under the CRD regime, the XRB may introduce staggered requirements for climate standards due to Section 19C of the FR Act. This approach is also enabled for staggering general financial reporting requirements through Section 20 of the FR Act.

Financial Reporting Act 2013(external link) — New Zealand Legislation

The XRB could release a roadmap providing more detailed dates towards assurance of the whole climate report.

5.4 Criteria

In this chapter we use 3 criteria to assess the 4 options. We consider whether each option will provide:

- effectiveness in achieving our objective i.e. enhancing trust and confidence in the climate statements (see part 1.2 of this consultation document)

- flexibility

- efficiency.

We consider that the first criterion (effectiveness in improving trust and confidence) is the most important and should carry the most weight. This criterion aligns directly with our objective in consulting with you about expanding the assurance requirement.

Our assessment of these options and preliminary conclusions about the preferred option are set out below.

23. Do you agree with the criteria we are using to assess the options? Do you consider that the effectiveness criterion should have the most weight or should they all have equal weight?

5.5 Assessment of the options

5.5.1 Effectiveness in improving trust and confidence in the climate statements

The first criterion we have considered is whether each option will effectively improve trust and confidence in the climate statements. As noted in Chapter 4, if information in the climate statements is not trusted, then it will not be relied upon to make investment decisions. This means that the effects of climate change are less likely to be routinely considered in business and investment decisions and consequently investors may not redirect capital to more sustainable activities.

Status quo

The status quo relies on voluntary assurance to expand the assurance engagement and therefore promote trust and confidence. It is likely that various climate-reporting entities will seek voluntary assurance engagements. Entities may engage in voluntary assurance to differentiate their reporting to investors or in anticipation of future compliance requirements. This is because assurance provides a clear message of intent, commitment, and confidence to stakeholders.

There is already increasing pressure on companies to disclose decision-useful climate-related information because institutional investors, banks and insurers are increasingly viewing climate as a financial risk that needs to be managed. As a result, entities that do not seek independent assurance over their material climate-related risks and opportunities may find it difficult to refinance existing debt or raise new debt.

Despite this pressure, it is unclear how many entities would seek voluntary assurance. Early voluntary adopters may have concerns about competitive disadvantage. For example, voluntary assurance will increase an entity’s costs and may result in more transparent disclosures being made to the market. This may disadvantage an entity undertaking voluntary assurance.

We are additionally concerned that it is unlikely a single high-quality climate assurance standard will be adopted under the status quo. The application of different standards may undermine investors’ ability to compare and make more informed decisions in the financial markets.

Due to uncertainties over uptake of voluntary assurance and the lack of a single clear standard for assurance of climate statements, in our view, the status quo may lead to a lack of trust and confidence in the climate statements and inconsistent reporting between entities.

24. What level of trust and confidence do you think users will have in the climate statements under the status quo?

Non-regulatory option

The non-regulatory option may help to encourage the uptake of voluntary assurance engagements. It would build upon the status quo by further supporting climate reporting entities and assurance practitioners, while maintaining the benefit of providing more time for entities to develop their reporting and for primary users to indicate their preference for assurance.

However, although an improvement, for similar reasons to the status quo, relying on a non-regulatory option may lead to a lack of trust and confidence in the climate statements. This is due to the potential for inconsistent and incomplete assurance through the application of different standards, making it very challenging for users to compare disclosures made by different entities. Early voluntary adopters may additionally have concerns about competitive disadvantage. We therefore do not consider the non-regulatory option as a significant improvement on the status quo when considering the effectiveness criterion.

Extending the assurance requirement to cover the whole climate statement from October 2028

In our view, the expansion of assurance requirements would increase the value of the disclosures to users by enhancing trust and confidence in all the disclosures, rather than only GHG emissions.

