Preliminary Proposal 1: Require Full and Final Settlement for Full Self Cover

On this page

Gauging your support for this preliminary proposal

Unlike the prior chapters, this proposal is more preliminary. The objective is to gauge whether there is sufficient support from stakeholders to warrant ACC committing further resources to fully develop the preliminary proposal to require full and final settlement for AE’s in the FSC plan.

The proposal includes a set of principles on which the final methodology for calculating full and final settlement would be based. If there is sufficient support for the preliminary proposal, a further targeted consultation on a fully developed version, requiring full and final settlement, will be undertaken next year.

The status quo

Under the FSC plan, AEs assume the lifetime responsibility and cost for their employees’ work-related injuries suffered during a cover period. An AE continues to manage their cover-period claims for two, three or four years after the end of the cover period. This is known as the Claims Management Period (CMP). Roughly 70% of AEs have chosen the FSC plan.

At the end of the CMP, all active claims are transferred to ACC for ongoing management, with the AE paying ACC a lump sum to settle the estimated liability for further costs over the lifetime of injured employees. There is also a residual ongoing cost liability for new claims arising, as detailed below.

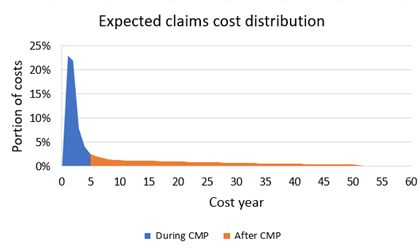

At an aggregate level, claims costs for work-related injuries follow a predictable distribution. Most costs are paid at the time of the injury or in the years shortly thereafter, with a smaller portion of claims costs incurred after that. The graph below illustrates this:

Text description

In return for taking on all these liabilities, AEs receive a downwards adjustment of the standard employer levy by an average of 92%.

Lifetime liability and reactivated claims

After the end of the CMP, an AE’s claims liability continues:

- indirectly, because they have paid ACC an estimate of the remaining lifetime cost of active claims that arose during the cover period, and

- directly, because they have to pay ACC in arrears for the cost of reactivated and incurred but not reported (IBNR) claims arising after the cover period.

A claim that is inactive at the end of the CMP can be reactivated for a number of reasons – including, but not limited to:

- The employee sustains a reaggravation of a covered injury and seeks entitlement

- The employee makes a first claim for cover for a covered injury only after the end of the CMP

- An invoice for prior treatment is received after the end of the CMP

- ACC or another AE requests information related to the claim to assist with their investigation of another claim.

If a closed claim is reactivated after the CMP, or the claim is for an injury that occurred during the cover period but the employee did not make a claim until after the CMP, the employer pays ACC for actual claim costs incurred during the lifetime of the claim plus an additional fee for case management services.

Reactivated claims are identified throughout the year and are invoiced collectively every 6 months.

What is the preliminary proposal?

It is proposed to enhance the current claims hand-back invoice calculation at the end of the CMP with a full and final liability calculation that will include (based on ACC’s best estimate) liability for all active claims, reactivated claims and IBNR claims. This should not change the cost of the claims, but it will affect when the liability of the AE for the claims is crystallised.

- ACC will request return of all claim files at the end of the CMP.

- From the commencement of the cover period in which the new AEP Framework is introduced, full and final settlement will be mandatory for all AEs in the FSC plan.

- ACC will estimate the full and final liability amount for each AE on this plan and invoice them for that amount

- This will be ACC’s estimate of outstanding lifetime costs for active and closed, and IBNR claims for work-related injuries occurring during the cover period.

- The estimate will be based on each AE’s reported claims to date and ACC’s expectations of future claims payments.

- The estimate will also consider the AE’s stop-loss and high-cost claims cover limits.

- Claims handling expenses and a risk margin will be added to the estimated lifetime costs of all claims for the cover period.

- The process will repeat annually at the end of the CMP for each cover period.

Once the full and final settlement has been paid, an AE will have no further liability for claims costs beyond the CMP – this will instead be fully carried by ACC.

Settlement of previous cover periods

It is proposed that during the transition from the current Framework to the new Framework, AEs will have an opportunity to request a full and final settlement for all the previous cover periods at the end of their CMP. Further details on this process will be presented during consultation (if this proposal is progressed).

If an AE elects not to have a full and final settlement calculated for previous cover periods, the AE will continue to have liability for claims from previous cover periods that may reactivate or were not identified beforehand (IBNR cases), and these claims will continue to be invoiced every six months as incurred.

What should the final methodology look like?

ACC is still working on developing what the methodology and calculation for full and final settlement will look like and what information it will consider. However, it is proposed that the final methodology will be based on the following principles:

- ACC should be able to justify individual calculations – the AE’s claim liabilities should be fair to all other AEs, to ACC, and to employers in the wider Work Account. This means:

- Apportioning the total AEP Outstanding Claims Liability in a manner which accounts for both the risk profile of the individual employer and their past claim experience, so that relative to other employers, and over time, each employer should pay the full cost of their employees’ claims.

- There is minimal impact on other AEs from employers entering or exiting the scheme.

- The AE’s fully fund their own claims with no cross subsidisation from non-AEP employers

- The methodology should self-correct so that over time an AE does not pay too much or too little relative to the cost of the claims incurred by their employees

- The methodology should not amplify existing volatility in claim patterns and liabilities.

- The approach should be transparent and easy to calculate.

- The approach should not incentivise adverse behaviour by the employer to reduce the hand-back liability. The outcomes of injured employees should remain the primary focus.

- The approach should allow for corrections over time for under or over collecting from AEs.

- There should be consistency with the basis for calculating the wider ACC outstanding claims liability, to the extent it makes sense.

If there is sufficient support for this change, ACC will further develop the methodology and undertake additional consultation.

What options were considered?

The options considered when developing this preliminary proposal included retaining the status quo and adopting the proposed change to require full and final settlement of all claims at the end of the CMP. How these options were weighed up is outlined below.

Option one: Status quo

Retaining the status quo would mean AEs continue to pay for reactivated claims:

- indirectly when they pay ACC an estimate of the remaining lifetime cost of active claims arising during the cover period, and

- directly when they pay ACC in arrears for the cost of reactivated and incurred but not reported (IBNR) claims arising after the end of the cover period.

However, if an AE’s business is liquidated then there is no surviving entity to pay ACC for the cost of any reactivated IBNR claims. This extra cost incurred by ACC inevitably has to be recovered from AEs remaining in AEP or the Work Account in general.

Option two: implement full and final settlement

This option is favoured because adopting it would improve the accuracy of the estimated liability of AEs for reactivated claims by using a full and final settlement methodology to calculate the liability of an AE. After the settlement payment is made, the AE would have no further liability for reactivated claims. This would give AEs greater certainty when determining their liabilities and allow them to better account for AEP liabilities on their balance sheets.

This option is also favoured because it would mean that continuing levy payers would not end up effectively having to meet the outstanding liabilities of AEs who are liquidated.

Tell us what you think

General feedback

- Do you support the preliminary proposal to change the FSC plan to require full and final settlement at the end of the CMP?

Why/why not? - Do you think that the proposed changes would reduce the administrative burden of claims invoicing? Yes/no; Why/why not?

- Do you agree with the proposed principles for developing a methodology for calculating a full and final settlement? Yes/no; Why/ why not?

- If you don’t support these changes, what alternatives do you propose?

- Should sufficient support be received for the preliminary proposal, would you like to be involved in the next round of consultation?