Chapter 2: Executive Summary

We propose to introduce direct licensing of CRD assurance practitioners with the Financial Markets Authority (FMA) as the regulator. We also propose to extend the assurance requirement to all disclosures in the climate statement.

On this page

2.1 Issue 1 – Developing a licensing regime for assurance practitioners

Status quo and problem definition

The CRD Act contains an assurance requirement that comes into force in October 2024. The Act will require disclosures in climate statements relating to GHG emissions to be independently assured. We are also proposing that the assurance requirement should be expanded to cover the whole climate statement (see discussion below).

There is a risk that individuals who are not appropriately skilled or subject to satisfactory professional standards could carry out the assurance engagement. This is because there are no licensing arrangements for CRD assurance practitioners in the CRD Act and nor are there are processes for dealing with complaints or monitoring their work. If un-skilled assurance practitioners carry out the assurance engagement this may reduce confidence in the practitioners and in the information that they assure.

The options to address the problem

We have explored 3 options to address the problem described under Issue 1 above:

- continuing with the status quo i.e., no occupational licensing for CRD assurance practitioners

- co-regulation modelled on the 'Auditor Regulation Act 2011' (Auditor Regulation Act)

- direct regulation by the FMA.

Under a co-regulatory model, professional bodies would be responsible for frontline regulation such as licensing and investigating complaints. The FMA would be responsible for accrediting the professional bodies and monitoring and reporting on the adequacy and effectiveness of their regulatory systems.

Under a direct regulation model, a government regulator would be responsible for carrying out all licensing and regulatory functions without an intermediary professional body. If direct regulation is the chosen option, the FMA would be the preferred choice for carrying out this function.

Objective and criteria for assessment

Our objective is to enhance the trust and confidence users place in the information disclosed in the climate statements. We assessed the 3 options against the criteria of:

- effectiveness in improving trust and confidence in the climate statements

- flexibility

- competitive neutrality

- efficiency.

Preliminary conclusion

In our view, both the co-regulation and direct regulation models would ensure that competent practitioners undertake the assurance work. Both represent an improvement on the status quo – at least in terms of promoting trust and confidence in the climate statements. This is because both regulatory options should enhance user confidence in the assurance practitioners which, in turn, would enhance confidence in the information being assured.

Of the 2 licensing options, direct regulation is our preferred option because it is more flexible than co-regulation if future changes to the occupational licensing regime are required. Co-regulation based on the Auditor Regulation Act also risks excluding competent practitioners who are not professional accountants from the assurance work because the 2 professional bodies accredited under the Auditor Regulation Act are accounting membership bodies. This means that they already have the necessary infrastructure in place to become accredited under a new co-regulatory regime for CRD assurance practitioners but membership bodies for new or developing professions may not. Co-regulation is also not as cost efficient as direct regulation.

Our preferred approach is therefore the direct regulation of CRD assurance practitioners by the FMA.

2.2 Issue 2 – The scope of the assurance engagement

Status quo and problem definition

Independent assurance is only required over the GHG emissions disclosures in the climate statements. This means that other parts of the climate statement are not required to be assured and, if they are voluntarily assured, there are no mandated assurance standards for the assurance engagement. This creates a risk that:

- users will have less confidence in the parts of the climate statement that are not independently assured

- assurance practitioners may not use the same assurance standards for any voluntary reporting resulting in inconsistencies between assurance reports.

The options to address the problem

We have explored 4 options to address the problem described under Issue 2 above:

- continuing with the status quo, i.e., no extension to the assurance requirement

- a non-regulatory option, i.e., encourage voluntary extension of assurance

- extending the assurance requirement to cover the whole climate statement from October 2028.

- extending the assurance requirement to cover the whole climate statement from October 2028 and empowering the External Reporting Board (XRB) to stagger the introduction of climate statement assurance requirements before this date.

Objective and criteria for assessment

Our objective is to enhance the trust and confidence users place in the information disclosed in the climate statements. We assessed the 3 options against the criteria of:

- effectiveness in improving trust and confidence in the climate statements

- flexibility

- efficiency.

Preliminary conclusion

In our view, expanding the assurance requirement to all disclosures in the climate statement will increase trust and confidence in the disclosures through faithful representation and improve their usefulness. Empowering the XRB to stagger the introduction of assurance requirements before the date for full assurance should also enhance trust and confidence in those parts of the climate statements being assured. Our preliminary conclusion is that there may be a lack of trust and confidence in the climate statement disclosures under the status quo and non regulatory options.

Although extending the assurance requirement is less flexible than the status quo or the non-regulatory option, this lack of flexibility is offset to some degree by the lead time before full assurance is introduced. We suggest that the date for full assurance is October 2028, i.e., 7 years after the CRD Act received Royal Assent. We also consider that full assurance (including with the staggering approach) is the most efficient option.

Our preferred approach is therefore to extend the assurance requirement to the whole climate statement from October 2028 and to empower the XRB to stagger the introduction of assurance requirements before the date for full assurance.

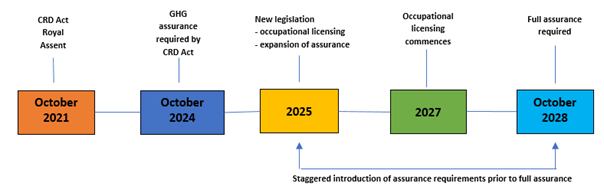

2.3 Timeframe for implementation of Preferred Approach for Issue 1 and Issue 2

We propose that the occupational licensing regime (Issue 1) be established before full assurance (Issue 2) is required. This is because we consider that there should be clarity and regulatory oversight over assurance practitioners before requiring a wide range of novel assurance engagements. In this regard, if direct regulation is introduced for CRD assurance practitioners, we will aim to pass legislation by 2025 so that the new occupational licensing regime can begin in 2027. This will provide time for licensees and the regulator to prepare, and for the Government to make regulations. Our intention is that this new legislation will also address the expansion of the assurance requirement and the ability of the XRB to stagger the introduction of assurance requirements. As noted, we propose that full assurance will be required for accounting periods ending on or after October 2028.

The timeframe for our combined proposals is set out below:

Image transcription