Option 3 would also provide the opportunity to mandate which assurance standards must be complied with. In our view, it would be preferable to require the application of prescribed standards by any service provider of assurance engagements. Without prescribed standards there may be doubt and confusion about the integrity and reliability of reported information, and reduced comparability between disclosures. Mandated standards would improve trust and confidence.

Setting a timeframe for whole of climate statement assurance in legislation provides clarity by setting expectations of quality and direction of travel for climate reporting entities and assurance practitioners. Government intervention would raise expectations for climate reporting entities and assurance practitioners which should accelerate progress.

This approach offers certainty to the market while simultaneously providing a few years of lead-in time for entities to develop their climate reporting. During these years, climate reporting entities may be further encouraged to obtain voluntary assurance engagements in advance of future compliance requirements.

Introducing full assurance requirements represents a significant improvement on the status quo when considering whether each option effectively enhances trust and confidence in the climate statements.

Extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the XRB to stagger the introduction of assurance requirements prior to this date

Full assurance could be introduced either with or without the possibility of earlier introduction of some assurance requirements, i.e., a ‘staggered’ approach. Bringing into force some assurance requirements over time would gradually improve the reliability of information, while providing a reasonable timeframe for climate reporting entities, assurance practitioners, and standard setters to prepare. The XRB could be empowered to introduce some of the assurance requirements prior to the date for full assurance.

If there is a staggered introduction of assurance requirements, the XRB would need to consult on the timing of their introduction and the relevant assurance standards. When introducing new standards, the XRB publicly engages to:

- understand where the proposed standard is likely to be needed and whether the proposed standard meets those needs for a New Zealand audience

- establish the pros and cons of adopting the standard in New Zealand

- explore any unintended consequences or risks arising from adopting the standard or potential drawbacks of not adopting it.

The Financial Reporting Act 2013 (FR Act) empowers the XRB to issue standards, subject to certain requirements and constraints, including:

- Section 13, which requires the XRB to act independently in performing its statutory functions and duties, and exercising its power;

- Section 22, which requires the XRB to take reasonable steps to consult with those substantially affected by a proposed standard; and

- Section 25, which states that standards issued by the XRB are secondary legislation. This means they are legislative instruments which are made under powers delegated by Parliament and are disallowable.

25. Do you agree with our assessment of the effectiveness criterion? If not, why not?

5.5.2 Flexibility

Non-financial reporting is a new endeavour for many climate reporting entities, and climate standards are rapidly developing globally, with reporting likely to evolve over the initial years. For assurance of the whole climate statement to be viable, climate reporting needs to meet a standard that would pass an independent assurance opinion.

As noted by the IAASB, the shift towards requiring assurance over all climate disclosures will be a journey. The data capture, information systems, and processes within many organisations needed to report reliably on all aspects of climate disclosures are in the process of maturing.

While there are some existing climate-related disclosure assurance standards which may be appropriate for climate statement assurance, further work is required to develop a specific assurance standard for all climate-related disclosures. We do not currently have certainty over how climate statements should be assured.

For these reasons, we must consider whether our preferred option is sufficiently flexible.

Status quo

Not introducing full assurance will allow time for reporting to mature and climate assurance standards to develop. In the future, the proposal of requiring full assurance over climate statements could be reconsidered when these considerations are more settled.

The main advantage of the status quo is that it provides more time for climate reporting entities to develop their reporting and for primary users to indicate what parts of the assurance statement they want to see assured. The status quo is inherently flexible.

Non-regulatory option

For the same reasons as the status quo, the non-regulatory option is inherently flexible.

Extending the assurance requirement to cover the whole climate statement from October 2028

Introducing a requirement for full assurance from October 2028 would reduce flexibility while reporting and standards are still under development and circumstances may change.

Extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the XRB to stagger the introduction of assurance requirements prior to this date

Implementing a staggered introduction of requirements would help to enable some flexibility in the years prior to 2028.

