Background to the screen sector and the New Zealand Screen Production Grant

This section outlines background information on the Aotearoa New Zealand screen sector, how the screen sector is funded, including government investment and information on the current New Zealand Screen Production Grant.

On this page

About the Aotearoa New Zealand screen sector

Screen has been recognised as a growing sector with potential to contribute to New Zealand's GDP, employment and economic diversification. As an internationally oriented high-value sector, screen can attract international investment and highly skilled workers. These can help to build New Zealand’s international connections, brand and reputation, and deliver value to the wider economy through innovation, technology transfer, tourism and infrastructure. New Zealand productions provide opportunities for telling New Zealand stories on screen and showcasing New Zealand cast, crew and culture.

Driven by new technologies, increased globalisation, evolving audience preferences and behaviour, the screen sector is rapidly changing. Key shifts include changing audience consumption and distribution patterns and trends; a trend away from feature films towards television series; the rise of streaming services; and the decline of cinematic releases accelerated by the Covid-19 pandemic. Digital technologies are also enabling businesses involved in screen production to engage in other areas, such as interactive entertainment (i.e. gaming) and to change methods of production and distribution (e.g. interactive entertainment).

Gross screen-sector revenue in New Zealand is estimated to be about $3.5 billion per annum.[3] As of 2020, there are 4,098 firms in the screen sector.[4] The average annual growth in the number of firms in the sector has been 8.3 per cent since 2015 – much higher than the national average of 1.9 per cent over the same period.[5] This growth has been almost entirely driven by an increase in sole traders or contractors.[6]

It is estimated that around 13,900 people are working in the screen sector.[7] The New Zealand screen sector continues to be structured around temporary working arrangements and project-based contracts.[8] Most new workers in the screen sector are contractors or self-employed, working mainly in post-production in Wellington. Auckland and Wellington are New Zealand’s main centres for screen production and post-production work.[9] The number of individuals employed in the screen sector in Auckland has remained roughly stable since 2010 and employment rates in the post-production sub-sector in Wellington peaked in 2012 and have remained static for most of the past decade.[10] Based on weightless exports, the screen sector is not constrained by natural resources and supply-chain disruptions to the extent other sectors are. It does, however, rely on a highly mobile labour force, access to high-quality talent, facilities and technology. All of this is underpinned globally by financial incentives.[11]

The Aotearoa New Zealand Screen Sector Strategy 2030

In August 2020, the Screen Sector Strategy Facilitation Group developed the Aotearoa New Zealand Screen Sector Strategy 2030[12] in response to a call from the then Minister for Arts, Culture and Heritage in 2017. The 2030 Strategy sets out a vision for ‘a thriving screen sector reflecting and enriching Aotearoa New Zealand for all our people’. The Strategy notes a number of issues facing the sector:

- It remains reliant at every level on some form of government support, with limited opportunities for sustainable growth.

- Developing the capacity, sustainability and resilience of the sector by building companies with the scale to compete globally is a key challenge.

- There is a need to enhance the capacity, skills and career opportunities of screenwriters, actors, directors, producers and other key sector roles vital to the development of intellectual property.

- It must strive to become more diverse and inclusive at all levels, including promoting greater use of Te Reo and Tikanga Māori in the sector’s practices and processes, and ensuring the sector successfully reflects New Zealand’s unique and diverse cultural landscape.

The review of government investment in the screen sector responds to the action proposed in the 2030 Strategy of exploring funding options. The review objectives also align with aspirations of the industry for more domestic companies at scale, greater commercial success, better jobs and creation of unique intellectual property.

Growth in film and television spending internationally

International spending on film and television has increased from US$189b in 2019 to US$220b in 2020. The international media and entertainment sector is set to continue year on year growth, with revenue predicted to approach US$3tn by 2026 off a base of US$2.5tn in 2022.[13]

The global growth in film and television spending is being driven by new entrant streaming platforms based in the USA with increasing and large subscription bases.[14] While there are a range of film and television production centres across the world (e.g., India, the United Kingdom and increasingly China and the African continent), the USA and European production centres are the largest. Productions from these centres are likely to consider alternative production locations and use of the international screen incentives offered.[15]

As audience numbers grow and more competition enters the market, the need to maintain or build audience share is becoming more important for content providers. To stay competitive, production budgets have risen significantly over recent years, especially for television series.