A staggered approach would be consistent with the proposed staggered implementation of climate standards requirements within the XRB’s climate standards. The CRD Act is silent about the content of climate standards, for example, it does not refer to TCFD or when certain climate disclosure requirements might come into force. This is because these are matters for the XRB to independently determine.

Empowering the XRB to modify assurance requirements through staggered introduction would enable more flexibility in response to changing circumstances. It would enable the XRB to set standards that are within the range of international best practice and modify them as bespoke climate assurance standards are created, best practice is established, and the assurance provider market evolves.

26. Do you agree with our analysis of the flexibility criterion? If not, why not?

5.5.3 Efficiency

A regulatory system should deliver, over time, a stream of benefits or positive outcomes that outweigh any costs or potential negative outcomes. We should not introduce a new regulatory obligation unless we are satisfied it will deliver net benefits for New Zealanders. While there is a need to improve trust and confidence in the CRD regime, we must minimise regulatory obligations on regulated parties.

Status quo

The status quo does not involve any increased regulation or costs for climate reporting entities or assurance practitioners. Climate reporting entities may voluntarily obtain assurance over the whole of the climate statement.

Non-regulatory option

Similar to the status quo, the non-regulatory option would not involve any increased regulation for climate reporting entities or assurance practitioners. Depending on which non-regulatory options were introduced, there may be increased cost for certain government organisations. For example, the FMA may need to increase focus on awareness raising and oversight of potentially misleading information.

Extending the assurance requirement to cover the whole climate statement from October 2028

Introducing further assurance requirements beyond GHG emissions would impose additional regulatory burden compared to options 1 and 2. The question then is whether the net benefits are sufficient to justify the burden.

We expect some climate reporting entities to obtain voluntary assurance engagements over the remainder of the climate statement, i.e., in addition to GHG emissions disclosures. Those that do not would be required to undertake additional assurance which would require entities to improve the quality of underlying information and reporting, and employ assurance practitioners.

Due to climate assurance standards for disclosures based on TCFD recommendations still being under development, and uncertainties over assurance practitioner market developments by 2028, we do not have much information about the additional cost of obtaining full assurance.

We consider the proposed timeframes to balance the increased cost to a certain extent by providing a significant lead in time. Additionally, while considering introducing new standards to be issued for full climate statement assurance, the XRB must assess whether any additional climate assurance requirements are appropriate for New Zealand entities and explore any unintended consequences or risks arising from adopting assurance standards. These provisions help to ensure any new assurance requirements will not be unduly burdensome on climate reporting entities.

For these reasons, we believe the increased regulatory burden of full assurance when compared to the status quo is appropriate considering the likely benefits to the CRD regime. Full assurance is likely to improve the trust and confidence in climate statements and therefore improve their usefulness.

27. Do you have any estimates of cost for obtaining full assurance over a Task Force on Climate-related Financial Disclosures based report?

28. Do you have any estimates of cost for obtaining assurance over GHG emissions only?

Extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the XRB to stagger the introduction of assurance requirements prior to this date

In a similar manner to introducing full assurance through legislation, a staggered introduction of requirements would impose additional cost compared to options 1 and 2.

We consider the expected gradual pace of staggered introduction of requirements would provide a reasonable timeframe for climate reporting entities, assurance practitioners, and standard setters. The XRB would additionally be provided with the flexibility to modify climate assurance standards and introduce requirements in response to changing circumstances and market conditions.

29. Do you agree with our analysis of the efficiency criterion? If not, why not?

30. Do you have any comments on potential cost impacts of the preferred option and who would be impacted?

5.6 Preliminary conclusion and preferred option

Our preliminary conclusion is that there may be a lack of trust and confidence in the climate statements under the status quo and non-regulatory options. These options may additionally cause confusion through inconsistent assurance standard application leading to a lack of comparability between climate reporting entities.

Full independent assurance on the other hand would effectively enhance trust and confidence through increased credibility over the whole climate statement. It would additionally create a level playing field of requirements across all entities and standardise the use of climate assurance standards. This would help to generate consistent information and improve comparability, enabling better informed investment decisions based on credible information, leading to a more efficient allocation of capital with higher levels of confidence.