How New Zealand’s screen sector is funded

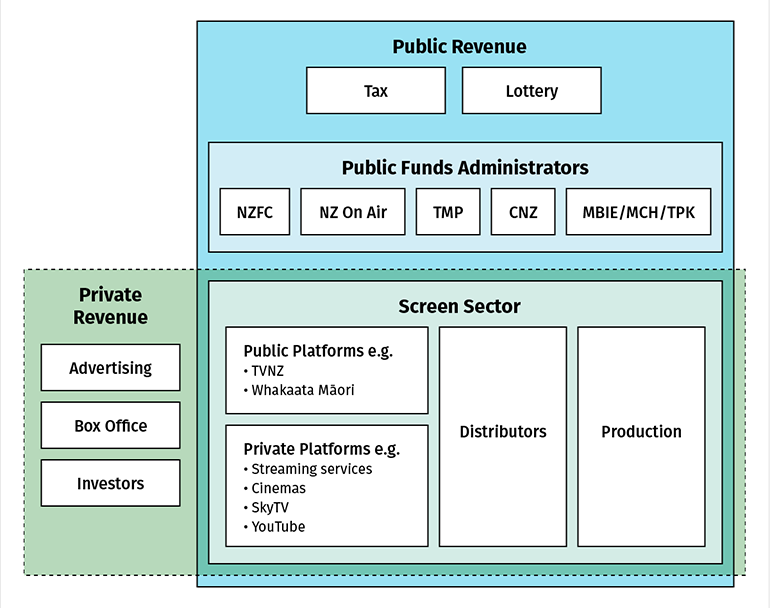

The screen sector is a mixture of private and public platforms, distributors and production facilities and studios (both production and post-production). Private sources of funding a production might access include advertising revenue, box-office revenue, financing or investment firms, and individual investors. An overview of funding and investment in the screen sector is outlined in Figure 1.

Figure 1: Current landscape of funding and investment in the screen sector

Text description of figure 1

How the government invests in the New Zealand screen sector

There are 7 ddifferent public funding administrators supporting the screen sector. They are a mix of central government agencies - MBIE, Manatū Taonga, and Te Puni Kōkiri, and crown entities – the New Zealand Film Commission, NZ On Air, Te Māngai Pāho and Creative New Zealand. There are three government-funded broadcasters/platforms: Whakaata Māori, TVNZ and Radio NZ.[16]

Funding can be accessed for all stages of the production process. The bulk of funding to the sector is committed to principal photography (i.e. live-shooting) and post-production over capability and development or distribution and sales.

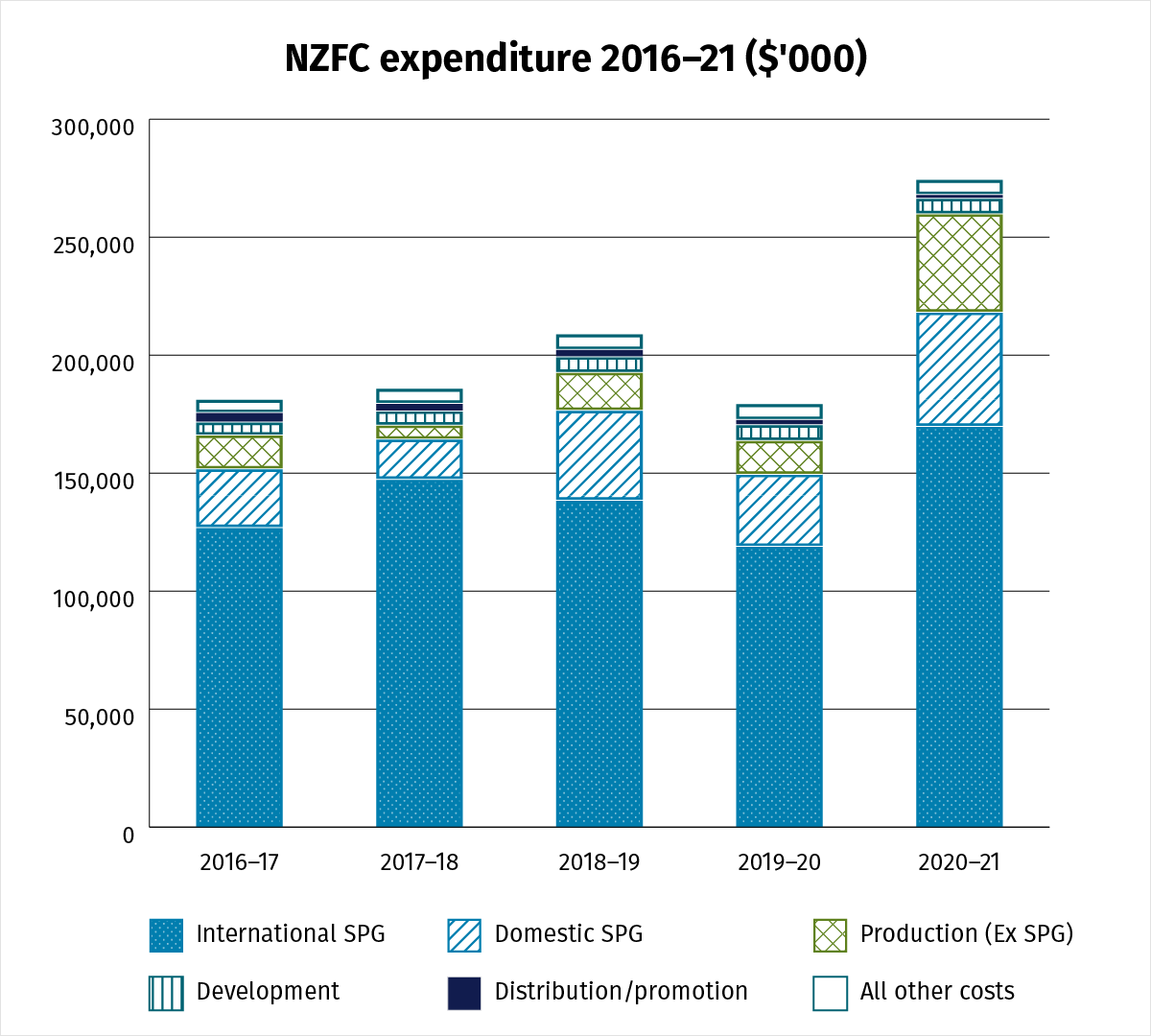

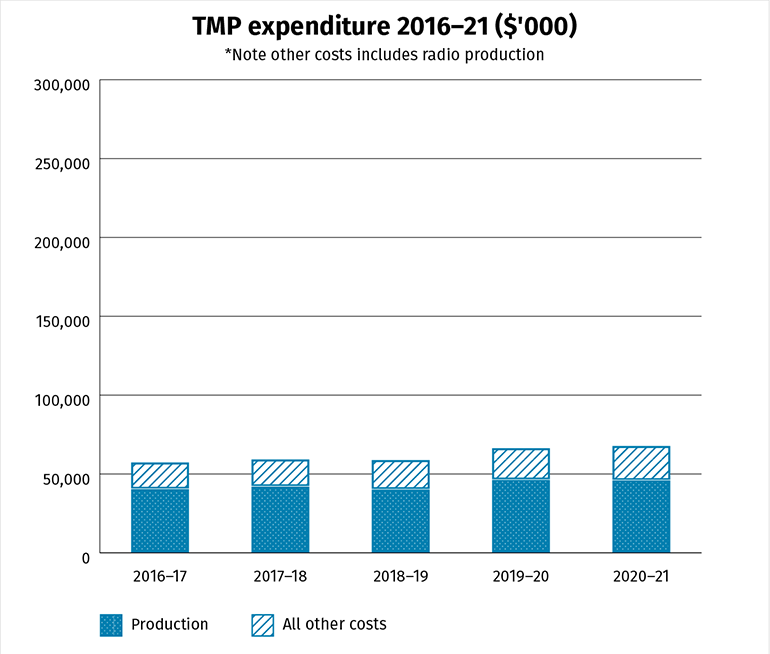

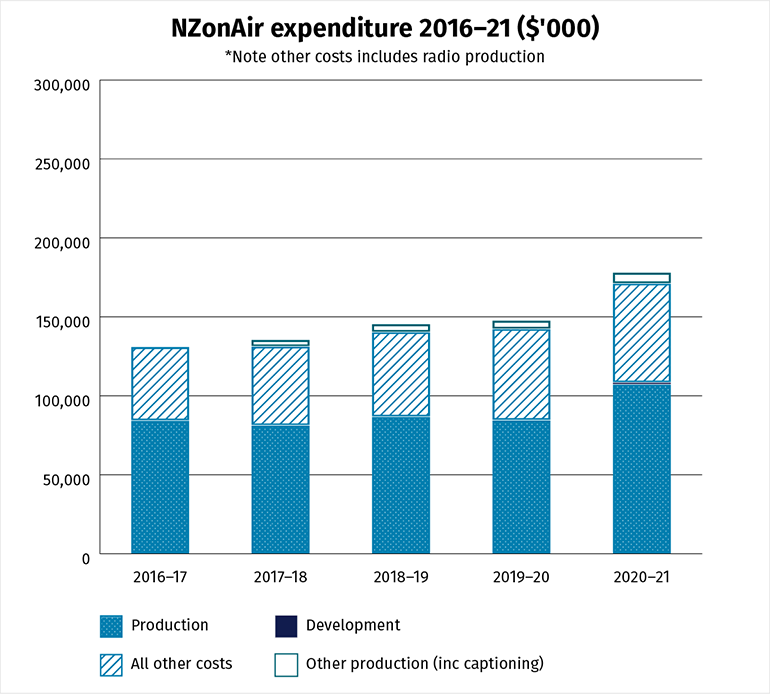

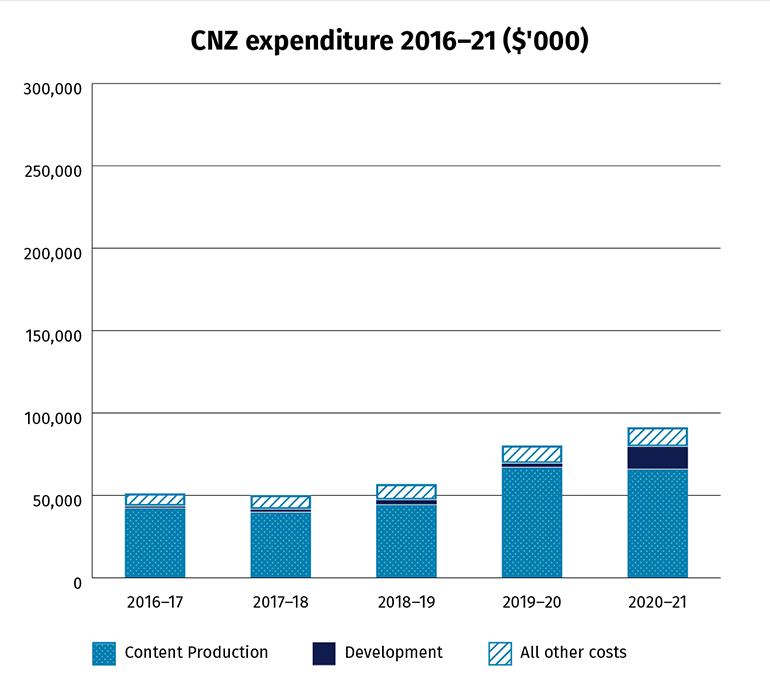

Figure 2: Screen expenditure- content producers 2016-21

Descriptive text for graph showing NZFC expenditure 2016 – 2021

Descriptive text for graph showing Te Māngai Pāho expenditure 2016 – 2021

Descriptive text for graph showing NZ On Air expenditure 2016 – 2021

Descriptive text for graph showing Creative New Zealand expenditure 2015 – 2021

In 2021, international productions received funding from the NZSPG totalling $169.8m and New Zealand productions received $48.4m. New Zealand productions received a further $301.6m in 2021 from other government screen funding sources. TVNZ and Māori TV also contribute to production funding through purchasing programme content, with around $150m additional funds spent in 2021.