It is therefore likely that independent assurance over the whole climate statement may eventually be necessary. We do not consider independent assurance of only some parts of the climate statement to be sufficient in the long term.

Option 4 of introducing full assurance through a set date in legislation, in addition to enabling a staggered introduction of assurance requirements, is the preferred option due to the certainty over the direction of travel provided to climate reporting entities, assurance practitioners, standards setters, and the regulator.

Without setting a timeframe through regulatory expectations, the assurance market will take longer to develop and available resourcing of assurance standard development by standards setters may also be lower, resulting in slower standard issuance.

We consider introducing full assurance requirements from October 2028 provides a sufficient lead time for climate reporting entities to develop their reporting, the issuance of bespoke assurance standards, and enable assurance practitioners to upskill while minimising regulatory obligations. By this time, an occupational licensing regime (discussed in Chapter 4) may also be implemented.

We additionally consider that empowering the XRB to require some aspects of climate assurance to come into effect earlier than others would enhance trust and confidence in the climate statements at an earlier date while maintaining flexibility in a changing environment.

Government intervention would improve trust and confidence, leading to increased expectations for climate reporting entities and assurance practitioners which should accelerate progress. Largely or solely relying on market forces may be too risky, given that urgent action is needed to invest in new technologies, energy efficiency and clean energy sources, and disinvest away from assets with significant physical risks, high GHG emitting products, processes, and activities.

31. Do you agree with our assessment of the 4 options? If not, why not?

32. Should there be mandatory assurance requirements in relation to the whole climate statement?

33. What are your views about a staggered implementation of assurance requirements prior to assurance in relation to the whole climate statement?

34. Should the XRB be empowered to stagger assurance requirements?

Summary of our preliminary assessment of the options

|

|

Option 1: Continuing with the status quo |

Option 2: A non-regulatory approach |

Option 3: Extending the assurance requirement to cover the whole climate statement from October 2028 |

Option 4: Extending the assurance requirement to cover the whole climate statement from October 2028 and staggered introduction of climate assurance requirements prior to this date |

|

Criterion 1: Effectiveness in enhancing trust and confidence in the climate statements (applied a multiplier of 2 to reflect higher weighting) |

0 No change | + 1 x 2 = 2 A non-regulatory approach would encourage voluntary assurance engagements and support development of the climate assurance market. |

+ 2 x 2 = 4 Expanding assurance requirements and mandating climate assurance standards would improve the usefulness of information reported through climate statements. |

+ 2 x 2 = 4 In addition to the benefits of option 3, a staggered approach may result in some independent assurance being required sooner. |

|---|---|---|---|---|

|

Criterion 2: Flexibility |

0 No change | 0 No change | - 2 Setting a timeframe for full assurance would reduce flexibility. |

- 1 Empowering the XRB to modify assurance requirements for climate statements in response to changing circumstances may offset some of the flexibility lost to a set timeframe. |

|

Criterion 3: Efficiency |

0 No change | 0 No change | + 1 Introducing further assurance requirements may increase some costs for entities. We believe this increase is justified by creating a net benefit considering the improvements in trust and confidence and therefore usefulness of climate statements. |

+ 1 Staggering some additional independent assurance requirements before October 2028 may increase some costs for entities. However, this increase is likely to result in a net benefit considering the improvements in trust and confidence and therefore usefulness of climate statements. |

|

Total |

0 No change | Total = 2 | Total = 3 | Total = 4 |

Key:

+ 2 much better than doing nothing/the status quo

+ 1 better than doing nothing/the status quo

0 about the same as doing nothing/the status quo

- 1 worse than doing nothing/the status quo

- 2 much worse than doing nothing/the status quo

< Chapter 4: Options for establishing an occupational licensing regime | Chapter 6: Recap of the questions >