Other mechanisms to support the sector include NZFC skills and talent incubator programmes, and NZFC, NZ On Air and Creative New Zealand grants to assist in developing a script or story. Awards and scholarships are also available to provide development/career opportunities for young creatives.

The New Zealand Screen Production Grant

The New Zealand Screen Production Grant (NZSPG) is one of the major sources of public funding for the screen sector in New Zealand and our investment in the NZSPG is growing.[17]

The NZSPG was introduced on 1 April 2014 with the objective of supporting the development of a sustainable and resilient domestic screen industry, providing economic and industry development and cultural benefits to New Zealanders and increasing the competitiveness of our incentives for international productions. It was preceded by the Large Budget Screen Production Grant and Screen Production Incentive Fund.

The budget for NZSPG is supported through MBIE and Manatū Taonga demand-driven Multi Year Appropriations. The NZSPG criteria determine eligibility and changes to the criteria require Cabinet level decision making.

The NZSPG is made up of 4 different components administered by the NZFC. Information specific to each of the respective NZSPG components is hyperlinked below.

-

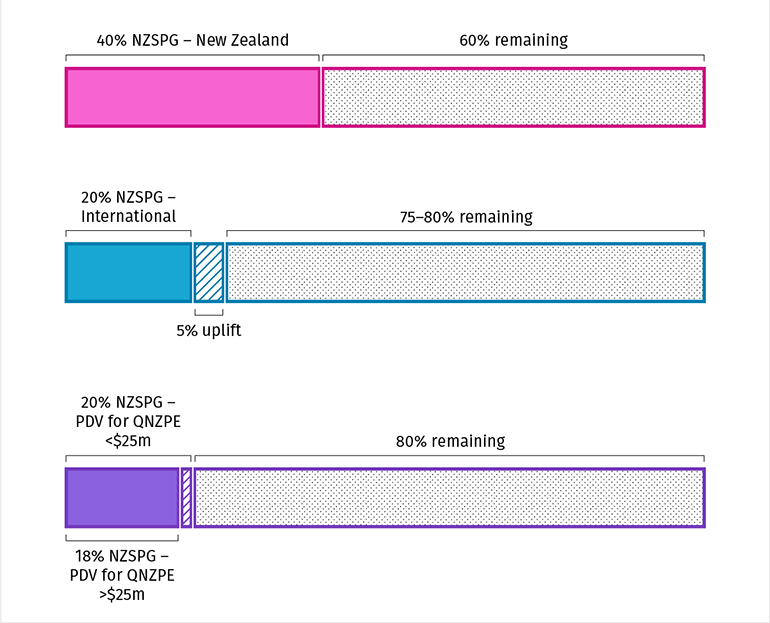

NZSPG-International supports large scale (mainly international) productions to undertake live production in New Zealand, with a 20% incentive on Qualifying New Zealand Production Expenditure (QNZPE).[18] This investment is intended to provide economic and industry development benefits to New Zealand. The funding is overseen by MBIE.

The New Zealand Screen Production Grant for International Productions(external link) — New Zealand Film Commission

-

5% Uplift provides productions that deliver significant economic benefits to New Zealand an additional 5% incentive on their QNZPE. The Uplift is intended to incentivise a range of spill-over benefits from international productions locating in New Zealand, including raising New Zealand’s profile internationally, attracting high-value tourists, investment in infrastructure and profiling our creativity and innovative people. It is a subset of the NZSPG-International.

Accessing the 5% Uplift(external link) — New Zealand Film Commission -

NZSPG-PDV supports post-production and digital effects (PDV) activity. It supports a 20% incentive on QNZPE up to $25m and 18% over $25m. The investment is intended to foster New Zealand’s PDV capacity and new business development. It is a subset of the NZSPG-International.

The New Zealand Screen Production Grant for International Productions(external link) — New Zealand Film Commission -

NZSPG-New Zealand supports the domestic film industry and the development of New Zealand creatives. Official co-productions[19] an access the NZSPG-New Zealand. Eligible productions can access an incentive equivalent to 40% QNZPE. This is capped at $6m per production unless the production qualifies for an Additional Grant, which is available to productions that meet additional criteria and have QNZPE from $15m to $50m. The funding is overseen by Manatū Taonga.

The New Zealand Screen Production Grant for New Zealand Productions(external link) — New Zealand Film Commission

An applicant cannot receive the NZSPG-International and NZSPG-New Zealand for the same production.

Within the NZSPG-International, productions can apply for either the NZSPG-International or the NZSPG-PDV. If a production is eligible for the NZSPG-International and meets specific criteria and tests they may also receive the 5% Uplift.

Applicants receiving the NZSPG-International are not eligible for any other New Zealand Government finance or tax incentives in relation to the production. Applicants receiving the NZSPG-New Zealand can receive other government funding to support their production.[20]

Figure 3: Current NZSPG structure and criteria in relation to QNZPE

Text description of figure 3

Promoting New Zealand as a screen production destination

MBIE provides $1.3m annually to the NZFC to attract and promote New Zealand as a filming destination. These activities include:

- Advertising and public relations activity across international and New Zealand publications, such as direct marketing of available studio and facility space

- Monitoring and reporting on international production activity happening in New Zealand

- Building relationships with international studios to support productions to locate in New Zealand

- Assisting and accompanying trade visits by New Zealand representatives and government officials

- Assisting in the arrangement of trips for international studios to visit New Zealand and scout locations.

Footnotes

3. Based on Statistics NZ data from 2017.

4. Economic Trends in the New Zealand Screen Sector, Firms and Employment, MBIE, 2021.

8. 92% of all screen sector firms were sole traders and 6.6% had between 1 and 9 employees, compared with the average across all New Zealand industries of 72% sole traders and 22% with 1 to 9 employees, sourced from Economic Trends in the New Zealand Screen Sector, Firms and Employment, MBIE, 2021

9. Economic Trends in the New Zealand Screen Sector, Firms and Employment, MBIE, 2021.

12. Strategy 2030 is an industry vision for the future of the screen sector. The Strategy outlines a 10-year framework and a 3-year plan consisting of 10 initiatives to move the sector towards the 10-year vision. One of the initiatives centres on funding and investment opportunities, including changes to the NZSPG.

13. Global Entertainment & Media 2022–2026 Perspectives Report (pwc.com)(external link)

14. 2019: 642m subscribers(external link), 2020: 1.1b subscribers(external link), 2025: 1.6b subscribers predicted(external link)

15. The US & Canada market = $149b spending in 2020 and Europe (including UK) = $32.6b spending in 2020(external link)

16. The Aotearoa New Zealand Public Media Entity legislation introduced in June 2022 will establish a new public media entity. TVNZ and RNZ will transition to the new entity once the legislation is enacted.

17. In 2015/16, crown spending on the NZSPG-International appropriation totalled $118.5m, this increased to $169.8m in 2020/21. Crown spending on the NZSPG-New Zealand appropriation totalled $15.4m in 2015/16, increasing to $48.4m in 2020/21.

18. QNZPE is eligible spend incurred by the applicant on a production in New Zealand. In general, this means: services provided in New Zealand; the use of land located in New Zealand; goods purchased, hired or leased in New Zealand, provided they are sourced from within New Zealand; and goods sourced from overseas, provided those goods are not otherwise available in New Zealand, are located in New Zealand during the making of the production and are purchased, hired or leased from a New Zealand business that typically supplies that type of good. QNZPE also includes the fees and expenses of non-New Zealanders who work on the production in New Zealand, provided (in the case of non-cast members) they work on the production for at least 14 days in total.

19. Official co-productions are film and television projects made in accordance with treaties or other formal agreements between New Zealand and other countries

20. A feature film, animation production and children’s drama can receive both production and non-production funding from other government agencies (including NZonAir and TMP). TV series can only receive non-production funding from government agencies.